The XRP price has recently surged by 40% and hit an 8-month high. However, the upward momentum is now slowing down, and XRP may face a potential correction.

This pullback suggests that there may be a shift in sentiment due to sell signals emerging among investors.

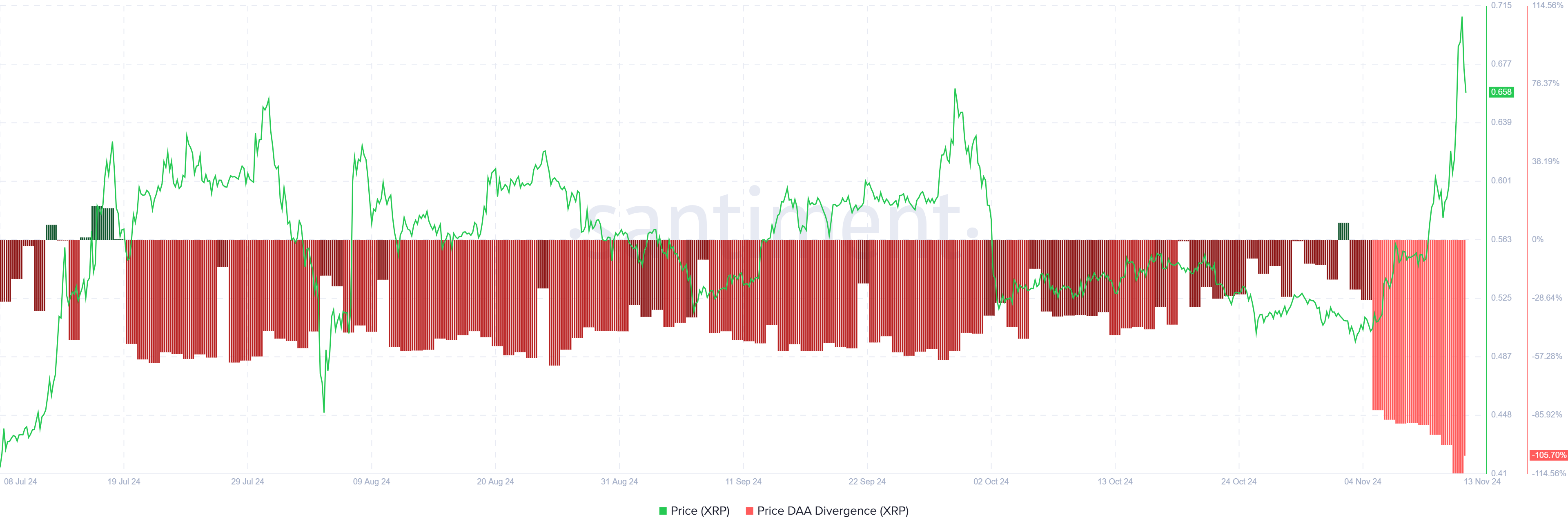

Decrease in Daily Active Addresses... Low Investor Participation

The current price DAA (Daily Active Addresses) divergence indicator is sending sell signals for XRP. This signal has emerged despite the recent price increase, as investor participation has declined, triggering an immediate market reaction. The resulting selling pressure contributed to a 6% drop in the price today, underscoring the impact of the sell signal.

As the price DAA divergence continues to warn of weakness, XRP is struggling to maintain its recent gains. Following a strong upward trend, the decrease in active participation may lead to a waning enthusiasm among short-term holders. This selling trend suggests that if participation remains low, XRP could face additional selling pressure.

XRP's macroeconomic momentum aligns with the sell signals, and the Relative Strength Index (RSI) is in the overbought zone. Historically, when XRP's RSI enters this zone, reversals often occur, and bullish sentiment becomes saturated. The presence of RSI in this zone confirms the recent sell signals and supports the possibility of short-term price declines.

The overbought RSI suggests that XRP's bullish momentum is weakening, and price corrections may continue. The current conditions imply saturation, and XRP may struggle to maintain its recent highs. This technical indicator further confirms the risk of XRP experiencing a correction on the daily chart, which could impact short-term investor sentiment.

Will it Surpass the $0.73 Resistance Level that Acted as a 'Fortress' for 8 Months?

Despite the recent 40% surge, XRP has not been able to break above the $0.73 resistance level that has acted as a barrier for the past 8 months. As a result, this altcoin has already declined by 6%, suggesting the possibility of a short-term correction phase.

XRP's next potential support level is $0.61, which has previously acted as a support level. However, if the selling pressure intensifies, XRP could drop further to $0.56, indicating that a deeper correction may occur as investors take profits.

The only way to invalidate the bearish outlook is for XRP to reclaim $0.66 as a solid support level. Achieving this would set the stage for another attempt to break above $0.73, potentially renewing the bullish momentum for this altcoin.