A quick overview of important events this week (11/03-11/09)

- Bitcoin dynamics : It broke through a new high and reachedUS$76,848 , setting a new history again. Ethereum exceeded US$2,900. Standard Chartered is optimistic that Bitcoin will reach US$125,000 by the end of the year and reach US$200,000 next year.

- The Fed's one-point interest rate cut was in line with expectations: Ball said that as the new government policy takes shape, the Fed will begin to evaluate its impact on its two goals of stabilizing inflation and maximizing employment.

- U.S. election: U.S. stocks generally rose after Trump won the election , but analysts are also concerned about the risk of renewed inflation.

- a16z senior executives appeal to Trump : 7 suggestions for the US government to seize the opportunities of Web3 after being elected.

- Binance founder : CZ fought back against the SEC, dismissed the crypto asset securitization charges, and asked the court to dismiss the SEC’s charges against Binance .

- Gold fell sharply . The dollar continued to be strong after Trump was elected, and gold fell.

- Buffett reduces Apple holdings again: Berkshire Hathaway continues to reduce its holdings of Apple shares by 100 million shares, bringing its cash reserves to a record high of 10 trillion yuan .

- Arthur Hayes : Solana has more potential . The key lies in interest rate cuts. The election has little impact. The focus is on the Fed's interest rate policy.

Changes in trading market data this week

Sentiments and Sectors

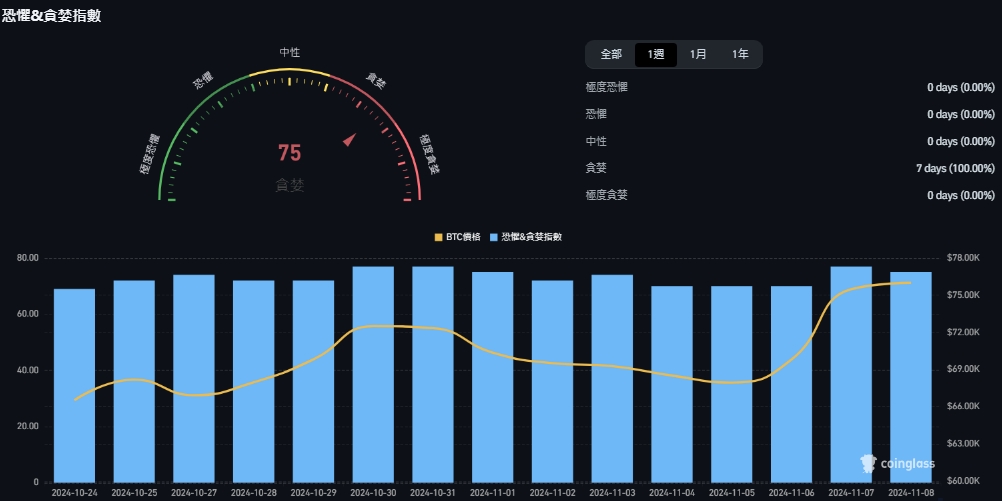

1. Fear and Greed Index

This week's market sentiment indicator rose from 74 (greedy) to 75 (greedy), staying in the (greedy) range throughout the week.

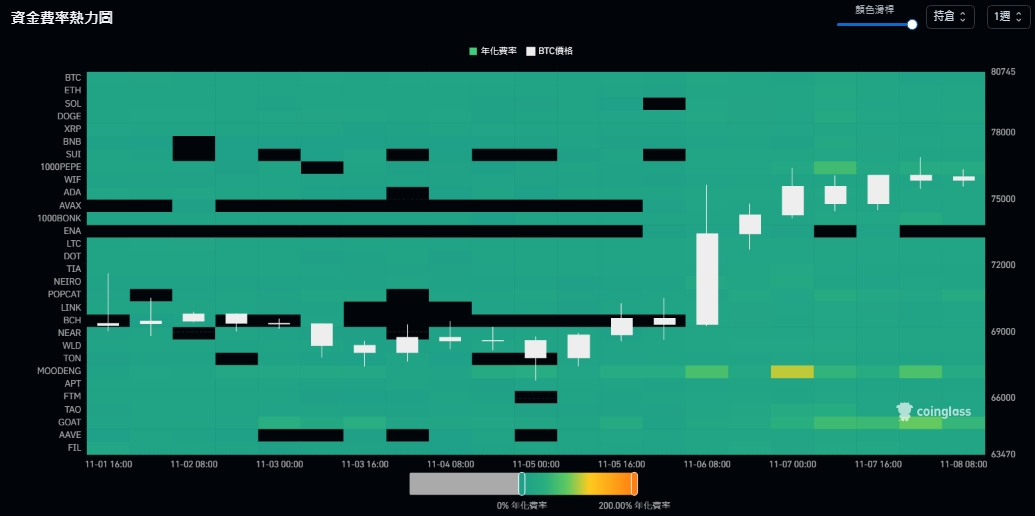

2. Funding rate heat map

This week, the Bitcoin funding rate reached a maximum of 17.82% and a minimum of 7.21% , indicating that the bullish sentiment continues to be strong.

The funding rate heat map shows the changing trend of funding rates for different cryptocurrencies. The color ranges from green with zero rate to yellow with 50% positive rate. Black represents negative rate; the white K-line chart shows the price fluctuation of Bitcoin. , in contrast to the funding rate.

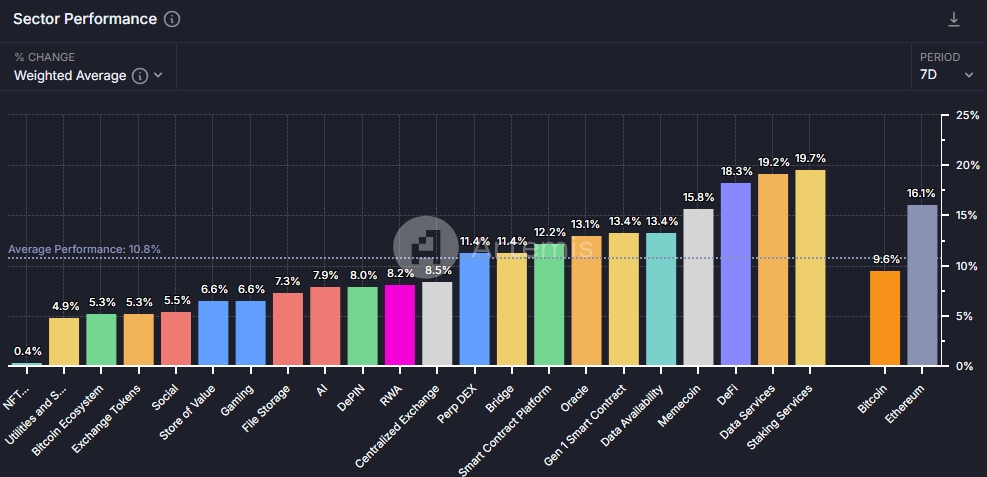

3. Sector performance

According to Artemis data, the average increase in the blockchain sector this week was (10.8 %) , with pledge services, data services, and DeFi occupying the top three respectively (19.7%, 19.2%, and 18.3%) .

This week’s gains for Bitcoin and Ethereum were (9.6 %, 16.1%) .

The three worst performing areas are: NFT (0.4%), Utilities and Services (4.9%), and Bitcoin Ecosystem (5.3%).

market liquidity

1. Total cryptocurrency market capitalization and stablecoin supply

Data on the total market value of cryptocurrency this week showed that it rose from US$2.37 trillion to US$2.61 trillion , an increase of US$240 billion, and the total market value increased by approximately 10.1%.

The total supply of stablecoins, an important indicator of market health and liquidity, increased this week from $163.26 billion to $166.05 billion , an increase of $2.79 billion, or about 1.7%.

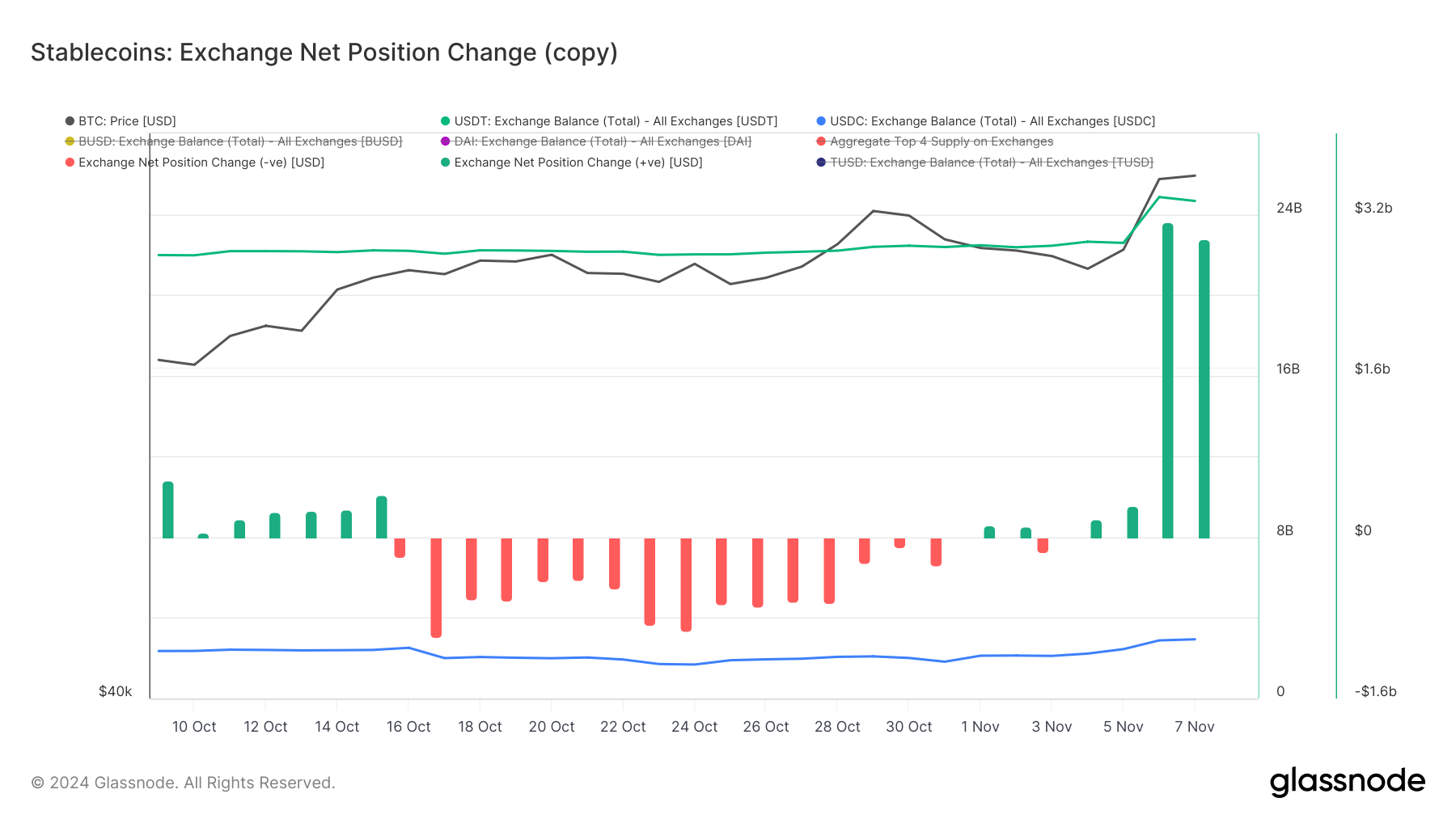

2. The potential purchasing power within the exchange has increased significantly

Data shows that the overall assets of the exchange showed a net inflow this week, especially after the US election, USDT saw a large inflow. This suggests that investors may be preparing for further market activity, with funds entering exchanges or signaling potential increased buying demand in the short term.

Bitcoin Technical Indicators

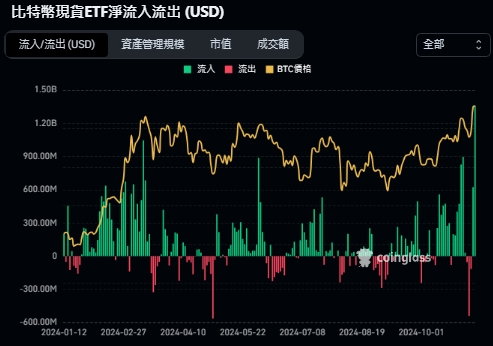

1. Bitcoin spot ETF saw a large net inflow of funds

Bitcoin ETF capital inflows this week were US$1.2691 billion, setting a single-day record of US$1.36 billion on November 7.

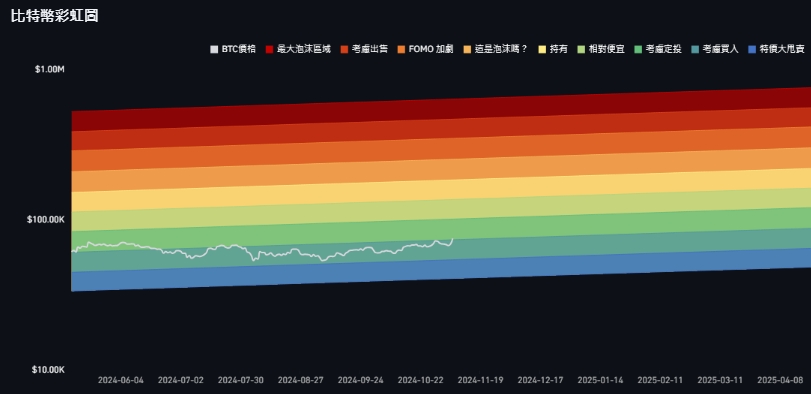

2. Bitcoin Rainbow Chart

The Bitcoin rainbow chart shows that the current price of Bitcoin ( $75,000 ) is in the range from " Consider Buying " to " Consider Fixed Investment ".

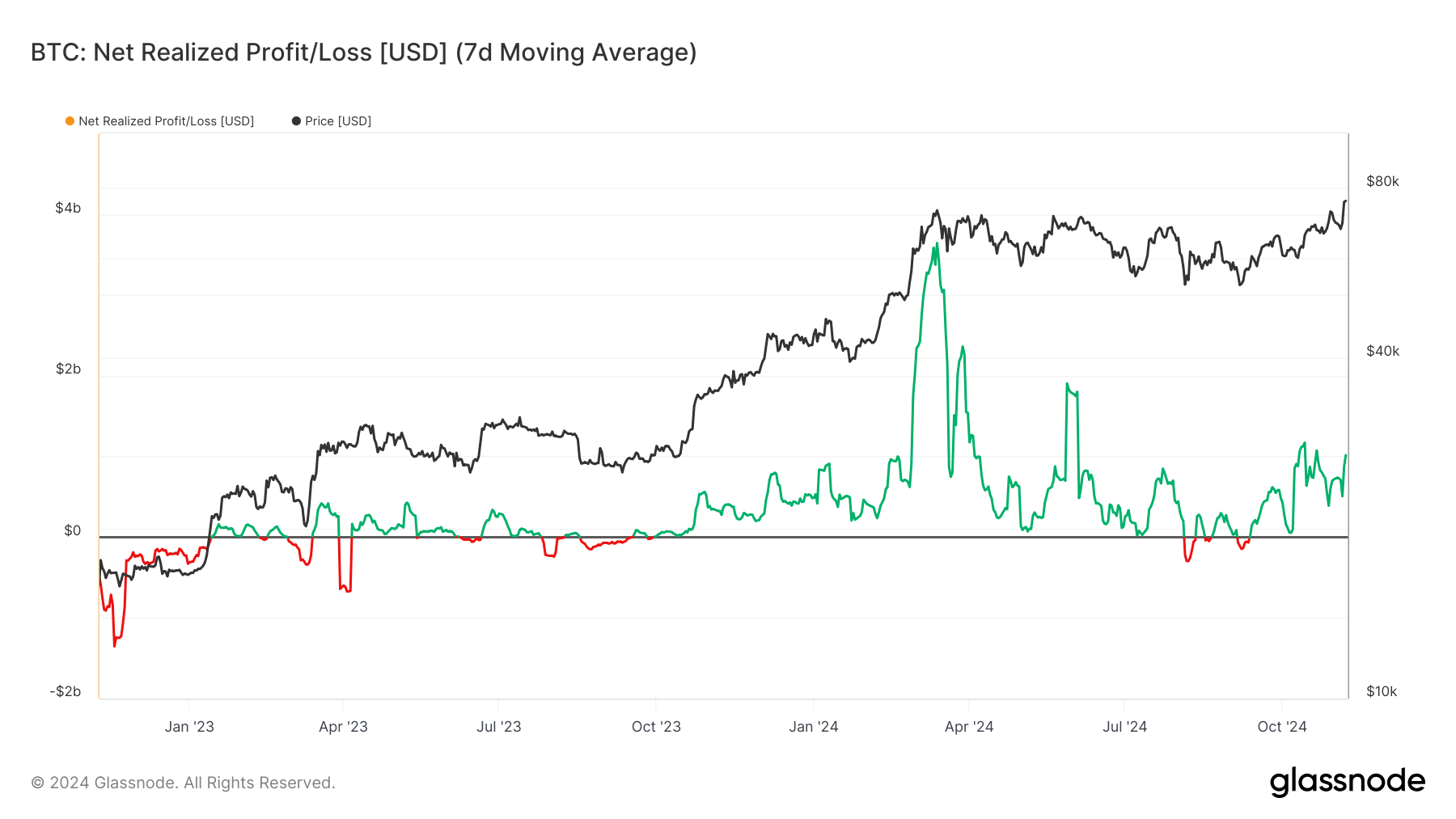

3. Bitcoin net profit and loss performance

Bitcoin's realized net profit and loss indicator shows that the current market conditions have recovered, and the proportion of profits and losses is generally similar to that at the end of February this year .

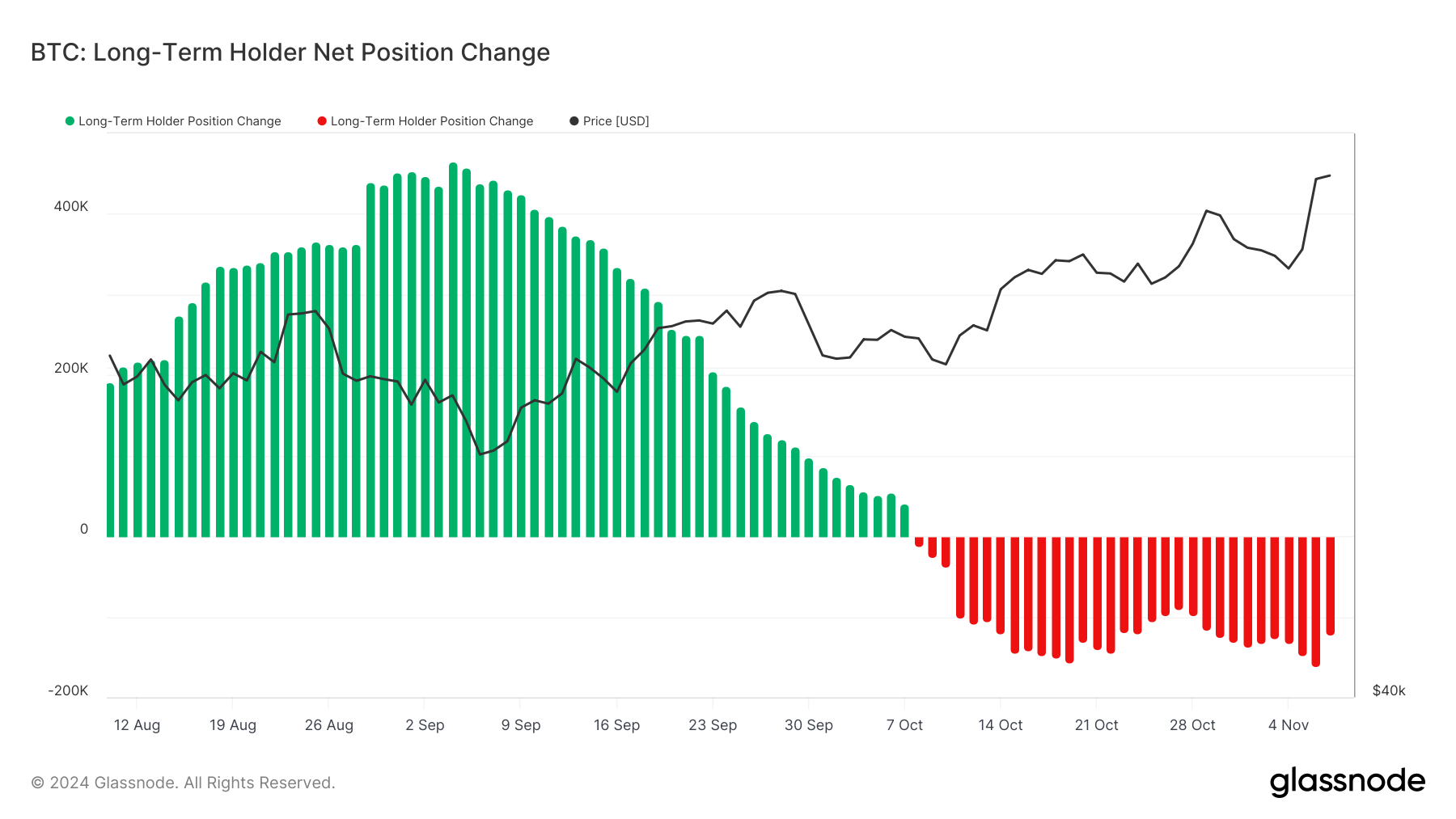

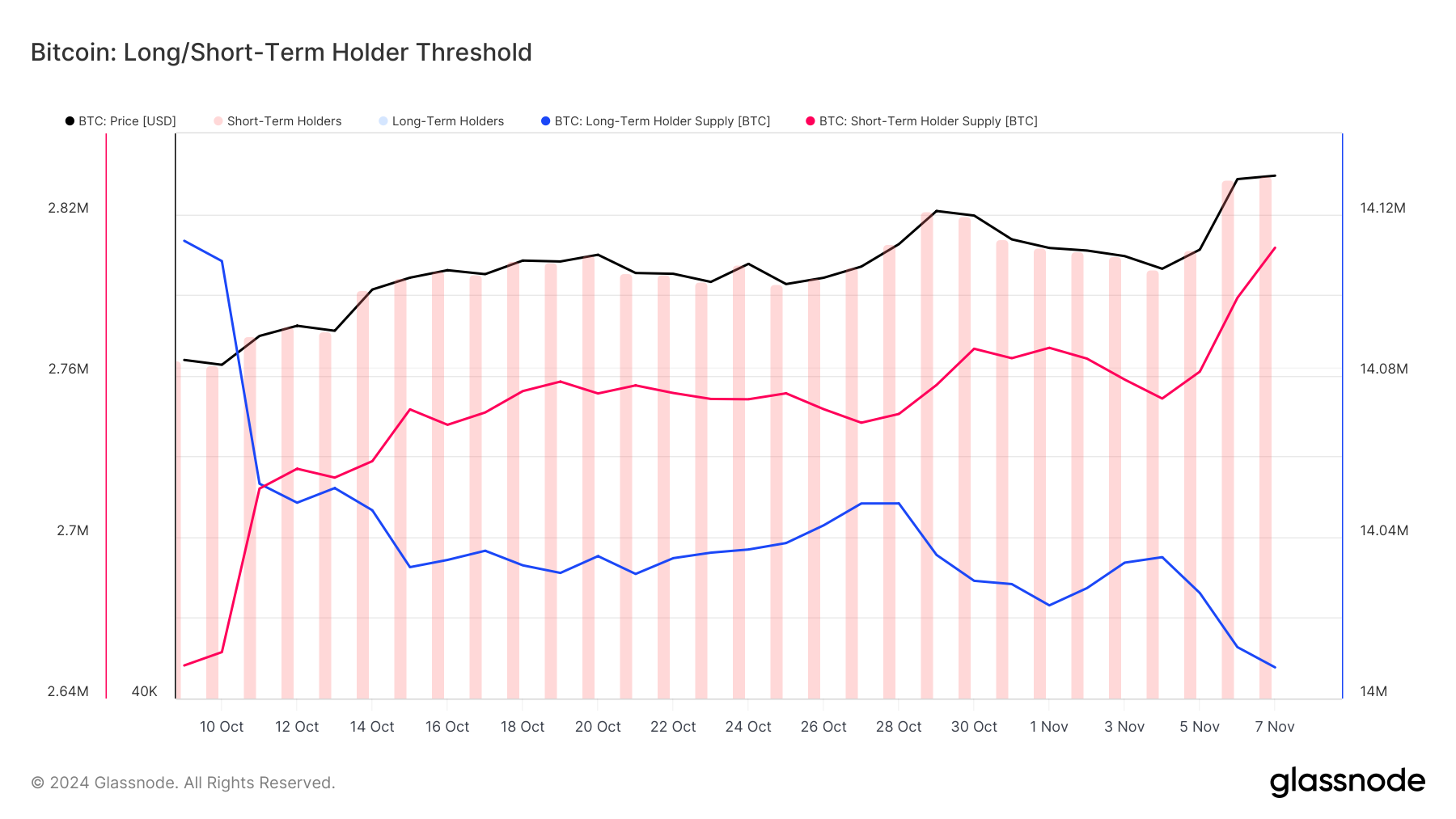

4. Long-term Bitcoin holders reduce their holdings

According to on-chain data , changes in the net position of long-term Bitcoin holders continued last week’s downward trend and have continued to turn negative since mid-October. As the price of BTC exceeded US$70,000, long-term holders' position reduction behavior accelerated significantly and showed a stable net outflow pattern, indicating that some long-term holders chose to take profits at high levels.

The reduction in positions by long-term holders has weakened the stable supply base, and if this trend continues, it may bring further downward pressure on the market.

5. The purchasing power on the Bitcoin chain is strong

5. The purchasing power on the Bitcoin chain is strong

According to on-chain data , the structure of Bitcoin’s long- and short-term holders shows a significant increase in market risk appetite. The continued increase in positions held by short-term holders indicates that the influx of short-term funds drives up prices and strengthens market liquidity; the increase in short-term holders also reflects investors' optimistic expectations for the market's short-term rise.

This week's data reflects the increased activity of short-term investors, which has become the main source of power for the market, while the reduction of long-term holders' positions has brought certain uncertainty to the market outlook. It is necessary to continue to pay attention to the dynamics of long-term holders in the coming weeks to judge the sustainability of the market trend.

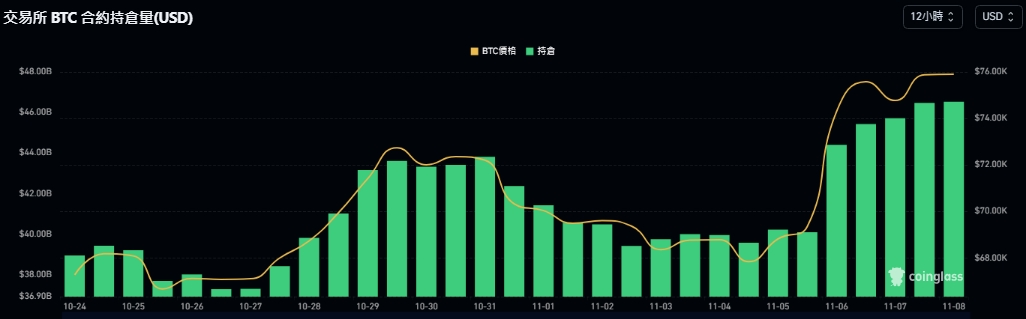

6. Bitcoin contract holdings hit a new high

According to data , Bitcoin contract positions on exchanges showed a steady upward trend this week, rising from US$40.55 billion to US$46.53 billion . While the number of Bitcoin contract positions hit a new high, the price of Bitcoin also hit a new high.

Important technical indicators of Ethereum

1. Ethereum spot ETF net inflow of funds

The net inflow of Ethereum ETF funds this week was approximately US$184.3 million .

2. Bitcoin Correlation

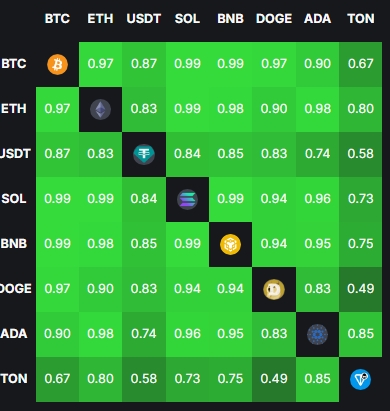

Data this week shows that the correlation between BTC and ETH and SOL reached 0.97 and 0.99 respectively. The correlation between major tokens has generally increased, showing that the market consensus on the overall trend has further improved. The correlation coefficients of major tokens are mostly stable at around 0.90, reflecting the consistency of market risk appetite. However, TON's correlation with other mainstream cryptocurrencies is still low, indicating that its price movements are relatively independent, providing the possibility of diversifying risks for investment portfolios.

3.DeFi market total locked position (TVL)

This week’s data shows that the total locked-up volume in the DeFi market increased from US$96.553 billion to US$86.785 billion last week.

Market analysis news this week

1. Bitcoin broke through 76,800 and hit a new high, Ethereum stood at $2,900, the Federal Reserve cut interest rates by 1 yard, US stocks rose more than fell.

Bitcoin reached a maximum of $76,848 around 4 a.m., setting a new all-time high, while Ethereum exceeded $2,900. Most of the four major U.S. stock indexes rose on the back of a one-digit interest rate cut in line with expectations. (continue reading )

2. Gold has suffered its largest single-day decline in the past six months. Is the safe-haven market gone? Pay attention to the Fed's interest rate decision announcement at 3 a.m.

After the election of US Republican presidential candidate Trump, the US dollar index hit a four-month high, and the price of gold fell to a three-week low. After the election results were released, the market focused on the FOMC meeting decision. The Federal Reserve will be held on 8 Taiwan time. The interest rate decision was announced at 3:00 am on the morning of the same day, and the market generally expected that the interest rate would be cut by 1% this time. ( continue reading )

3. Bitcoin surged 1900% during Trump’s first term! Can BTC hit $1 million this time?

The results of the U.S. presidential election came out, and Republican presidential candidate Donald Trump won the ticket to the White House. According to historical data, Bitcoin rose 1,900% during Trump’s first term. As Trump ushered in his second term, Will Bitcoin hit $1 million this time? ( continue reading )

4. Standard Chartered Bank is optimistic that Bitcoin will break $125,000 by the end of the year and rise by another 60% in 2025.

Standard Chartered Bank said that with Trump's victory, Bitcoin will exceed US$125,000 by the end of this year and reach US$200,000 by the end of next year. ( continue reading )

5. Buffett sold another 100 million shares of Apple, holding a record 10 trillion yuan in cash! Is it possible for U.S. stocks to escape the fate of a flash crash after the election?

Buffett's Berkshire Hathaway announced its third-quarter financial results on the 2nd, further reducing its holdings in Apple stock (selling approximately 100 million shares, accounting for 25% of its holdings), and increasing its cash reserves to a record high. A record US$325.2 billion (over NT$10 trillion). ( continue reading )

6. Arthur Hayes: I am more optimistic about Solana than ETH. The election result is not important. "Fed interest rate cut" is the key.

Arthur Hayes said in a recent interview that if Bitcoin performs well, Solana may rise stronger. In addition, he pointed out that it does not matter whether Trump or Harris is elected, the key is the Fed's interest rate decision. ( continue reading )

7. Binance was accused of charging US$100 million in "listing fees". He Yi put out the fire: the rules are very transparent and FUD will never disappear.

Cryptocurrency exchange Binance (Binance) was recently accused by Moonrock Capital CEO Simon Dedic of charging project parties high currency listing fees. Binance said that Binance required project parties to provide 15% of the total supply of tokens. In response, Binance co-founder He Yi clarified that if the project party fails to pass the screening process, no matter how much money or percentage of the currency is given, it will not be able to list the currency on Binance. ( continue reading )

8. The UK's first pension fund "directly invests 3% of its assets in Bitcoin" breaking the indirect holding convention of ETFs: betting on asymmetric returns

British pension consulting company Cartwright announced on Monday that a British pension fund with a scale of 50 million pounds ($65 million) has invested 3% of its assets directly in Bitcoin with the help of Cartwright, rather than through indirect means such as ETFs. , becoming the first of its kind in the UK. ( continue reading )

Cryptocurrency regulatory status in various countries

1. Fintech associations of 14 Asian countries signed the "Anti-Fraud Cross-Border Joint Defense MOU", and the Financial Supervisory Commission and the Ministry of Justice are happy to see its success

The Asian Fintech Alliance (AFA) made its debut at the FinTechOn 2024 Annual Forum hosted by the Taiwan Fintech Association on November 4. AFA members representing 14 Asian economies announced the signing of the Memorandum of Joint Anti-Fraud Prevention Cooperation (Memorandum of understanding, MOU). ( continue reading )

2. The United Arab Emirates issues a tokenized U.S. bond fund, Realize T-BILLS Fund: $RBILL debuts IOTA and ETH, and enters the RWA market

Abu Dhabi-based asset management company Neovision Wealth Management and technology company Realize have joined forces to launch a new RWA investment vehicle that focuses on purchasing U.S. Treasury bonds and tokenizing them. It is understood that the tokenized fund has a target size of US$200 million. , and will initially be launched on the public chains IOTA and Ethereum. ( continue reading )

3. Taiwan’s encryption regulation enters the fast lane》Can VASP self-discipline be the key to breaking the situation? What are the advantages and risks?

At the FinTechOn 2024 "Virtual Asset Supervision and Anti-Fraud Action" hosted by the Taiwan Financial Technology Association (TFTA), legislator Ge Rujun and a number of blockchain leaders discussed how Taiwan's VASP operators can achieve self-discipline? What are the advantages and risks? ( continue reading )

Taiwan's Supervisory Yuan stated on the 1st that after previous deliberation by the Ministry of the Interior, it believed that the cross-border circulation of virtual currency machines may lead to foreign forces intervening in Taiwan's political situation. At the same time, because political donations need to be transparent and immediately usable, The draft amendment to the Political Donation Law stipulates that virtual currency cannot be used as a political donation. ( continue reading )

Hong Kong media reported today (4th) that Jeremy Allaire, co-founder of Circle, the issuer of the second largest stablecoin USDC, intends to hire more employees to establish business in Hong Kong and is currently waiting for the introduction of new stablecoin regulations. ( continue reading )

The U.S. Securities and Exchange Commission (SEC) filed an amended complaint against Binance, Binance founder CZ and others in September, reaffirming the accusation that Binance violated federal securities laws. However, after CZ was recently released from prison, Binance and CZ’s lawyers The team countered by filing a motion on November 4 asking the court to dismiss the SEC's allegations in the amended complaint. (continue reading )

7. Blockchain cross-border payment is coming! UBS launches UBS Digital Cash: supports US/EUR/RMB transfers in multiple fiat currencies

UBS announced on November 7 that it had successfully developed and piloted UBS digital cash and implemented multi-currency cross-border payments based on blockchain. ( continue reading )

Market focus next week

11/12 (Tue)

- Germany: Consumer Price Index CPI in October (month-on-month), forecast 0.4%, previous value 0.0%

11/13 (Wednesday)

- United States: Core Consumer Price Index CPI in October (mom), previous value 0.3%

- United States: Consumer Price Index CPI in October (month-on-month), previous value 0.2%

- United States: Consumer Price Index (CPI) in October (year-on-year), previous value 2.4%

11/14 (Thursday)

- UK: Q3 Gross Domestic Product GDP ((quarter-on-quarter), previous value 0.5%

- United States: Initial Jobless Claims

- United States: Producer Price Index PPI in October (month-on-month), previous value 0.0%

11/15 (Friday)

- United States: Federal Reserve Chairman Powell speaks

- Japan: Q3 GDP (quarter-on-quarter), previous value 0.7%

- China: Industrial production index in October (year-on-year), previous value 5.4%

- UK: Q3 GDP (year-on-year), previous value 0.7%

- UK: GDP in September (month-on-month), previous value 0.2%

- Hong Kong: Q3 GDP (year-on-year), forecast 1.8%, previous value 3.3%

- Hong Kong: Q3 GDP (quarter-on-quarter), forecast -1.1%, previous value -1.1%

- US: October core retail sales (mom), previous value 0.5%

- United States: October retail sales (mom), previous value 0.4%

Recommended interview videos

1. Exclusive Interview: Ajelex on expanding Bitcoin education globally

( Video link )

2. Exclusive interview: Oleg Mikhalsky talks about Bitcoin, innovation and the future of Lugano.

( Video link )

Top 5 popular articles this week

1. Intel is hopeless? The 15th generation CPU was "performance exceeded 104%" by AMD 9800X3D, and the Blue Empire fell

Intel launched the 15th generation CPU "Ultra 200S" in October in an attempt to save the company's bleak situation through products. However, Youtuber Geekerwan released a review video of Ultra 200S yesterday. After evaluating the game performance, he directly criticized Intel for going backwards. ( continue reading )

2. Microsoft shareholders are trying to force the company into bankruptcy: If you don’t invest in Bitcoin, if it goes up later, be careful and I will sue you!

Microsoft will vote on whether to invest in Bitcoin at its shareholder meeting on December 10. Microsoft recommended shareholders vote against Bitcoin, citing high volatility. In this regard, Ethan Peck, deputy director of the Free Enterprise Program at the National Center for Public Policy Research (NCPPR), the sponsor of the proposal, said that if Microsoft does not invest in Bitcoin and its price subsequently rises, shareholders may have grounds to file a lawsuit against the company. ( continue reading )

3. Satoshi Nakamoto’s first collaborator restores the behind-the-scenes story of Bitcoin, the future of BTC in the eyes of the founder of Blockstream

Adam Back has big plans to make the Bitcoin network more than just a store of value. ( continue reading )

4. The most evil stock in the world! Indian small-cap stocks "surge 6692635% in a single day", but still can't beat Bitcoin

This week, Elcid Investments, a monster stock in the Indian stock market, soared 6,692,535% in a single day, setting a record for the highest single-day increase in global stock prices. ( continue reading )

5. Is Ethereum hopeless? 21Shares refuted: ETH has huge potential! Like Amazon in the 1990s

After the listing of the Ethereum spot ETF, investor response was muted, and the price of Ethereum did not show significant improvement. However, 21Shares, a crypto asset management company, one of the eight issuers of Ethereum spot ETF in the United States, said today that investors are still Not realizing the potential of Ethereum, just like Amazon in the early 1990s. ( continue reading )