This week's cryptocurrency news covers Donald Trump's historic election victory and its impact, the influence on Bitcoin and SEC Chairman Gary Gensler, the application for a new XRP ETF with institutional support, and Cardano's major new upgrade.

These confusing and interconnected developments have sparked positive sentiment across the entire cryptocurrency community.

Cardano (ADA) Node 10.11 Upgrade, Ushering in a New Era

On November 1, the Intersect MBO, a member organization led by Cardano, initiated the Node 10.11 update. This was the first mainnet update to support the Plutus #2 hard fork. This update provides several key technical and democratic innovations, marking a new era for Cardano's mature on-chain governance model.

"After the successful Plutus #2 hard fork, decisions on the Cardano blockchain will be formed and voted on through fully decentralized governance, as detailed in CIP-1694," Intersect announced.

While the community is excited about these decentralization upgrades, views on Cardano founder Charles Hoskinson are becoming increasingly polarized. Hoskinson posted a poll on social media asking "Is Charles Hoskinson a cancer on Cardano?" The results were nearly a perfect tie, highlighting the community's mixed views on him.

Grayscale Applies for XRP Trust and 21Shares ETF

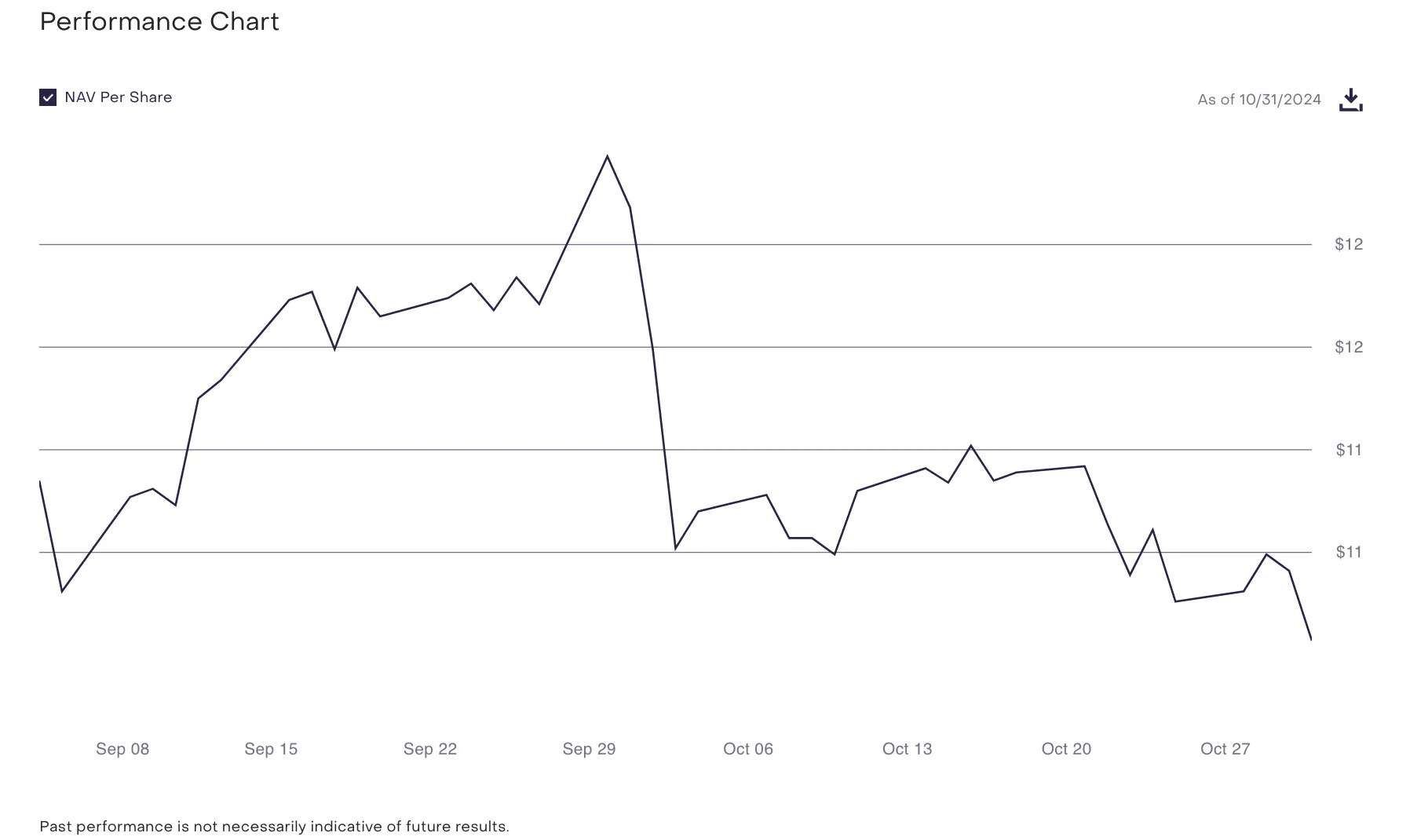

Major ETF issuer Grayscale has launched a new XRP-based trust fund offering. This is consistent with Grayscale's previous ETF history, where their Bitcoin ETF originated from a similar trust fund. These trusts are legally salable before official ETF approval, but their market value often suffers when approval is granted. This XRP trust actually declined in price when sales began.

Competing ETF issuer 21Shares also applied for an official XRP ETF this week. The SEC has not yet officially confirmed or denied it, but the competition for new cryptocurrency products has officially begun. BitWise has also applied for an XRP ETF, and Ripple CEO Brad Garlinghouse believes SEC approval is "inevitable".

Bitcoin Hits $77,000 All-Time High After Trump Victory

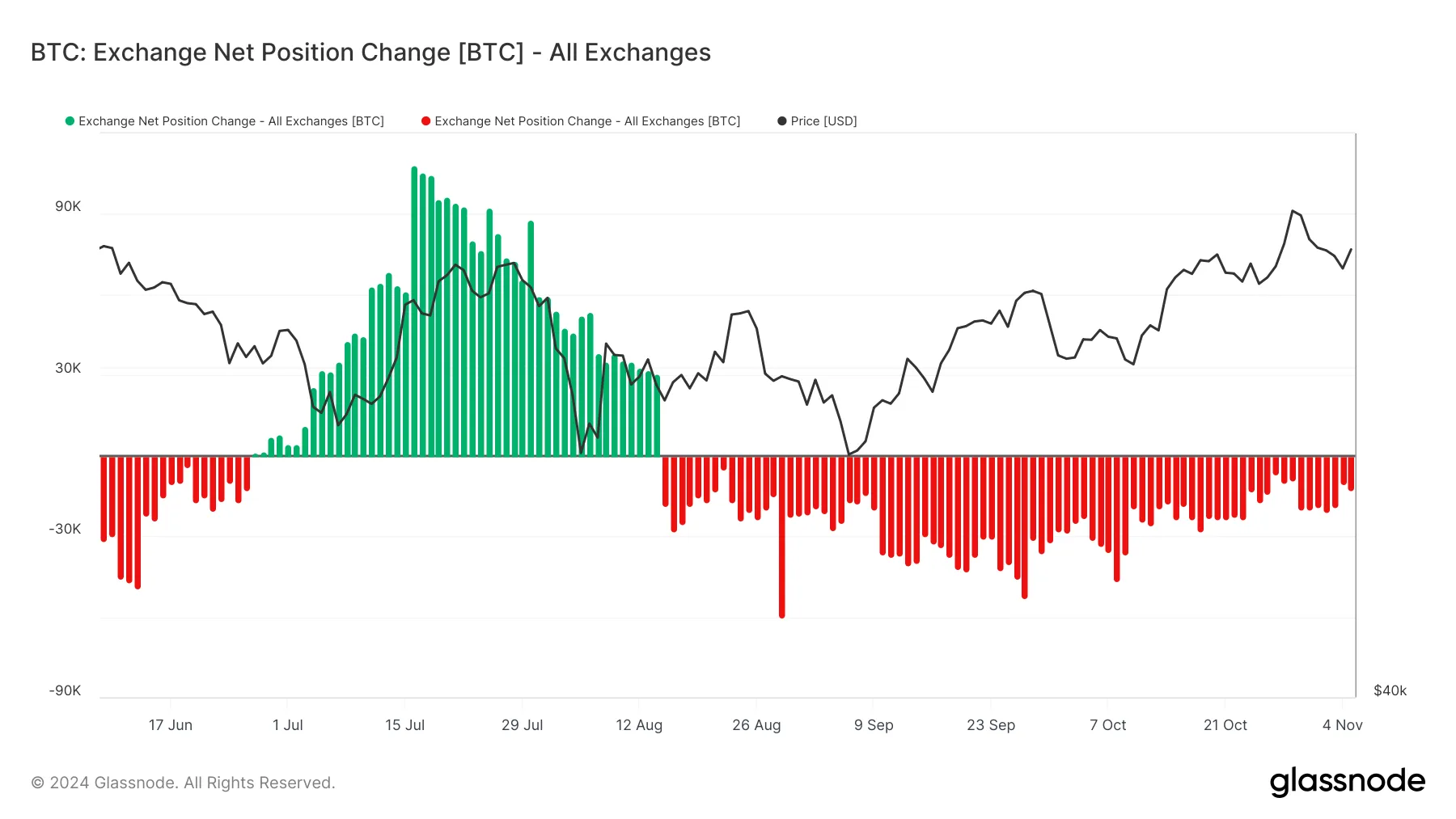

After Donald Trump's recent presidential election victory, Bitcoin recorded a new all-time high. Immediately after his victory, Bitcoin's value surged above $75,000, and it has been fluctuating around $77,000 on Friday. Massive demand was seen on cryptocurrency exchanges from new investors interested in buying Bitcoin.

A series of positive factors related to political developments are boosting the positive outlook on Bitcoin. Trump's election victory also increased gains for risk-on asset ETFs, and cryptocurrencies are considered risk assets. BlackRock's IBIT has already benefited from this trend. Additionally, the Federal Reserve cut interest rates by 25bp, another positive signal.

Institutional Demand Drives Increased XRP Trading

Ripple reported strong growth in Q3 2024, largely driven by institutional interest. This adoption was highlighted as major financial institutions like the Chicago Mercantile Exchange began offering XRP products. This trend occurred despite the SEC's regulatory challenges, instilling confidence in CEO Brad Garlinghouse.

"The message in the market is clear - institutional interest in XRP products is stronger than ever...The SEC's war on crypto is losing battle after battle - as they continue to defy the authority of the courts, the SEC's credibility and reputation will only further erode," Garlinghouse said.

During this period, XRP saw overall high trading volumes. Average daily trading volumes across multiple exchanges consistently ranged from $600 million to $700 million, with some even much higher. XRP trading volume also nearly doubled, but a significant portion of this was small trades, reducing the impact on overall on-chain transaction volume.

Justin Sun Offers Job to Gary Gensler if Trump Fires Him

TRON founder Justin Sun offered a job to SEC Chairman Gary Gensler if Trump fires him upon taking office. At the Bitcoin conference in Nashville, Trump publicly declared he would fire Gensler, eliciting a strong reaction from the audience. Trump made several promises to halt the "crypto crackdown" by regulators and lawmakers, which includes Gensler.

"Our industry must have an inclusive mindset. If Gensler sincerely engages with the cryptocurrency industry, I would be willing to hire him. After all, this person also has to support his family," he argued.

It is unclear whether Sun made this proposal sincerely or in jest. Gensler's hostile actions towards the cryptocurrency industry have earned him many enemies, but he has a deep understanding of this industry. Sun also congratulated Trump's electoral success, hoping that he could promote industry growth through friendly cryptocurrency regulations.