Bitcoin Hits New All-Time High

Bitcoin broke through $89,000 and hit a new all-time high. As of the editorial deadline, Bitcoin is quoted at $89,400, up more than 11% in the past 24 hours and over 32% in the past 7 days.

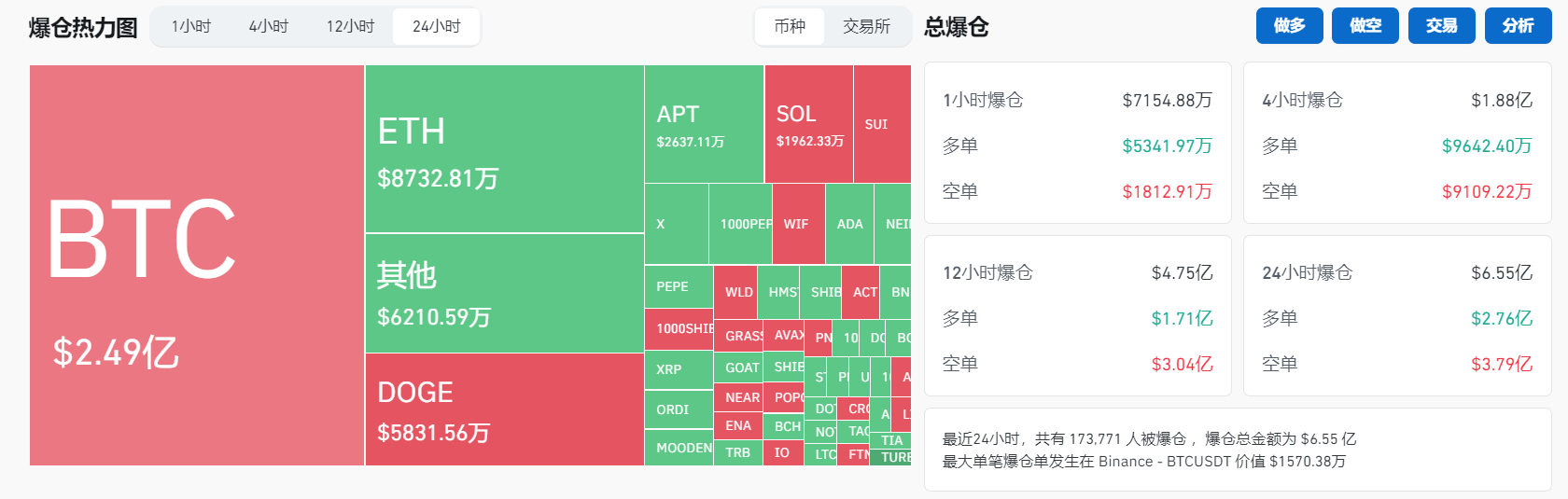

Coinglass data shows that in the last 24 hours, a total of 174,194 people were liquidated, with a total liquidation amount of $657 million. The largest single liquidation occurred on Binance - BTCUSDT, worth $15.7038 million.

On the news front, it is reported that U.S. President-elect Trump is preparing to take a more relaxed stance towards cryptocurrencies, and is looking for key position candidates who are friendly to the crypto industry, while his senior advisors are consulting crypto executives on potential changes in federal policy. The initial discussions have focused on a range of financial regulatory agencies, including the U.S. Securities and Exchange Commission.

According to five informed sources, Trump's advisors are considering appointing current regulators, former federal officials, and financial industry executives to key leadership positions, many of whom have publicly expressed support for cryptocurrencies. They warned that the discussion process is still in the early stages and the list of candidates is still changing.

Last night, Tesla, the company owned by Musk who supports Dogecoin, continued to surge, rising about 9% and reaching its largest five-day gain in four years, with a total market value of $1.12 trillion, rising to seventh place in the U.S. stock market.

As of the editorial deadline, Dogecoin is quoted at $0.36, up more than 25% in the past 24 hours, with a market capitalization of over $53 billion.

In addition, Sam, the founder of Open AI, tweeted: I'm optimistic about the bright future of cryptocurrencies! Over the past year, (fka worldcoin) has made amazing progress, and I'm very proud of the team, especially the leadership of @alexblania! A rare combination of vision and execution.

As of the editorial deadline, WLD is quoted at $2.76, up more than 28% in the past 24 hours, with a market capitalization of over $1.7 billion.

Crypto Concept Stocks Surge

On Monday (November 11), European and American stock markets collectively closed higher, with the Dow Jones up 0.69%, the S&P 500 up 0.1%, and the Nasdaq up 0.06%, all hitting new highs. Crypto concept stocks surged, with Canaan up 41%, MicroStrategy up 25%, and Coinbase up 19%.

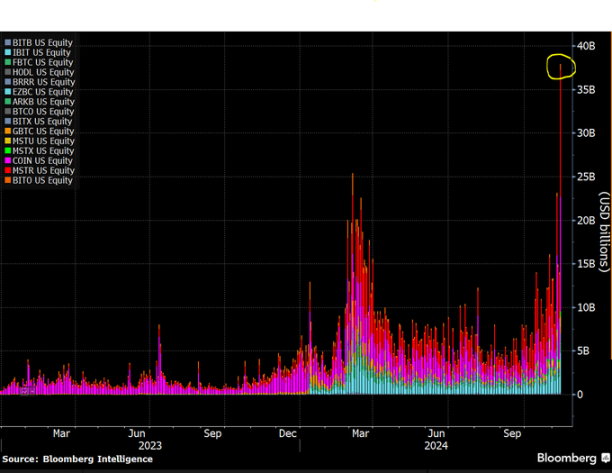

ETF Trading Volume Continues to Hit New Highs

Since the election, the inflow of funds into spot cryptocurrency ETFs has continued to rise.

With Bitcoin surging above $89,000 for the first time, BlackRock's spot Bitcoin ETF also set a new daily trading volume record, with Bloomberg data showing that BlackRock's spot Bitcoin ETF had a daily trading volume of $4.5 billion.

Citi strategists in a research report emphasized that cryptocurrencies are one of the "few Trump trades that have not yet retreated".

The strategy team stated: "Part of the reason is the expectation that the Trump administration will take a friendly stance towards cryptocurrencies, and investors hope this will translate into regulatory clarity in the U.S. Specifically, the net inflows into BTC and ETH ETFs were $2.01 billion and $132 million respectively in the two days after the election. We continue to view ETF fund inflows as a key driver of Bitcoin's price appreciation."