Recently, with Trump's victory in the US election, the crypto market has been heating up, and the RWA track has been seeing new dynamics. For example, on November 14, Tether announced the launch of its asset tokenization platform Hadron by Tether, while Visa also released its Tokenized Asset Platform (VTAP) for tokenized asset issuance and management in early October.

Against the backdrop of gradually clarifying regulatory policies, the industry's optimism about the future of tokenization is also increasing. Jesse Knutson, the operations manager of Bitfinex Securities, recently pointed out that large financial institutions will be the main driving force for the growth of the tokenization industry. BlackRock CEO Larry Fink even sees the tokenization of financial assets as "the next step in future development".

Giants and platforms like Tether and Visa are actively deploying and launching tokenization platforms

The core idea of RWA tokenization is to mint financial assets and other tangible assets onto the immutable blockchain ledger, thereby increasing the accessibility of investors, enhancing the liquidity of these assets, creating more trading opportunities, while saving transaction costs and improving security.

According to data from rwa.xyz, as of November 18, the top 5 issuers (excluding stablecoins) in the RWA track by Total Value were BlackRock ($542 million), Paxos ($506 million), Tether ($501 million), Ondo ($452 million), and Franklin Templeton ($410 million).

The RWA track is heating up as the crypto market as a whole is on the rise. On November 14, Tether, the issuer of the stablecoin USDT, announced the launch of the asset tokenization platform Hadron by Tether, which can simplify the process of converting various assets into digital tokens. The platform allows users to easily tokenize stocks, bonds, commodities, funds, and reward points. According to the official introduction, Hadron aims to open up new opportunities for individuals, businesses, and even virtual nations to raise funds using tokenized collateral. Hadron not only provides risk control, asset issuance and destruction, KYC and anti-money laundering compliance guidance, but also supports blockchain reporting and capital market management.

Technologically, Hadron supports Ethereum, Avalanche, and Blockstream's Bitcoin scaling network Liquid, and will soon add the TON network and other smart contract chains.

Meanwhile, giants in the traditional finance sector are not lagging behind. On October 3, Visa launched the Visa Tokenized Asset Platform (VTAP) to simplify the issuance and management of tokenized assets, including tokenized deposits, stablecoins, and central bank digital currencies (CBDCs). Through VTAP, financial institutions can use the sandbox environment provided by the Visa Developer Platform to create and test their own fiat-backed tokens.

While supporting institutions, some projects are also starting to focus on the potential of the retail market. On October 8, the EU tokenization protocol Midas opened up the mTBILL and mBASIS tokens to retail traders. Reportedly, this tokenization company has obtained regulatory approval from the Liechtenstein Financial Market Authority to offer these funds to retail traders, making Midas' real-world asset (RWA) tokens the only regulated crypto instruments in Europe without a $100,000 minimum investment limit.

On the other hand, the tokenization of specific asset types is also attracting the attention of professional investors. In late October, the tokenized fund platform Elmnts, supported by oil and gas royalties, announced its public testnet launch on Solana. Elmnts is a compliant investment fund tokenization platform. These funds are supported by royalties from the extraction of oil and gas on the land owned by the fund. The platform is currently focused on institutions and high-net-worth individuals.

In addition, participants in the DeFi field are also trying to explore more innovative paths through cooperation with traditional financial giants. Earlier this year, the DeFi protocol Ondo began using the BlackRock US Dollar Institutional Digital Liquidity Fund (BUIDL) token to develop its derivative products.

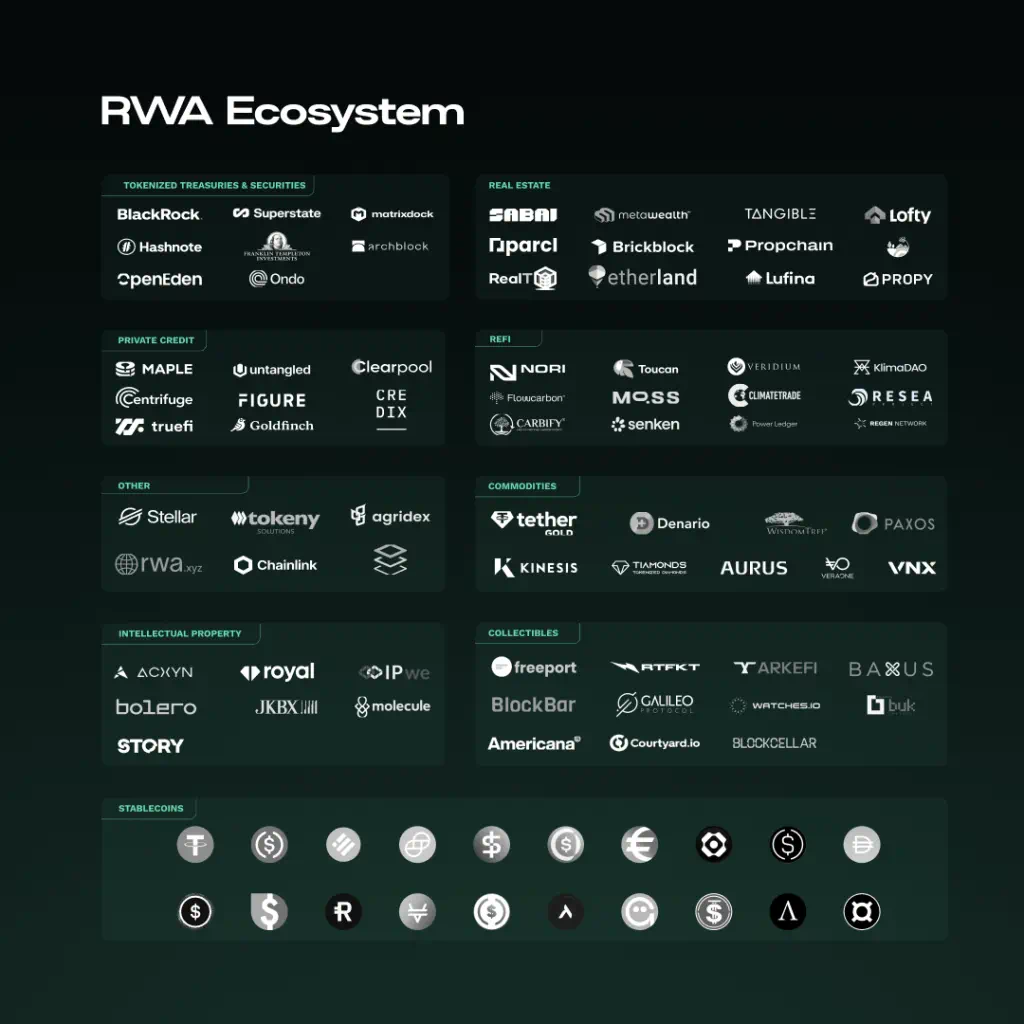

RWA ecosystem landscape Source: Tren Finance

Regulation is expected to become clearer, heralding the third revolution of asset management

In an October 29 paper, the global consulting firm Boston Consulting Group (BCG) referred to RWA tokenization as "the third revolution of asset management". It is believed that ETFs are the core of asset management 2.0, and tokenization may be the era of asset management 3.0. BCG believes that within just seven years, the assets under management of tokenized funds may reach 1% of the global mutual fund and ETF assets, meaning that by 2030, assets under management will exceed $600 billion; this trend is expected to continue in the near future, especially when regulated on-chain currencies (such as regulated stablecoins, tokenized deposits, and CBDCs) are realized.

The forecast from the Tren Finance report in October is even more aggressive, predicting that the size of the real-world asset (RWA) tokenization industry could exceed $30 trillion by 2030, a growth of over 50 times. Behind its rapid development are not only the push from flexible financial institutions and mainstream financial institutions, but also the support of blockchain technology progress and the gradual clarification of regulations.

Against the backdrop of the continued rise in the crypto market, the improvement in regulatory clarity has injected new confidence into the industry. In a recent blog post on the a16z crypto website for crypto founders, it was pointed out: "The good news is that there is now a path to engage constructively with regulators and policymakers to bring regulatory clarity, and you should all feel empowered to explore all the breakthrough products and services that blockchain can support, including tokens."

The post specifically points out that token issuance is an activity that founders can be more confident in: "For many of you, you've held back on using tokens to allocate project control and build community, due to concerns about over-regulation, and now you should feel more confident in using tokens as a legitimate, compliant tool for your projects."

Meanwhile, Jesse Knutson, the operations manager of Bitfinex Securities, said that large financial institutions will be the main driving force for the significant growth of the tokenization industry. Knutson said that institutions have already been driving significant growth in the crypto industry, and this influence may further extend to the tokenization field.

The positive expectations for RWA tokenization have also received responses from more industry professionals. Larry Fink, CEO of the world's largest asset manager BlackRock, recently stated that "the tokenization of financial assets will be the next step in future development". He pointed out that in the future, every stock and bond will have a unique identifier (similar to a CUSIP), and all transactions will be recorded on a unified ledger, and investors will also have their own identity. Fink said that tokenization not only can effectively prevent illegal activities, but more importantly, it can achieve instant settlement, significantly reducing the settlement costs of stocks and bonds. In addition, tokenization will also bring the possibility of personalized investment strategies and improve corporate governance efficiency, ensuring that each shareholder can exercise their voting rights in a timely and accurate manner. Tokenizing real-world assets such as real estate, commodities, wine, or art means creating blockchain tokens representing ownership, making these traditionally hard-to-sell assets more tradable.

Specifically, according to a paper by State Street Global Advisors, bonds are expected to lead the large-scale adoption of tokenized real-world assets due to their structural characteristics. The report states that the bond market is mature and suitable for tokenization; the complexity of these instruments, the repetitive nature of issuance costs, and the high degree of competition between intermediaries support rapid adoption and provide room for significant impact; blockchain technology can play an important role in markets that value transaction speed (such as repos and swaps).