Bitcoin (BTC), the leading cryptocurrency, has continued to set new all-time highs in the past week, showing an endless upward trend. At the time of writing, Bitcoin is trading at $88,000.

As the market expects Bitcoin's price to reach $90,000, there are signs that this target may not be achieved. This analysis addresses two important factors that could slow down or even stall the cryptocurrency's upward momentum.

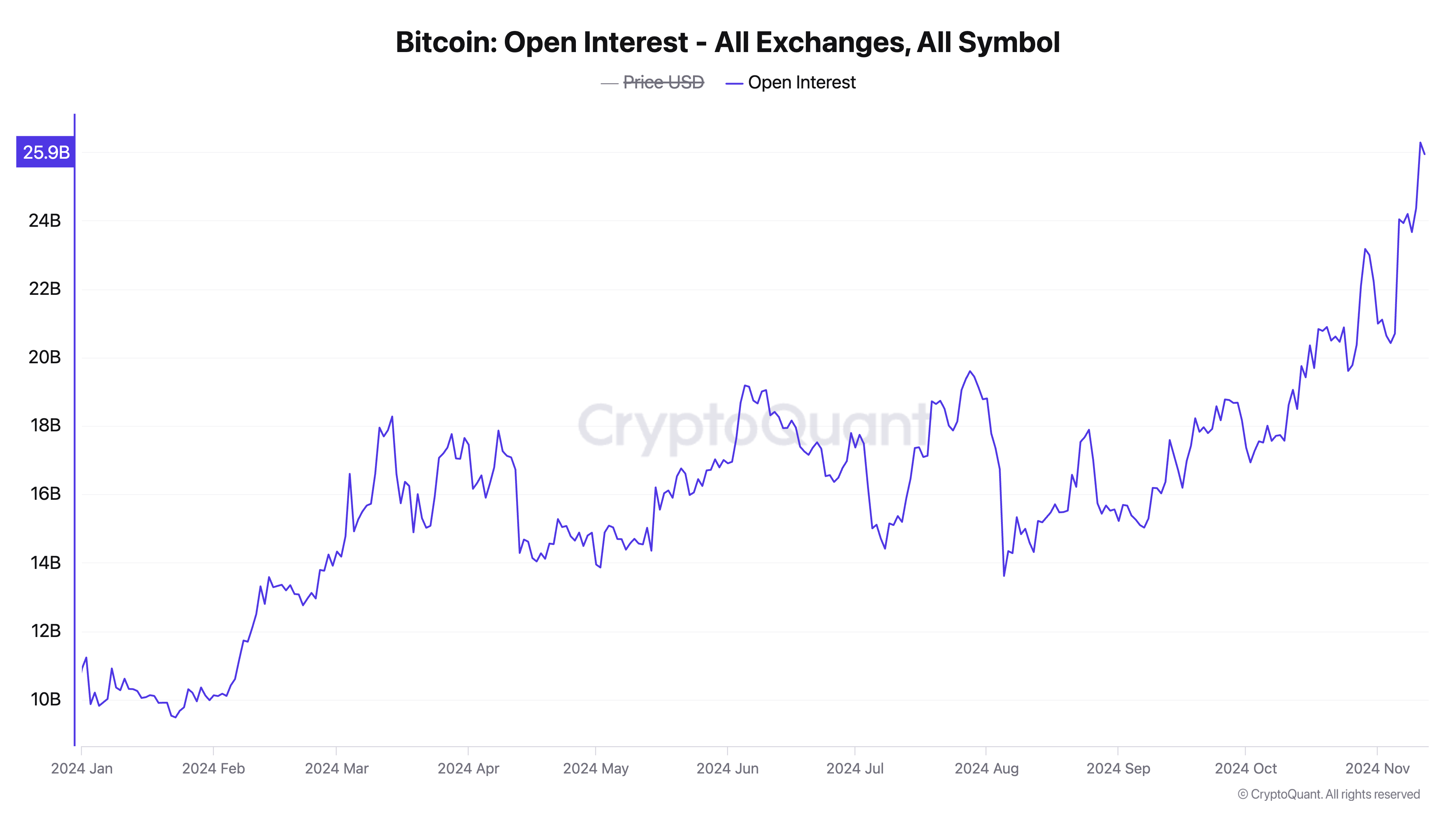

Explosive Increase in Open Interest... Burden at $90,000

The explosive open interest in Bitcoin can be a major factor that could hinder the achievement of the $90,000 price target in the short term. According to CryptoQuant's data, over $16 billion in open positions were added in the futures market last week. This indicates a significant increase in leverage. At the time of writing, BTC's open interest is $25 billion, the highest since August 2022.

Open interest tracks the total number of outstanding contracts (options and futures) that have not yet been settled. During price rallies, a surge in open interest is a bullish signal. However, when asset prices rise too quickly, high open interest can indicate potential instability.

Over the past week, Bitcoin's price has risen by 25%. The surge in open interest indicates that many investors have taken on leveraged positions. This has created a fragile environment where a price reversal could trigger a cascade of liquidations.

If the coin's price reverses even slightly, these leveraged positions could trigger a chain reaction. Sell orders from high-leverage traders trying to avoid losses can amplify the downward pressure, further driving down the coin's price and triggering additional liquidations.

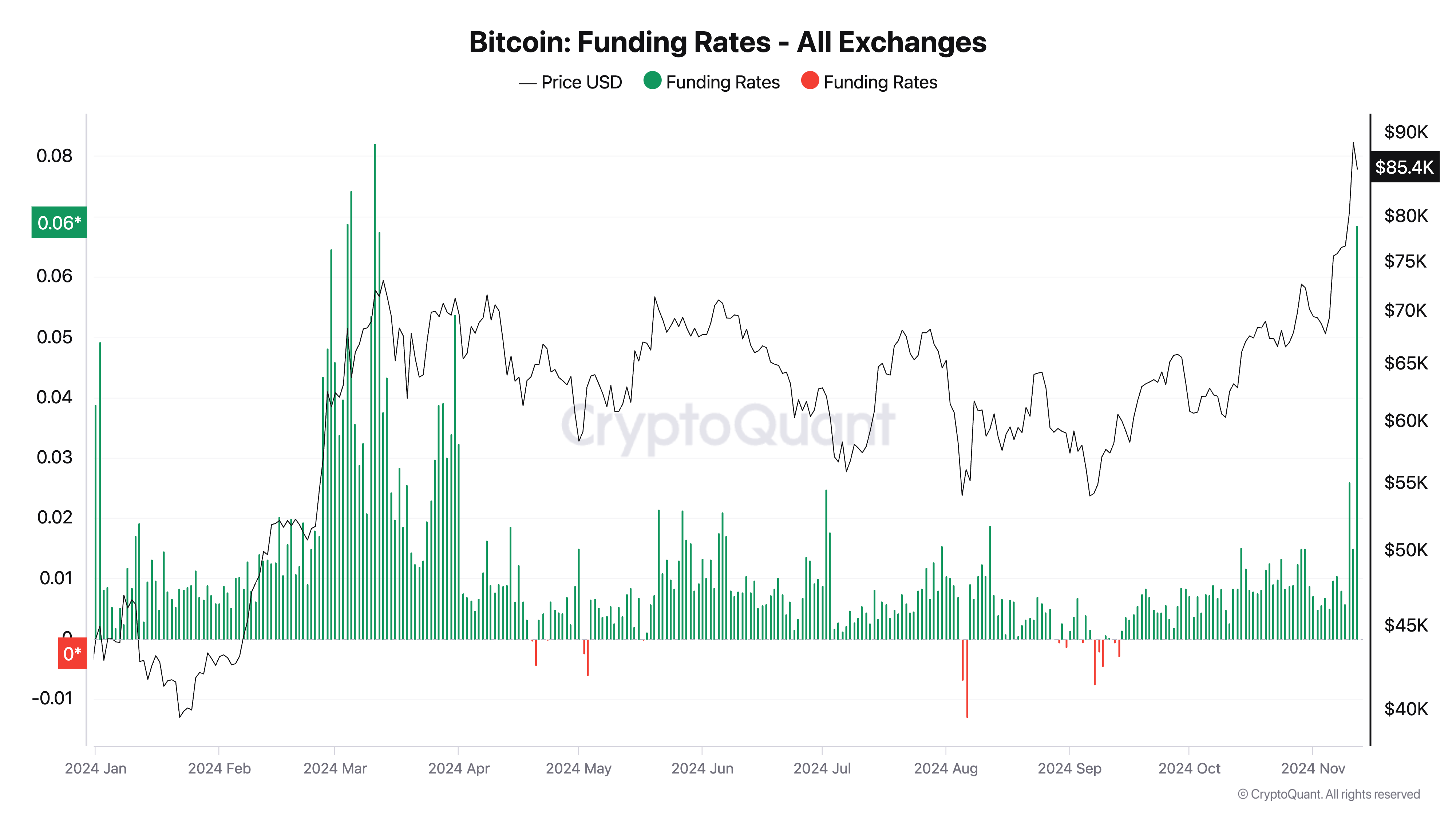

Additionally, BTC's rising funding rates are another factor that could keep its price below $90,000 in the short term. Currently at 0.015%, it is the highest value since the end of March, when BTC experienced a more significant correction.

In futures trading, the funding rate is a periodic fee paid between long and short position holders to maintain balance. However, a significant increase in the funding rate is a bearish signal, indicating the market is dominated by buyers and can foreshadow a price correction.

Bitcoin RSI at 74.83... Substantial Overbought Condition, Likely to be Burdensome

When the cost of maintaining long positions becomes too high, some traders may liquidate their positions to avoid the high funding costs, which can put downward pressure on the asset's price. Additionally, as the asset's price starts to decline, highly leveraged long positions may face liquidation risk, creating a cascading effect that can lead to a sharp price drop.

The overbought reading on Bitcoin's Relative Strength Index (RSI) confirms the bearish outlook mentioned above. At the time of writing, the coin's RSI is 74.83.

The RSI indicator measures the overbought and oversold market conditions of an asset. It ranges from 0 to 100, with values above 70 indicating the asset is in an overbought state and may require a correction, while values below 30 suggest the asset is oversold and may be due for a rebound.

With an RSI of 74.83, Bitcoin's RSI is significantly overbought and may soon experience a correction. If these factors persist, Bitcoin could undergo a temporary adjustment and fall to $81,215. If this level is not maintained, the coin's price could further decline to $74,340.

However, if buying pressure strengthens, the coin may recover its current all-time high of $89,972 and even rise above $90,000.