Author: Alex Thorn, Galaxy; Compiled by: Tong Deng, Jinse Finance

This report was initially sent privately to Galaxy clients and counterparties on November 7, 2024.

The digital asset industry is about to enter a golden age. Cryptocurrency in the US may experience a whole new regulatory approach, while the House and Senate as well as the White House will also welcome new supporters. The industry has demonstrated its political strength, issuing a strong warning to its enemies, a way that will resonate across the entire political landscape. The oppressive headwinds that have hindered the industry's development and increased legal costs over the past 4 years have weakened, and the cryptocurrency industry is now in a downward trend in the world's largest capital markets.

Election Night - Remarkably Similar History

President-elect Donald J. Trump made history - becoming the second president in history to win a second non-consecutive term. Grover Cleveland is the only former president to have achieved this feat, defeating Benjamin Harrison in 1892 to win a second term. Then, the anti-tariff, pro-gold Democratic Party regained power in 1892, winning a second non-consecutive term, and today, the pro-tariff, pro-Bitcoin Republican Party won a second non-consecutive term in 2024. History is often astonishing.

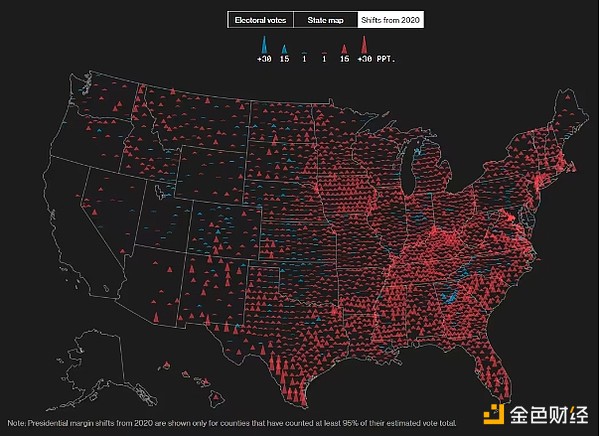

Trump's victory also has historical significance in the modern era. He will expand his electoral vote count, increasing from 306 votes in 2016 to over 310 votes. He became the first Republican to win the national popular vote since George W. Bush in 2004. Trump swept the "blue wall" states of Pennsylvania, Michigan and Wisconsin, just as he did in 2016, but he may also win Nevada, which Clinton won in 2016. In Florida, Trump won by a stunning 13% margin, although this performance can largely be attributed to demographic changes in the state over the past few election cycles. This Bloomberg heat map shows over 95% reporting for each county and the changes in Republican and Democratic presidential candidates between 2020 and 2024. There's too much red.

The Senate has shifted to the Republicans, with the likely result being a 54-seat Republican majority. It will take longer to know the results for the House, but the Republicans have a slight edge and are expected to maintain control of the House.

Some other key points about the election:

Cryptocurrency has demonstrated its political power. In addition to very publicly working to secure a broad and deep cryptocurrency agenda from President-elect Trump, the industry has also gained widespread support in the House and Senate. The most notable victory was Bernie Moreno (R-OH) defeating Sherrod Brown (D-OH). Cryptocurrency PACs spent tens of millions of dollars to defeat Brown, the current chairman of the important Senate Banking Committee. Defeating Brown, an ally of Elizabeth Warren, sent a strong message that being anti-cryptocurrency is a losing political position.

Trump enters his second term. It is well known that presidents tend to tackle more complex and distant issues in their second term. His victory also provides him with greater power than in 2016, as Trump takes office with the support of one of the most diverse Republican voter coalitions in decades. This increases the likelihood of Trump pursuing bold initiatives, which could include major modernization of the financial system.

Trump's team is very supportive of the digital asset industry. Trump's inner circle is very supportive of digital assets, with many having disclosed their own Bitcoin holdings. Vice presidential candidate J.D. Vance disclosed his Bitcoin holdings, Vivek Ramaswamy has been an outspoken supporter of the industry throughout the campaign cycle, Robert F. Kennedy Jr. owns Bitcoin and has been a vocal Bitcoin supporter for at least 2 years, transition team co-chair Howard Lutnick stated that he and others at Cantor Fitzgerald hold "a lot" of Bitcoin (Cantor owns Tether), and many other major donors are either directly involved in cryptocurrency or have shown a clear positive attitude towards the asset class and industry. Let's not forget that Trump himself has issued NFTs and launched his own affiliated DeFi protocol World Liberty Financial. The affinity of his team, family, and donors for cryptocurrency increases the likelihood of Trump delivering on his campaign promises to the industry.

What to Expect in Washington

Let me outline what could happen with crypto policy:

Banking Regulators. Trump will immediately appoint new acting Comptroller of the Currency and acting FDIC Chair. These agencies have prudential and supervisory authority over banks and insured depository institutions. Perhaps within days, the banking regulators could issue guidance clearly prohibiting unfairly targeting specific industries (Chokepoint 2.0), just as Trump did when he first took office, and they could certainly rescind existing interpretive guidance or letters adverse to the industry - like the joint letter of January 3, 2023. Within weeks or months, the OCC could issue guidance explicitly permitting banks to custody digital assets and use, operate, and interact with public blockchains and stablecoins. (Recall that Trump's former Acting Comptroller Brian Brooks issued such interpretive letters in 2020).

Market Regulators. Trump will elevate the current SEC and CFTC commissioners to acting chairs. While Trump has promised to "fire Gary Gensler", most constitutional scholars believe the President cannot remove independent agency commissioners. However, the President can immediately designate the current commissioners to serve as acting heads of those agencies. In the short term after these personnel changes, some crypto enforcement will be paused, some litigation will be stayed or withdrawn, no action letters will not be issued on any particular topics or projects, and the industry and regulators will have an opportunity to discuss a reasonable path forward. More comprehensive rulemaking will take longer, but the cryptocurrency industry may quickly obtain exemptions, primarily in relaxing the SEC's stance on "securities" and "exchanges". The CFTC's stance would be similar, but we note that without comprehensive market structure legislation to clearly delineate jurisdiction between the SEC and CFTC, having chairs at both market regulators who can coordinate and develop progressive policies will be crucial.

Congressional Legislation. The biggest crypto policy agenda items in Congress are well known: market structure (clarifying the regulatory status and oversight of digital assets) and stablecoins (legalizing and licensing stablecoin issuance). In May, the FIT21 bill passed the House with bipartisan majorities and will at least form the outline of future market structure legislation. Currently, the parties are relatively aligned on stablecoin legislation, with the main House Financial Services disputes between Democrats and Republicans being 1) whether only national banks can issue, or if there is also a national pathway, and 2) which agency (or multiple agencies) will have prudential and supervisory authority over these issuers.

Crucially, if the Republicans control the House, we believe the likelihood of these bills rapidly advancing in 2025 is lower. A unified Republican Congress may use the first 100 days of 2025 to focus on tax reform, trade, and other issues - leveraging the budget reconciliation process to drive Republican priorities. This does not mean crypto legislation is unlikely to progress in the next Congress, but in a unified Congress, we do believe it will take a backseat to other priorities - requiring close coordination between Congress and regulators on crypto policy. Our base case is that crypto legislation will shift to the latter half of the 119th Congress, allowing Cabinet officials and independent regulators to get their footing before engaging with Congress on policy issues.

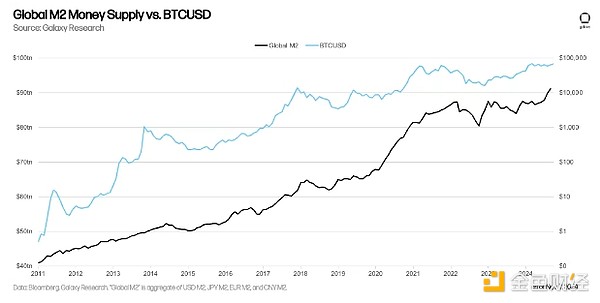

Bitcoin and Global M2

Bitcoin has historically responded to changes in the global money supply. While this correlation is not unique to Bitcoin, it is still worth noting, especially if Bitcoin starts to be used more as a hedge asset as Larry Fink has called for.

Outlook

The incoming Trump administration, combined with a powerful Republican Senate, can confirm the agencies it appoints, which is favorable for regulatory relief for the US cryptocurrency industry. We expect various forms of exemptive relief to be issued soon, while a stronger supportive regulatory framework will take more time to emerge. A relaxed enforcement environment coupled with progressive policy thinking will pave the way for traditional financial services companies and institutional investors to deepen their participation in the asset class. This will challenge the moats of existing crypto infrastructure participants, but will also broadly support the expansion and maturation of the asset class. In this environment, we expect the trading prices of Bitcoin and other digital assets to be significantly higher than their historical highs today within the next 12-18 months.