After former President Donald Trump's victory in the US presidential election on the 6th, the cryptocurrency market has continued its explosive upward trend for the third day. BTC has set a new all-time high. As of 5:29 pm on the 8th, based on CoinMarketCap, BTC has risen 10% from last week to $75,967. At the same time, it is trading at 148.86 million won on the domestic cryptocurrency exchange Bithumb. Major altcoins such as ETH, SOL, and XRP have also recorded a surge of up to 20%, and the total market capitalization of the cryptocurrency market has increased to nearly $2.6 trillion (about 360.68 trillion won).

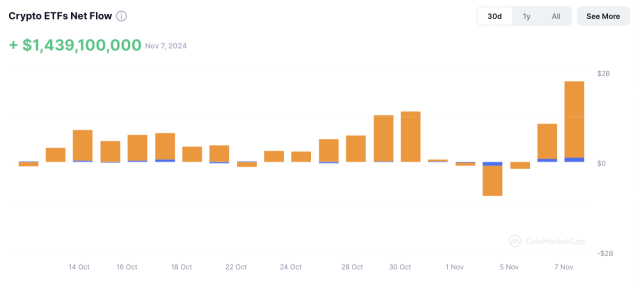

Institutional investors are also flocking to BTC investment. After the launch at the beginning of this year, the largest amount of funds ever has flowed into BTC spot exchange-traded funds (ETFs). On the 7th, local time in the US, $1.36 billion (about 1.89 trillion won) was net inflow into BTC spot ETFs. More than $1.1 billion (about 1.52 trillion won) was inflow into BlackRock's IBIT product in a single day. Mike Novogratz, CEO of cryptocurrency financial firm Galaxy Digital, observed that a "tsunami" could hit the cryptocurrency market, and "if the Trump administration allows traditional financial institutions to hold cryptocurrencies on their balance sheets as the market expects, institutional investors will flock to the cryptocurrency market."

Related Articles

- [Coin Report] 'Uptober' finally realized... BTC briefly re-crossed 100 million won

- [Coin Report] Solana soars 14% in a week, meme coins still on alert

- [Coin Report] If Trump is elected, will Musk become a minister? Dogecoin surges 23% in a week

- [Coin Report] Ripple mixed with good and bad news... Plunged 16% early in the week, hovering around $0.5

The new Trump administration expected to take office next year is expected to have a crypto-friendly policy stance. The fact that the Republican Party has also become the majority party in both the Senate and the House of Representatives with Trump's election adds to the optimistic outlook. Brian Armstrong, CEO of the largest US exchange Coinbase, said, "This election is a big boon for the cryptocurrency industry," and "the next Congress will be the most crypto-friendly Congress ever. The Trump administration will re-examine all cryptocurrency-related lawsuits that have been raised so far."

Among the pro-cryptocurrency pledges made by former President Trump during the election campaign, the two that cryptocurrency investors are most closely watching are the BTC strategic asset stockpiling and the dismissal of Gary Gensler, the chairman of the Securities and Exchange Commission (SEC). In July, Trump gave a keynote speech at the 'Bitcoin 2024 Conference' in Nashville, Tennessee, and emphasized that "it is the policy of our administration that the US government will 100% hold all BTC it currently owns or acquires in the future." Although Trump did not mention specifics, after the speech, Republican Senator Cynthia Lummis introduced a bill requiring the Federal Reserve to hold up to 5% of the total BTC supply as a strategic reserve asset. With Trump's election and the Republican Party's control of both the Senate and the House, the chances of this bill passing Congress have increased further. If the US holds BTC as a reserve asset, it could lead to a competition among countries to stockpile BTC, which could be a major boon for BTC prices.

Former President Trump's statement on the first day of his inauguration that he would fire Chairman Gensler also received a huge response from crypto investors. Chairman Gensler is notorious among crypto investors as the most representative anti-crypto figure. This is because he has sued numerous U.S. crypto companies under the premise that all cryptocurrencies except BTC are securities. After Trump's election, comments demanding Gensler's dismissal have been pouring in on Gensler's X account. Brad Garlinghouse, the CEO of Ripple, which has been in legal disputes with the SEC for years, also requested through his X account after Trump's election that "Gensler be fired on the first day of his inauguration".

The enthusiastic response of crypto investors to Trump's election has made cryptocurrencies the representative beneficiary asset of the so-called 'Trump Trade'. Trump Trade refers to a strategy of investing in assets that are expected to be bullish when Trump is elected. There are also forecasts that BTC could soar to $100,000. Matrix Port, a crypto service provider, analyzed that "611 million people, or 7.51% of the world's population, own cryptocurrencies. An 8% adoption rate is a key turning point for the mainstream adoption of BTC" and "BTC could reach $100,000 in the next few months, driven by positive factors such as Trump's presidential victory." Ryan Rasmussen, chief research analyst at Bitget, also said, "The total market capitalization of stablecoins has reached an all-time high and is maintaining around $160 billion. The net inflow of physical ETFs also shows that Wall Street institutions are optimistic about the market outlook," and "BTC has a possibility of reaching $100,000 within the next 3 months."

Reporter Kim Jeong-woo

woo@decenter.kr

Copyright ⓒ Decenter, Unauthorized reproduction and redistribution prohibited