Introduction

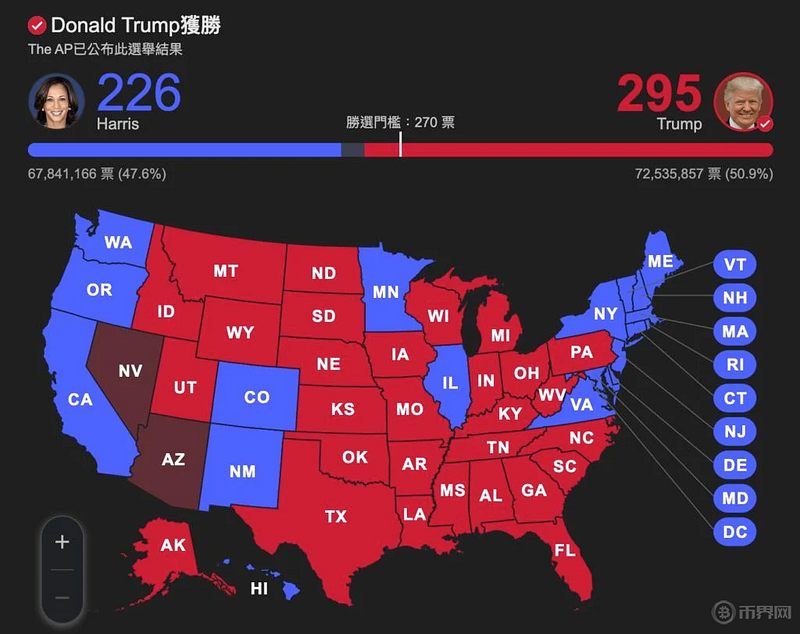

The 2024 US presidential election concluded successfully on November 6, 2024, with former President Donald Trump defeating his opponent and winning 295 electoral votes to return to the White House. This victory not only attracted widespread attention from American voters, but also injected new confidence into the global Bitcoin and Ethereum markets. During the campaign, Trump repeatedly stated that if re-elected, he would implement a series of policies favorable to the crypto industry, which has filled the market development of these crypto assets with new expectations. With Trump's victory, industry insiders are closely watching whether he can fulfill these promises and bring about far-reaching industry changes.

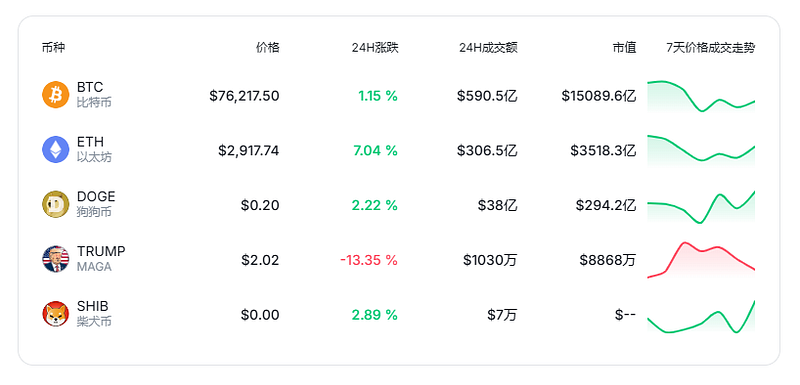

Latest price trends of Trump & Musk-related currencies and mainstream currencies

Trump's Crypto Policy Commitments

During this year's election process, Trump has made supportive statements about cryptocurrencies on multiple occasions and promised to introduce a series of favorable policies if elected. The following are some key points he has publicly stated, and whether these commitments will be implemented during his second term has become a focus of attention for the crypto industry.

1. Banning Central Bank Digital Currencies (CBDCs)

In January 2024, Trump emphasized in a campaign speech in Portsmouth, New Hampshire that if re-elected, he would ban the launch of Central Bank Digital Currencies (CBDCs) in the US. He stated that CBDCs pose a huge threat to personal freedom, as they would give the federal government absolute control over people's money and could even confiscate people's assets without their knowledge. Trump said he would implement strict protective measures to ensure that the bank accounts of American citizens are not unfairly treated. The introduction of CBDCs could change the existing monetary system, and Trump clearly wants to maintain the independence of the traditional financial system and avoid the central bank's full control over digital currencies.

2. Pardoning "Silk Road" Founder Ross Ulbricht

In May 2024, Trump publicly stated that if elected, he would commute the sentence of "Silk Road" founder Ross Ulbricht. Ulbricht was sentenced to life in prison for allegedly operating the Dark Web trading platform "Silk Road". Trump promised to reduce Ulbricht's sentence to the time he has already served, allowing him to be released from prison early. This commitment has received enthusiastic attention from the crypto community, as Ulbricht played an important role in the history of cryptocurrencies, and the "Silk Road" he founded was one of the earliest platforms to use Bitcoin for transactions. Trump's move is seen as support for the spirit of cryptocurrencies, especially in terms of legal and political promotion.

3. Supporting Domestic Bitcoin Mining

In June 2024, Trump stated on the social media platform Truth Social that he hopes all unmined Bitcoin can be mined in the US, and promised to support the development of crypto mining businesses after being elected. Trump pointed out that Bitcoin mining could be an effective way for the US to resist Central Bank Digital Currencies (CBDCs). He also stated that the Biden administration's hostile attitude towards Bitcoin is only encouraging other countries, especially China and Russia, to accelerate the development of their own digital currencies, and that the US should seize the opportunity of Bitcoin mining to become a global energy leader.

4. Treating Bitcoin as a Strategic Reserve Asset

At the Bitcoin2024 conference in July 2024, Trump publicly stated that if re-elected as president, he will absolutely not sell the Bitcoin held by the US government, and will treat it as a strategic reserve asset for long-term holding. This statement is impressive, as Bitcoin is not only seen as a digital currency, but also as "digital gold" with a value-preserving property. Trump's clear statement that he will not sell Bitcoin reflects his recognition of Bitcoin's value and his willingness to treat it as a reserve asset for the US, a policy that could impact the US's fiscal policy and promote the global recognition of Bitcoin as a reserve asset.

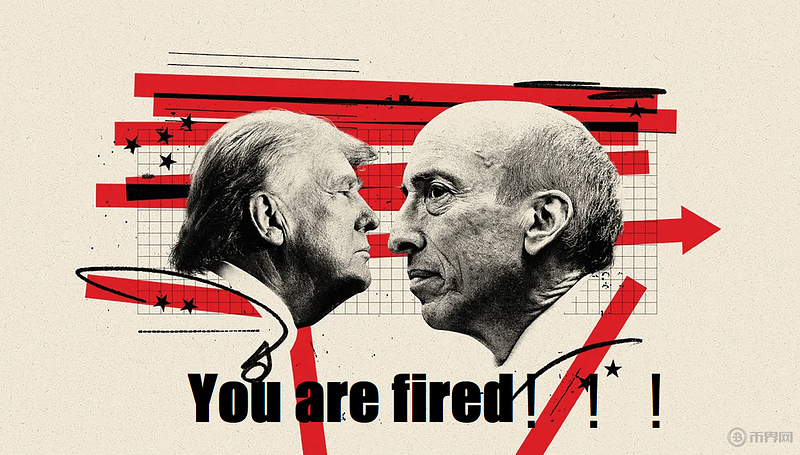

5. Firing SEC Chairman Gary Gensler

In July 2024, Trump stated that in order to promote the thriving development of the crypto industry, he plans to immediately dismiss Gary Gensler, the chairman of the US Securities and Exchange Commission (SEC), who has long been critical of cryptocurrencies. Gensler is seen as an enemy by the crypto industry due to his strict regulatory measures, especially on the issues of crypto regulation and legitimacy. Trump believes that under Gensler's leadership, the SEC's suppression of the crypto industry will constrain the industry's innovation and development, so he has promised that once elected, he will remove this regulatory leader who is unfavorable to the industry.

6. Using Bitcoin to Repay $35 Trillion in National Debt

Trump also mentioned in a Fox News interview in August 2024 that the US is facing a huge national debt problem, and he believes that Bitcoin could become an important tool to solve the US debt crisis. He proposed that the US could issue Bitcoin to repay the $35 trillion in national debt, an seemingly far-fetched suggestion that actually shows Trump's confidence in Bitcoin's potential to solve traditional financial problems. Although this view may be more for attention-grabbing, it also demonstrates Trump's recognition of Bitcoin as a financial tool.

7. Musk's Role and Crypto Support

Trump also announced that if elected president, he will establish a government efficiency committee and plans to conduct a comprehensive financial and performance audit of the entire federal government, with Tesla CEO Elon Musk agreeing to lead the committee. Musk's open attitude towards the crypto industry also provides support for Trump's policies. Musk himself not only owns a large amount of Bitcoin, but also publicly supports the decentralized monetary system, and his views on the crypto industry will help Trump push forward relevant policies.

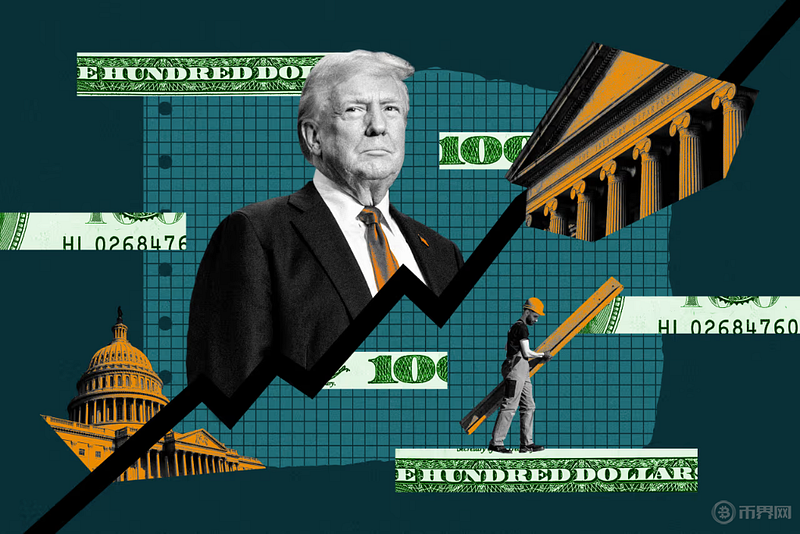

The Impact of Trump on the Crypto Market

If Trump officially takes office in 2025, his policies are expected to bring about many changes to the crypto market. Here are some potential policy changes:

1. Positive Support for Bitcoin: Trump's policies could further promote the global adoption and value recognition of Bitcoin, especially his support for treating Bitcoin as a strategic reserve asset, which could prompt other countries to consider including Bitcoin as part of their foreign exchange reserves.

2. Advancing Bitcoin Mining: Trump's support for Bitcoin mining will drive the US to become a global center for Bitcoin mining, especially in energy-rich regions like Texas and Alaska.

3. Relaxed Regulation: Trump's criticism of the U.S. Securities and Exchange Commission (SEC) and his promise to fire its chairman may lead to a more relaxed regulatory environment for the cryptocurrency industry, which would be a boon for innovative crypto companies.

4. Resistance to CBDC: Trump's stance is likely to make the U.S. take a more conservative approach to CBDC development, providing space for the growth of decentralized monetary systems.

5. The Role of Cryptocurrencies in Debt Management: Trump's suggestion to use Bitcoin to pay off the national debt, although unlikely to be implemented immediately, is enough to spark discussions about the potential of cryptocurrencies as a financial tool.

Trump's Victory Fuels Crypto Market Euphoria

After Trump's successful re-election, the cryptocurrency market experienced a strong rebound. Since November 6th, the price of Bitcoin has surpassed $75,000, setting a new all-time high, and further increased to $76,422 in a short period, showing a strong upward trend. Although the price slightly retreated to $75,000 on November 7th, the market sentiment remains high, with a gain of around 5%. This rally not only brought substantial returns to short-term investors but also exposed the high volatility of the market, reminding investors to pay attention to the risks.

Latest BTC Price Trend

Ethereum performed even more impressively in this rally, breaking through $2,800 with a gain of 13.78%, far exceeding Bitcoin. This phenomenon reflects investors' optimism about Ethereum's long-term development potential, especially with the push of Ethereum 2.0 upgrade, the market demand for Ethereum is constantly increasing.

However, with the intensification of market volatility, the risk of leveraged capital is constantly increasing. In the past 24 hours, the global cryptocurrency market has seen $587 million in liquidations, with short positions accounting for the majority, further exacerbating the instability of the market. Investors need to manage their funds prudently and avoid the risks brought by high leverage operations.

Latest ETH Price Trend

Conclusion

Trump's victory has undoubtedly brought unprecedented excitement to the cryptocurrency market. With the prices of mainstream crypto assets like Bitcoin and Ethereum reaching new highs, the market's optimistic sentiment remains high, and investors are full of expectations for the future of the cryptocurrency industry. The series of crypto-friendly policies proposed by Trump during the campaign, particularly his support for Bitcoin, opposition to Central Bank Digital Currencies (CBDCs), and promotion of Bitcoin mining, if implemented during his second term, will have a far-reaching impact on the industry. These policies may not only bring a more relaxed regulatory environment for Bitcoin, Ethereum, and other crypto assets, but also help the U.S. occupy a more important position in the global cryptocurrency industry.

However, along with the strong market rally, there are also undeniable risks. The price fluctuations of Bitcoin and Ethereum are violent, and the risk of leveraged capital is constantly increasing, reminding investors to remain vigilant while enjoying short-term profits. The high volatility of the cryptocurrency market makes fund management and risk control particularly important. Nevertheless, Trump's support for the cryptocurrency market will undoubtedly encourage more capital to enter the industry, laying the foundation for the long-term development of cryptocurrencies.

With Trump's re-election and the rise of the cryptocurrency market, the next few years may see more proactive policy support and industry transformation. If Trump can fulfill his campaign promises, especially in promoting Bitcoin as a strategic reserve asset, relaxing regulations, and opposing CBDCs, it is expected to create favorable conditions for the maturity and global adoption of the cryptocurrency market. Cryptocurrencies may not only gain more support in the U.S. market, but also become an important part of the global financial system. Therefore, investors and industry participants should continue to closely monitor policy changes, prudently respond to market volatility, seize opportunities while avoiding risks, and be well-prepared for the future market development.