Due to the strong price surge, unprecedented capital inflows have led investors to increase their investments in BTC and ETH ETFs.

In early November, the BTC price soared to nearly $90,000, triggering a massive influx of funds into the US spot BTC ETFs.

In November, BTC entered a bull market, with its price skyrocketing from $69,000 to nearly $90,000 in just seven days. Driven by positive market sentiment and FOMO, the BTC price surge led both retail and institutional investors to increase their BTC investments.

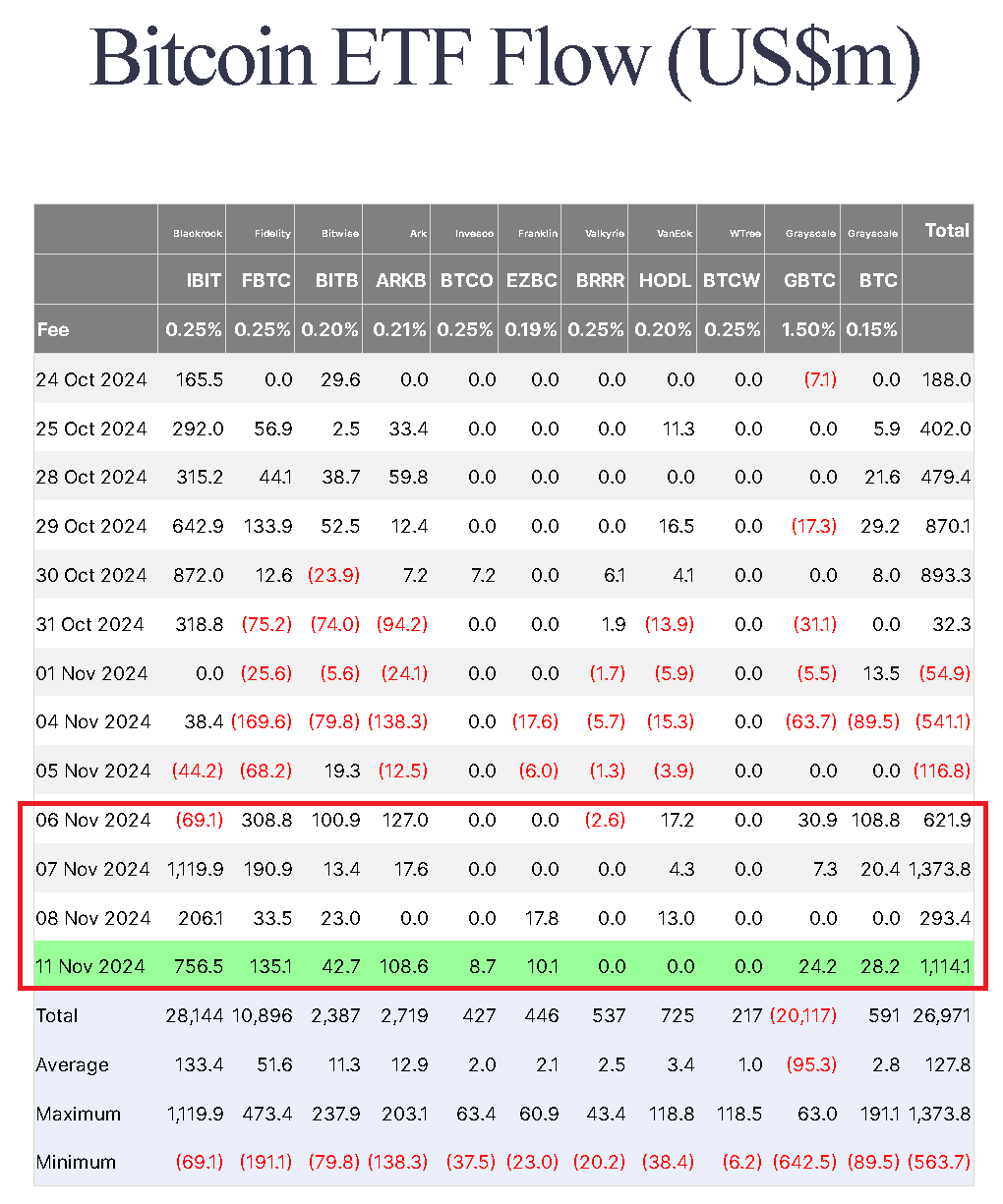

According to data provided by Farside Investors, the investment in US spot BTC ETFs reached $2.6 billion in the week of November 6-11.

Inflows and outflows of spot BTC ETFs. Source: Farside Investors

All ETF providers attracted investments during the BTC bull market

Among the 11 US spot BTC ETFs, BlackRock's iShares Bitcoin Trust attracted the most investments, worth over $2 billion, during this period.

Other well-known ETFs that contributed to the weekly inflows include Fidelity's Wise Origin Bitcoin Fund, Bitwise Bitcoin ETF, and ARK 21Shares Bitcoin ETF, with inflows of $668.3 million, $180 million, and $253.2 million, respectively.

Grayscale records a rare positive inflow trend

Additionally, the Grayscale Bitcoin Trust, which was once notorious for causing a $20 billion outflow from the ETF ecosystem, also recorded net inflows during the BTC bull market.

According to Farside Investors, Grayscale's BTC ETFs (GBTC and BTC) have attracted a total of $219.8 million in inflows since November 6.

The positive investor sentiment has also spread to the spot ETH ETF ecosystem. On November 11, the daily inflow of US spot ETH ETFs reached the highest level since their launch in July.

The inflow of spot ETH ETFs on November 11 reached $294.9 million, breaking the previous record of $106.6 million set on the launch day.

Rachael Lucas, a crypto analyst at BTC Markets, said in a report to Cointelegraph: "After lagging for much of this cycle, Ethereum is now attracting attention."