Author: Teng Yan, Chain of Thought; Translator: Jinse Finance xiaozou

1. The Data Gold Rush

During the California Gold Rush in the mid-19th century, thousands of people flocked to the new frontier in search of wealth.

The poor suddenly found themselves rich, and stories of self-made fortunes became commonplace, fueling the growth of new industries and cities. Infrastructure developed at an astonishing pace, reshaping the face of America.

The similarities between Crypto AI and the Gold Rush are hard to ignore.

Today, most Crypto AI products are still in the development stage, either running on test networks, indicating that we are in the infrastructure-building phase.

Investors and builders are preparing for a potential surge in growth. The tools, networks, and protocols being created now may become the foundation for a vast decentralized artificial intelligence ecosystem.

We are witnessing the early stages of a digital gold rush - one that may be as transformative as the 19th-century gold rush.

So, you can imagine my surprise when I stumbled upon a Crypto AI project that claims to have over 700,000 daily active users. Not monthly, but daily. In such an emerging field, these user metrics are unheard of. So, I had to dig deeper to find out what was happening behind the scenes.

What is this project? DIN, the "Data Intelligence Network".

2. Crypto Data Networks

I've been closely following the data networks in the Crypto AI space, and it's clear that they are addressing a key pain point in the AI field: access to valuable data sets.

Today, many of the most valuable data sources are tightly controlled by centralized entities, who charge exorbitant fees for access.

For example:

Reddit signed a $60 million per year licensing agreement with OpenAI to provide access to its user-generated content.

X (formerly Twitter) no longer provides free API access to developers, and the cost of Twitter data now ranges from $100 per month to $42,000 per month (no joke).

The message is clear: Businesses recognize that data is the new battleground, and they are locking down control to maximize profits.

Crypto offers a potential solution - a way to break free from the centralized control of valuable data sets.

Crypto data networks have taken a completely different approach, aiming to build high-quality decentralized data sets without the bottlenecks of traditional models. Through the use of tokens, these networks can incentivize large-scale data labeling work, incentivize individuals to contribute to large-scale data collection, and even organize the web scraping of training data.

And with the transparency of blockchain, they have created a framework for tracking the ownership and provenance of data. This ensures that contributors are fairly compensated whenever their data is used, establishing a new paradigm where data value is shared, not monopolized.

3. The DIN Vision

DIN is a team that is tackling the data problem head-on.

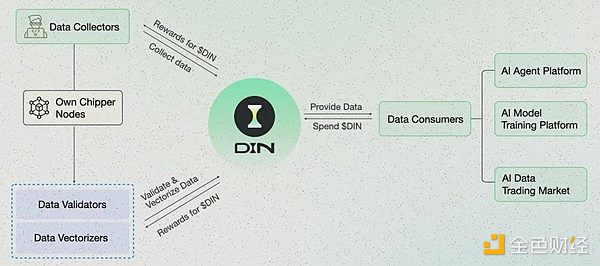

The core of DIN is a data layer that collects and verifies on-chain and off-chain data, using the blockchain as a settlement layer.

The main idea? To return data ownership to users and reward them for their contributions to the system.

How DIN Works:

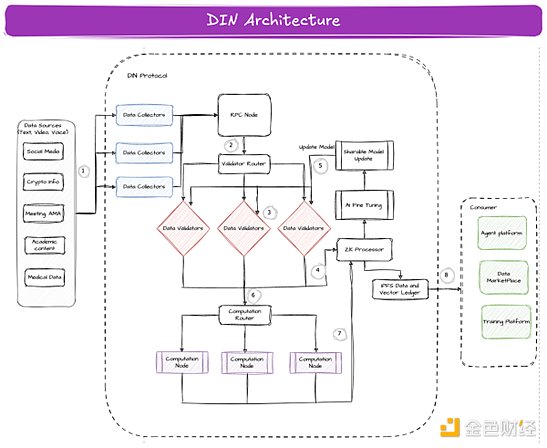

This diagram may seem complex at first glance, so let's break it down.

The DIN network has three main participants:

Data Collectors

Data Verifiers

Compute Nodes

To better understand how the data collectors and verifiers work, let's dive into xData, which is DIN's current flagship product.

(1) xData: Data Collection

xData is DIN's flagship platform, primarily used to collect, organize, and store data from social media platforms like X, without relying on APIs. It runs on a decentralized network, ensuring user ownership and privacy. It was launched on opBNB (a BNB Chain L2) in April 2024.

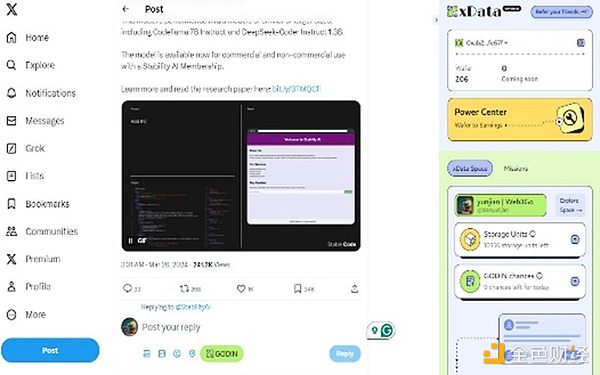

xData uses gamification mechanisms to make data collection fun and profitable for users. Let's quickly go through how it works:

Users install a browser extension, log in with their wallet, and connect their X account.

Users can tag interesting tweets by replying to tweets and tagging accounts.

Users earn "wafers" points for tagging tweets, which can be converted to tokens during the TGE.

There are various gamification mechanisms. Each user has a limited number of tweets they can tag (store), but they can increase their storage space by consuming wafers. Users also need to consume wafers every 24 hours to keep their account "unlocked" and earn more wafers.

DIN publishes tasks for the community to search for tweets and tag them based on specific keywords or labels.

The permissionless nature of xData means that users from anywhere in the world can participate in data collection and annotation to earn rewards/income, without being limited by nationality. Currently, data collection is happening off-chain, with tagged tweets stored on the BNB green field, a decentralized data layer on the BNB Chain.

(2) Chipper Nodes: Data Verification

The next question is: How do we ensure the quality and integrity of the data submitted by users? After all, someone could run an AI bot to randomly tag tweets that don't match the specified label, just to maximize their gains.

Data labeling is also not always straightforward. Tweets often contain usernames, slang, and cultural factors - for example, BTC is often referred to as "big pie" in Chinese tweets.

This is where data verification comes into play.

Chipper nodes are DIN's AI-driven data verification and processing nodes, responsible for verifying and vectorizing the data, while also allowing users to earn tokens (xDIN and DIN).

Behind the scenes, each user-operated node is actually running a small AI model locally to verify that the content of the tweet matches the attached label, and then storing it in the decentralized data layer. Users can operate these nodes on a standard PC, without the need for expensive hardware setups.

As more verified data is processed, the AI models used by the verifiers continuously improve, making the network smarter and more accurate over time.

Currently, DIN handles all data verification internally, but the goal is to decentralize the verification process. They are actively testing nodes, and users can run the node software on their local devices to test the network. DIN plans to release its mainnet and tokens in the coming weeks, with bug bounties already in place.

(3) Compute Nodes

While the compute nodes are not yet in use, they are DIN's future plan for securely storing data in a privacy-preserving manner. Here's how the compute nodes work:

Vector Conversion: The compute nodes convert the verified data into vectors.

Privacy Processing: The vectors are processed through a ZK (zero-knowledge) processor to ensure privacy.

Data Finality: The finalized data sets and vectors are stored on IPFS for third-party access.

A New L2 on BNB Chain?

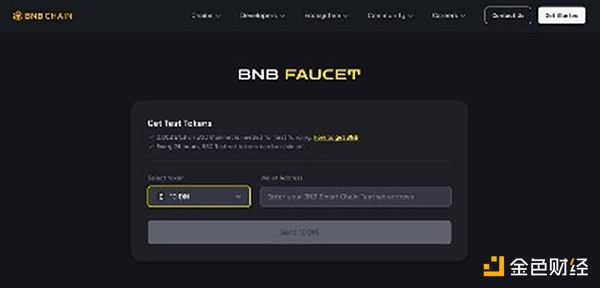

Although no official announcement has been made, our research has uncovered a DIN token on the BNB Chain testnet. This suggests the future development of the blockchain - potentially as a sidechain or L2 solution on the BNB Chain.

About DIN:

DIN may seem like a new player, but the project's origins can be traced back to late 2021. It was initially launched as "Web3Go", an on-chain data analytics platform in the Polkadot ecosystem, receiving funding from the Web3 Foundation and collaborating with clients like Moonbeam and Oak Network.

In 2022, the team expanded its business scope to the BNB Chain ecosystem, joined the Binance Labs MVB incubator, and received the investment needed to develop a "multi-chain open-source data analysis platform".

By July 2023, they saw the signs: generative artificial intelligence was thriving, and the demand for powerful data infrastructure was more urgent than ever before. So the team shifted to building a comprehensive "AI data intelligence layer" to align their mission with the data needs of AI innovation. This evolution reached a climax in May 2024, when Web3Go was officially renamed to DIN, signaling a bold focus on data and indicating that the data layer would become key to the next wave of AI progress.

4. The Traction of DIN - Momentum So Far

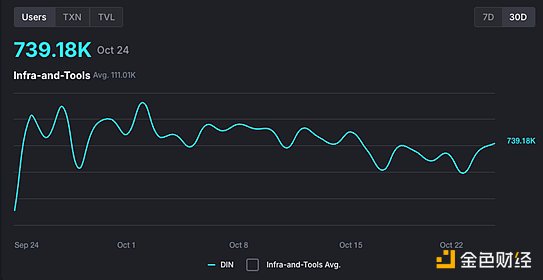

The daily active users of opBNB are around 700,000.

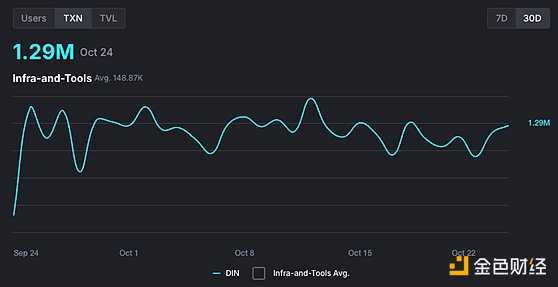

The daily trading volume of DIN on opBNB is around 1.2 million.

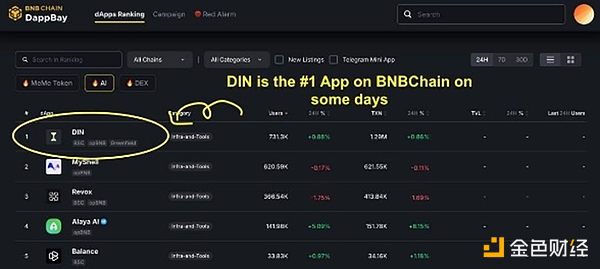

According to DappBay data, DIN performed steadily in October, with an average daily active user count exceeding 700,000 and a daily trading volume exceeding 1.2 million. Most of the transactions are because xData users must make a on-chain transaction every 24 hours to activate their xData app and earn points.

DIN has consistently been one of the top 10 dApps on the BNB Chain, and at many times, it has been the number one application by user count on the network. While I don't track the BNB Chain ecosystem as closely as I do Solana and Base, this is no small feat, especially considering the BNB Chain's launch timeline and Binance's powerful support.

To better understand, I analyzed some other top-ranking applications on the BNB Chain to see what shapes user stickiness:

Vooi (DeFi) is a perp DEX aggregator.

Particle Network (Infrastructure) is a cross-chain protocol in testnet.

Revox (Infrastructure) is a modular on-chain network with a popular content app - ReadON.

SERAPH (Gaming) is a Souls-like RPG game.

MyShell is a no-code AI app store ecosystem.

According to the team, DIN has already collected and annotated over 100 million tweets, with user bases exceeding 30 million on opBNB and Mantle.

The key here is that DIN can leverage its massive user base to quickly generate large, relevant real-time data sets of tweets. This process is entirely independent of the X API.

While xData's current focus is on Twitter, the team plans to expand the data collection and annotation platform to Reddit, Facebook, Instagram, and other data sources, as well as any user data platform with high-value information. To me, this is where the real gold lies.

Reiki:

Reiki is another product of DIN, closely tied to the ongoing AI agent meta. In fact, given the potential consumer interest in AI agents that we've seen in recent weeks on Truth Terminal and GOAT, DIN may already be ahead of the curve.

In January 2024, DIN launched the Reiki platform, allowing users to create AI agents (primarily chatbots) without any coding experience. Users can also integrate their own knowledge bases to build engaging, personalized chatbots, reminiscent of MyShell.

The platform quickly gained attention upon launch, becoming the #1 product on Product Hunt.

Reiki also provides creators with various ways to monetize their bots, participate in reward programs, and even turn their bots into NFTs - adding an interesting layer of ownership to the gaming experience. Notably, the BNB Chain Discord knowledge support bot is powered by Reiki.

While the platform is currently largely abandoned, the DIN team doesn't rule out the possibility of reviving it after they launch their token. If revived, Reiki could provide additional utility for the token and a way for AI agent creators to leverage the data collected by xData.

5. Token Design: xDIN, DIN, and Node Sales

From August to September 2024, DIN held a Chipper node sale and raised $2.5 million from it. These Chipper nodes will allow users to run verification software on their local devices, using models to ensure data is accurately annotated. The sale was very successful, with all 25,112 secondary nodes (priced at $99 each) sold out.

Supply Side:

Prior to the TGE, xData users could exchange their wafers points for xDIN - the pre-launch token. However, there will be a 5-30% conversion fee, which will be distributed to Chipper node owners. This conversion mechanism is not yet live but is expected to be immediately activated once the node "pre-mining" goes live later this month.

During the TGE, users will receive an airdrop of DIN (the tradable token) proportional to their xDIN holdings, fully unlocked with no complex locking mechanisms.

After the TGE, 25% of the total DIN supply will be reserved for Chipper node rewards. Half of this allocation will be released in the first year, with the remaining half released at a 50% rate each year.

It's worth noting that the unlocking speed of this node sale is relatively faster compared to other projects conducting node sales, where node rewards are typically vested over 3-4 years.

Demand Side:

Validator nodes may need to stake DIN tokens to participate in the network. In return, they will receive rewards for verifying data, but they will face slashing penalties if their output is inaccurate.

On the other end, data users must use DIN tokens to access the network data. As most Web2 companies are still hesitant about using cryptocurrencies, the company will need to facilitate these transactions to bridge the gap between traditional enterprises and decentralized networks.

We are still awaiting the detailed DIN token economics to be published, which should be released closer to the TGE.

Team and Funding:

The core DIN team is composed of talents from Columbia University, University College London, and the University of Stuttgart, with over a decade of expertise in AI and blockchain.

DIN's founder, Hao Ding, holds a master's degree in Information Technology from the University of Stuttgart. Before delving into cryptocurrencies, he served as the R&D director at the Suzhou AI Research Institute in China, then as the VP of the identity authentication oracle network Litentry, and later founded Web3Go.

I was pleased to meet Hao in person, and we had an engaging discussion about the future of AI. If you ask me what his conviction is? It's that data will be the core of everything. The DIN team currently has 16 members, mostly engineers.

DIN participated in Binance Labs' MVB 5 accelerator program and raised $4 million in a seed round in July 2023, led by Binance Labs, HashKey, NGC, and Shima Capital. In August 2024, DIN secured an additional $4 million in funding from Manta Network, Moonbeam Network, Ankr, and Maxx Capital, bringing its total funding to $8 million.

6. Our Thoughts

Thought 1: Building a Decentralized Scale AI is Interesting

Data collection and annotation is a big business.

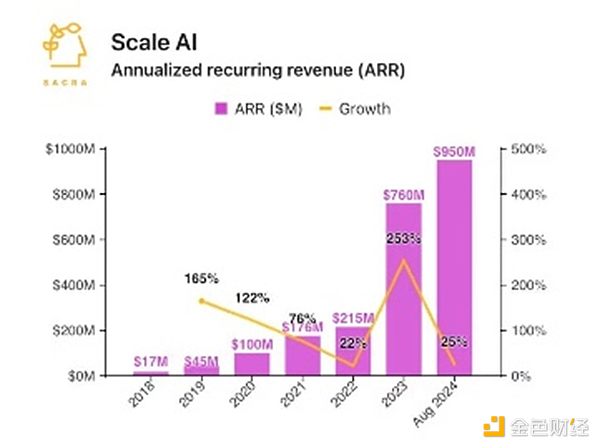

Scale AI is the most prominent player in this space, with an estimated annual recurring revenue of around $1 billion. This is driven by the massive demand from foundational AI model companies like OpenAI, Anthropic, and Cohere, who are Scale's primary customers. As of May 2024, the company was valued at $14 billion.

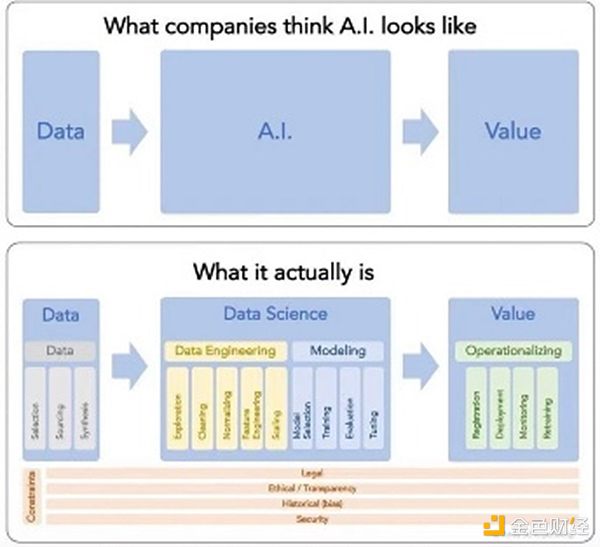

Let's take a closer look at Scale AI's business model.

Scale's data annotation tasks rely on a large distributed workforce, including manually tagging videos, classifying photos, and transcribing audio.

The company employs around 240,000 workers across multiple countries, actively recruiting in regions with high unemployment and lower living costs. For example, Kenya has become an important recruitment hub in Africa, with an in-person training "boot camp" in Nairobi and targeted paid advertising to attract workers.

The annotation process typically has two layers: the first layer is annotators, who start annotating the data from scratch; the second layer is quality controllers, who check the work, add missing annotations, and correct errors. This is a labor-intensive task, but it is effective because labor costs are low, and clients are willing to pay substantial sums.

Now, imagine expanding this model through a decentralized network. Permissionless, globally distributed workers incentivized by tokens could allow anyone to participate, while a distributed verification network could ensure data accuracy and quality. Decentralization can open up new possibilities for scaling data annotation, turning it into a truly democratized global process.

Idea 2: A large user base = a good thing

DIN's main advantage today is its large, sticky community, built through over two years of focused community-building efforts. With such a network, DIN can quickly mobilize data collection according to specific criteria. However, the challenge is to determine where the real data needs are, guide users to collect and annotate the right datasets, and establish sustainable revenue streams to support long-term growth.

Idea 3: Incentives are a double-edged sword

Currently, most user stickiness is driven by the expectation of token rewards after token release. But if the team cannot generate sufficient demand for the tokens after their release, token usage may decline as the initial hype fades. Creating this demand requires speculative interest and building a market of data consumers who are eager to purchase these datasets.

Idea 4: Data annotation is a highly competitive field

DIN is not the only crypto team vying for a share of this market - projects like Sapiens, Grass, and Masa are also competing. But the pie is huge. For example, Grass currently has a market capitalization of $2.5 billion, highlighting the immense opportunities in this industry.

One way for DIN to differentiate itself and stand out from the competition may be to train and deploy proprietary AI models for data verification, reducing reliance on manual labor. This automation-first approach can streamline operations, enhance scalability, and give DIN an advantage over competitors still heavily dependent on manual processes.

7. Conclusion

Data networks are one of the most exciting frontiers at the intersection of AI and crypto. Unlike traditional centralized models, crypto-driven data networks leverage decentralized participation and incentive mechanisms to build high-quality datasets at scale.

DIN positions itself as a pioneer in this field, and witnessing the development of this project will be a fascinating journey. This is an opportunity that DIN needs to seize. I often tell people: data networks are one of the wisest areas to build in right now.

Crypto is reshaping the way data is collected, verified, and monetized, laying the foundation for a new decentralized data economy.