According to a report by Bloomberg, MicroStrategy, the leading corporate holder of Bit, currently holds a Bit reserve valued at approximately $26 billion, surpassing the cash reserves and securities holdings of global companies such as IBM, Nike, and Johnson & Johnson, with only a dozen or so companies, including Apple and Alphabet, still leading MicroStrategy in asset reserves.

MicroStrategy's Bitcoin Holdings Reach $13.3 Billion in Unrealized Gains

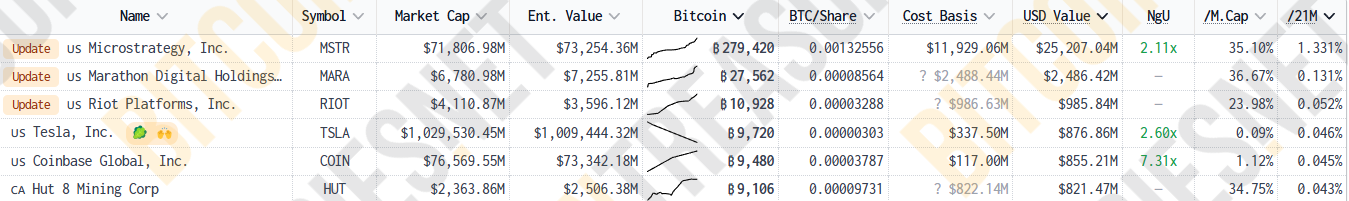

According to the latest statistics from bitcointreasuries, with the continued issuance of convertible bonds and further accumulation of Bit this year, MicroStrategy's Bit holdings have reached 279,420 coins, with a holding value of $25.234 billion and unrealized gains of approximately $13.3 billion.

Furthermore, not only has MicroStrategy previously pledged to never sell its Bit holdings, but its founder, Michael Saylor, also announced the launch of the so-called "21/21 Plan" in October this year, which involves raising $21 billion through equity financing and issuing $21 billion in bonds over the next three years, for a total of $42 billion to continue accumulating Bit.

MicroStrategy's Stock Price Surges 20-Fold in Five Years

MicroStrategy was founded in 1989 and was originally a technology company providing data analysis, software development, and cloud computing services, but its revenue performance was not particularly outstanding in recent years. It was not until August 2020, when MicroStrategy announced its continued investment in Bit, that it embarked on a massive stock price surge.

According to Google Finance data, as the bull market progressed and Bit hit new highs multiple times, it also fueled the continued surge in MicroStrategy's stock price (MSTR), which has now broken through $340 and set a new record high. The stock price has risen 397% so far this year and has surged more than 20-fold in the past five years, with a market capitalization of $69 billion.

It is worth mentioning that although MicroStrategy's stock is now seen as a leveraged Bit play, TD Cowen analyst Lance Vitanza still maintains a "buy" rating on the stock:

MicroStrategy's initial purchase of Bit was merely a defensive value storage strategy, but it has now become a strategy to accelerate value creation for shareholders, and the current rating remains a buy. This sustained value creation deserves market attention.

More Companies Emulate MicroStrategy

Inspired by MicroStrategy, several publicly traded companies have announced Bit strategies this year, including:

- Japanese Web3 infrastructure provider Metaplanet, which announced in April that it would include Bit on its balance sheet;

- Singapore AI education group Genius Group, which announced on November 12 that it would allocate 90% of its cash to Bit investment;

- US-listed battery company Solidion Technology, which announced on November 14 that it would use a significant portion of its excess cash reserves to purchase Bit.