MicroStrategy founder Michael Saylor announced that the company will offer $175 million in zero-coupon convertible senior notes to purchase more Bitcoins. This morning, MicroStrategy purchased $4.6 billion worth of BTC.

The post-Trump cryptocurrency bull run is accelerating MicroStrategy's Bitcoin-first policy, with the company making record investments in BTC.

MicroStrategy "Will Buy More Bitcoins"

According to a recent announcement, these convertible notes will be offered as zero-coupon convertible senior notes, which will be convertible into MicroStrategy stock in 2029 at a discounted price.

"MicroStrategy plans to use the net proceeds from this offering to acquire additional Bitcoins and for general corporate purposes," the company said in a press release.

This $175 million fundraising was announced on the same day that MicroStrategy purchased $4.6 billion worth of BTC. The previous week, the company invested over $2 billion in Bitcoin.

This has made MicroStrategy the world's largest Bitcoin holder. The company continues to pursue its Bitcoin-first policy.

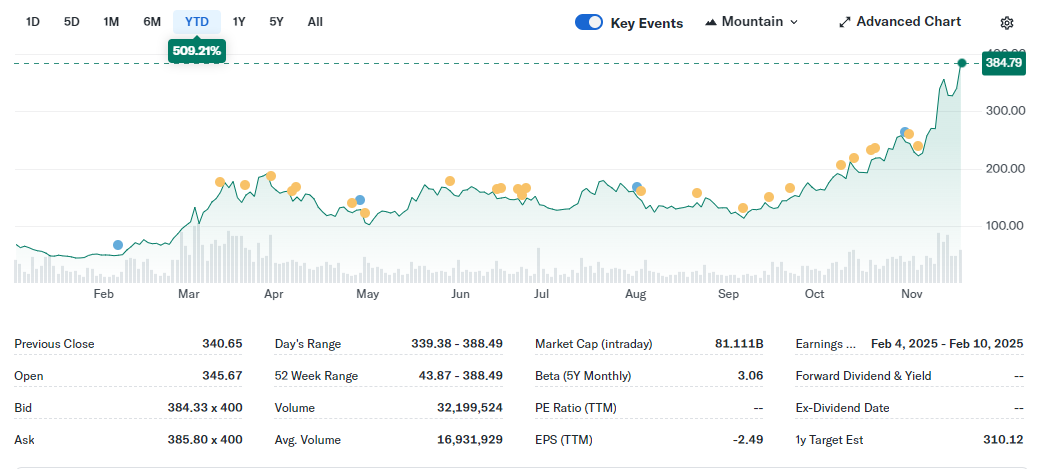

Since adopting this policy, MicroStrategy's stock price has soared, hitting a 24-year high in October, outperforming Bitcoin. The stock has risen over 460% in the past year and nearly 75% this month alone.

The company's value is closely tied to Bitcoin's performance. However, it does not always directly correlate. Nonetheless, MicroStrategy recorded these peaks before Trump's re-election, and the subsequent cryptocurrency bull run has skyrocketed their profits.

Some specific details related to this private offering were not explicitly mentioned in the press release, such as the exact conditions of asset maturity and MicroStrategy's right to redeem the notes in cash.

In this regard, Saylor announced a webinar on Tuesday, November 19th to discuss the proposal, which will be open to qualified institutional investors who can purchase the notes.

As long as the bull market continues, there appears to be no clear limit to MicroStrategy's appetite for Bitcoin. However, Bitcoin's supply is finite, and ETF issuers have already exceeded miners' production levels. Such large-scale purchases cannot last forever, especially in this buyer's market. But Saylor will continue as much as possible.