Author: Mark丨Stewart丨Mavis丨Jason丨Ryan丨Luiz, First Class

TechFlow by: TechFlow

Investment Summary

Aptos is a public chain project launched at the end of 2021.

From the perspective of the team, the core team of Aptos has deep roots with the blockchain projects Diem (formerly the stablecoin project Libra) and Novi that Meta had developed. After Meta was forced to abandon its exploration in the blockchain field due to regulatory pressure, several important members of the original development team chose to establish the public chain project Aptos. To some extent, Aptos can be regarded as one of Meta's legacy in the blockchain field. As a top software development company in the industry, Meta's talent pool accumulated for blockchain development itself has a very good academic background and reliable technical development capabilities . As the scale of the Aptos project continues to expand, the subsequent development of Aptos has a very good team foundation.

In terms of funding, as of November 7, 2024, Aptos has completed 6 rounds of financing. According to the disclosed financing information, Aptos raised $350 million at a valuation of $2.75 billion before the mainnet was launched in 2022. Subsequently, Aptos also conducted 4 rounds of strategic financing with undisclosed financing amounts. Aptos' investors are all first-tier investment funds in the industry, including Binance Labs, Dragonfly Capital, A16z, Multicoin Capital, Circle, Coinbase Ventures, etc. The latest round of financing was completed on September 19, 2024, so it is estimated that the project itself is still relatively well funded.

From the perspective of products and technology, Aptos aims to build a smart contract platform with scalability, security, reliability and upgradeability. The Move programming language, Diem BFT consensus algorithm, Block‑STM parallel execution engine and efficient node synchronization solution have laid the foundation for achieving this goal. While pursuing scalability and security, Aptos has also made certain trade-offs in the degree of decentralization. Although the number of Aptos nodes is small and has a high threshold, it has certain centralization risks, but the performance advantages gained are immediate . Since the launch of the mainnet, Aptos' peak TPS has reached more than 12,000, and more than 300 million transactions have been processed per day. The transaction delay has been reduced to less than 1 second, and there have been no failures such as transaction delays or network downtime, which proves its efficiency and reliability as a performance. At the same time, from the perspective of transaction costs, Aptos has also greatly reduced users' Gas expenditures through the excellent Gas fee mechanism design, which has broadened the space for the development of ecological DeFi or other application projects.

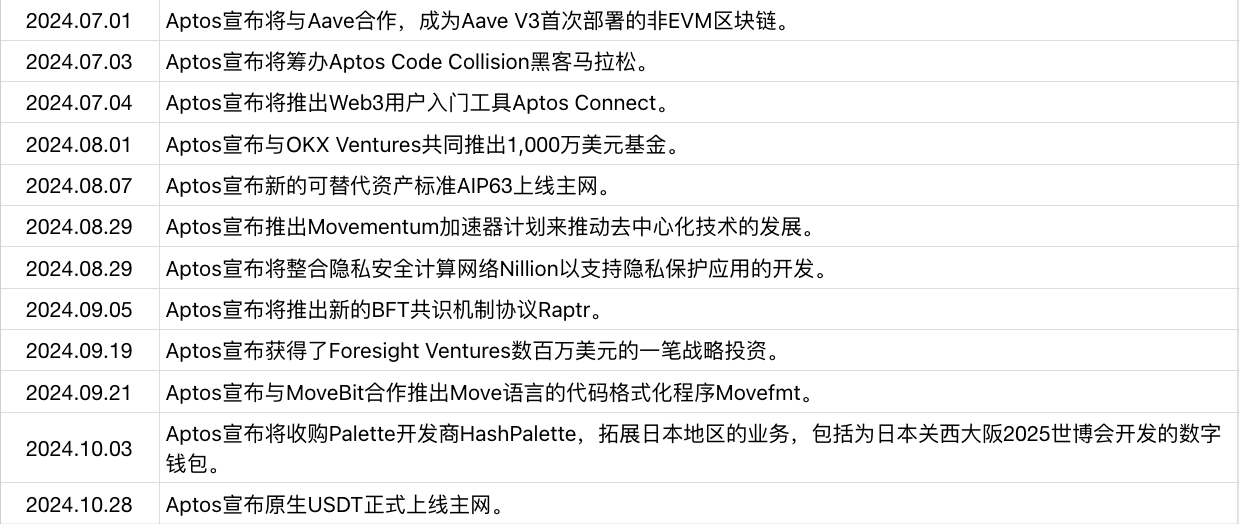

From the perspective of project development, Aptos is currently developing well, especially since the third quarter of 2024, the number of active addresses has continued to grow and maintain a certain stickiness, and the transaction volume has also increased significantly. On August 15, it set a record of more than 300 million transactions per day, and the peak TPS was close to 13,000, which also indirectly confirmed the excellent performance of the Aptos public chain. In terms of the ecosystem, Aptos's territory is also expanding, with both breadth and depth, especially DeFi, games, social and other tracks will likely become the cornerstone of Aptos' future expansion. At the same time, Aptos is also actively maintaining a good relationship with traditional companies and regulatory authorities, and has technical and commercial cooperation with Microsoft, Google, Alibaba, Amazon, South Korea's Lotte, SKT and other companies. In addition, at the end of October 2024, the native USDT will be officially launched on Aptos, which will likely bring more liquidity to Aptos and release more potential for the ecosystem.

From the perspective of token economics, APT tokens exist mainly as application tokens of the Aptos network, used for network consensus, governance, paying gas fees and promoting ecological development. The currently issued APT tokens are mainly in the hands of the Aptos Foundation, used for future project operations and ecosystem construction, reflecting Aptos' emphasis on future ecological development and adding more possibilities for the subsequent development of the public chain ecosystem.

From the perspective of the track, the public chain track where Aptos is located has gone through several rounds of bull and bear market changes and the development of blockchain technology. The market demand has become clearer and clearer, and the understanding of public chains among various projects has become deeper and deeper. We can find that the underlying consensus and performance of a public chain are the roots for the public chain ecological project to thrive, and the prosperity of the ecology is the fruit produced on it. For an excellent public chain, the underlying technology must be strong to produce good fruits, and at the same time, the fruits must be dazzling enough to obtain the final affirmation of the market. All three are indispensable. At present, Aptos has laid a solid foundation for the prosperity of the ecology with its excellent architectural design, and has also watered the seeds of the ecology with token economics and ecological construction plans, waiting for the development of subsequent ecological projects to grow dazzling fruits. From the perspective of public chain competition, Ethereum and Solana are still the first echelon of public chains. Aptos and Sui have a very large gap with the former two in all aspects except performance, and it takes some time to catch up. Compared with Sui, Aptos is from the Meta series and developed in the same language, and its performance is comparable. Due to the different preferences for ecological development of the two parties, there are currently some deviations in market perception. We believe that in the future, as the Aptos ecological layout continues to improve and as ecological projects that the market pays more attention to emerge, Aptos will have the potential for rapid development and a very high ceiling.

1. Basic Overview

1.1 Project Introduction

Aptos is a public chain project established at the end of 2021. It inherits some of Meta's achievements in the blockchain field and has a very good team and financing lineup. Since the launch of the mainnet, Aptos has proven its efficiency and reliability with practical actions. In the future, it will be possible to achieve greater development relying on the long-established ecosystem.

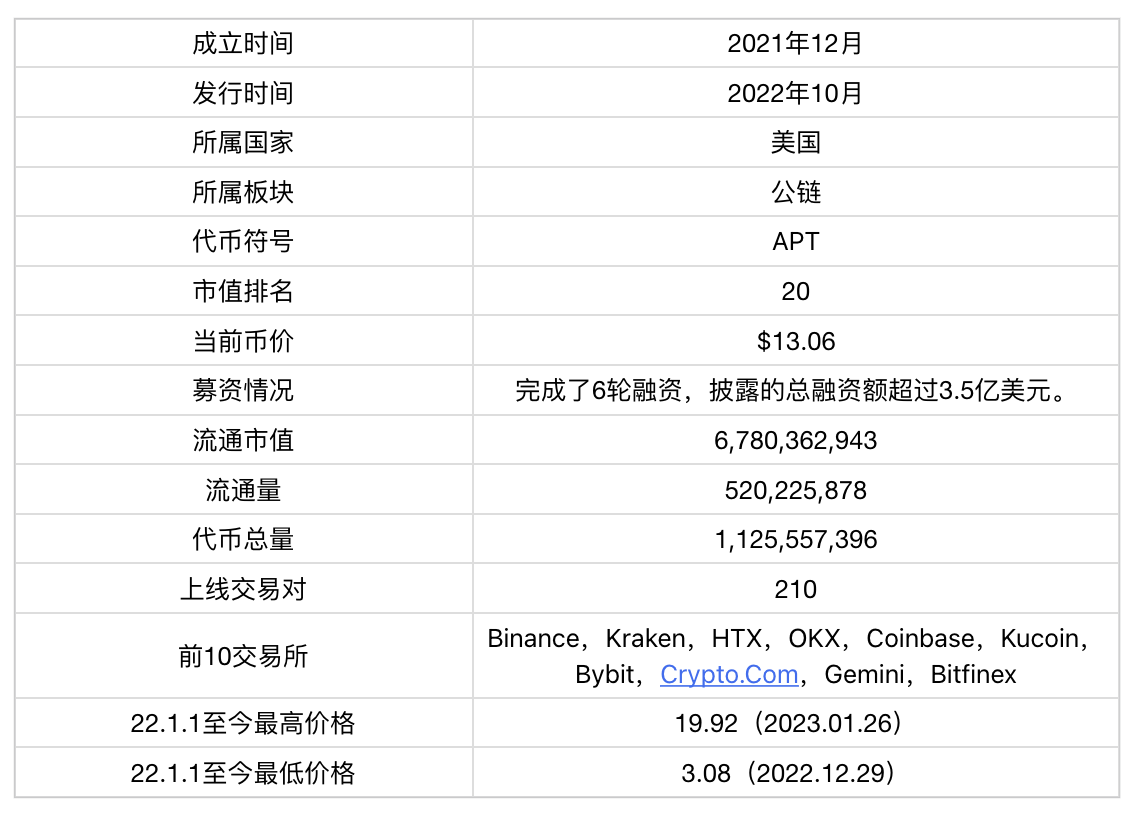

1.2 Basic Information

2. Project details

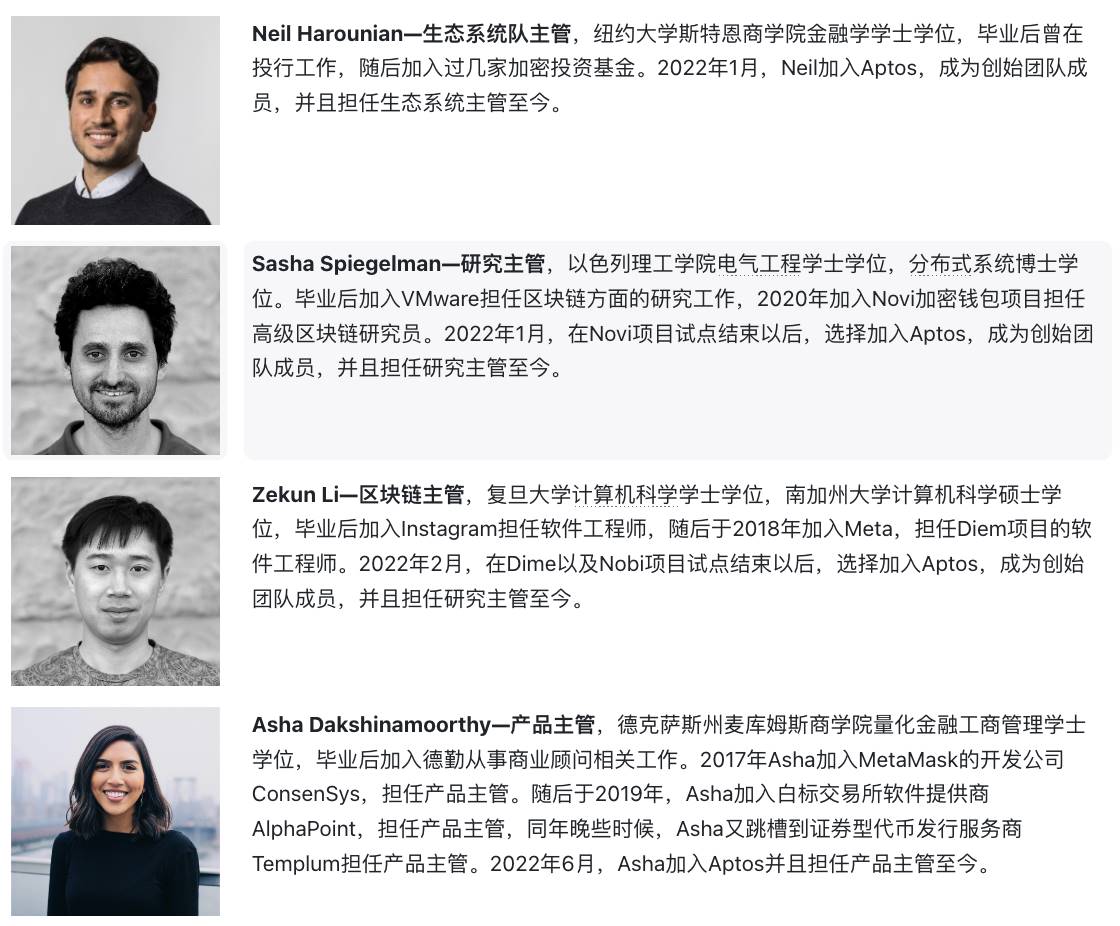

2.1 Team

According to the information currently available, Aptos' core development team, Aptos Lab, is mainly located in California, North America. It employs employees all over the world, with a total number estimated to be over 100. LinkedIn shows that Aptos currently has 225 relevant personnel, and according to the Aptos white paper, before the mainnet goes online in 2022, a total of more than 350 developers have participated in the development of Aptos. According to the official page, the current leadership team of Aptos has 16 founding members and 12 department heads. The profiles of some important members are as follows:

Based on the resumes of the core members of the Aptos team, we can find that most of them have deep roots in the blockchain projects Diem (formerly the stablecoin project Libra) and Novi that Meta had developed. After Meta was forced to abandon its exploration in the blockchain field due to regulatory pressure, several important members of the original development team chose to establish the public chain project Aptos. To some extent, Aptos can be regarded as one of Meta's legacy in the blockchain field. As a top software development company in the industry, Meta's talent pool accumulated for blockchain development itself has a very good academic background and reliable technical development capabilities. As the scale of the Aptos project continues to expand, the subsequent development of Aptos has a very good team foundation.

2.2 Funding

Table 2-1 Aptos Financing

As of November 7, 2024, Aptos has completed 6 rounds of financing. According to the disclosed financing information, Aptos raised $350 million at a valuation of $2.75 billion before the mainnet was launched in 2022. Subsequently, Aptos also conducted 4 rounds of strategic financing with undisclosed financing amounts. Aptos' investors are all first-tier investment funds in the industry, including Binance Labs, Dragonfly Capital, A16z, Multicoin Capital, Circle, Coinbase Ventures, etc. The latest round of financing was completed on September 19, 2024, so it is estimated that the project itself is still relatively well-funded.

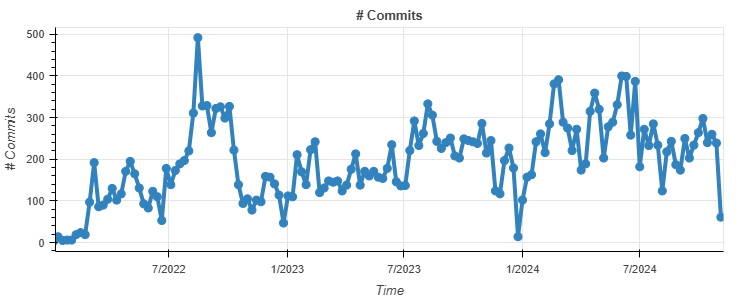

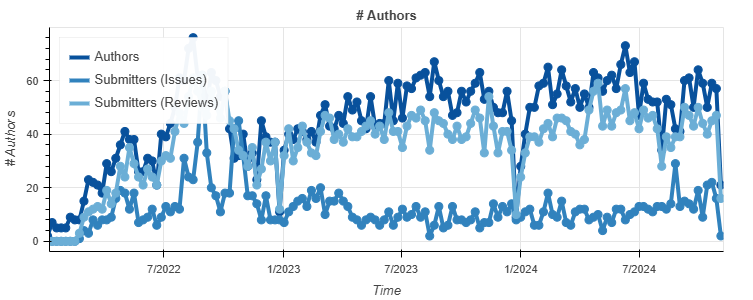

2.3 Code

Figure 2-1 Aptos code submission status

Figure 2-2 Aptos code contributors

The source code of Aptos is open source on Github . As of November 7, 2024, as can be seen from the above figure, the Aptos code is continuously updated, with a total of 40,223 commits. The number of developers is more than 70 at most, and the current number of developers is about 50. There have been three peaks in project development. The first peak occurred in the third quarter of 2022, corresponding to the development preparations before the incentive test network and the main network launch. The second peak occurred in the third quarter of 2023, corresponding to the development of the Move language and new on-chain identity solutions. The third peak occurred in the second quarter of 2024, corresponding to the development of new asset standards and consensus protocols. In general, the development rhythm of Aptos is relatively stable, and there has been no obvious development stagnation line phenomenon, so it is expected that there will still be good technical development potential in the future.

2.4 Products and Technologies

Aptos is a public chain project designed with scalability, security, reliability and upgradeability as the main principles. It is committed to bringing mainstream applications to Web3 and solving the core pain points of users in the real world in a decentralized way. Based on the principles and vision of Aptos, Aptos has made unique designs in the consensus of the protocol, smart contract design, system security, performance and decentralization.

2.4.1 Target Vision and Technical Framework

Aptos' goal is to build a smart contract platform with scalability, security, reliability and upgradeability. This goal implies an understanding and response to the "Blockchain Trilemma" problem of the public chain. The "Blockchain Trilemma" problem of the public chain was proposed by Vitalik Buterin, the founder of Ethereum, which means that the public chain cannot achieve scalability, decentralization, and security at the same time, but can only achieve two of the three.

In simple terms, Ethereum and Bitcoin pursue decentralization and security at the expense of scalability. New public chains such as Solana pursue extreme scalability, but lack decentralization and security. In Aptos' white paper and medium article, the goals are described as "scalability, security, reliability, and upgradeability" without mentioning decentralization, which reflects the trade-offs in the overall architecture design and technology development of the project.

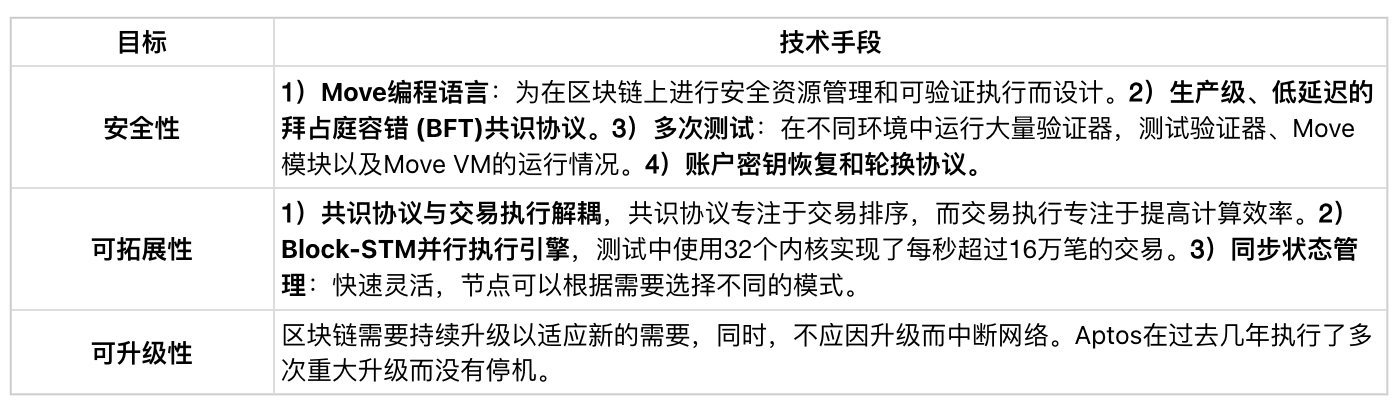

Table 2-2 Aptos goals and corresponding technical means

According to the Aptos white paper, the core principles of its technical framework include:

1) Fast and secure transaction execution through the new smart contract programming language Move.

2) Pipelining and parallelizing applications to achieve high throughput and low latency.

3) Support the processing of arbitrarily complex transactions through the Block-STM parallel engine.

4) Optimize performance, decentralization, and reputation tracking through fast stake-weighted validator rotation.

5) Upgradability and configurability are first-level principles, embracing new technologies and new use cases.

6) Modular design and component-level testing can improve safety and operability.

Below we will explain the core technologies involved above to a certain extent.

2.4.2 Move Programming Language

In 2021, the Diem engineering team under Meta described the use of programming languages in blockchain in their article "Why Build Move", that is, the accurate representation of states and transitions in blockchain is achieved through programming languages. The state here generally refers to the value of assets, where assets are stored, and the ownership of assets, while transitions generally refer to who can create/destroy/move assets, which state transitions are allowed, and what are the rules for converting assets.

Due to the particularity of blockchain itself, the programming language must not only accurately represent the state and transformation of blockchain but also meet the requirements of blockchain for certainty, sealing and measurability:

Determinism means that since blockchain relies on state machine replication to achieve consensus, the programming language needs to have a high degree of determinism to allow the validator nodes to maintain state consistency. General programming languages such as C that lack memory safety or Java that allow undefined semantic operations cannot be used in blockchain because they cannot safely and accurately replicate state machines.

Sealing means that in order to ensure the authenticity of blockchain message transmission, the input of transaction execution needs to be strictly limited. In the blockchain, the program can only accept input from the global state or the current transaction, and references to external sources may affect the formation of network consensus, because different validators may obtain different inputs from external information.

Meterability means that in order to ensure that the network can continuously process transactions, each state transition must set an upper limit on resource consumption, namely the Gas function. The metering capability represented by the Gas function is not a built-in component in most general-purpose languages, so a special programming language is needed to provide meterability for the blockchain.

In order to achieve the certainty, sealing and measurability required by the blockchain and ensure the security and reliability of blockchain operation, the Move programming language, inspired by programming languages such as Rust, introduced the concepts of "resources" and "modules" in its design.

Move is a language about resources. Resources describe certain types of values, and any asset in Move can be represented by or stored in resources. At the same time, resources are also scarce. Each resource has a defined life cycle, storage, and access mode, which ensures that resources such as tokens cannot be minted or destroyed out of thin air, nor can they be called repeatedly, which ensures the security of blockchain assets.

A module is a Move code that contains data types and programs. It is identified by the account address and the name of the module that declares the module, and is used to create, store or transfer assets. The module in Move emphasizes the function of "access control". The modules are divided into private modules and public modules. Private modules cannot be accessed by other modules and can only be modified in the module that defines them. Public modules can be accessed by other modules and can also be accessed by public accessors. After distinguishing between private and public modules, the security of Move has been further improved. In addition, modules under the same account address will be merged into the same software package. The owner of this account address can publish the software package as a whole on the chain, and can choose whether the software package has the ability to be upgraded. The owner can add new functions and resources to the software package without changing the old functions and resources, thereby improving the programmability and upgradeability of the smart contract. In addition to modules, Move also includes another type of program, called a transaction script, which is a function that can accept any number of parameters but does not return content. It is mainly used to call public modules to achieve specific changes in global status.

Through the design of resources and modules, Move has created the possibility for Aptos to achieve efficient and secure transaction execution and subsequent code updates and iterations on the basis of meeting the certainty, sealing and measurability required by the blockchain.

2.4.3 Diem BFT consensus algorithm

A consensus mechanism (also called a consensus protocol or consensus algorithm) refers to a mechanism that keeps a distributed system (computer network) working together and keeping accounts securely. More specifically, it is a mechanism for ordering and confirming blocks (transactions) among a group of validators.

Different blockchains may use different methods based on different goals. Bitcoin uses the Proof of Work (PoW) mechanism, where nodes perform massive calculations, collide random numbers, and allocate bookkeeping rights. POW has the highest degree of decentralization, the largest resource consumption, and relatively low performance efficiency. Early proof of stake (PoS) reduces the difficulty of mining and speeds up the speed of finding random numbers based on the proportion and time of tokens held by the node. PoS has a lower degree of decentralization, lower resource consumption, and higher performance efficiency.

Aptos uses the BFT mechanism. Diem BFT is a production-grade, low-latency Byzantine Fault Tolerant (BFT) engine developed by Aptos. This consensus protocol is a derivative version of HotStuff, which is the underlying consensus protocol originally used by Diem. In order to improve efficiency, the BFT mechanism only requires a threshold number of nodes to participate in consensus and verification. The total number of Diem BFT verification nodes is ≥ 3f + 1, and there can be a maximum of f faulty validators. In other words, only ≥ 2f + 1 nodes are required to complete the verification before it can be confirmed.

Over the past few years, Diem BFT has implemented the fourth iteration of the protocol, the main contents of which include:

1) The time for block submission is shortened, and only two network round trips are required to submit, achieving sub-second finality.

2) A node reputation system has been added to check on-chain data and automatically change leader rotation. It can analyze and judge the situation of unresponsive validators without manual intervention.

Under the BFT consensus, a leader rotation mechanism is usually adopted, where the leader proposes the order of the blockchain. Most rotation mechanisms do not take into account the status of the leader, that is, a faulty node may be selected as the leader. Once there are too many faulty nodes, the speed of the blockchain will be affected.

Diem BFT improves the leader rotation mechanism and adds a node reputation system (State-Machine Replication, SMR). The system focuses on the activity and effectiveness of the node. Activity refers to tracking active parties by checking on-chain data and electing leaders from them. When the leader node is attacked or the network is interrupted, it may not be able to perform its tasks, but the on-chain reputation system will quickly find a suitable node to serve as the leader node and start working, thereby avoiding the attack from causing large-scale impact on the network.

Furthermore, Aptos’ protocol clearly separates network liveness from safety. In the event that the network is unreachable or the non-secure core is compromised in some way, there is no need to fork the blockchain as long as the honesty guarantees of the BFT mechanism are maintained. The security of the consensus protocol has been audited and formally verified.

At present, Aptos is still developing the next-generation formula protocol. In September 2024, Alexander Spiegelman, head of research at Aptos Labs, announced that Aptos will launch a new BFT consensus mechanism protocol Raptr in the near future. It combines the main DAG (directed acyclic graph) technology to provide the network with higher TPS while retaining the best theoretical delay. This change in the consensus mechanism protocol will be deployed on the Aptos network in two phases in the future.

2.4.4 Block- STM Parallel execution engine

When we describe the system performance of a public chain, the two indicators usually used are throughput and finality. Throughput (TPS) refers to the number of transactions processed per second, and finality refers to the time required from the client creating and submitting a transaction to the other party confirming the transaction.

As of November 12, 2024, since the launch of the mainnet, Aptos' TPS has reached nearly 13,000, and more than 300 million transactions have been processed in one day, with a finality of less than 1 second, and there have been no network delays, downtime and other problems. It is estimated that Aptos' maximum theoretical TPS will reach 160,000.

All of these records come from Aptos' excellent transaction processing architecture design:

1) Complete separation of consensus protocol from transaction execution : The consensus protocol accepts a proposed transaction ordering. Validators execute transactions in a different protocol away from the critical path and agree on the final transaction ordering and execution results. By eliminating the common dependencies that come with combining consensus and execution, higher throughput and latency can be achieved. Aptos Labs is working on this decoupling for the next protocol iteration, which is expected to be integrated into the testnet later this year.

2) Block-STM Parallel Engine: Aptos Labs has designed an in-memory smart contract parallel execution engine called Block-STM. STM stands for Software Transaction Memory, a new engineering approach that supports flexible transactional programming of synchronous processes.

In Ethereum, the Ethereum Virtual Machine (EVM) is single-threaded, with only one core that can process transactions. When there is a peak in transactions, since there is only one thread, a large number of transactions are piled up, and it takes a long time to digest these transactions, resulting in transaction delays. To solve this problem, new public chains such as Solana try multi-threaded concurrent processing. Aptos also adopts this approach. According to its current tests, the maximum number of threads is 32.

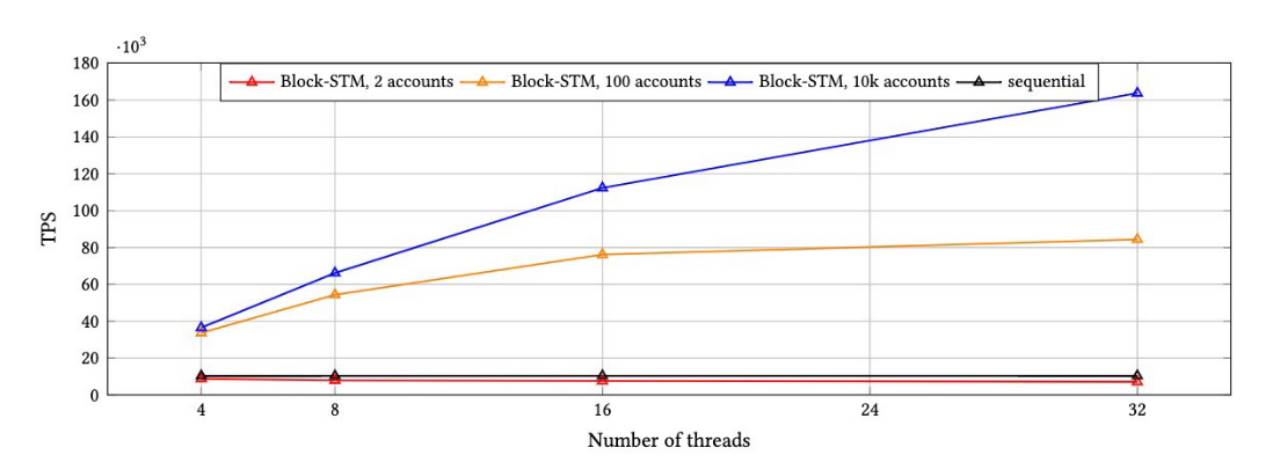

Aptos implemented Block-STM in the open source code base, relying on Rayon, Dashmap and ArcSwap crates to achieve concurrency, and conducted execution efficiency test evaluation. As shown in Figure 2-4, each block contains 10,000 transactions, and the number of accounts determines the level of system conflict and contention. The red line represents 2 accounts, the yellow line represents 100 accounts, the blue line represents 10,000 accounts, and the black line represents sequential execution. The horizontal axis represents the number of threads, and the vertical axis represents TPS. The system's TPS performance is different under different numbers of threads and different numbers of accounts.

Figure 2-3 Performance of Block-STM in different threads

As can be seen from the above figure, the TPS of sequential execution is not affected by the number of threads, and the TPS is 10,000. When there are 4 threads, the highest TPS of Block STM is 40,000. When there are 16 threads, the highest TPS of Block STM is 110,000. When there are 32 threads, the highest TPS of Block STM is 160,000. It can be seen that the parallel engine improves the transaction speed. When the number of users is larger, the advantage of 32 threads is more obvious, and it can provide higher TPS.

3) Optimizing authentication data structures: To address the scalability issues associated with writing Merkle trees to persistent storage, Aptos is developing authenticated data structures that are designed to be scalable, database-friendly solutions. This will be achieved by evaluating higher branching factors, access pattern optimization caching, and careful versioning.

2.4.5 Node Status Synchronization Solution

State synchronization is a protocol that allows non-validating nodes to distribute, verify, and persist blockchain data and ensures that all nodes in the ecosystem are synchronized. Most blockchains are hierarchical, with a set of active validators at the core of the network. Validators evolve the blockchain by executing transactions, producing blocks, and reaching consensus. Other peers in the network (e.g., full nodes and clients) replicate the blockchain data (e.g., blocks and transactions) generated by validators.

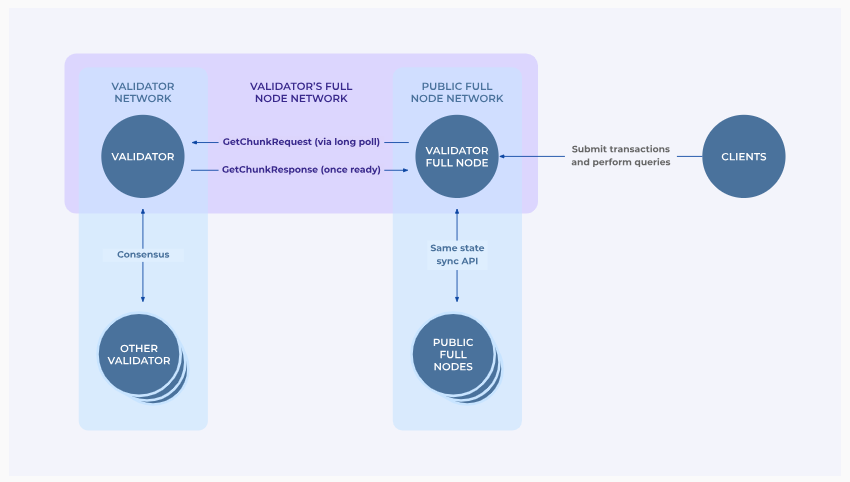

Figure 2-4 Aptos node system

The above figure shows the node system of Aptos. Each validator node is connected to each other. In addition, there are full nodes, clients and other nodes that do not participate in verification to perform other functions. In this process, how to achieve effective synchronization between nodes plays a vital role in the entire blockchain for the following reasons:

1) Data correctness. State synchronization is responsible for verifying the correctness of all blockchain data during the synchronization process. This prevents malicious peers and adversaries in the network from modifying, censoring, or forging transaction data and displaying it as valid.

2) Impact on user experience. When a validator executes a new transaction, state synchronization is responsible for propagating data to peers and clients. If state synchronization is slow or unreliable, peers will perceive longer transaction processing delays, artificially exaggerating the time to finalization.

3) Impact on consensus. Validators that crash or fall behind the rest of the validator set rely on state synchronization to bring them back up to speed. If state synchronization cannot process transactions as fast as consensus executes, the crashed validator will not be able to recover. New validators will not be able to start participating in consensus, and full nodes will not be able to sync to the latest state.

4) Impact on the realization of decentralization. Having a fast, efficient and scalable state synchronization protocol allows:

A. Faster rotation of the active validator set, as validators can enter and exit consensus more freely;

B. There are more potential validators to choose from in the network;

C. More full nodes are online quickly without having to wait for a long time;

D. Reduced resource requirements and increased heterogeneity. All of these factors increase the decentralization of the network and help scale blockchains in size and geography.

Therefore, in order to achieve more efficient state synchronization, Aptos has taken the following measures:

1) Support a series of different state synchronization protocols, and different protocols match different CPU capacities and network bandwidths. Nodes can choose according to their needs, thereby encouraging more nodes to participate in the Aptos system.

2) Support low-cost full nodes that can synchronize transactions and their execution results. Signed by a certain number of validators, it allows nodes to skip calculations and update results directly from the executed ledger state.

3) Clients can use the top transaction accumulator to get the latest submitted transactions without having to download the full ledger to get the latest ledger as in most blockchains. This also allows cheap pruning of previous transactions and ledger history if needed.

Through the implementation of an efficient node state synchronization scheme, Aptos' throughput has increased by 10 times, latency has decreased by 3 times, and peers can verify and synchronize more than 10,000 transactions per second.

2.4.6 Security Design

Aptos aims to promote Web3 to the general public, therefore, it emphasizes the security of user transactions. Currently, blockchain fraud occurs frequently, and measures need to be taken to increase the security of user transactions:

1) Transaction feasibility protection

When users make a transaction, they need to sign an authorization. Sometimes, users inadvertently sign a transaction that they do not want to complete, or do not fully consider that the transaction may be manipulated. To reduce this risk, Aptos limits the feasibility of each transaction and protects the signer from unlimited validity. The Aptos blockchain currently provides three different protections: the sender's serial number, the transaction expiration time, and the specified chain identifier.

For each sender's account, a transaction sequence number can only be submitted once. If the sender observes that his account sequence number is greater than or equal to a transaction sequence number, then either the transaction has been submitted or it will never be submitted (because the sequence number used by the transaction has been used by another transaction).

The blockchain time is recorded with sub-second accuracy. If the blockchain time exceeds the expiration time of a transaction, then either the transaction has been submitted or it will never be submitted.

Each transaction has a unique chain identifier to prevent malicious parties from duplicating transactions across different blockchain environments.

2) Key rotation and hybrid custody mechanism

Aptos accounts support key rotation to help reduce the risk of private key leakage, remote attacks, and future cracking of existing cryptographic algorithms. Users can delegate the ability to rotate account private keys to one or more custodians and other trusted entities, and then define a policy through the Move module to enable these trusted entities to rotate keys under specific circumstances. For example, an entity may be a k-out-of-n multi-signature key held by many trusted parties, thereby providing key recovery services to prevent user key loss. Compared with some other key recovery solutions such as cloud backup and social recovery, Aptos' key management solution is on-chain and more open and transparent.

3) Improve the transparency of pre-signed transactions

The current wallets lack transparency in signing, and many signatures are not in plain text, so users cannot clearly know the consequences behind each signature. This leads to frequent malicious transactions that trick people into signing, resulting in theft of funds.

To address this issue, Aptos provides a preventive measure that describes possible transaction outcomes to users before signing to reduce fraud; the wallet can also impose restrictions on transactions during execution, and transactions that violate these constraints will be terminated, which can further protect users from malicious program attacks.

Through the above security designs, Aptos can provide users with a safer usage environment.

Summarize

From the perspective of the team, the core team of Aptos has deep roots with the blockchain projects Diem (formerly the stablecoin project Libra) and Novi that Meta had developed. After Meta was forced to abandon its exploration in the blockchain field due to regulatory pressure, several important members of the original development team chose to establish the public chain project Aptos. To some extent, Aptos can be regarded as one of Meta's legacy in the blockchain field. As a top software development company in the industry, Meta's talent pool accumulated for blockchain development itself has a very good academic background and reliable technical development capabilities. As the scale of the Aptos project continues to expand, the subsequent development of Aptos has a very good team foundation.

In terms of funding, as of November 7, 2024, Aptos has completed 6 rounds of financing. According to the disclosed financing information, Aptos raised $350 million at a valuation of $2.75 billion before the mainnet was launched in 2022. Subsequently, Aptos also conducted 4 rounds of strategic financing with undisclosed financing amounts. Aptos' investors are all first-tier investment funds in the industry, including Binance Labs, Dragonfly Capital, A16z, Multicoin Capital, Circle, Coinbase Ventures, etc. The latest round of financing was completed on September 19, 2024, so it is estimated that the project itself is still relatively well funded.

From the perspective of products and technology, Aptos aims to build a scalable, secure, reliable and upgradeable smart contract platform. It has laid the foundation for achieving this goal through the Move programming language, Diem BFT consensus algorithm, Block‑STM parallel execution engine and efficient node synchronization solution. Since the launch of the mainnet, Aptos' peak TPS has reached more than 12,000, and more than 300 million transactions have been processed per day. The transaction delay has been reduced to less than 1 second, and there have been no transaction delays or network downtime failures, which proves its efficiency and reliability as a performance. At the same time, from the perspective of transaction costs, Aptos has also greatly reduced the user's Gas expenditure through the excellent Gas fee mechanism design, which has broadened the space for the development of ecological DeFi or other application projects. However, while pursuing scalability and security, Aptos has also made certain trade-offs in the degree of decentralization. At present, Aptos has a small number of nodes and a high threshold, which has certain centralization risks.

3. Development

3.1 History

Table 3-1 Aptos major events

3.2 Current situation

3.2.1 Operational Data

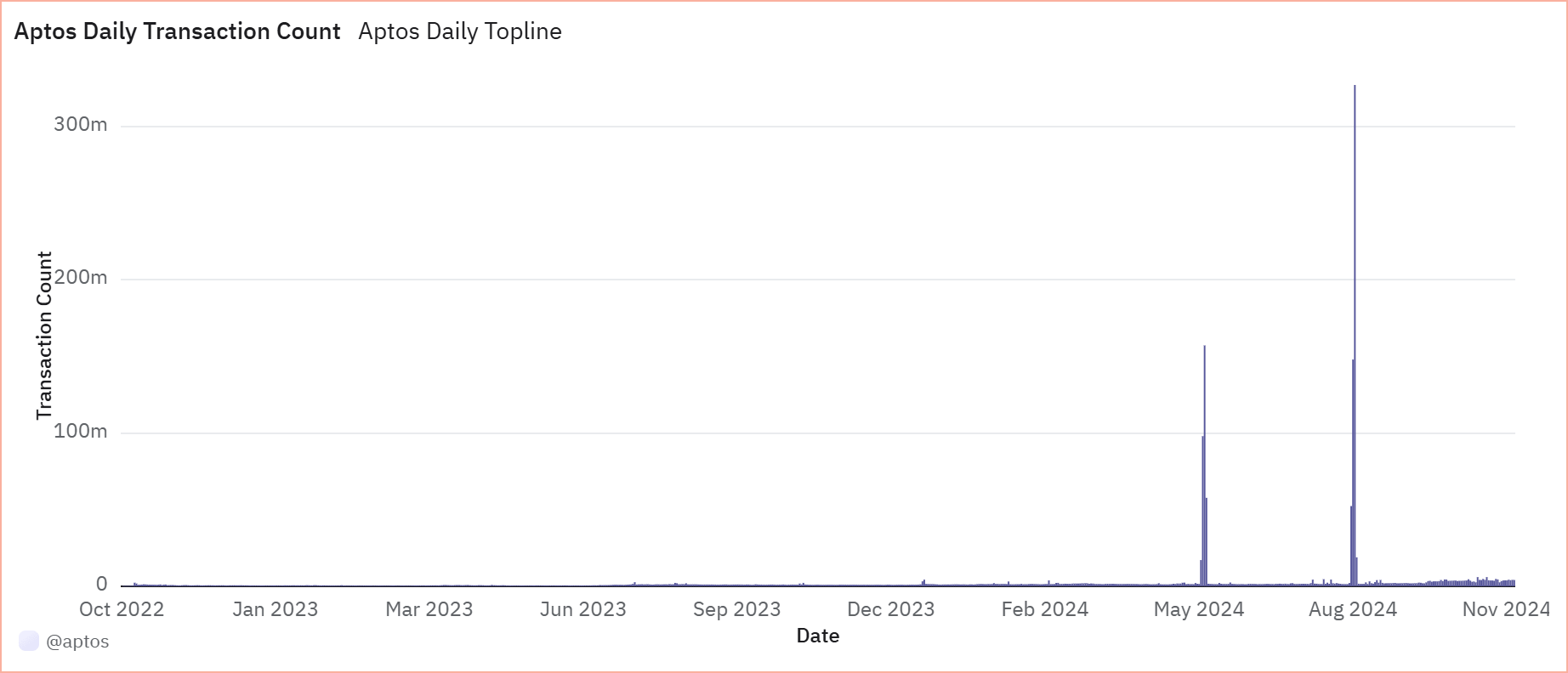

Figure 3-1 Aptos daily cumulative transaction volume

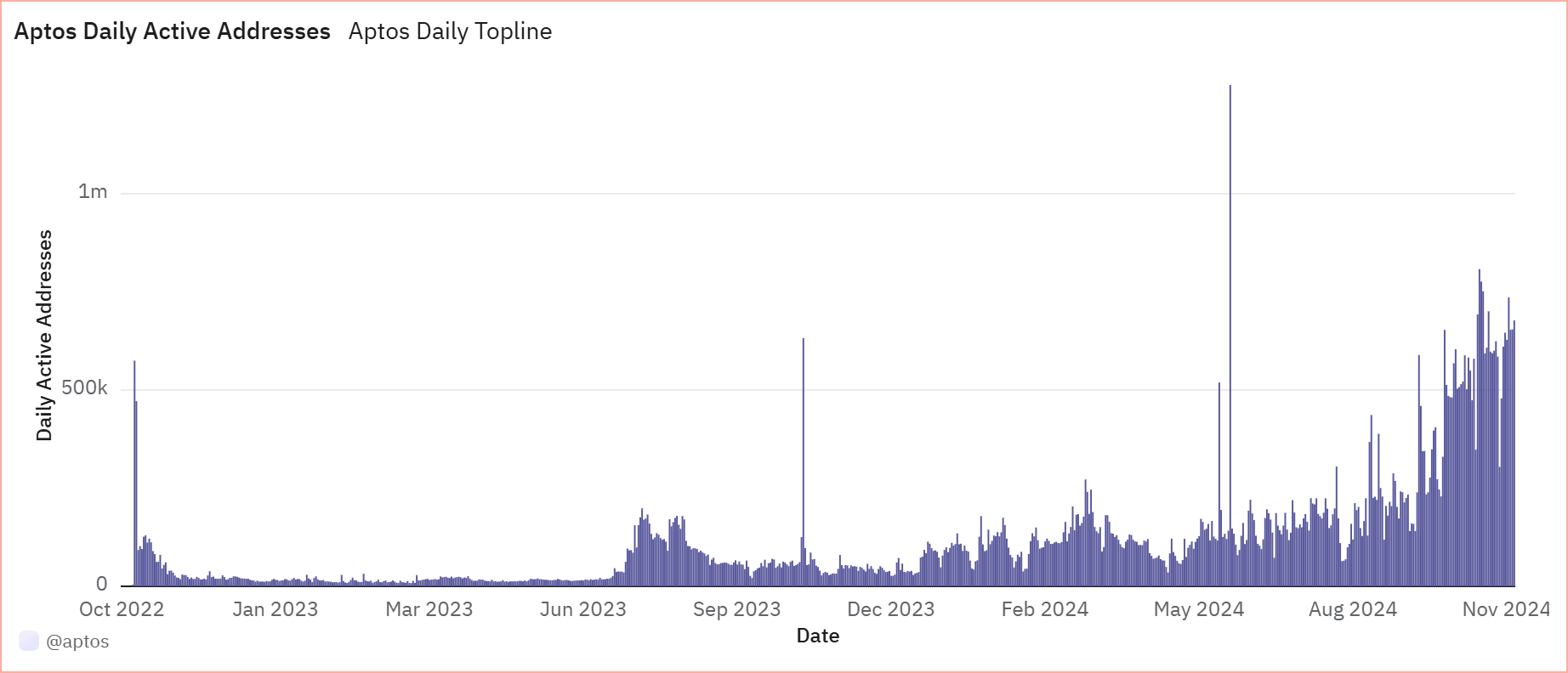

Figure 3-2 Aptos daily active addresses

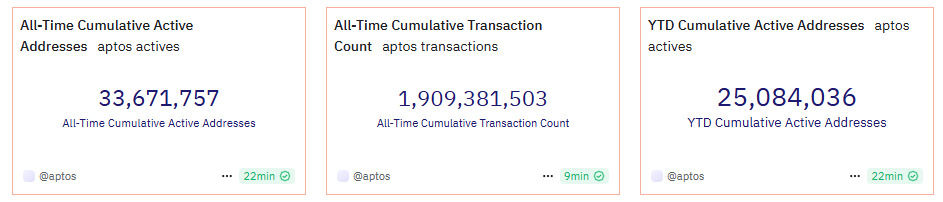

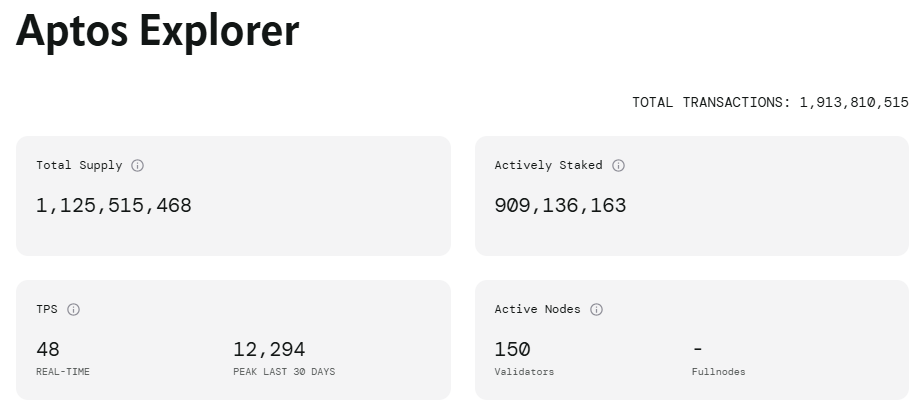

Figure 3-3 Aptos basic data 1

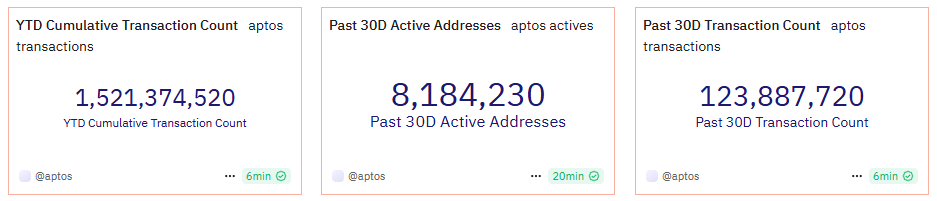

Figure 3-4 Aptos basic data 2

According to the official Dune data board of Aptos, as of 10:00 on November 11, 2024, the cumulative number of active addresses on Aptos was 33,671,757, and a total of 1,909,381,503 transactions were generated. The number of active addresses in the past 30 days was 8,184,230, accounting for about 24.30% of the total number of addresses. The number of active addresses so far this year is 25,084,036, accounting for about 74.50% of the total number of addresses. It can be seen that Aptos has good user stickiness.

Judging from the number of daily active addresses and transaction volume, Aptos' network usage data has continued to grow since the mainnet was launched in October 2022, especially in the fourth quarter of 2024, when the number of daily active users of Aptos showed a more significant increase, and a similar trend was also seen in terms of transaction volume.

In addition, due to the popularity of the ecological project Tapos, the transaction volume of Aptos reached two peaks in May 2024 and August 2024. The single-day transaction volume on August 15 reached 326,972,362 transactions, breaking its own record of Layer1 daily transaction volume. The peak TPS was close to 13,000. Even so, the Aptos network did not encounter any block generation difficulties , proving that it has extremely excellent performance in handling transaction concurrency issues and can meet the needs of subsequent development of ecological projects.

3.2.2 Ecosystem

As a Layer 1 project, with the support of excellent network performance, Aptos has both breadth and depth in its ecosystem layout.

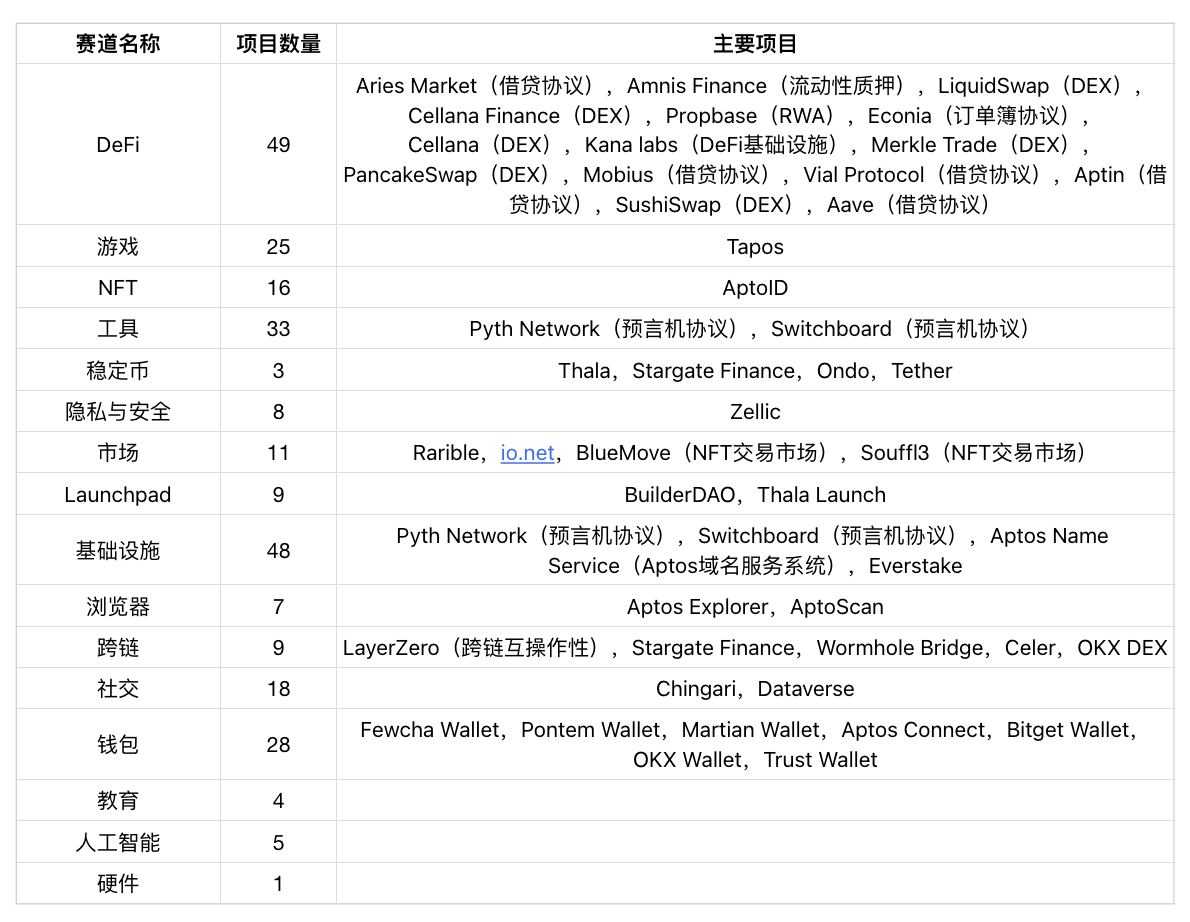

Its breadth is reflected in the rich track layout. As of November 11, 2024, Aptos' ecosystem basically covers the current 16 mainstream tracks, and the number of ecological projects has reached 192, including 49 DeFi projects, 48 infrastructure projects, 28 wallet projects, 25 game projects, 18 social projects, and 16 NFT projects, including many star projects that have attracted market attention. Judging from the number of projects currently on Aptos' track layout, the development of Aptos' ecosystem is still in the early and middle stages, mainly focusing on functional infrastructure and liquidity infrastructure. In the future, when the public chain ecological foundation is complete and rich, more projects and track use cases will emerge, and the overall ecology will have greater development potential.

Table 3-2 Statistics of projects in the Aptos ecosystem track

In terms of in-depth exploration of the ecosystem, Aptos actively promotes cooperation with ecological projects in technology and applications, providing ecological projects with new Move language versions, code compilers, code formatters, game development kits, token standards, NFT standards, wallet standards, etc., to help ecological projects better leverage their unique advantages in the Aptos network.

In addition to the above ecological projects, the Aptos Foundation is also actively promoting hackathons and ecosystem funding programs. Currently, four categories of project funding applications are open, including "Ecosystem Funding", "Registration Funding", "Gas Fee Funding" and "Security Audit Funding", which can fully help Aptos ecological developers turn ideas into a blockchain project from scratch. As of November 2024, more than 200 projects have received ecosystem-related funding, including Thala Labs, Pontem Wallet, Merkle Trade, Mercato, Wapal, Aptos Arena and other projects.

While actively laying out the on-chain ecology, thanks to its good reputation during the Meta period, Aptos has also maintained good cooperative relations with Internet companies and traditional companies in various countries. The cooperation between the two parties involves both technical and commercial fields, including Amazon, Alibaba, Google, NBCUniversal, Microsoft, Brevan Howard, SK Telecom, Boston Consulting Group, South Korea's Lotte, etc. In addition, Aptos also maintains a good relationship with US regulators. Aptos co-founder Mo Shaikh was appointed as a member of the Digital Asset Subcommittee by the US Commodity Futures Trading Commission in June 2024.

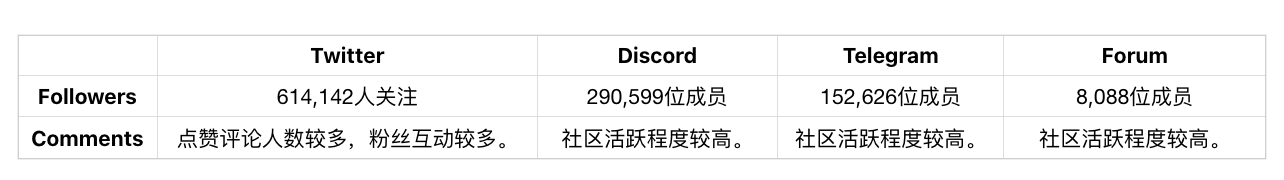

3.2.3 Scale of social media

Table 3-2 Aptos social media data

As of November 11, 2024, Aptos' social media platform is large in scale, with a large number of fans and a lot of interactions. The community is large in scale and active, and the content of communication mainly revolves around the project token and the subsequent development of the ecosystem. The governance forum is active, and the content of communication mainly revolves around the current status of the project development, subsequent project technology upgrades and development directions .

3.3 Future

Aptos has not announced any subsequent roadmap plans recently. According to the official staff’s response to the community, the roadmap will not be announced in the near future, but the relevant information of the project will be updated in the community in real time.

According to the current development status of Aptos, the main public chain development work has been basically completed, and only a certain degree of technical iteration and updating is needed in the future. The main development direction of the project in the future may be placed on the ecosystem and business cooperation.

Summarize

From the perspective of project development, Aptos is currently developing well, especially since the third quarter of 2024, the number of active addresses has continued to grow and maintain a certain stickiness, and the transaction volume has also increased significantly. On August 15, it set a record of more than 300 million transactions per day, and the peak TPS was close to 13,000, which also indirectly confirmed the excellent performance of the Aptos public chain. In terms of the ecosystem, Aptos's territory is also expanding, with both breadth and depth, especially DeFi, games, social and other tracks will likely become the cornerstone of Aptos' future expansion. At the same time, Aptos is also actively maintaining a good relationship with traditional companies and regulatory authorities, and has technical and commercial cooperation with Microsoft, Google, Alibaba, Amazon, South Korea's Lotte, SKT and other companies. In addition, at the end of October 2024, the native USDT will be officially launched on Aptos, which will likely bring more liquidity to Aptos and release more potential for the ecosystem.

4. Economic Model

4.1 Supply

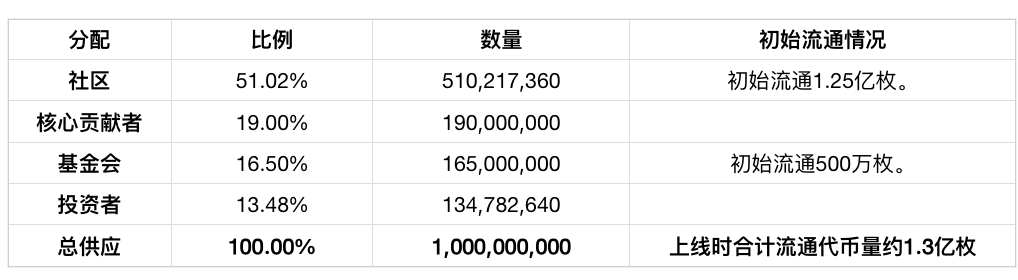

4.1.1 APT Token Distribution

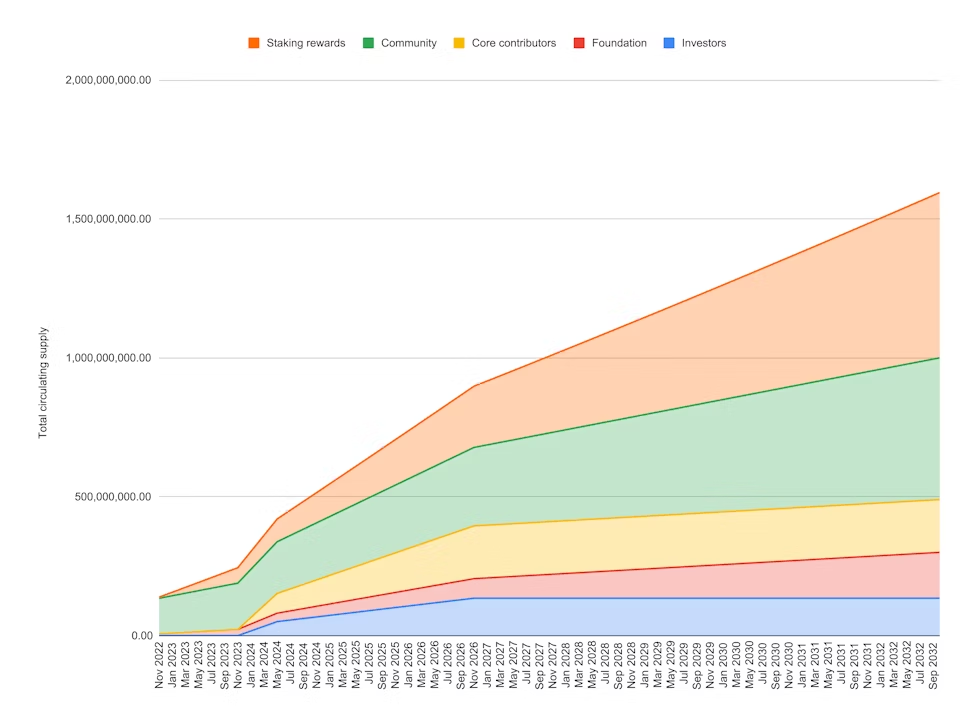

APT is the project token of Aptos. It will be launched on the mainnet in October 2022 with a supply of 1,000,000,000 APT tokens. New APT tokens will be issued in an inflationary manner. The token inflation rate in the first year will be 7% of the total token amount. The annual increase in tokens will then slowly decrease by 1.5% for about 50 years until the lower limit of the token inflation rate is reached at 3.25%. These tokens will be distributed to current and future network node operators and token staking participants to maintain the normal operation of the network. As of November 11, 2024, the supply of APT tokens is 1,125,360,719, and the total circulation is 520,057,351, accounting for 46.2%.

Table 4-1 Approximate distribution of APT tokens in initial issuance

Community and Foundation

The community (51.02%) and foundation (16.5%) shares will be designated for ecosystem-related projects, such as donations, incentives, and other community growth programs. Some of these tokens have been allocated to projects developed on the Aptos protocol and will be awarded when the projects complete certain milestones. The majority of these tokens (410,217,360) are currently held by the Aptos Foundation, and a small portion (100,000,000) are held by Aptos Labs, which is expected to be distributed over a ten-year period. The specific lock-up and circulation are as follows:

1) In terms of community share, 125 million APT will enter circulation when the token is first issued, which can be used for ecological support, donations and other community growth plans;

2) In terms of foundation shares, 5 million APT will also enter circulation when the token is first issued, and can initially be used to support programs initiated by the Aptos Foundation;

3) Over the next 10 years, the remaining tokens of the community and the foundation will be unlocked at a rate of 1/120 per month.

Core Contributors and Investors

The shares of core contributors (19%) and investors (13.48%) will be completely locked for 1 year and distributed in the next 3 years. The specific lock-up and circulation are as follows:

1) In the first 12 months after the initial issuance of tokens, no core contributors or investors’ shares will enter circulation;

2) From the 13th to the 18th month (including the 18th month) after the initial issuance of tokens, these tokens will be unlocked at a rate of 1/16 per month;

3) Starting from the 19th month after the initial issuance of tokens, the remaining tokens will be unlocked monthly at a rate of 1/48 per month.

It should be noted that according to Aptos' token issuance plan, all tokens can participate in token staking, including unlocked tokens and tokens that are still in a locked state. Therefore, the vast majority of Aptos tokens are still in a pledged state and have not entered circulation.

Figure 4-1 APT token distribution stacking diagram

From the perspective of token distribution, among the 1 billion APT tokens initially distributed, the community apparently holds more than half of the tokens, but in fact most of the tokens are still kept in the Aptos Foundation for the future development of the ecosystem, and since the locked tokens can also participate in staking, the token pledgers will receive a share of the newly issued tokens as a staking rewards, so in fact the proportion of circulating tokens initially distributed by the community to the total token issuance will decrease in the future. In general, the current distribution and holding of APT tokens is still relatively centralized, and the Aptos Foundation occupies a dominant position, which is not conducive to the participation of small token holders in the ecosystem in the future.

4.2 Requirements

As the application token of the Aptos network, APT token mainly includes the following functions:

1) Serves as the basis for PoS to achieve network consensus and as a block reward that validator nodes can obtain.

2) As a governance token, vote on governance proposals, including network parameters and subsequent marketing, ecosystem development and technology upgrades.

3) As Gas in the Aptos network ecosystem to pay for transaction fees on the network.

4) Used to reward ecosystem participants and community contributors.

4.2.1 Network Nodes

The Aptos network uses the Byzantine Fault Tolerant (BTF) consensus algorithm to conduct PoS-based network consensus.

Figure 4-2 Aptos verification node distribution

There are two main types of network nodes in Aptos, full nodes and validator nodes. Although they share the same code, they have slightly different divisions of labor. Full nodes are responsible for obtaining and maintaining the latest status of the blockchain, while also providing scalability and DDoS mitigation for the network, but they do not participate in the Aptos network consensus. Any third-party blockchain browser, wallet, exchange or Dapp can run Aptos's local full node. The validator node is responsible for running the distributed consensus protocol, executing transactions, and storing transactions and execution results on the blockchain. Token holders can run validator nodes through token staking or delegated staking (the minimum threshold for token staking is 1 million APT tokens, and the upper limit is 50 million APT tokens), and can obtain the network's consensus rewards.

Figure 4-4 Aptos token staking situation

As of November 12, 2024, there are 150 validator nodes in the Aptos network, distributed in 47 cities in 23 countries, with 909,136,163 APTs staked, accounting for about 80.78% of the total token issuance. From the perspective of the number of validator nodes, there is still a certain degree of centralization problem, but from the perspective of distribution, it still has a certain degree of security.

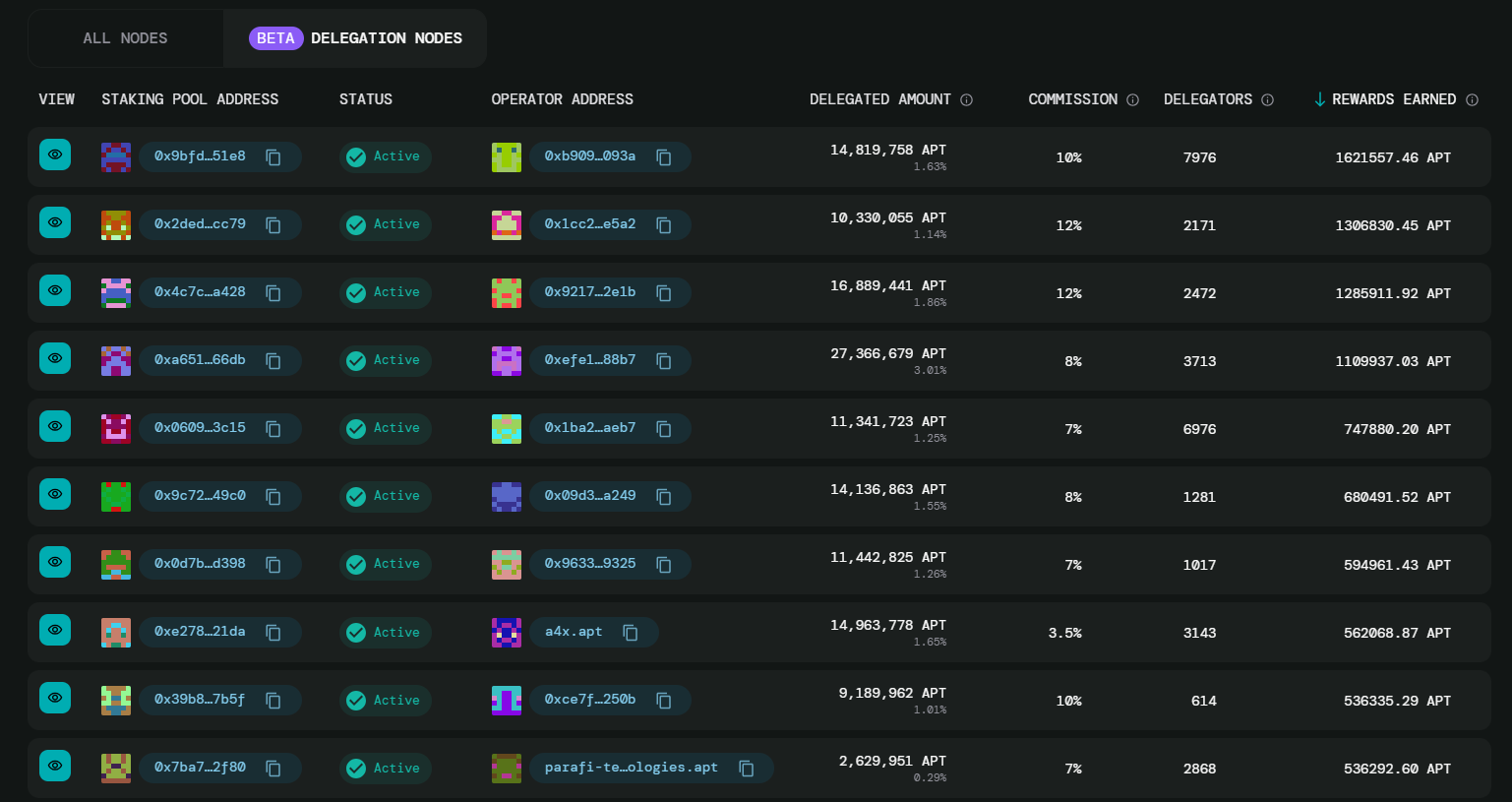

4.2.2 Entrusted Pledge

In April 2023, Aptos officially released the delegated staking function, providing APT token holders with an official channel to participate in the Aptos network consensus and obtain consensus rewards, while also increasing the network's decentralization and improving security.

Figure 4-5 Entrusted pledge interface

APT token holders can use the delegated staking function through Aptos Explorer. After opening the validator node interface, click on the delegated node to pull down and see the table of currently active validators. The table will display the information of the validator nodes that currently accept APT tokens for delegated staking, including the amount of tokens that have been delegated, the number of delegators, the node staking service fee, and the node staking rewards that have been obtained. If the APT token holder clicks the button on the left of the node address, more detailed information about the validator node will be displayed, including the node's performance so far and the expected annual interest rate for participating in the delegated staking. The expected annual interest rate for all nodes is currently around 7%. APT token holders can freely choose the validator node they want to delegate and click the button on the right to delegate staking.

In addition to the official delegated staking service, APT token holders can also delegate staking through liquidity staking projects in the ecosystem, and obtain liquidity staking tokens to perform more DeFi operations. Similar liquidity staking projects on Aptos include Tortuga, Ditto, Thala, etc.

4.2.3 Governance

APT token holders can obtain the right to propose and vote on Aptos governance proposals by staking tokens.

The right to propose Aptos governance proposals has a minimum token stake (currently 1 million APT tokens staked) and a minimum token stake time (at least until the proposal's 14-day stake lock-up period and 3-day voting period), but there are no such restrictions on voting rights. After staking, APT tokens will receive an Aptos voter key, which represents the voting weight held by the token staker. It can be used for self-voting, stored in the hands of a custodian, or delegated to other voters. The Aptos voting weight will be determined by the proportion of the tokens staked by the voter to the total staked tokens.

As a public chain, Aptos’ governance power is relatively limited, with technological updates as its main goal. Specifically, Aptos’ on-chain governance proposal will include the following four aspects:

1) Change blockchain parameters, such as epoch duration, minimum or maximum staking threshold for validators.

2) Changes to the core blockchain code

3) Upgrade Aptos framework modules to fix errors or add new module functions.

4) Deploy new framework modules.

As of November 12, 2024, a total of 116 governance proposals have been submitted to the Aptos governance interface, of which 1 vote is in progress, 7 proposals have not been submitted for a final vote, 1 proposal has been rejected (AIP-52: Automatic account creation for sponsored transactions was rejected once and passed after subsequent resubmission), and the remaining 107 votes have been accepted and executed on the chain.

So far, the more important proposals include reducing voting rights restrictions, upgrading the Gas solution to reduce Gas fees, enabling multi-signature solutions, enabling delegated staking, enabling arbitration storage, enabling fee payment, reducing block rewards, increasing the Gas limit to increase network concurrency, reducing voting deadlines, lowering proposal thresholds, enabling Keyless account functions, etc. The main focus is on improving network performance, expanding ecological use cases, and lowering the threshold for governance.

Summarize

From the perspective of token economics, APT tokens exist mainly as application tokens of the Aptos network, used for network consensus, governance, paying gas fees and promoting ecological development. The currently issued APT tokens are mainly in the hands of the Aptos Foundation, which will be used for future project operations and ecosystem construction, reflecting Aptos' emphasis on future ecological development and laying the foundation for the subsequent development of the public chain ecosystem.

5. Track

5.1 Track Overview

Aptos belongs to the public chain track.

The public chain is the infrastructure of the blockchain, carrying the narrative ceiling of the blockchain, and has an imaginative market value space, thus attracting a large amount of capital and talent to enter, and the competition is fierce. The development stage of the public chain can be roughly divided into three stages:

The first stage was from 2008 to 2013. After Satoshi Nakamoto published the Bitcoin white paper, Bitcoin became popular, and many "Altcoin" appeared with the purpose of improving Bitcoin, resulting in the first batch of public chains represented by BTC.

The second stage was from 2014 to 2017. The addition of Turing completeness made Ethereum a turning point in the development of public chains. The concept of smart contracts appeared in blockchain for the first time, and the public chain had the programmability to carry application operations. At the same time, with the advent of applications such as CryptoKitties, people began to truly experience the application display of blockchain technology. Ethereum also established its own ecological barriers in the public chain with its first-mover advantage. The public chains produced during this period include ETH, NEO, QTUM, EOS, etc.

The third stage is from 2018 to the present. The iteration of various consensus mechanisms and verification transaction layer technologies has created a group of high-performance and low-cost public chains, represented by BSC, Solana, Avalanche, etc.

There are three trends in the development of public chains at this stage: first, the development of Ethereum as the base layer and various second layers; second, the development of monolithic chains that adopt new technologies, such as Aptos, Sui, etc.; third, the development of specialized and characteristic public chains, such as modular public chains and privacy public chains.

Regarding the development of public chains, we mainly examine three aspects:

First, from the perspective of consensus mechanism, the public chain community recognizes the decentralization of the project. This involves the security of the public chain in the public's mind. Users tend to put their core assets on the blockchains they think are the safest, such as BTC and Ethereum, rather than BCH or LTC. This is the most difficult situation for the public chain to break through, and it is also the core competitiveness. EOS was on par with Ethereum in popularity for a while, but in the end, due to its own serious node centralization, it was short-lived.

Second, from the perspective of technical mechanism, whether it has innovation and advantages, and whether it can achieve performance optimization. This mainly involves the "Blockchain Trilemma" problem of public chains. The "Blockchain Trilemma" problem of public chains was proposed by Vitalik Buterin, the founder of Ethereum. It refers to the fact that public chains cannot achieve scalability, decentralization, and security at the same time, but can only achieve two of the three. In simple terms, Ethereum and Bitcoin pursue decentralization and security at the expense of scalability. New public chains such as Solana pursue extreme scalability, but lack decentralization and security.

Third, from the perspective of ecological construction, whether it can attract developers and projects, thereby obtaining more user participation and forming a virtuous circle. The public chain itself is only infrastructure, and it needs developers, projects, and users to continuously capture value. The more developers, the stronger the innovation, the more prosperous the ecology, and the more active users, the greater the marginal benefits will be.

As time enters 2024, after several rounds of bull and bear markets and the development of blockchain technology, the market demand for public chains has become increasingly clear, and the understanding of public chains among various projects has become increasingly in-depth. We can find that the underlying consensus and performance of a public chain are the roots for the thriving development of public chain ecological projects, and the prosperity of the ecology is the fruit produced on it. For an excellent public chain, the underlying technology must be strong to produce good fruits, and at the same time the fruits must be dazzling enough to gain the final recognition of the market. All three are indispensable.

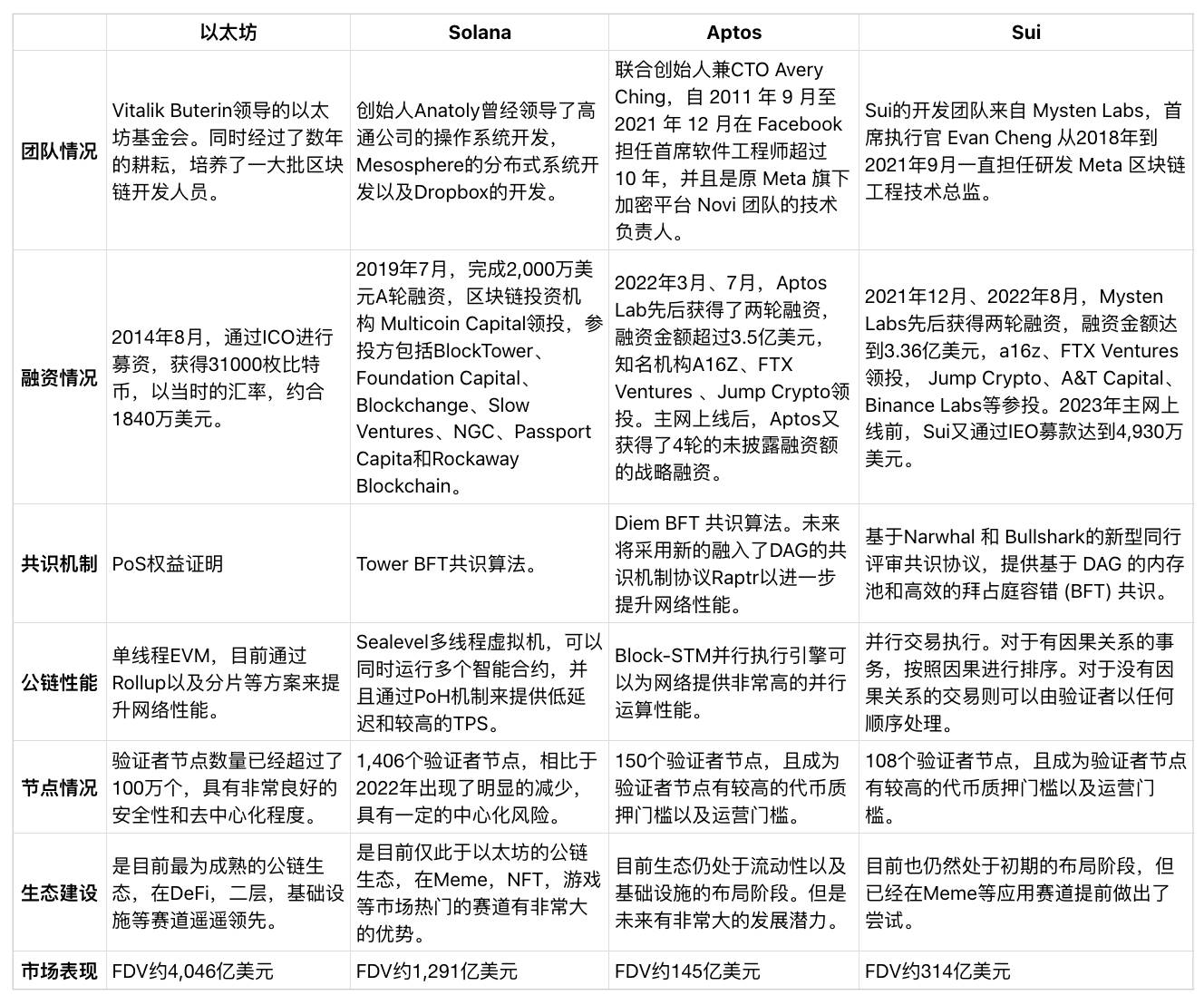

5.2 Comparison of Competitive Products

Aptos is currently facing fierce competition. Ethereum occupies an absolute leading position and is working hard to improve efficiency and expand capacity through ETH2.0 and second-layer technology. Among the new public chains, Solana, BSC, etc. have also attracted specific projects and users with their respective advantages. Among the next generation of new public chains, Sui, a public chain developed by the Meta-related team, has been launched on the mainnet in May 2023, while Linera is still under development. In this internal competition, Aptos, which took the lead in launching the mainnet, has a certain advantage in the construction of the ecosystem.

In order to fully demonstrate the competitive landscape faced by Aptos, the following three projects are selected as competing products for comparison:

Ethereum is a decentralized, open-source public blockchain platform with smart contract deployment and development capabilities. It was developed in 2014 and proposed concepts such as Turing completeness and smart contracts, which brought programmability to the blockchain and the possibility of application development and ecological development. It currently has the largest number of developers and the most prosperous ecology. Most public chains will find it difficult to surpass Ethereum in the short term. Using Ethereum as a comparison will help to clearly understand the positioning of Aptos.

Solana is a high-performance new public chain that focuses on solving the scalability problem of public chains. Its highest TPS can reach 100,000. It was developed in 2017 and proposed concepts such as POH (Proof of History), validator tree propagation, pipeline mode, and multi-threaded virtual machines, which greatly improved performance. Its ecological development has advantages among new public chains. After experiencing the last round of bear market disasters, Solana's resurgence has once again proved its value, and it even has a tendency to be on par with Ethereum. It is one of Aptos' future competitors.

Sui is a Meta-based public chain. Its founder was born in Meta. Its team members were once the main creators and core developers of Diem and crypto wallet Novi. A16z also participated in the investment. The goal is to develop a new public chain with high performance and low latency. Aptos and Sui both use Move as their smart contract programming language. The two projects have high technical similarities, so Sui is the most direct competitor of Aptos.

The following compares the development of different public chains from seven aspects: team situation, financing situation, consensus mechanism, public chain performance, node situation, ecological construction, and market performance.

Table 5-1 Comparison between Aptos and other public chain competitors

Judging from the team and financing situation, although Ethereum and Solana, as early public chain pioneers, appear to have a certain gap with new public chains such as Aptos and Sui, the blockchain industry resources accumulated by the former two as pioneers are still beyond the reach of the latter two.

From the perspective of consensus mechanism and public chain performance, Ethereum is currently the weakest among the four, which is also a problem that Ethereum has been continuously solving in the past few years. Currently, through the development of the second-layer ecology and the promotion of sharding solutions, Ethereum has gradually been able to meet the needs of some project applications, but it is still far from the requirements of those projects that really need high TPS. Compared with Solana and the latter two, there is no obvious difference in performance among the three, but Aptos is currently superior in terms of network and parallel transaction processing stability, which will be conducive to the development of subsequent ecological projects.

From the node situation, after Ethereum switched to PoS consensus, the number of validator nodes increased significantly. Currently, there are more than 1 million validator nodes, which has the best decentralization among public chains. Solana is relatively lacking, and the number of nodes has even dropped significantly compared to two years ago. In addition, the design of Solana's node consensus mechanism depends to a certain extent on the performance of the leader node. If there is a problem with the leader node, it may endanger the security of the entire network. Aptos and Sui are still in the early stages of node network development. Both have high threshol