Bitcoin (BTC) broke through the psychological barrier of $90,000 on November 12. The highest price that day was $93,265. However, this was only temporary, and two days later, Bitcoin has lost 6% of its value and is trading around $87,757.

According to on-chain data, Bitcoin's price has declined due to an increase in profit-taking activities by short-term holders. The increase in 'paper hands' investors realizing their profits has reduced the likelihood of Bitcoin reaching $90,000 in the short term.

Short-term Bitcoin holders dragging down the market

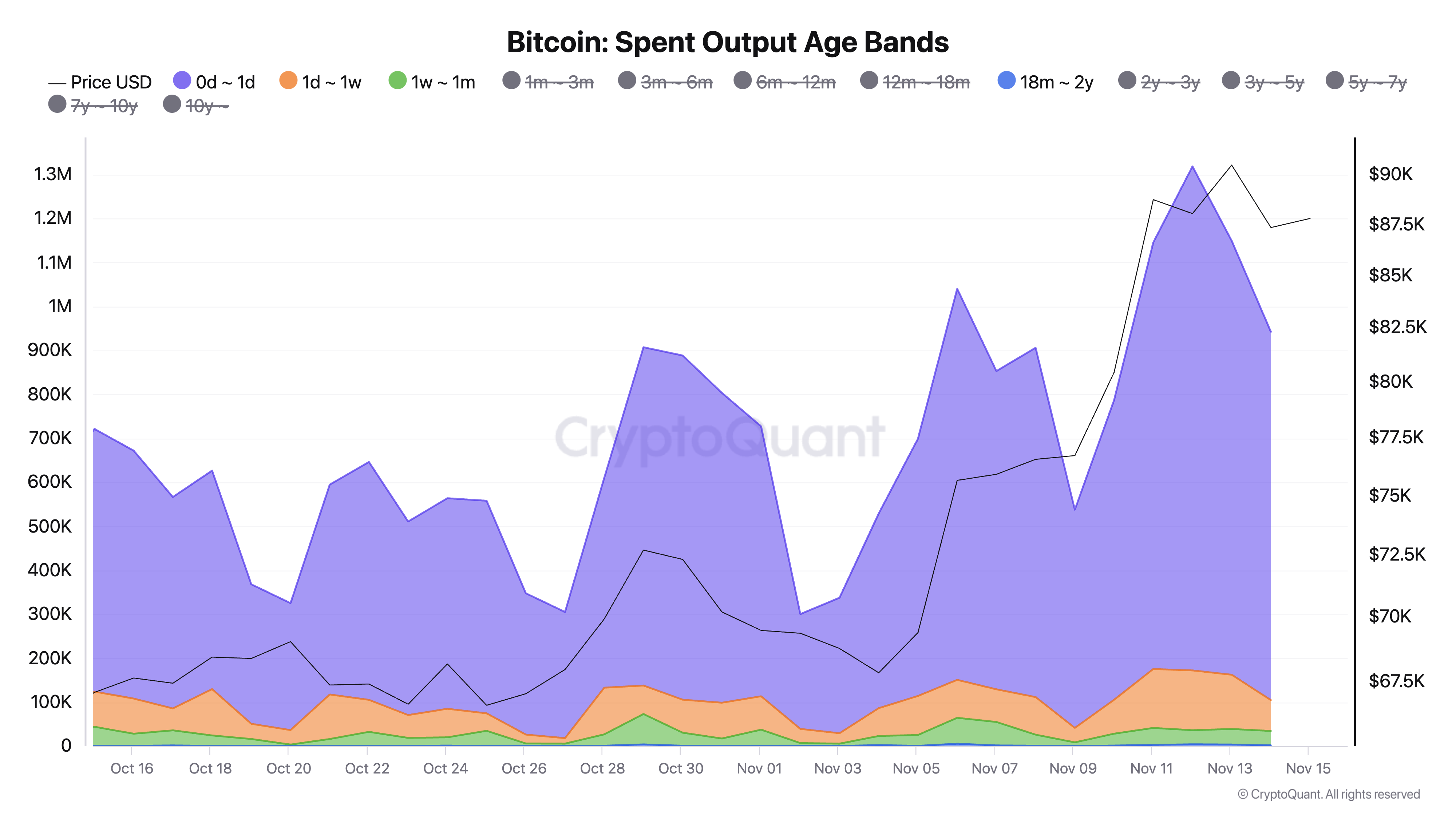

BeInCrypto's analysis of Bitcoin's Spent Output Age Bands (SOAB) provides insights into the activities of holders. This metric classifies Bitcoin's unspent transaction outputs (UTXOs) by age and tracks their spending activity. Bitcoin UTXOs represent the amount of coins available to users and are tracked across the entire network as inputs to new transactions.

Analyzing BTC's SOAB can provide insights into market sentiment and potential price movements. For example, an increase in younger age bands often indicates increased trading activity and profit-taking by short-term holders (those holding for less than 30 days). This was observed in the BTC market after it first broke through $90,000 on Wednesday.

According to CryptoQuant's data, investors who held Bitcoin for only a day transferred 1,146,151 BTC on that day, the highest level in two months. Holders with a holding period of 1 to 7 days transferred 135,950 BTC, and those with a holding period of 7 to 30 days transferred 32,021 BTC.

The increase in spent outputs from coin holders with less than 1 month of holding typically indicates that new short-term investors are selling or transferring BTC. This may reflect increased profit-taking or a decrease in confidence among recent buyers, often contributing to selling pressure and short-term price volatility.

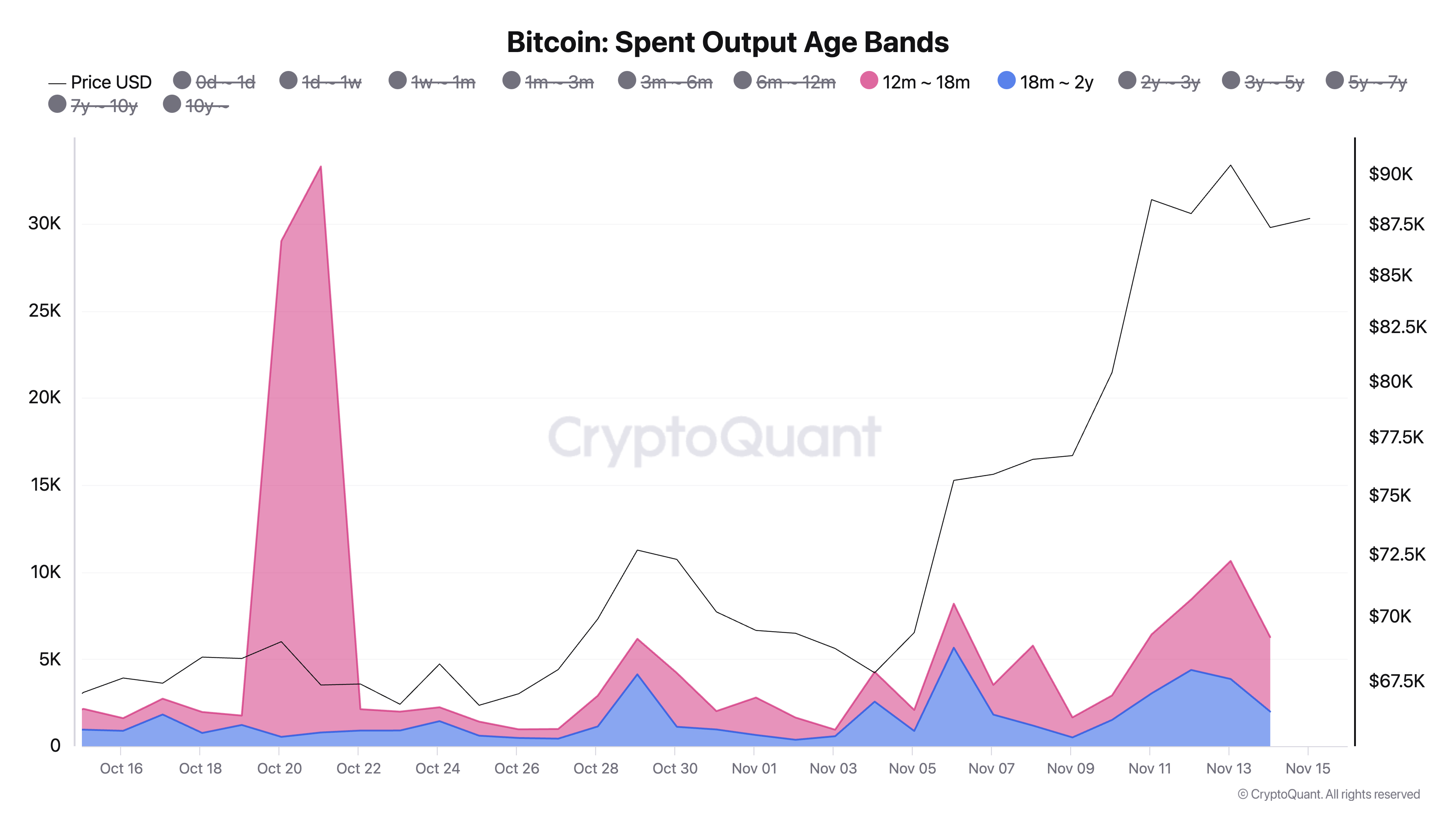

Relatively less movement from long-term holders

Notably, long-term holders who have held their coins for over 12 months have had relatively less coin movement, despite some coin transfers.

This suggests that the price fluctuations since Bitcoin reached $90,000 have been primarily driven by the strong desire of short-term holders to quickly realize their profits.

Short-term holders account for a significant portion of Bitcoin's circulating supply. Therefore, their continued increase in selling activity can exert downward pressure on the coin's price. If their selling continues, BTC will move further away from the $90,000 level.

According to the Fibonacci retracement indicator, if Bitcoin's price continues to decline, the next price target could be set at $83,792. If this level fails to hold support, BTC could fall below $80,000 and trade around $76,356.

However, if short-term holders refrain from selling, this bearish outlook would be invalidated. This would increase the likelihood of Bitcoin's price rising above $90,000 and potentially retesting its all-time high of $93,256 and attempting to break through the $100,000 mark.