Author: Revc

Foreword

Recently, the cryptocurrency market has performed strongly, with the total market capitalization rising to $2.7 trillion, an increase of 3.21% from the previous day. The trading volume in the market has also increased significantly by 67.79% in the past 24 hours, reaching $208.85 billion. However, market risks cannot be ignored. According to Coinglass' early morning data, the total liquidation amount in the past 24 hours reached $695 million, with $317 million in long positions and $378 million in short positions being liquidated. At this time, careless operation may result in a huge cost of exit.

Since Donald Trump's victory in the US election, the regulatory ceiling that has restricted the cryptocurrency industry has been lifted, and it remains to be seen how high this round of market trend can rise. We try to find the answer from the recent performance of mainstream cryptocurrencies.

Analysis of Mainstream Cryptocurrencies

BNB

Over the past 7 days, BNB has only increased by 10%. After reaching a high of $643.3, the price has started to fluctuate and correct. BNB has strong utility in the Binance ecosystem, such as trading fee discounts, which provides long-term value support. Recently, the linkage between the Binance ecosystem and the MEME sector has to some extent alleviated the pressure of new coin listings, but has not yet directly reflected in the coin price. In the long run, Binance needs to further optimize the new coin offering model around BNB staking and the pre-trading market to narrow the gap with user expectations and build a healthier and more sustainable new narrative for BNB.

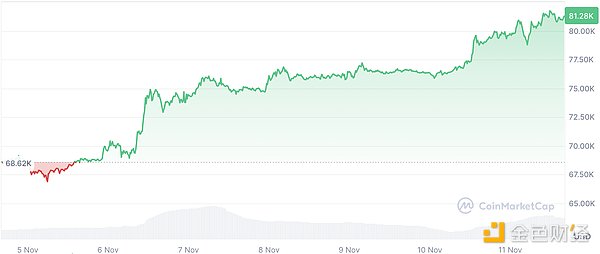

BTC

With Trump's confirmed victory, the regulatory pressure that has long suppressed the development of the cryptocurrency industry has gradually been lifted, and there is no adverse news in the short term, ushering in a new development cycle for BTC. Some Wall Street analysts point out that Trump is less likely to be constrained before the midterm elections, meaning that the cryptocurrency industry is expected to maintain a moderately upward momentum over the next two years. Each time BTC breaks a new high, the market's value support is strengthened, and the risk of violent corrections due to regulatory uncertainty is also reduced. However, caution is still needed at the operational level for black swan events, such as changes in the Federal Reserve's interest rate cut path due to economic conditions, geopolitical conflicts, and contingency events during the transition of presidential power, as the current market is full of greed and sensitivity.

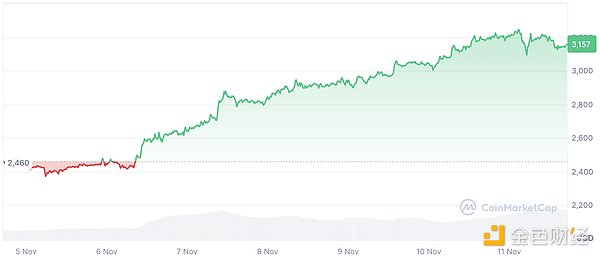

ETH

During the FUD period before the election, ETH experienced a month of volatility, especially on social media, with investors and crypto researchers alike pondering the development direction of Ethereum. Compared to Bitcoin's continuous new highs, Ethereum is still some distance away from the high point of the previous cycle, so the recent logic for ETH is oversold correction, with the price rising strongly from $2,600 to $3,200, which has also triggered some FOMO among investors. However, the $3,200 area is still the trapped position of the previous cycle. As the "second dragon" asset of the cryptocurrency industry, Ethereum's technical strength and decentralization degree are sufficient to gradually shed the "Altcoin" label, especially the large developer community that provides support for its development. Speaking of ETH, Solana cannot be ignored. The short-term logic for ETH is oversold correction, while in the long run, it still needs to focus on how to develop a business-innovative application layer and consider whether to shift the community focus to North America to attract more Web2 entrepreneurs into Web3. Currently, Ethereum's layout in Europe, Asia and North America is relatively balanced.

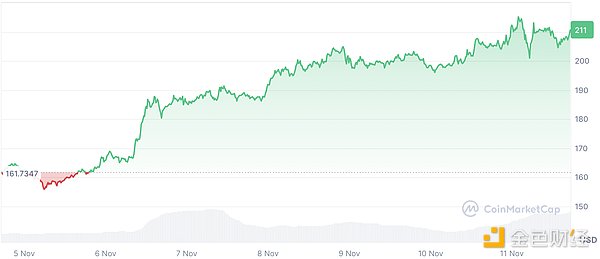

Solana

Solana's price is still fluctuating at the top of the previous cycle, but this is obviously unable to meet the expectations of its supporters. Since the FTX event, Solana has repaired its correlation with ETH, and as an excellent L1 like ETH, Solana has returned to the peak it deserves. It is worth mentioning that the rampant VC tokens are also present in the Solana ecosystem, but the community's commercial sensitivity and innovation have covered up such problems, giving rise to the RWA, MEME and DePin tracks. Ethereum is more about blurred organizational boundaries (leading to weak governance token value support), and the consumption of a large amount of energy and resources on infrastructure construction with weak commercial returns, which has not shown obvious improvement so far. Solana is a long-term Alpha asset worth watching, and after BTC stabilizes at new highs, liquidity spillover is expected to have a good performance.

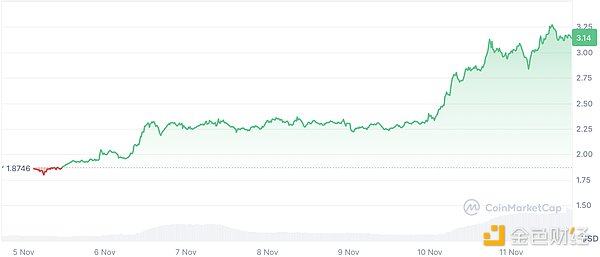

SUI

SUI has recently broken through new highs, with a total circulating market value of $32 billion, up more than 67% in the past seven days. The team has the pragmatic spirit and engineering rigor of an Internet giant, and is different from other L1s, focusing on compliance and the gaming track. The recent increase in the ecosystem's TVL is significant, but attention should be paid to the sustainability of SUI's price trend. The gaming track has occasionally performed well in bear markets, and whether it can develop a new narrative in the bull market context remains to be observed.

Conclusion

With Bitcoin continuously breaking new highs and the Federal Reserve releasing liquidity, the cryptocurrency industry will usher in at least two years of "abundant rainfall" development. Investors should find investment methods and tracks that suit their own needs in order to achieve good returns in this cycle. The road may be long, but steady progress will lead to the destination.