This week, the cryptocurrency market is focusing on the US economic events after Donald Trump's re-election and the Federal Open Market Committee (FOMC)'s interest rate decision last week.

As the impact of US macroeconomic data on the Bitcoin (BTC) and cryptocurrency market is restored, traders and investors need to be prepared for volatility around the next events.

Consumer Price Index (CPI)

The important US Consumer Price Index (CPI) data will be released on Wednesday, November 13. Federal Reserve (Fed) Chair Jerome Powell is scheduled to announce the October CPI data.

This announcement comes after the FOMC decided to cut rates by 25bp in their last meeting. Powell acknowledged that Americans are still feeling the impact of high prices, while noting that policymakers have no plans to raise rates. In this context, the US CPI will be a key indicator influencing the Fed's future policy decisions.

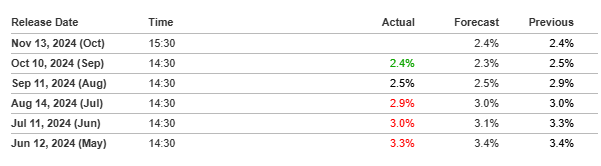

The US CPI in September was 2.4%, down from 2.5% in August and 2.9% in July, suggesting that inflation has been easing since April.

Economists expect the headline inflation in October to decline by 0.2%, and the core CPI, excluding volatile food and energy costs, to decrease by 0.3%.

If Wednesday's data comes in higher than expected, it could suggest that inflation may rise again in the coming months, limiting the Fed's policy rate cut trend and, more importantly, disrupting the upward trend of BTC.

"Keep in mind that as interest rates fall, institutional investors have more liquidity to invest in risky markets like cryptocurrencies," said popular analyst Crypto Future of X in a tweet.

Initial Jobless Claims

Another key US economic event this week is the Initial Jobless Claims. The continuing claims measure the size of the unemployed population. The Department of Labor is scheduled to release this macroeconomic data on Thursday, November 14, after new claims increased by 3,000 to 221,000 in the week of November 2.

It's worth noting that the FOMC's concerns about the gradual weakening of the labor market led the central bank to cut rates by 0.5 percentage points in September. Against this backdrop, federal officials announced a 0.25 percentage point rate cut last week. Excessive jobless claims could increase the risk of a recession by reducing purchasing power as unemployment rises.

Producer Price Index (PPI)

The US Bureau of Labor Statistics is also scheduled to report the October core Producer Price Index (PPI) this week. This data determines the price increases at the producer level, impacting financial markets by measuring inflation at the wholesale level.

Rising PPI indicates higher production costs, which could increase the energy and hardware costs required for mining and cryptocurrency processing. Therefore, a high core PPI on Friday could have a negative impact on BTC and cryptocurrencies.

US Retail Sales

Concluding the list of US economic events this week is the US Retail Sales. The Census Bureau is set to release the US Retail Sales data on Friday, providing important insights into consumer spending trends.

This accounts for a significant portion of the US economy. In September, US retail sales increased by 0.4%, and a 0.3% increase is currently expected month-over-month.

If the October US Retail Sales data shows strength, it could signal a reduction in recession concerns, a robust economy, and increased consumer spending. This trend would suggest healthy financial conditions and likely increase the appeal of risky assets like stocks and cryptocurrencies.

While awaiting the US economic data, BTC has risen almost 2% since the Monday session open. Despite this modest increase, the pioneering cryptocurrency is trading at $80,808, well above the psychological $80,000 level.