As market participants seem to rule out the possibility of a significant drop in the price of Bit, the bullish sentiment on Bit is on the rise.

Bit rose 4.5% on November 11, and the unexpected weekend uptrend has been firmly maintained.

BTC/USD 1 hour chart. Source: TradingView

Bit Price Reaches $87,000

Data from Cointelegraph Markets Pro and TradingView shows that the Bit price broke through $84,000 after the Wall Street open and briefly soared to $87,000.

Over the past seven days, BTC/USD has risen nearly 25% and shows no signs of a significant correction or consolidation, with the bulls continuing to push the price discovery.

The well-known analysis account Bitcoindata21 responded in some posts on the X platform: "In the short term, the bears will help push up the Bit price, as they continue to increase their short positions, providing impetus for the market liquidation."

"I won't consider a significant correction (20-30%) until we see the daily 'god candle'."

Bitcoindata21 mentioned that some market participants are still betting on a significant drop in the Bit price, including the trader "Crypto Godfather Il Capo," who predicted in the current bull market that Bit could plummet to $12,000.

The post also added: "My target is still $150,000 (as the indicator suggests it will be adjusted), but there is still plenty of time to sit back and enjoy the ride."

"This is a bull market, don't be in a hurry to sell."

BTC Liquidation Heat Map. Source: CoinGlass

Data from the monitoring resource CoinGlass shows that the buy-side liquidity above $81,000 on the exchange order book is thickening, which may help drive further spot price increases.

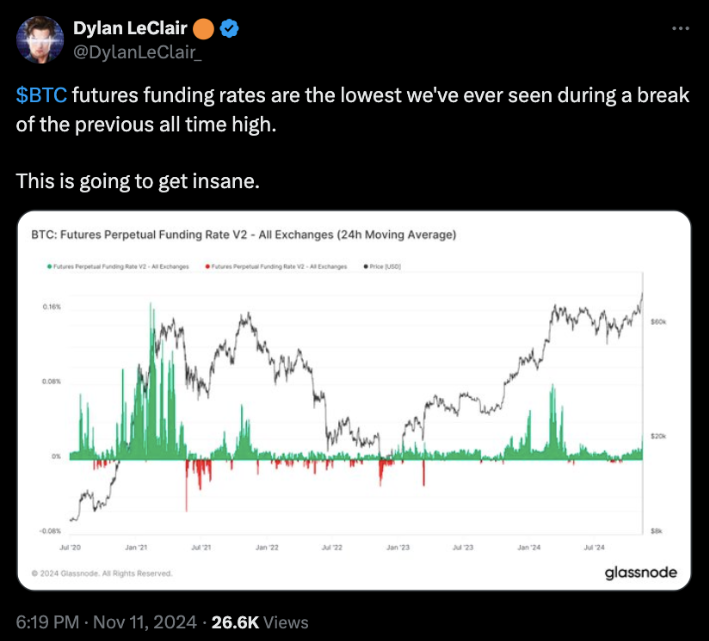

Considering the potential for BTC/USD to further enter uncharted territory, commentators point to the low funding rates in the derivatives market, which are not common when breaking historical highs.

Source: Dylan LeClair

From a macro perspective, veteran trader Peter Brandt provided another bullish case for Bit: the breakout of long-term resistance has formed a clear "inverse head and shoulders" pattern.

"Bit has issued a major buy signal on the weekend," he told his followers on the X platform, accompanied by a chart suggesting Bit may have the potential to reach $200,000 and beyond.

BTC/USD 1 day chart. Source: Peter Brandt/X

MicroStrategy Adds $2 Billion in Bit, Market Focuses on ETF Dynamics

Meanwhile, the spot buying frenzy is further supported by business intelligence company MicroStrategy, which announced a Bit acquisition worth over $2 billion on the same day. As Cointelegraph reported, on November 10, the company's holdings had already gained over 100%.

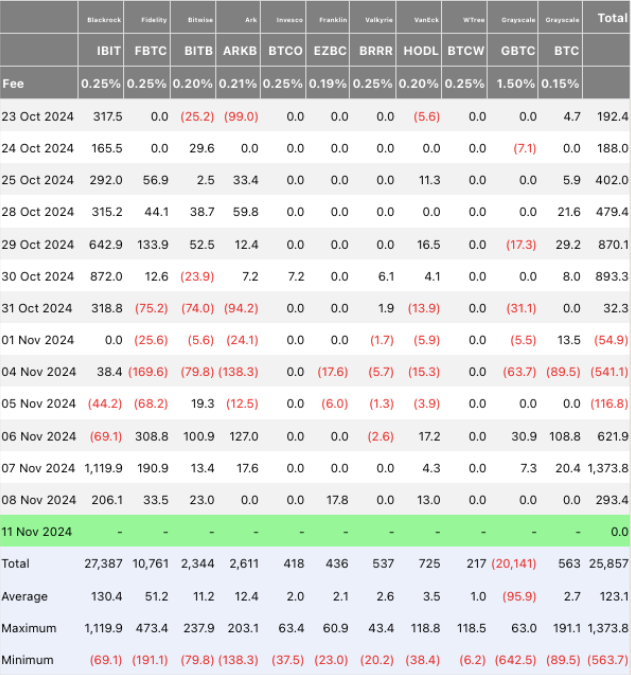

The market's attention is also focused on the spot Bit ETF, with net inflows of over $1.5 billion in the previous week.

Gemini co-founder Cameron Winklevoss commented on the weekend: "The path to $80,000 Bit is paved by the steady demand of ETFs, not retail FOMO, and there is hardly any fanfare."

"People are buying ETFs, not selling, a kind of sticky capital like HODL. The bottom keeps rising. What stage of the cycle are we in? We just won the coin toss, the game hasn't started yet."

US Spot Bit ETF Net Flows (screenshot) Source: Farside Investors

Previously, Cointelegraph reported that the inflows into the largest Bit ETF, the iShares Bit Trust (IBIT) from BlackRock, have surpassed the inflows into its gold ETF, which has been trading for 20 years.