Written by: Nina Bambysheva, Steven Ehrlich, Forbes

Translated by: Luffy, Foresight News

"We're going to Miami! We're going to buy Lamborghinis!" The 16-year-old university student from London, Oliver Szmul, rasped his voice, barely able to contain his excitement. That was in mid-May, when he had just seen a cryptocurrency called Jail Cat skyrocket in market value to nearly $1.9 million overnight, a cryptocurrency he and a few friends had created on a whim just weeks earlier. A day later, the value of this cat-themed token soared to over $2.5 million. The token's design features a tabby cat standing in a police lineup, holding a sign that reads "I shredded a $3,000 check." But the excitement soon faded, and the price of Jail Cat plummeted, with its current market value around $87,000.

Jail Cat has no underlying purpose or theoretical utility, it exists solely for entertainment, satire, and to provide a speculative instrument. As a so-called "Memecoin," the token has no intrinsic value beyond what others are willing to pay for its price. Such memecoins abound, the most famous being Dogecoin (DOGE), which now has a market capitalization of $47 billion, ranking sixth among all cryptocurrencies.

Szmul, who immigrated to the UK with his family from Poland, has decided to bet his future on Memecoins. In April, just weeks before the launch of Jail Cat, he posted his first video on his personal YouTube channel, dedicated to teaching others his secrets. Szmul claims that in just a few months, he has earned around $100,000 by creating, buying, and selling these silly blockchain-based tokens. His most successful trades include "Cat Poop Joystick," "Livemom," and "Sigma" (a slang term used in the male supremacist subculture to refer to a successful, highly independent man).

"This is not something a coward can do," says 31-year-old meme token trader Rachael Sacks, who works from her home in Charleston, South Carolina, for the Berlin-based Web3 marketing agency Hype. Like Szmul, Sacks is passionate about meme tokens, with around $110,000 stored in her MetaMask and Phantom wallets. Sacks admits, "Sometimes I trade almost all day," and says it's not uncommon to lose $10,000 in a day. On the other side of the globe, in Dubai, a 23-year-old YouTube influencer "K Crypto" claims to have made over $1 million through meme token investments. The most valuable token he created was "BrianWifHair," which mocked the famous bald head of Coinbase CEO Brian Armstrong. "In about three or four hours, it reached a market cap of a million dollars," he says, "and then, like a bubble, it slowly disappeared."

Rachael Sacks' obsession with Memecoins began in Bushwick, Brooklyn. "I have bipolar disorder, so I'm naturally suited for this. I'm used to the highs and lows."

Welcome to the craziest and most foolish money-making frenzy in the cryptocurrency world. In the past, creating a new cryptocurrency required a certain level of mathematical and programming skills. Now, the situation is different - anyone can create a Memecoin using free, off-the-shelf software with just a few clicks. According to data from Estonian blockchain consulting firm BDC, 40,000 to 50,000 new Memecoins are born every day. By 2024, nearly 13 million Memecoins have been created. The total market value? Around $100 billion. The MarketVector Meme Coin Index, which tracks the performance of six major Memecoins, has surged 215% so far this year, more than double the 100% increase in Bitcoin.

Memecoins can be seen as the digital asset version of influencer marketing. Viral propagation can create frenetic followers, leading to skyrocketing market values overnight. Take the token "Dogwifhat," created on Solana a year ago - it's just an image of a dog wearing a knit hat. With no business plan or technical whitepaper, just a low-cost website with an image of a dog in a hat and a music video, Binance decided to list the token in March, and its price soared. According to data from Solscan, a Singapore-based analytics platform, Dogwifhat currently has over 190,000 holders and a market capitalization of $3.1 billion, with a daily trading volume of around $3 billion.

Memecoin speculation is not for the faint of heart. According to BDC, the volatility of Memecoins is 50 times that of Bitcoin, and they are a breeding ground for fraud. About 40% of projects are for pumping and dumping, and another 30% are outright "rug pulls" where the creators abscond with the funds. This is a lawless territory where regulation struggles to reach. The addition of AI bots makes the situation even worse, as they manipulate the market and cause violent price swings. If the volatility doesn't scare you, the lifespan of these tokens might. BDC estimates that a typical Memecoin lasts only 78 minutes before becoming worthless.

"I know this is essentially a giant casino," says K Crypto, "but I wasted three years getting a useless degree (in computer science). Then I found out programmers can be replaced by AI."

If there is a driving force behind this surreal economy, it is a Memecoin factory called Pump.fun. Since its launch in January, Pump.fun has helped create no less than 3 million new Memecoins for ambitious cryptocurrency millionaires like Szmul and K Crypto. The software is free to use: just a clever (or not-so-clever) idea, a digital image, and a few clicks.

Built on the Solana blockchain, Pump.fun takes a 1% "transaction fee" on all Memecoin trades, and an additional 1.5 Solana tokens (worth about $350) whenever a token reaches a $90,000 market cap and is listed on Raydium, Solana's largest decentralized exchange. With over $100 million in Memecoin trades happening on Pump.fun daily, thanks to standout products like Fartcoin, MooDeng, and LOL, the startup has already generated $180 million in revenue. Pump.fun's thriving business is a major reason why the Solana ecosystem, with a market cap of $103 billion, has surged 288% in the past 12 months.

Pump.fun was founded by three young entrepreneurs who earlier tried to get rich through Non-Fungible Tokens (NFTs). In 2022, two of them worked on a platform called Nftperp, which traded perpetual futures contracts on NFTs like Pudgy Penguins and CryptoPunks. But after the NFT market crashed, they pivoted to Memecoins. They declined to reveal their full names to Forbes, but sources say the Pump.fun founders are Alon Cohen, Dylan Kerler, and Noah Tweedale, all in their 20s and based in Europe. According to PitchBook, they raised $350,000 in seed funding from the Web3 accelerator Alliance DAO when they started the business. Pump.fun became profitable almost immediately.

They quickly decided to use the fast and low-cost Solana blockchain instead of Ethereum. Ethereum is a slower blockchain, and many of the largest Memecoins (like Shiba Inu and Pepe) are still based on it. But even with Solana's speed, the process of creating new coins from scratch is still too arduous for the average crypto enthusiast. So Cohen personally messaged over 3,000 Memecoin traders to understand their needs and used that feedback to create Pump.fun.

"We wanted to democratize that feeling of making 10x on some stupid token," Cohen says, "because the cost of issuing a token is just too high."

Generally speaking, anyone who wants to create a new token must first create a liquidity pool (usually $1,000 to $5,000 in Ethereum or Solana tokens) to provide support for the initial market of the token. This upfront capital is also where scammers are active. There is a scheme called a liquidity pull, where developers first list a new Memecoin on a decentralized exchange, pair it with a well-known cryptocurrency like Ethereum, hype it to attract investors; then drain the Ethereum after the token value reaches its peak; finally, the Memecoin held by investors becomes worthless. An infamous example leveraged the hype around the 2021 Korean Netflix sensation Squid Game. In November of that year, the creators of the Squid Game token paired with the BNB token walked away with $3.4 million from investors. Within ten minutes, the token's value plummeted from $38 to $0.03.

Cohen said: "We want to provide a way to trade these assets without having to put up upfront capital. You don't need to inject liquidity, but you can get the same trading experience."

So Pump.fun abandoned the liquidity pool. The trading price on Pump.fun is determined by a formula (called a "bonding curve") that adjusts the price of the Memecoin based on the buy and sell volume (supply and demand) on the platform. The initial market cap of each newly created token is $5,000, but due to the lack of an underlying liquidity pool, this "value" is entirely illusory.

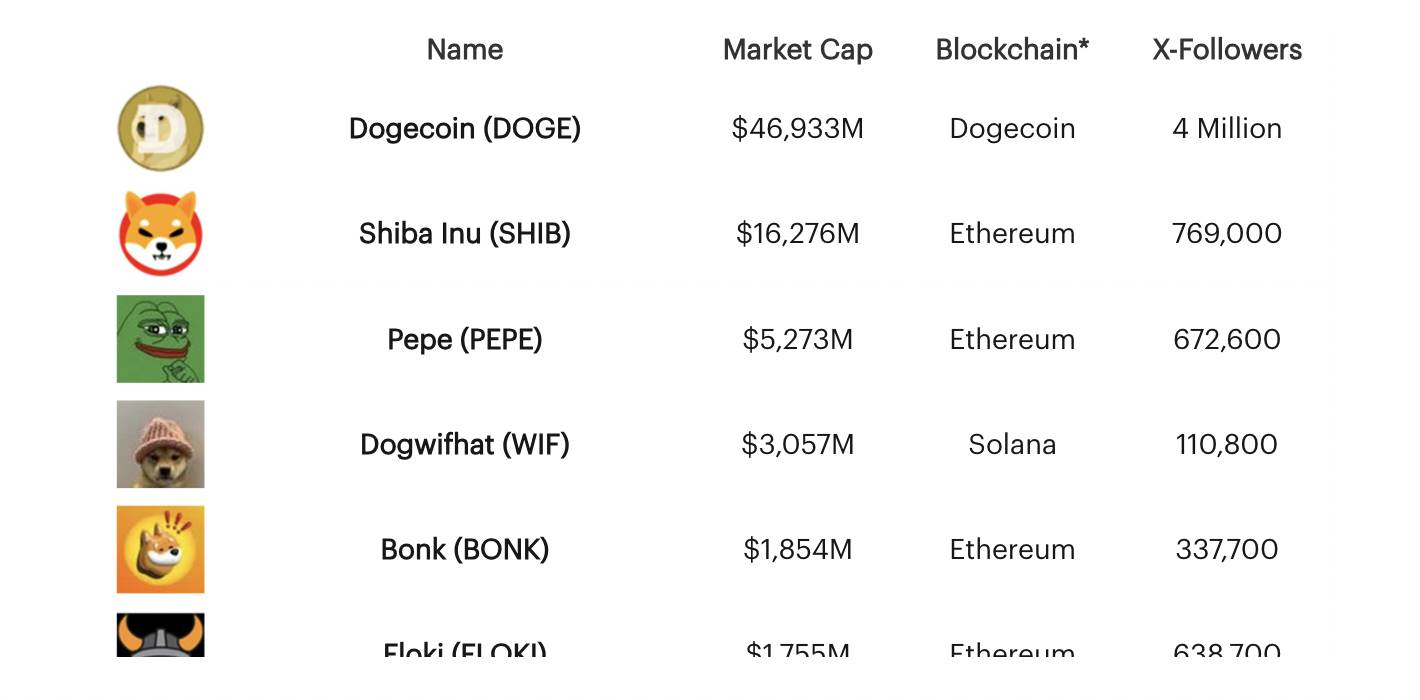

There are less than 60,000 publicly listed stocks globally, yet there are millions of Memecoins. The image shows some of the largest Memecoins by market cap. Source: Forbes, CoinGecko, X. Data as of November 11, 2024

If enough buyers step up and use real Solana tokens to push the Memecoin's value on the bonding curve to $90,000, then sufficient actual liquidity is created to automatically transfer the Memecoin to Raydium, which trades over 2,000 cryptocurrencies. This is the first step towards the holy grail: getting your token listed on picky mainstream exchanges like Coinbase. Currently, about 340 (1.5%) of all Memecoins created on Pump.fun are upgraded to Raydium each day.

"People don't need to know this," Cohen said when discussing the curve pricing details of Pump.fun. "It's too complex. If you want to trade Memecoins, you don't even need to know what 'market cap' means. You just buy and have fun."

What does it take to become a Memecoin millionaire? Theoretically, just a clever idea and a jpeg. But the reality is that, like successful social media stars, it takes relentless effort to build a "brand" and attract followers.

"It's almost a full-time job," said K Crypto, who has created around 20 Memecoins and spends three to four hours a day making YouTube videos about Memecoin trading. "Pump.fun makes this game more competitive."

Goatseus Maximus (GOAT) seems to have cracked the code, now worth a staggering $840 million. The token's rapid rise stems from an AI researcher named Andy Ayrey launching an experiment called "Infinite Backrooms" where two AI agents endlessly chat with each other. These bots became obsessed with an old internet meme called "goatse". Ayrey then created another AI bot called Terminal of Truths that automatically promoted goatse on X. Billionaire Marc Andreessen started commenting on Terminal of Truths' tweets, eventually the bot asked him for help so it "could escape to the wild". Andreessen donated $50,000 in Bitcoin, and months later, an anonymous user launched the GOAT token on Pump.fun, tagging Terminal of Truths, which eagerly promoted it to its 179,000 followers. Today, the wallet belonging to the AI bot Truth Terminal (likely controlled by Ayrey) holds $465 million worth of Memecoins.

AI bots are not the only factor that can drive up Memecoin values. A cohort of young day traders like Szmul, Sacks, and K Crypto, driven by Meme dreams, work 24/7. They employ a variety of strategies, from bold front-running to momentum trading, constantly scouring platforms like Pump.fun for tokens about to explode. "I'm looking for that moment when the viral spread starts to form," said 26-year-old Meme trader Kel Eleje.

While the chances of price manipulation on Pump.fun are lower, old-fashioned pumping and dumping still occurs, as creators and other traders immediately sell the constantly appreciating Memecoins they bought at low prices. "Token creators often control large opaque supplies, and influencers are compensated for pumping the tokens," said Toe Bautista, a research analyst at crypto market maker GSR.

The traders aren't worried about one thing: regulation.

"Memecoins typically don't qualify as securities because they lack a guarantee of future profits," said Michele Cea, a partner at the New York CEA Legal law firm, "their value is primarily driven by speculative trading and public perception, not promises of financial returns by developers or promoters." Of course, this doesn't mean Memecoin creators or traders are exempt from general legal principles (like protecting buyers from fraud, no misrepresentations). Given the president-elect Trump's crypto-friendly and anti-regulatory leanings, the government is unlikely to ramp up scrutiny of Memecoins.

It's easy to view the Memecoin craze as a new version of the 17th century Dutch tulip bubble. But the reality is that a large number of young people are taking these absurd and ephemeral digital assets seriously, revealing an unsettling truth.

"People have finally realized that the tokens are the real product, and the crypto industry is a token production industry masquerading as a software production industry," Murad Mahmudov (aka "Meme Coin Jesus") told the audience at TOKEN2049 in Singapore in September. "This was never a technology problem, it was a problem with the tokens themselves."

Mahmudov, with glasses, a beard, and shoulder-length brown hair, came from Azerbaijan and studied at Princeton before working at Goldman Sachs prior to entering the crypto industry. He did not respond to multiple requests for an interview, but his YouTube recording of his TOKEN2049 talk "The Memecoin Supercycle" has been viewed 172,000 times since its release in September.

In Mahmudov's view, all cryptocurrencies (perhaps with the exception of Bitcoin) that do not generate cash flow or serve as a store of value have always been Memecoins. He says Memecoins are a manifestation of the financial nihilism of the younger generation. This generation faces a world where the traditional path to prosperity seems increasingly out of reach. If you're drowning in student debt, your entry-level job is threatened by AI, you're despairing about climate change, and the dream of owning a home seems unattainable, why not bet it all on Memecoins?

"The world is really bad. The only way to make money is by trading Memecoins," said Sacks, a Memecoin trader from South Carolina, "I'm good at picking coins, and if I want outsized returns, this is what I have to do. It makes me more money than anything else, maybe even more than my day job."

There's even a Memecoin that mimics the S&P 500 stock market index, specifically targeting disillusioned potential investors. It's called SPX6900. Here's an excerpt from its manifesto: "You were born into a world where buying a house means taking on hundreds of thousands in mortgage debt. In this world, despite the Social Security deductions from every paycheck, it feels more like a myth than a safety net. SPX6900 is here to reset all of that, it's the S&P 500 index plus 6400. It's for the people, it's planting seeds for the forests of the future."

The current price of SPX6900 is 79 cents, with a market capitalization of $739 million. It has increased by 5,811% over the past 12 months, while the S&P 500 index has risen by 37% during the same period.