“The process of Americanization of crypto has already begun, not through decentralization, but through intervention in the political center.”

Author: Zuoye Waiboshan

Cover: Photo by Steve Harvey on Unsplash

If you were amazed by Trump’s victory, revisiting Alexander’s story would calm us, rather than wallowing in the sadness of the decline of Athenian democracy.

In 338 BC, Alexander the Great defeated the coalition of Greek city-states at the gates of Chaeronea, and then swept across the world, starting the worldwide process of Hellenization. For example, the Gandhara region, which was influenced by him, developed exquisite Buddhist sculpture art, and the Gandhara style later profoundly influenced China's cave sculpture art. The world has gone around in circles, but it is always connected and developing.

Crypto Americanization, the rule of law in progress

Today, Trump will be dancing alone in the next two years as he controls the party (Republican Party), public opinion (Musk), executive, legislative and judicial branches. The generous sponsorship of up to 135 million by the cryptocurrency industry in this round of elections is bound to bring Trump extremely rich returns.

In contrast, what should city-states such as Dubai, Singapore and Hong Kong do next? The global regulatory storm against cryptocurrency exchanges started with high leverage and tax issues in 2022, reached a climax after the collapse of FTX, and finally ended with CZ paying money, going to jail and being banned from the industry.

- BN’s choice is global arbitrage, from mainland China, Japan, Singapore, to France and the UAE. Wherever my heart is, that’s my home.

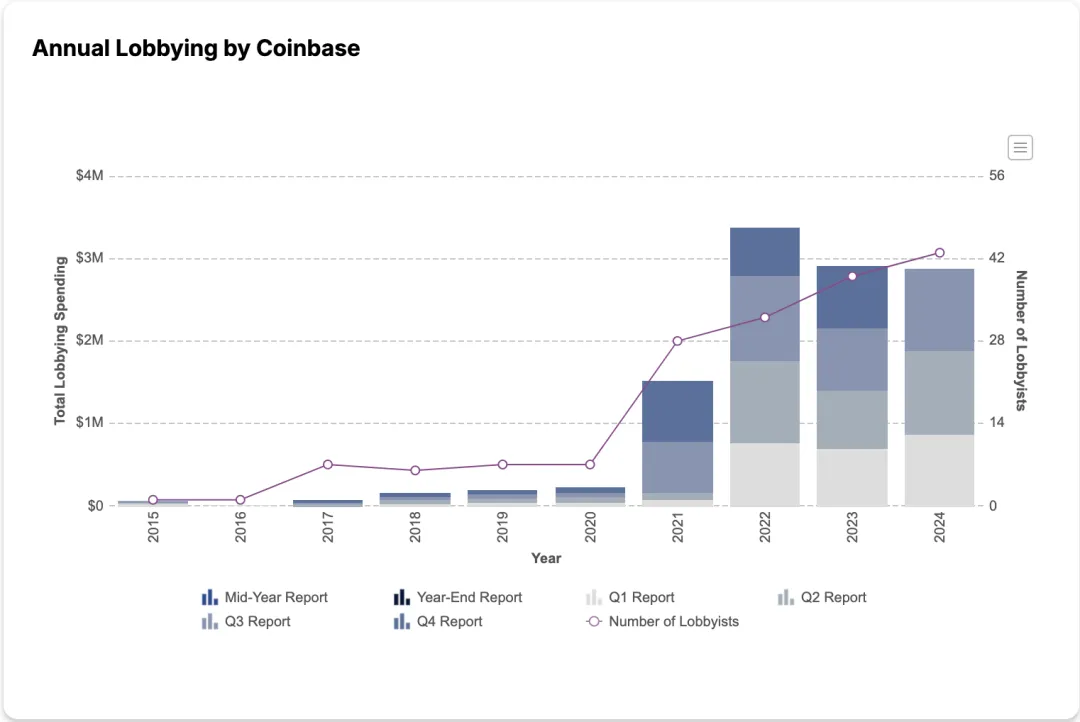

- CB's approach is to take the initiative, starting with hiring Chris Lehane to lobby, and following up with FairShake PAC to support crypto-friendly candidates. What can't be killed will make me stronger.

But Trump’s coming to power is not the end of chaos, nor is it the establishment of new order.

In fact, Rome was not built in a day. Following the collapse of FTX in 2022, the cryptocurrency industry began to actively save itself. Top players in the industry such as Coinbase, A16Z and Ripple have begun to take the initiative since then. The above figure also shows that 22 years was the peak of spending.

From the perspective of the entire U.S. political structure, cryptocurrency is close to full legalization. This does not refer to the legalization of sub-sectors such as exchanges, stablecoins, public chains, and token issuance, but rather the subsequent supervision and legal framework. Specifically, the overall idea has taken shape.

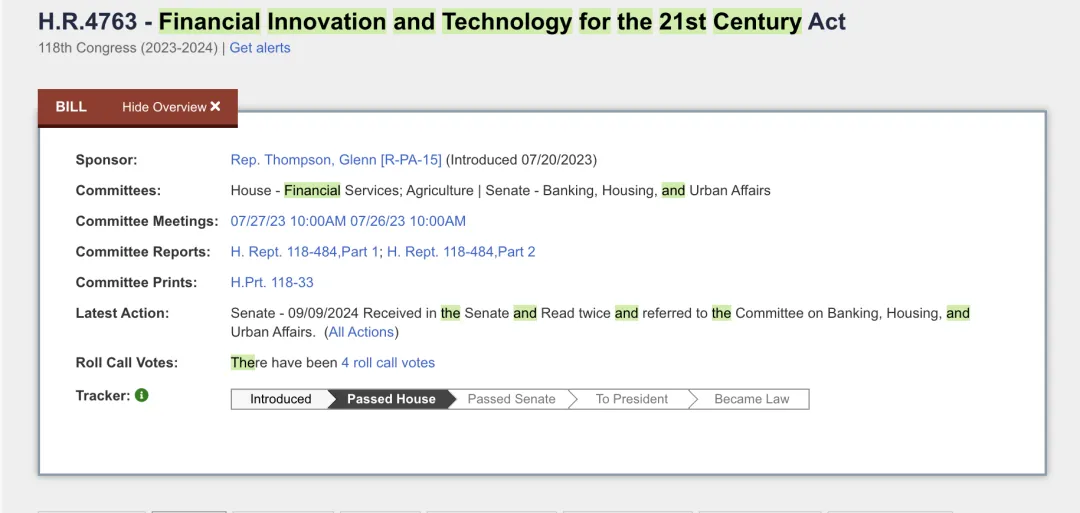

- Congress -- FIT21 Act

- Regulation - Switching from SEC to CFTC

- Administration - Trump prepares to use Bitcoin as a strategic reserve, not issue CBDC, and pardon Silk Road founder

The FIT21 Act (Financial Innovation and Technology Act for the 21st Century), the overarching framework for these changes, was passed by the House of Representatives in May, and given Trump's overwhelming majority in the Senate, the day when the bill becomes law is not far away.

Under the FIT21 framework, the main focus is to distinguish between digital assets and digital commodities, and to divide the powers and responsibilities of the SEC and CFTC.

- Digital assets are under the jurisdiction of the SEC;

- Digital commodities are under the jurisdiction of the CFTC.

For example, ETH is necessary to maintain the operation of Ethereum, so it obviously has practical value and should be classified as a "digital commodity" and can be regulated by the CFTC (U.S. Commodity Futures Trading Commission). Even SEC Chairman Gary Gensler agrees with this.

However, some tokens are issued for the purpose of financing (IXO), and their holders and issuers only seek the expected returns of the tokens, but do not have actual value to the public chain or products. They will be defined as digital assets and should be under the jurisdiction of the SEC. In essence, they are regarded as securities issuance.

In addition, there are relevant compliance requirements for stablecoins and intermediaries. However, after the division of responsibilities between the SEC and the CFTC, token issuance will in fact become law-based. As long as the token can prove its actual use and value, it can get rid of Gary Gensler’s "harassment" and a clearing mechanism will be established in the market to exclude fraudulent projects.

Although Gary Gensler openly opposes the bill, it is certain that his term is already in the countdown, and Trump has announced that he will fire him on the first day of his election.

In Trump's view, Bitcoin or more broadly, cryptocurrencies are an option to solve the debt crisis, at least a partial option. In a broader sense, he will recognize cryptocurrencies at the US political level, and cryptocurrencies will correspondingly express their support or control over him in advance.

Based on this, we can set an observation point: if large-scale crypto advertising (supporters other than Trump rarely talk about cryptocurrencies directly) and exchanges can reappear in the discussion space of American political life, then the Americanization of crypto will be fully formed.

It is difficult for city-states to arbitrage, but there is no gap for big countries

"Clamps" are part of Ethereum, like barnacles to turtles. People even recognize that they are part of the ecosystem, but people have never thought about an ecosystem without parasites.

We list the names of three countries or regions as follows:

- Cayman Islands, British Virgin Islands

- Dubai, Singapore and Hong Kong

- Vietnam, Morocco and Mexico

If you are active in the venture capital, crypto or overseas circles for many years, then the common point of the above countries or regions is that they actually play the role of a cross-chain bridge between the East and the West. For example, after the outbreak of the Russia-Ukraine war, dignitaries from both sides met in Dubai, as if the killing and bloodshed in the distant region had not happened and had nothing to do with the source and direction of their funds.

But with Trump's limited return, all of this will change, but in the form of deglobalization, all parts of the world will be entangled and interact with each other. To dismantle the intricate relationships, they need to be connected to each other in order to ensure consistent actions.

Between Dubai, Singapore and Hong Kong, cryptocurrencies can be reduced to two categories: exchanges and stablecoins. The competition over exchanges has basically ended, with Hong Kong only having "truly compliant" exchanges such as Hashkey and OSL, while Dubai has taken in many global exchanges such as BN/OK/ByBit that are unable to apply for Hong Kong licenses.

Dubai: Middle East Peace Hotel

When the SEC was frantically pursuing Ripple, Ripple said it would take itself to Dubai to reduce the global competitiveness of the United States. Such familiar tactics have been used repeatedly by companies such as Coinbase and A16Z. In the end, the winner has the legal power to reset the agenda.

Specifically, Dubai focuses more on exchange business, and its regulatory framework is under VASP (Virtual Asset Service Providers). Different from the division between SEC and CFTC, Dubai chose to tailor a new regulatory system for the crypto industry. But please don’t take it too seriously, because FTX also obtained the license and quietly withdrew it after the incident, proving that no one can regulate the black box.

What’s even more interesting is that USDT has penetrated into oil trading, completing its first $45 million in oil trade financing support last month. However, it should be noted that not buyers and sellers directly use USDT to trade, which opens up new markets outside of traditional crypto transactions and is worthy of encouragement.

Tether's other gesture of goodwill was to cooperate with local companies to issue a stablecoin pegged to AED (UAE Dirham) in accordance with the regulations of the UAE Central Bank, and the deal fell on TON. Telegram moved to Dubai after fleeing Russia, and the UAE Central Bank also issued special regulations for stablecoins, giving all crazy behaviors a legal basis. Get on the bus first and buy the ticket later. As long as it can bring profits to the local area, everything is welcome.

But all this is not as good as it is said above. Dubai or the UAE is still a marginal follower of the United States and the West. Although CZ lives in the UAE, he still chose to go to the United States to settle the lawsuit, even though the UAE is not on the list of 100 signed extradition treaties by the United States.

There is also Telegram founder Nikolai Durov, who holds multiple nationalities including the United Arab Emirates, but he was still arrested by France. All of the above shows that although Dubai can shelter you from the wind and rain, its ability is limited, and the key still depends on yourself.

Singapore: A sweet place for Chinese people

Compared to the exotic feeling of Dubai, Singapore, which is an eight-hour flight south from Beijing, is obviously closer to Shenzhen and Fujian. More than 200 years of migration to Southeast Asia has created a huge overseas Chinese community. For example, after being investigated by the FBI, Justin Sun chose Singapore as his first choice for escape, as it is close to China and far from the United States. But in other words, compared to Dubai, Singapore is more suitable for making a living close to the mainland.

After the collapse of FTX, Singapore's Temasek, as a participating investor, also conducted a review, and the government's policy on cryptocurrencies has become more cautious, but this does not affect the grandeur of Token 2049 and the stunning concept of PayFi on Solana Break Point.

In addition, Singapore's largest bank, DBS (DBS Bank), has not given up on following the cryptocurrency industry. The most important thing is the issuance of USDG (Global Dollar). DBS is the US dollar reserve management bank, and Paxos is responsible for the issuance. Paxos is the issuer of the former BUSD. As early as 2022, it obtained the MPI (Large Payment Institution License) from the Singapore MAS (Monetary Authority). Other license holders include Alibaba and Coinbase.

The cooperative issuance of USDG is an important attempt after the introduction of MAS's stablecoin regulatory framework in 2023. Localized US dollar-compliant stablecoins will not be a rival to USDT for the time being, but they point out the direction for the future.

In general, Dubai and Singapore are on par with each other, and it is difficult to tell which is better. However, in terms of living comfort for Chinese people, Dubai's 300,000 cannot be compared with Singapore's 4 million.

Hong Kong: The dilemma of true compliance

The biggest difference between Hong Kong, Singapore and Dubai is the long history of the Hong Kong Stock Exchange. However, at a time when mainland technology stocks are weak and their overseas appeal is declining, Hong Kong's encryption policy has never been able to make great strides forward.

Although it followed the United States in passing the BTC/ETH spot ETF, its traffic and scale are completely incomparable to the US ETF.

As for Hong Kong's exchange policy, since it has implemented a "true compliance" policy that is different from Dubai's, such as requiring exchanges registered in Hong Kong to exclude mainland customers, it is obvious that major exchanges choose the latter between compliance and profit. Although it will be in a gray area for a long time, Marx has already given the answer. As long as the profit is high enough, the capitalists don't mind selling their noose. Hayek wins this game.

As for stablecoins, Hong Kong's idea is still to cooperate with large companies, such as JD.com and other companies, but the problem is that although they can operate in compliance, they are completely unable to open up new scenarios under the current market structure, resulting in the inability to make a move.

Welcome to a new era

Compared with the policies of the above three companies, exchanges cannot operate globally without compliance, and no company can accept fragmented liquidity. Hashkey Global and Coinbase Global have appeared one after another. After all, compliance cannot be used to make a living, and business is the way of the world.

The neoliberal globalization that began in the 1980s is about to end, and regionalization will become the mainstream, just like Singapore's regional stablecoin, Dubai's local compliance license, and Hong Kong's non-mainland user exchanges. Everyone is practicing it.

But in Trump's plan, not only China will be targeted, he will spread hatred equally to all non-US economies. American First does not care about human relations, and there are no common values under MAGA.

In Trump's plan, a 15% corporate tax is an economic reform that must be achieved, and it is an important bargaining chip for Ireland and other countries to attract American investment into Europe. During his first term, the plan failed to be implemented globally due to the strong lobbying power of large companies. Now is the time to end it all.

If the price is the same, then the United States will obviously have an advantage, Trump said.

In short, the confrontation between the world's major powers will return to hard power such as industry and high technology, and the space left for small giants to maneuver will become smaller and smaller. They will even compete with each other. The competition in the era of stock will be extremely cruel, and cryptocurrency is also the only remaining global industry. In this sense, cryptocurrency is also an important symbol connecting the world.

" References:

- Crypto's $135 Million Campaign Is Undefeated in 48 Races So Far

- House Passes Digital Asset Market Structure Legislation: Financial Innovation and Technology for the 21st Century Act (FIT21)

- Tether Funds First Oil Trade for Major Producers in Middle East

- Tether to Develop UAE Dirham-Pegged Stablecoin

- Paxos Secures Major Payments Institution License from Monetary Authority of Singapore

Disclaimer: As a blockchain information platform, the articles published on this site only represent the personal opinions of the author and the guest, and have nothing to do with the position of Web3Caff. The information in the article is for reference only and does not constitute any investment advice or offer. Please comply with the relevant laws and regulations of your country or region.

Welcome to join the Web3Caff official community : X (Twitter) account | WeChat reader group | WeChat public account | Telegram subscription group | Telegram exchange group