Cardano's ADA price has risen more than 35% to reach a multi-month high of $0.63. This surge came after Charles Hoskinson announced his plans to influence US cryptocurrency policy under the Donald Trump administration.

ADA briefly traded above $0.60, the first time since April. However, while market enthusiasm is evident, Cardano's ADA price rally may be difficult to sustain. This analysis explores the reasons why.

Cardano's Charles Hoskinson Driving the Current Rally

Cardano's price has reached a 7-month high. During the Sunday trading session, this altcoin surged over 30%, outperforming Bitcoin and other major cryptocurrency assets. This price increase was triggered by Charles Hoskinson's declaration that he could become a member of the Trump administration by 2025.

On the X Podcast on November 9th, Cardano founder Charles Hoskinson announced his commitment to supporting US cryptocurrency policy initiatives under the Trump administration.

"I will be spending a lot of time with lawmakers in Washington DC to help promote and advance cryptocurrency policy," Hoskinson mentioned.

Cardano Market Overheating

Cardano is currently trading at $0.56, down 11% from the multi-month high of $0.63. While buying activity is still ongoing, the Cardano market appears overheated, and a price correction may soon occur.

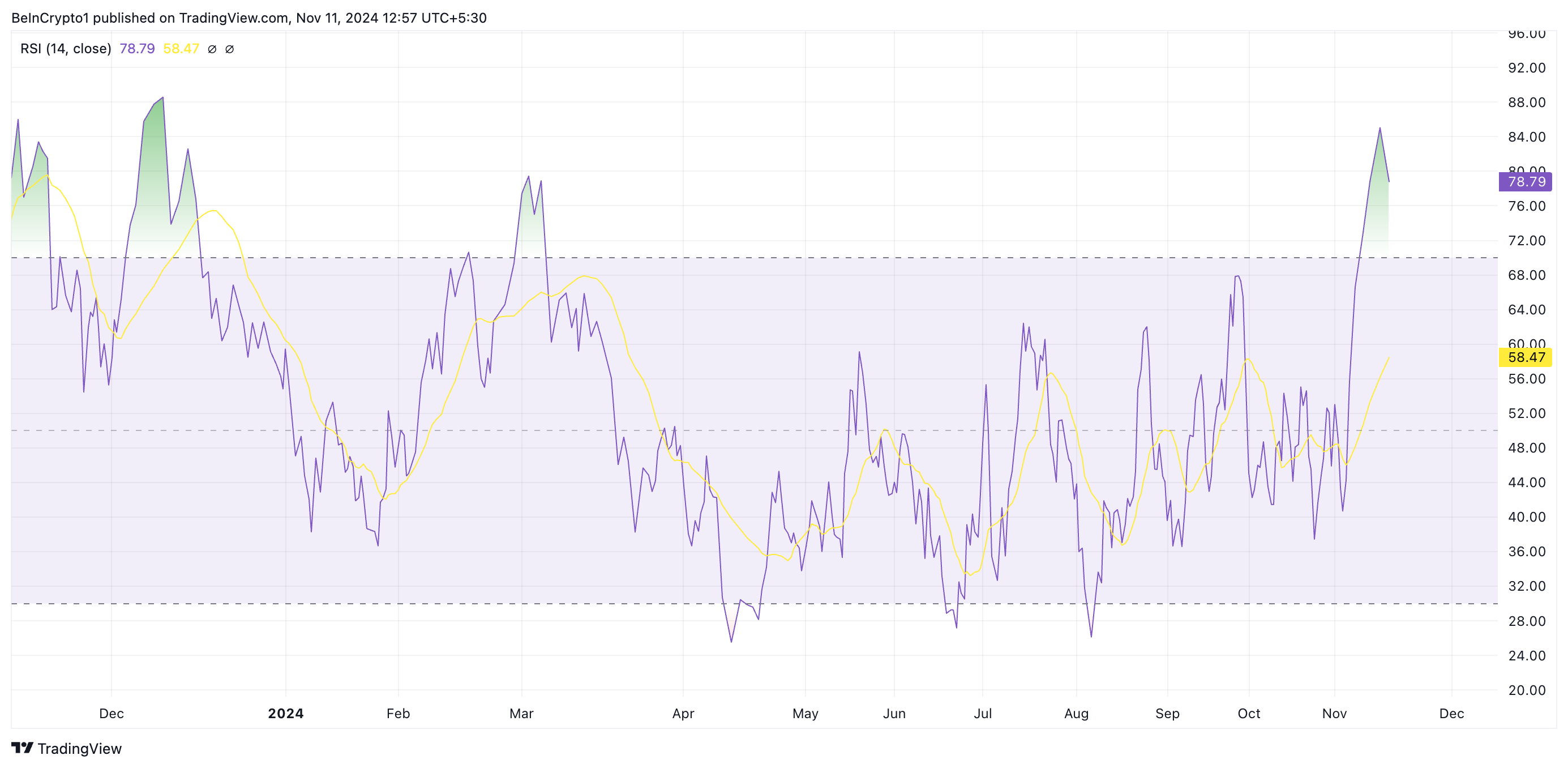

The current high Relative Strength Index (RSI) is a key indicator signaling this. Cardano's RSI is currently at 78.79, the highest level since December 2023.

This indicator measures the overbought and oversold market conditions of an asset. Ranging from 0 to 100, values above 70 indicate the asset is overbought and a price decline is imminent, while values below 30 suggest the asset is oversold and a rebound may soon occur.

Cardano's RSI of 78.79 indicates a significantly overbought condition, suggesting buyers may soon experience fatigue. This high RSI increases the likelihood of ADA facing selling pressure, and investors may start to take profits, leading to a price correction.

Additionally, Cardano's current price has breached the upper Bollinger Band, confirming the overbought state. The Bollinger Bands indicator measures market volatility and identifies potential buy and sell signals. It consists of three main components: the middle band, the upper band, and the lower band.

When an asset's price trades above the upper band of this indicator, it signals the asset is overbought and may be excessively extended. Traders often interpret this as a signal of impending downward pressure, prompting them to sell after realizing substantial gains.

ADA Price Prediction, Key Levels to Watch

Currently, ADA is trading at $0.56, just below the $0.60 resistance level. If the Cardano market becomes significantly overheated and buyers experience fatigue, the price may correct and test the $0.54 support level. If this level fails to hold, ADA's decline could extend to $0.40.

On the other hand, if trading activity remains strongly supportive and the coin maintains its upward momentum, a successful breach of the $0.60 resistance level could propel Cardano's ADA price to its yearly high of $0.81.