Although the upward trend of Bit has slowed down in the past week, the price is consolidating in a narrow range at a high level, but the US-listed company MicroStrategy remains confident and has increased its Bit holdings again. According to the document released by MicroStrategy, the company acquired an additional 51,780 BTC at a price of $4.6 billion using the proceeds from stock sales during the period from November 11 to 17, 2024.

So far, the company holds a total of 331,200 BTC, with an average holding price of approximately $49,874.

Shortly afterwards, MicroStrategy also issued a press release, announcing that it plans to issue $1.75 billion in convertible senior notes with a 0% coupon rate through a private placement, and the company stated that it intends to use the net proceeds from this issuance to purchase additional BTC and for general corporate purposes.

It is worth mentioning that although the notes do not pay interest, they can be converted into Class A common stock of MicroStrategy under certain conditions, which provides investors with the opportunity to participate in the company's stock price appreciation. In other words, if MicroStrategy's stock price rises in the future, investors can obtain higher returns through the conversion rights, rather than relying solely on fixed interest income.

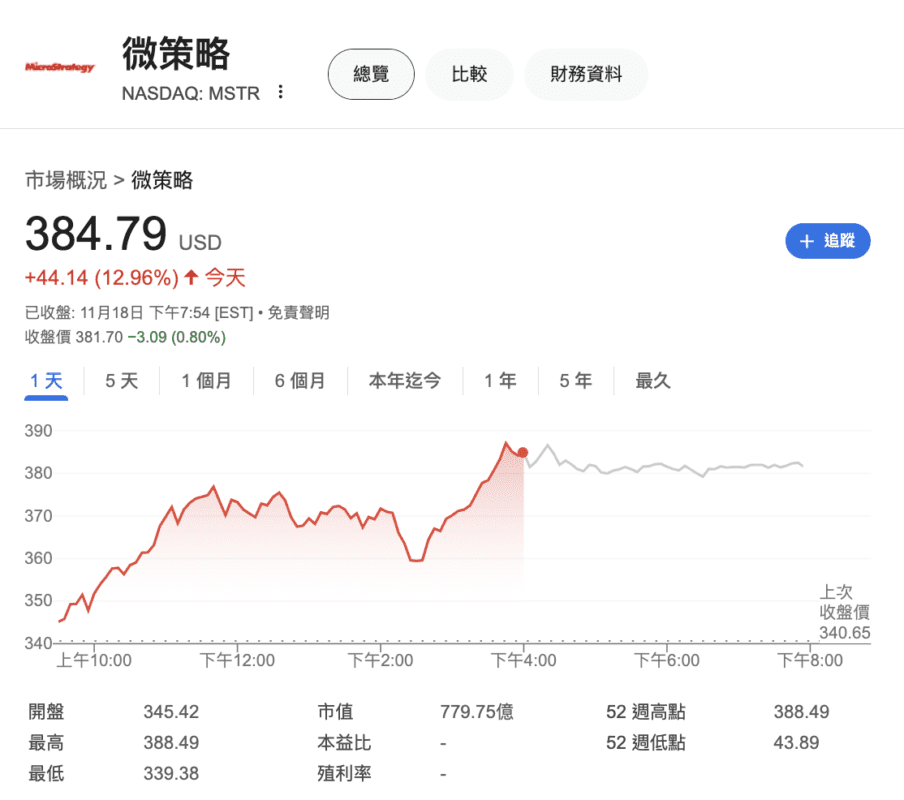

According to market data, MicroStrategy's stock price closed up 12.96% yesterday.