On Sunday, Bit coin reached a historic high of nearly $80,000, buoyed by new optimism within the crypto currency community following Donald Trump's re-election as US president.

This support has strengthened the upward momentum of Bit coin, and it is currently showing an unstoppable upward trend.

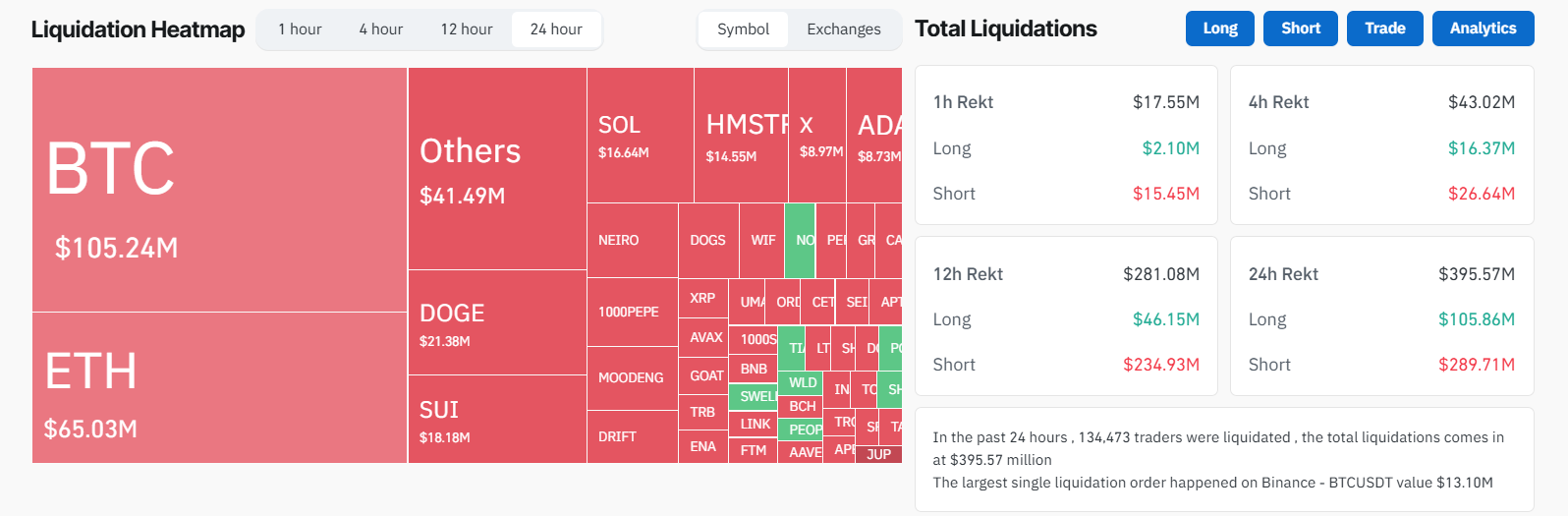

Bit coin's latest all-time high triggers $400 million market liquidation

On November 10, Bit coin recorded an unprecedented high of $79,600, surpassing the previous all-time high (ATH) of over $77,000 according to BeInCrypto data. It has currently retreated slightly to $79,326, but the prices of major digital assets have risen by more than 3% in the last 24 hours.

"$79,000 Bit coin, a new ATH. Guys, stay calm. This is just the beginning. It's time to make the right decisions and wait patiently. No need for hasty action. HODLing is working for you," said Bit coin investor Tuur Demeester said.

Analysts attribute a significant part of this growth to optimism over Trump's return to power. Many believe his administration will take a crypto-friendly approach to regulation, providing additional momentum. Trump himself has endorsed crypto currencies, and has participated in various industry events, including the Bitcoin2024 conference, and promised to create a crypto-friendly environment.

Similarly, recent global interest rate cuts have also contributed to Bit coin's recent price movements. The US Federal Reserve and the Bank of England have both recently cut rates by 25bp, a move that generally increases liquidity and weakens the dollar. These conditions have historically been favorable for risk assets like Bit coin, making them an attractive option for investors in a more accommodative monetary policy environment.

Meanwhile, Bit coin's new all-time high has also had a positive impact on the broader crypto currency market, with several major assets seeing upward momentum. Over the past 24 hours, Ethereum has risen 5.4%, Solana 3.2%, and Dogecoin 11%.

However, this bullish trend has also resulted in significant losses for traders speculating on the prices of these digital assets. According to Coinglass data, around 132,000 traders experienced nearly $400 million in liquidations during the market rally.

Short sellers who had anticipated a market downturn saw the largest losses of around $288.46 million. Long traders suffered around $105.6 million in losses, with Bit coin traders accounting for around $105 million in liquidations and Ethereum traders around $65 million.

By exchange, Binance had the highest share of liquidations, accounting for 46.76% of the total, or around $180 million. OKX and Bybit also recorded significant losses of $79.6 million and $65.4 million, respectively.