The US Bitcoin spot ETF (exchange-traded fund) reached a new high in several months, reaching a trading volume of $7.22 billion on December 11.

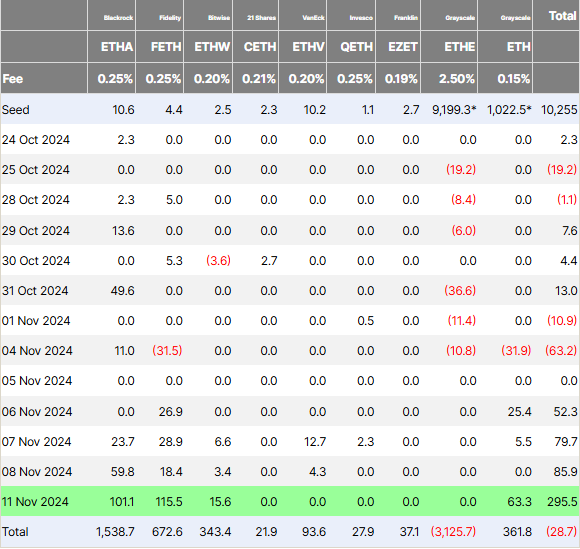

Meanwhile, the Ethereum ETF set a new record in inflow metrics, recording $295 million. This represents a notable surge in cryptocurrency-based exchange-traded funds.

Bitcoin ETF, $7.22 billion in trading volume... 6th highest on record

This is the sixth highest trading volume on record for a Bitcoin ETF. According to Bloomberg ETF analyst James Seyffart, this is the highest single-day trading volume since March 14. BlackRock's iShares Bitcoin Trust (IBIT) ETF led the pack.

"$7.22 billion in US spot Bitcoin ETF trading on the day. Highest since March 14 and 6th highest on record. BlackRock's IBIT led with $4.6 billion, with Fidelity's FBTC also crossing $1 billion," Seyffart tweeted.

The observed surge in trading volume across major Bitcoin ETFs coincides with increased enthusiasm in the US market following the elections. This reflects the crypto community's positive regulatory outlook and broader institutional adoption.

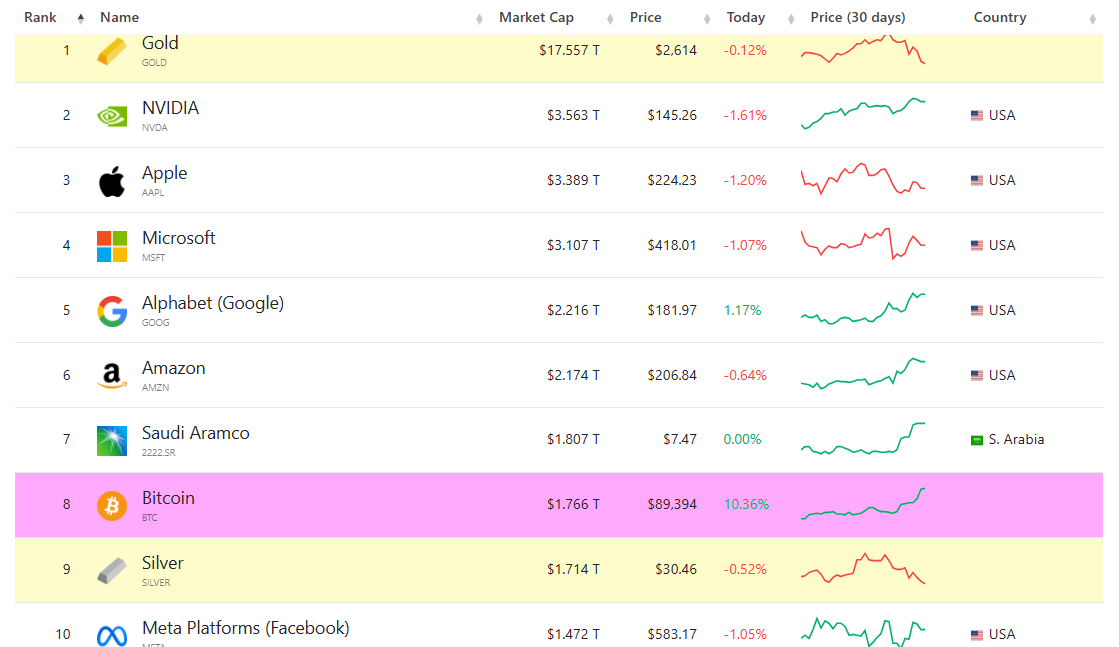

The observed trading activity may also be driven by Bitcoin's recent price surge. This rise has propelled Bitcoin above $88,000, surpassing Silver as a global asset and becoming the 8th largest asset in the world at $1.736 trillion in market capitalization.

The momentum in IBIT and other spot Bitcoin ETFs underscores the growing institutional demand for Bitcoin exposure. BlackRock's IBIT ETF has consistently attracted substantial trading volume since its launch, and recent data highlights its pivotal role in driving the Bitcoin ETF market's growth.

Specifically, IBIT's trading volume exceeded $4 billion on two consecutive high-volume days last week, with one day seeing a net outflow of $69 million. The next day saw a record-breaking net inflow of over $1 billion. According to SoSoValue's data, this financial instrument continued its positive performance, recording a net inflow of $75.645 million.

Experts warn that high trading volume may indicate strong demand, but could also signal selling activity. Bloomberg's ETF specialist Eric Balchunas noted that it may take a few days to interpret such trading volume in terms of sustained net inflows.

For now, the surging Bitcoin ETF activity reflects a strong post-election rally. Many investors are watching to see if this bullish momentum will continue to strengthen in the coming weeks.

Ethereum ETF, Record Inflows... Institutional Interest at All-Time High

While Bitcoin ETFs experienced a surge in trading volume, Ethereum ETFs simultaneously broke inflow records. In the week ending November 10, US-based Ethereum ETFs exceeded $295 million in total inflows, setting a new all-time high.

BlackRock's Ethereum Trust (ETHA) led the pack with $110 million in inflows, while Fidelity's Ethereum Trust (FETH) recorded $115 million in new capital, as reported by BeInCrypto.

The recent activity reflects the overall recovery in the cryptocurrency ETF market. Bitcoin and Ethereum funds have experienced record-breaking trading volumes and inflows, buoyed by an optimistic market sentiment.

Institutional interest in Ethereum ETFs continues to grow. Recent data shows notable support from similar institutions, including Michigan's largest public pension fund.

Notably, this was one of the first institutional investors to allocate funds to an Ethereum ETF. The moves by these prominent pension funds mark an important milestone in Ethereum's journey towards mainstream adoption.

As the post-election fervor in the US subsides, the market is closely watching for signs of sustained interest and new capital inflows. These developments demonstrate significant progress in the adoption of cryptocurrency assets, with more investors beginning to include Bitcoin and Ethereum ETFs in their portfolios. This trend helps establish cryptocurrencies as an accepted asset class in institutional finance.