Author: Brayden Lindrea, CoinTelegraph; Compiled by: Tong Deng, Jinse Finance

On November 13, the Federal Bureau of Investigation (FBI) raided the home of Polymarket CEO Shayne Coplan, seizing his phone and electronic devices.

According to a source cited by the New York Post, at 6 a.m. Eastern Time, Coplan was awakened at his residence in New York City by U.S. law enforcement officials and asked to hand over his phone and electronic devices.

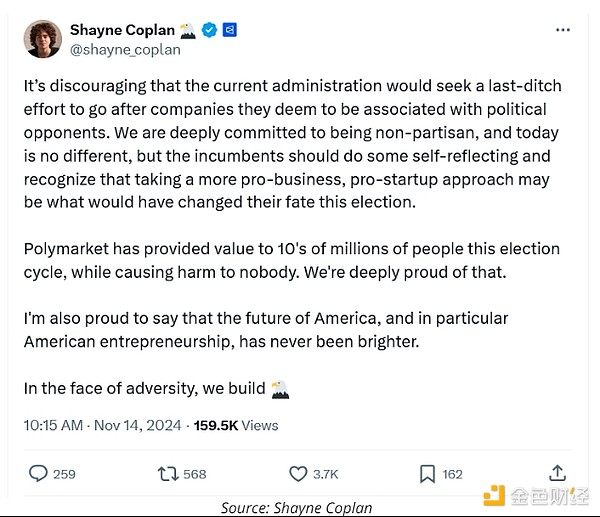

A Polymarket spokesperson confirmed the incident to Cointelegraph, stating that the raid was an "obvious political retaliation" by the outgoing Biden administration because "it provided a market to correctly predict the 2024 presidential election."

"We do not charge any fees, do not engage in trading, and allow observers from around the world to analyze all market data as a public good," the spokesperson said.

"We look forward to standing up for ourselves and our community, and continuing to help people understand important world events."

A source told the New York Post that the Coplan incident was "a grand political farce."

"They could have sought any assistance from his attorney. But they orchestrated a so-called raid in order to leak the matter to the media and use it for an obvious political purpose."

The New York Post's source also speculated that "the government is likely trying to build a case accusing Polymarket of manipulating the market and manipulating opinion polls to favor Trump."

A week ago, Republican Donald Trump won the U.S. presidential election by a landslide.

Polymarket had a $3.7 billion bet on the "2024 Presidential Election Winner" market, prompting critics to call for the platform's influence.

U.S. residents are prohibited from betting on the platform.

However, Americans can bypass this ban through virtual private networks (VPNs).

It is reported that Polymarket is investigating to ensure that whales who placed large bets before the U.S. presidential election are located overseas.

Before Polymarket's popularity soared, it had already reached a $1.4 million settlement agreement with the U.S. Commodity Regulatory Authority in January 2022 for providing over 900 event-based binary options markets without registration.