Since Trump's election as President of the United States, the narrative around cryptocurrencies has changed. Many say that Trump's inauguration ushered in the era of the "crypto gold standard," and cryptocurrencies may no longer be heavily regulated by the SEC as "securities." The US stock market has also seen an extreme "Trump trade" market sentiment, with Tesla and the Trump Media Group seeing massive gains.

BTC has also been in sync with the US stock market, and its performance has been even better. Within this time period, it has broken out of the prolonged sideways trading range and embarked on a strong upward trend, consecutively breaching the $80,000 and $90,000 milestones, with hardly any "pullbacks" in between. Interestingly, many large short-sellers in the market have been liquidated, with $80 million and $20 million short positions being witnessed getting wiped out in the futures market.

However, the feast cannot last forever. As the "Trump trade" sentiment has cooled, the US stock market has seen a significant correction, with the Nasdaq index closing in the red for five consecutive trading days. Initially, BTC was able to rise independently of the US stocks, but on November 14th and 15th, it also saw a slight pullback. However, it appears to have found support at the 4-hour EMA20 and is currently rebounding, still trading above $90,000.

Most Altcoins have seen very significant gains of 20-30% after Trump's election, but for those who have experienced "halving" and "knee-cutting" in the past, the road to "break-even" remains long and arduous. Now that BTC has opened up upside space, do Altcoins still have a chance, and is it still suitable to continue longing BTC here? Let's see what the traders in the market think.

Technical Analysis Perspective

@biupa

OTHERS.D has been in an overall downtrend channel for the past 49 days, while DXY has been in an uptrend channel. The two exhibit a strong negative correlation, explaining why Altcoins have only been riding BTC's coattails in the uptrend, but have seen deeper corrections. We have been too focused on the internal data of the crypto space and have overlooked the impact of macroeconomic factors. A reasonable forecast is that a reversal in DXY is needed to bring about a rebound in OTHERS.D.

As for BTC, the market saw a negative premium on Coinbase for the first time at 5 AM on the 15th (the last hour of the US market close), but this did not persist in the following hours, perhaps an isolated incident, but worth noting. As US spot buying weakens, BTC's upside space in the short term is limited. I personally believe the probability of it reaching $100,000 by the end of the year is not high.

@Cryptos_Laowai

@Cryptos_Laowai believes that the true bull run will only begin after Trump is officially elected President of the United States and implements truly favorable measures for crypto, i.e., after 2025. This is likely just a temporary top of a small bull run, and there may not be a widespread Altcoin season explosion. After breaking the uptrend line of this rally, this is considered a standard retest of the uptrend, and a significant downside is expected, aiming to fill the CME gap next week, with a target short position at $76,000.

@CryptoPainter_X

Currently, there are four possible scenarios for BTC's trajectory. The quantitative strategy still holds a long position at $69,000. Structurally, it is still a bull market, but the subsequent trajectory may have the following four possibilities:

1. Price remains above $90,000 (maintain an upward oscillating trend);

2. Price remains below $90,000 (confirm a range-bound market);

3. Price breaks below $85,000, leading to a breakdown (maintain a range-bound market + long opportunities);

4. If the price confirms a breakdown below $85,000 and fails to recover, consider the potential for an extreme pullback to fill the CME gap.

If BTC performs even weaker than the fourth scenario, the possibility of a cyclical bull market ending should be considered.

@roger73005305

I will continue to analyze the overall market and Altcoin trends today.

You will see BTC drop and Altcoins rise, which will be a fascinating phenomenon.

Let's first analyze the market from December 2021 to February 2022, which is the period from now until the Lunar New Year in February.

At the end of December 2021, the overall market began a period of oscillation and adjustment, which lasted until February. Normally, when the overall market is oscillating or declining, Altcoins should see a sharp drop. But that is not the case, because BTC has already risen significantly by then, and the Altcoin sentiment is just starting to pick up. BTC's market dominance has reached its peak, and it has started to head downwards, signaling the start of Altcoin season. So during this time, we see BNB, SOL, and other quality Altcoins gradually rise. It would not be very wise to take profits or reduce positions at this time, as they have not even risen yet.

So my view is to continue to accumulate quality Altcoins that have not yet risen. For those that have already risen several times or even tens of times, it is at least necessary to take out the principal, and the more cautious can sell them all and redeploy into Altcoins that have not risen.

Data Analysis Perspective:

@Maoshu_CN

As of this week, the market sentiment following Trump's victory has lasted for 2 weeks. Through market data, we can clearly see that the sentiment is gradually weakening. Next week, whether the market can continue to extend the Trump victory expectations and maintain an independent trend is what we need to focus on.

Of course, in the future, if the overall expectations are good, capital will also be fully deployed into the market for settlement. This is undoubtedly a positive for the future market, and it will also provide a guarantee for the price decline of the market, especially for BTC. If there is a significant short-term negative news that leads to a sharp decline, I believe it may trigger a lot of capital to buy the dips.

If next week does not continue the short-term Trump victory expectations, then we need to prepare for a correction, referring to the on-chain analysis.

Compared to Thursday's data, the overall market cap has decreased, with #BTC and #ETH market caps decreasing primarily, while Altcoin market cap has increased, with its proportion increasing. Based on the proportion, the market risk appetite is gradually improving, but the current plight of #Altcoins is still overly dependent on the meme sector.

Trading volume has weakened overall, with activity declining as the weekend approaches. However, if we compare it to Saturday market data this year, the current trading volume activity is still at a peak, whether it's BTC, ETH, Altcoins overall trading volume, or the activity of USDT/USDC capital.

Capital continues to flow into the market in large amounts, with the current market liquidity at $186 billion, a significant increase from Thursday.

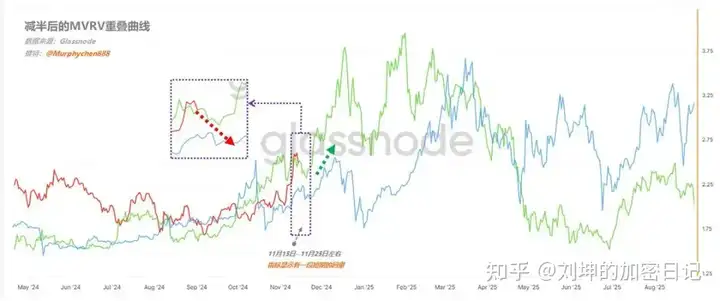

@Murphychen888

According to the indicators:

1. The red line is currently approaching the short-term high point, and if it continues upward, it will create a "deviation." Based on past experience, the greater the deviation, the greater the subsequent correction.

2. At the same time, it is observed that there may be a small correction in the next 10 days. The current red line is at 2.52, and the correction range is around 2.35, corresponding to a BTC price of around $82,000 (this estimated price will change over time).

3. After this period, the upward trend is expected to resume around mid-December, but whether it can significantly exceed the previous high is still uncertain based on the current data.

For me personally, since the holding cost is relatively low, I will ignore this short-term fluctuation. If the holding cost is relatively high, you need to make your own trading plan.

Options market data:

Thomas Erdösi, head of product at CF Benchmarks, said market data shows traders appear to be snapping up Bitcoin call options with a $100,000 strike price. The 30-day constant maturity 25 delta skew has now breached the 5 vol threshold, approaching the highest level since the start of the year, indicating much greater demand for upside exposure.

In addition, demand for call options with strikes above $100,000 is also surging, as evidenced by the rising implied volatility of these options.

Macro analysts:

@Maoshu_CN

The inflation data is basically neutral data, not favorable or unfavorable, fully in line with market expectations. Inflation is still under control overall, but the short-term rebound in inflation will also raise market concerns about future inflation.

As for the US stocks, the trend is relatively cautious, especially the S&P 500 forming an effective turnover at the 6,000-point mark. This kind of action is actually a good thing for the US stocks.

As for Crypto and BTC, the current sentiment is overly optimistic. As long as it is not bad news, it is good news. That's the current state of Crypto enthusiasm.

The inflation data has once again sparked market discussions about a 25-basis-point rate cut in December, and the current CME rate shows an 82.5% high probability of a rate cut in December.

And for the current US economic sentiment, the CPI data rebounded but did not break expectations, in line with the Fed's expectations in Powell's speech last week, so the short-term CPI data will not affect the Fed's decision-making change. At the same time, the next US president, Trump, is also an advocate of actively cutting interest rates, which may also indirectly affect the Fed's next move.

And the market has now gradually accepted the expectation that future inflation may rise, so the short-term inflationary pressure is no longer a significant negative sentiment.

And in the last Powell speech, he mentioned a key point, that the Fed is looking for the right neutral interest rate, and then adjust policies around that rate. The current neutral rate may be higher than market expectations, and the neutral rate may be the next important topic for the Fed.

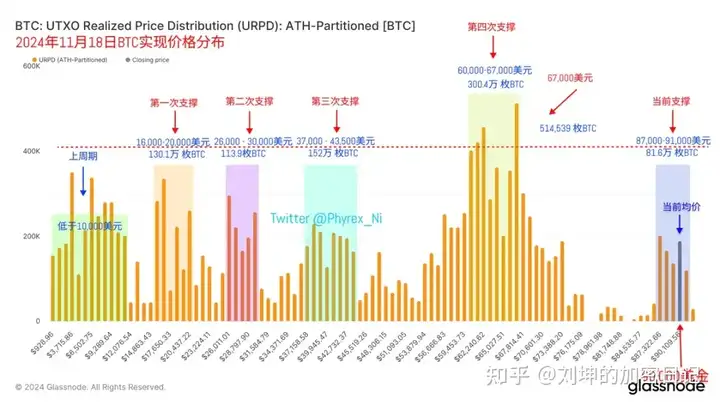

@Phyrex_Ni

Based on the current data, the FOMO sentiment of US investors is likely to have cooled down, and for now we can see fluctuations around $87,000 to $91,000. Whether this position can form a new bottom is not yet clear, but historically there has never been a gap in BTC prices. But from the URPD data, we can clearly see that the holding volume at $77,000, $78,000 and $82,500 is almost non-existent, which is something that has been imagined before, but has been "filled" later.

The ETF data from last week also shows that both BTC and ETH have seen a significant decline in buying power, and BTC even had a large sell-off yesterday, which suggests that the FOMO sentiment during the election period may have ended, and it should be time to rebuild the bottom.

I still want to emphasize that this is not me being bearish, but just being prepared for a correction.