Author: Revc, Jinse Finance

After the material is greatly enriched, the crypto whales, like the tech giants, have also started to focus on the "immortality" biotech track.

On November 13, Binance founder CZ posted a dynamic on the social platform X, sharing his feelings after attending a small decentralized science (DeSci) entrepreneur gathering organized by Binance Labs, and attached a photo with Ethereum founder Vitalik. At this event, Vitalik introduced CZ to VitaDAO's first longevity product - VD001, a natural high-dose spermidine supplement approved by the Thai Food and Drug Administration. CZ expressed in the interaction that he hopes to see the emergence of 1,000 DeSci-related projects next year.

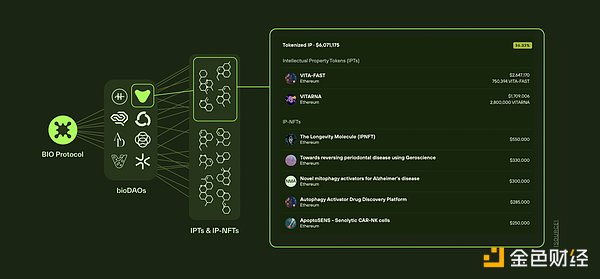

On November 8, Binance Labs announced that it has invested in the BIO Protocol. The BIO platform enables global scientists, patients and investors to co-fund, develop and co-own new drugs and therapies. Currently, BIO's network consists of seven BioDAs, focusing on diverse fields such as cryopreservation, women's health, and psychedelics for mental health.

And the keen-nosed crypto users seized the DeSci hotspot over the weekend, participating in the frenzy of MEME Tokens with a market value of tens of millions of dollars.

Introduction to DeSci-related Projects

Bio Protocol

Bio Protocol is a new financial protocol designed for decentralized science (DeSci), aiming to accelerate the flow of capital and talent into scientific research through on-chain mechanisms. Its core objectives include:

1. Create and support a network of BioDAs to provide on-chain funding and liquidity for scientific research.

2. Standardize the framework, economic model and data products of BioDAs to improve the efficiency of scientific intellectual property (IP) generation and commercialization.

3. Provide continuous funding and liquidity to address the long-term development needs of scientific research.

Core Operating Modules

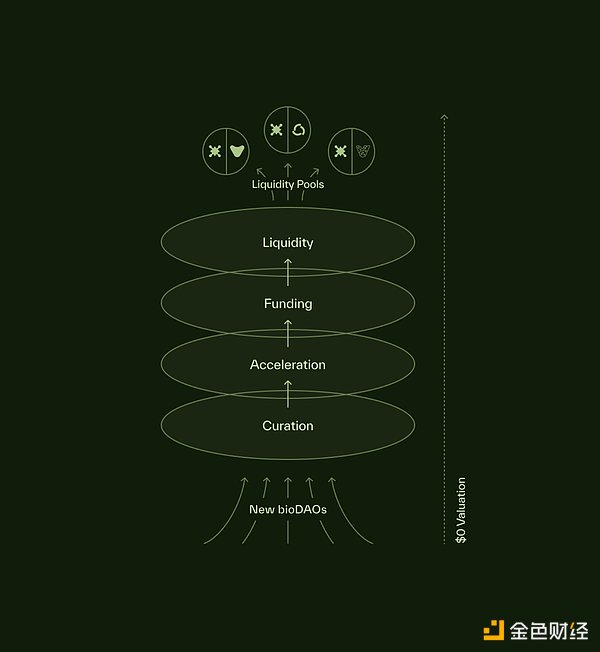

BIO Protocol achieves its goals through the following five core functions:

1. Curation:

- Use $BIO Tokens to screen new BioDA projects and select quality projects through community voting.

- Holders use locked vBIO Tokens to express support, and successful projects will receive funding, support and market priority.

2. Funding:

- Provide initial seed round financing opportunities for selected BioDAs, with participants able to obtain conditions equal to or even better than institutional investors.

- Ensure a high degree of alignment between research and community participation.

3. Liquidity:

- Provide market liquidity for BioDAs through BIO Tokens and other assets (such as ETH) held by the BIO Treasury.

- Reduce exchange costs and accumulate protocol-owned liquidity (POL) through liquidity pools (e.g., VITA/BIO, BIO/ETH).

4. Reward Mechanism (Bio/acc Rewards):

- Distribute BIO Tokens as rewards to incentivize BioDAs to achieve milestones (such as advancing IP to the clinical stage or achieving sales revenue).

5. Meta-Governance:

- BIO holds Tokens of multiple BioDAs, granting the community governance rights over the entire ecosystem (BioDAs and IP assets).

The value sources of the BIO Protocol include:

1. Token Distribution:

- Provide $100,000 funding for new BioDAs in exchange for 6.9% of their Tokens; meanwhile, the BIO Treasury can hold equity in their scientific IP.

2. Protocol-Owned Liquidity (POL):

- Continuously increase the value of the BIO Treasury through liquidity pool earnings (BIO, BioDA Tokens, IP Tokens, ETH, etc.).

3. BIO Token Utility:

- Curate the selection and funding plan for BioDAs.

- Prioritize participation in BioDA Token and IP sales.

- Enjoy discounts on BioDA products/services.

- Vote on fund allocation and protocol updates in governance.

The BIO Token's 2.5th round of auctions has been completed, raising about $58 million, but the Tokens are not yet in circulation, with only about 3,200 holders, which is judged to be mainly institutions and large investors. In addition, the Tokens have an inflationary mechanism, with details to be determined.

pump.science

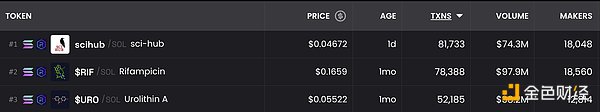

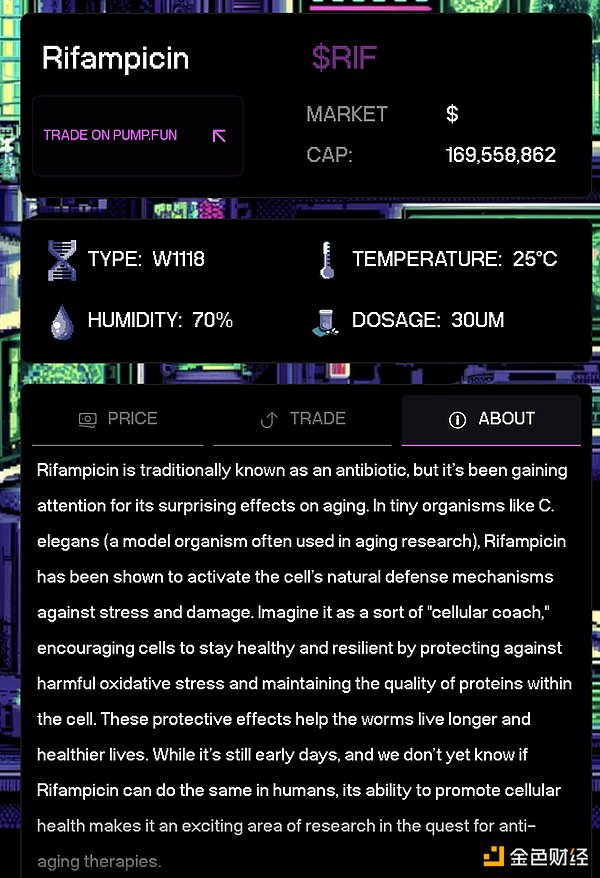

Currently, there are three MEME Tokens under the DeSci concept that have attracted major capital, with RIF's market value reaching $180 million.

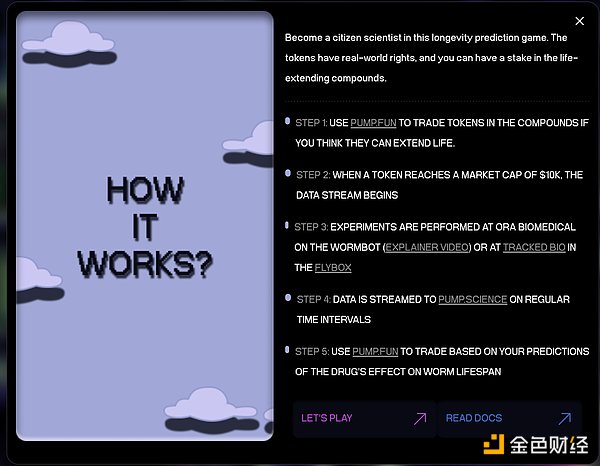

RIF is deployed by pump.science, a project that has undergone strict screening and examination. The DeSci track has shown different performance from traditional MEME, with higher thresholds in asset issuance. Pump.Science is a decentralized science (DeSci) platform based on the Solana blockchain, aiming to promote longevity research. The project is funded by the Solana Foundation, and combines IP-token and real-time experimental transparency to incentivize community participation in scientific research. Its core experiments focus on compound testing, including Urolithin A ($URO) and Rifampicin ($RIF), covering subjects from worms to humans, and gradually unlocking experiments through market valuation (such as $69k for worms and $10m for human stages). Experimental data is live-streamed, similar to the scientific transparency model of Twitch, and anyone can submit compound suggestions to participate in the testing.

Rif

RIF is a research Token about the antibiotic rifampicin, whose potential anti-aging effects have attracted attention in the medical field. Research on model organisms such as "Caenorhabditis elegans" (C. elegans) has shown that rifampicin can activate cellular defense mechanisms, enhancing resistance to stress and damage. It helps reduce oxidative stress and maintain protein quality within cells, promoting healthier and longer lifespan in these organisms. Although the research is still in the early stages and its application in humans has not been proven, rifampicin's ability to enhance cellular health makes it a promising candidate for the development of anti-aging therapies.

As of 6 pm Beijing time on the 18th, RIF has seen a 24-hour increase of over 129%, with a market value of nearly $200 million. As the track leader, it continues to trigger market FOMO sentiment, with some smart money building positions at the bottom and gaining 74 times in profit.

Uro

URO is a research Token about Urolithin - Urolithin A, a natural compound generated by the human gut microbiome through the metabolism of tannins (such as the active ingredients found in pomegranates). It has unique biological functions in cellular health. It activates "mitophagy" to clear out aged or dysfunctional mitochondria, supporting the generation of new mitochondria. This process helps cells optimize energy metabolism, improving overall efficiency and vitality. In animal studies, Urolithin A has been shown to extend the lifespan of Caenorhabditis elegans, demonstrating its anti-aging potential.

Similarly, in the past 24 hours, it has seen a 113% increase, with a market value of nearly $70 million.

SCIHUB

SCIHUB champions academic freedom and the resistance against the long-term monopoly of the academic publishing industry. Sci-Hub was founded by Russian Alexandra Elbakyan, providing free access to academic papers and helping users overcome the high cost of downloading research articles. Elbakyan faced financial barriers as a student and created Sci-Hub after teaching herself programming. Sci-Hub is particularly popular in China, with Chinese users accounting for a large portion of its traffic and donations. The platform faces multiple lawsuits, mainly from Elsevier and other publishers, and its domain names and social media accounts have been blocked. Despite legal challenges, Elbakyan relies on crowdfunding to maintain the service operation.

The existence of this platform highlights the persistent problems in the academic publishing industry, where high subscription fees limit people's access to research outputs. Many researchers support Sci-Hub because it is convenient and easy to use. Elbakyan hopes to restore Sci-Hub's paper upload function and introduce AI features to enhance its services. In China, Sci-Hub is affectionately called "Little Bird," and Elbakyan is hailed as the "Goddess of Academics." The Sci-Hub logo consists of a hammer and sickle and a key, symbolizing its stance in the copyright struggle. Here is the main timeline of the struggle:

In May 2017, Elsevier filed a lawsuit in court against Sci-Hub and LibGen for illegally providing 100 articles, seeking a permanent injunction and $15 million in damages. On June 21, 2017, the U.S. District Court for the Southern District of New York ruled in favor of Elsevier in a default judgment. Subsequently, on November 6, 2017, the court ordered Sci-Hub to pay $4.8 million to the American Chemical Society (ACS) and blocked its servers and domain names. However, Elbakyan stated in an interview with The Scientist that she would not pay the damages.

In December 2018, a Russian court, at the request of the British publisher Springer Nature, blocked several domains related to Sci-Hub. In January 2021, Twitter suspended the Sci-Hub account for posting pirated papers.

From a narrative perspective, SCIHUB is more likely to evoke widespread sympathy and resonate with the long-term oppression experienced by scholars in the industry. In this sense, MEME has evolved into a community expression of social inequality.

In the past 24 hours, SCIHUB also recorded a 158% increase, with a market capitalization of $50 million.

Summary

The Desci track has shown independence in project review and application, and combined with the launch of MEME assets, has provided "community finance" support for frontier scientific exploration. However, the landing of related concepts is uncertain, and investors need to pay attention to the relevant risks. From the financing operation of BioProtocol, the team has high professionalism until the assets are issued to the PumpFun market, but the excessive financial hype should also be considered whether it deviates from the original intention of the experiment. Whether Desci is close to us or just the "vision" of the super-rich, it is no longer important in the eyes of investors in the short term.

If we were to summarize the current red-hot MEME market in a single sentence, "Initial Emotion Offering" might be a relatively apt understanding, as the more likely the narrative is to evoke people's emotional resonance, such as Pnut hamster and SciHub, the more likely it is to bring excess returns in the context of a bull market.