The on-chain traffic has recently exploded, with the trading mascot concept coin surging 60,000%, and the DeSci narrative on the rise, making MEME coins the biggest dark horse of this bull market!

On-chain operations are quite difficult, and in this tutorial, Biteye will teach newbies step-by-step how to use GMGN to play with MEME coins!

There will also be an advanced edition, so please stay tuned.

This article will focus on new project launches, mainly teaching you how to find, analyze and trade newly launched MEME coins.

01 Quick Newbie Crash Course

1. What is GMGN?

A website that combines a MEME coin data dashboard and a trading tool.

2. What is on-chain trading?

Activities and transactions directly on the blockchain, without relying on centralized exchanges like Binance or OKX.

3. What wallet to use?

Mainstream wallets like Phantom and OKX. You can search on Youtube for installation and usage tutorials, which won't be covered here.

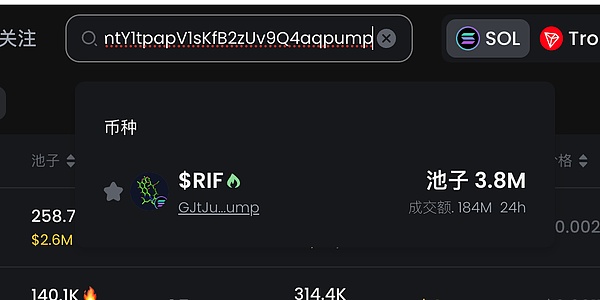

4. What is a token address (CA)?

A string of letters like "GJtJuWD9q*****wMBmtY1tpapV1sKfB2zUv9Q4aqpump". Paste it into the GMGN search bar to find the token.

As shown in the image below:

02 Discovering New Projects

1. Follow the Smart Money

Track the smart money, which means tracking the wallet addresses of users who have achieved relatively high returns on-chain, and observe the investment targets they choose. The three links below are lists of smart money on different chains, as well as corresponding icon explanations:

ETH chain: https://gmgn.ai/discover?chain=eth

Solana chain: https://gmgn.ai/discover/?chain=sol

Blast chain: https://gmgn.ai/discover?chain=blast

After following the smart money, when there are new dynamics, a red bubble and sound alert will appear in the bottom left corner of "Following" (can be turned off or on).

GMGN also provides the function of binding Telegram notifications, so that you can receive notifications immediately whenever the wallets you are following make any transactions.

Click on "Following" to view the real-time transaction dynamics of the smart money, including buying, selling, adding positions, increasing positions, opening positions, and closing positions.

You can also click on any smart money address interface to get more detailed information, including position analysis, profit and loss distribution, and transaction activities.

Hundreds or even thousands of MEME coins are launched on-chain every day, and there may be concentrated buying by smart money. When choosing the objects to follow, it is best to consider your own trading habits to avoid following too many wallets, which can lead to information noise. It is recommended to choose wallets with similar styles to your own for tracking, to ensure the efficiency of the information flow.

Note that checking contract security cannot be ignored, as many smart money also have the habit of buying recklessly without considering contract safety.

2. Scan Twitter and Chains

Scan Twitter: Follow a large number of Chinese and English KOL accounts related to MEME coins on Twitter, and join various discussion groups, in order to obtain the latest information and dynamics.

Scan chains: Closely follow the tokens that are moving from the inner market (small market) to the outer market (large market), and quickly assess whether these tokens are worth investing in.

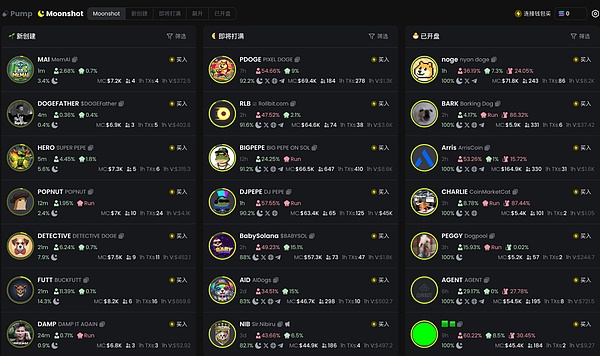

On the GMGN platform, you can view the following three types of tokens:

The first type: newly created inner market tokens (highest risk)

The second type: inner market tokens that are about to be filled

The third type: tokens that have entered the outer market (lowest risk)

Explanation of inner market/outer market:

When a new project successfully deploys using the automatic token issuance tool pump.fun, users can use SOL to purchase the project's tokens. When its market cap reaches $69,000, the project's liquidity will automatically be added to Raydium.

Before reaching $69,000, we call it the inner market. At this stage, the project is in a very early stage and the risk is extremely high;

After reaching $69,000 and successfully adding liquidity to Raydium, we call it the outer market. At this stage, the project has undergone further development, and the risk has been reduced.

It is recommended to focus mainly on tokens that have entered the outer market. Although the outer market still has relatively high risk, the risk has been greatly reduced compared to the inner market, and it is more friendly to beginners.

Moreover, most of the outer market tokens that have reached the million-dollar market cap level are still a minority, and there is still a lot of room for profit.

Note that a token entering the outer market does not mean it will definitely rise in price. There are also many cases where tokens quickly go to zero after opening on the outer market, so please always be cautious in the investment process!

By patiently monitoring and analyzing the performance of these tokens, judging their potential and investment value, we can ultimately achieve profitability. But how exactly should we analyze them? Let's see the details below.

03 Token Analysis

After learning how to use GMGN to find new on-chain coins, the next step is to analyze and select the targets worth buying from the pile of MEME coins.

Specifically, you need to judge whether to buy based on hot spots, narratives, market cap, community, and market dynamics. The strategies for different types of MEME coins are also different:

1. Hot Spot Type

Many of these tokens have quickly become popular small-cap tokens due to a specific event or trend in a short period of time. They may have very high initial growth, with potential upside of over 10 times, from a market cap of millions to tens of millions.

However, if the hot spot is not sustainable, the price has no support, the celebrity doesn't shill, the new narrative hasn't reached a certain level, an influential community hasn't formed, and there hasn't been an inspiring low-probability event, they may gradually lose liquidity and the price may continue to fall.

So-called low-probability events, here are a few examples:

The founder of $SLERF accidentally burned all the liquidity pool tokens (LP), airdrop reserved tokens, and minting tokens, triggering a bullish sentiment on-chain, causing $SLERF to quickly list on the exchange.

There is also the recent $BITCAT. When the on-chain sentiment was constantly fermenting around the "mascot" concept, the official Bitcoin Twitter suddenly posted a black cat picture, and some people thought this hinted at the Bitcoin mascot. As the consensus continued to spread, the related token $BITCAT quickly pumped, experiencing a price surge from a market cap of hundreds of thousands to one hundred million in just 3 hours, and then maintained around 50 million market cap overnight.

For this type of token, the suggestions are as follows:

Buy in early, with a market cap of hundreds of thousands being the best. If you enter too late, don't wait until it reaches $10m (tens of millions) to chase the high, as you are very likely to get stuck;

If you are optimistic about the sustainability of the hot spot, wait for the price to pull back 80% and then enter, which can reduce the risk.

2. Narrative Type

These targets often do not rely on short-term hot spots to rise, but rather gradually grow from a small market cap to a large market cap around a certain narrative or community.

Unlike the instantly skyrocketing hot spot tokens, they may go through multiple stages of stable growth, usually with a market cap between a few hundred thousand to a few million dollars, and even break through a hundred million at the highest point.

For example, $RIF, with a background of using antibiotics to treat tuberculosis, is currently the DeSci + MEME leader. The reason for its pump is that the on-chain attention to the DeSci (decentralized science) narrative has risen, and as the first token launched by Pump science, with the increase in narrative heat, the buy orders have been constantly increasing, and its position in the track has gradually been consolidated as the leader.

For this type of token, my suggestions are:

Focus on new narratives that are also good narratives, such as DeSci, and choose to build a position in low market cap (a few hundred thousand to a few million) in stages;

Pay attention to the social media, community activity, and capital inflow of these tokens in the medium and long term to judge their sustainability and potential.

04 How to Trade

The following is an overview of the GMGN trading system:

1. Left Interface

Favorites, Holdings List

Quickly understand the price and profit changes of the tokens you have collected and held, and you can also quickly sell them when watching the market.

Hot, Pump, Followed List

By checking the time, transaction volume, price, and price percentage, you can filter out the hot tokens and Pump tokens that best fit your trading strategy. The followed list makes it convenient to follow up and buy with one click when watching the market.

2. Main Interface in the Middle

The area below the K-line covers a lot of relevant information about the token, including trading activities, traders, holders, blue-chip holders, etc., and they are classified into smart money, KOL/VC, whales, new wallets, snipers, large holders, developers, followed, and old mouse warehouses.

When researching the token, you also need to refer to this information and analyze the large whales and smart money. For example:

Mark suspected old mouse warehouses to judge whether the boss wants to disperse the tokens with small wallets to try to crash the market and run away.

Mark suspected phishing wallets, and if the tokens are not purchased but transferred in, a mark will be given.

3. Trading Interface on the Right

Check Indicators

Check the token's trading volume, buy, sell, net buy, liquidity, minting data, blacklist, etc. It is also important to check the burning pool ratio and the probability of running away.

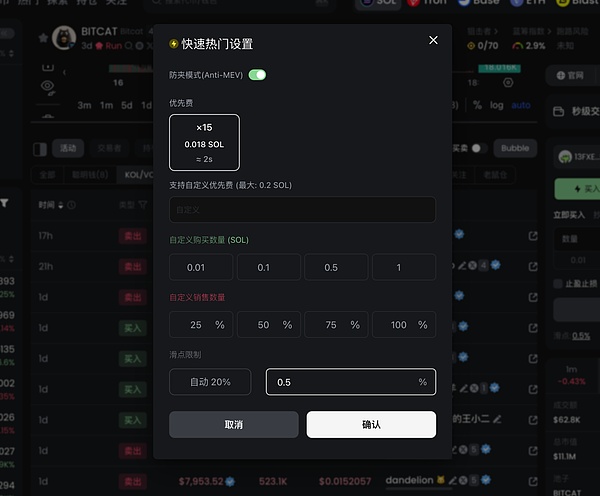

Set Slippage, Turn on Anti-MEV Mode

Slippage refers to the maximum acceptable token quantity deviation declared in a single transaction. The higher the slippage, the faster the transaction speed. Most of the time, it is recommended to use about 0.5% slippage, and when the market is highly volatile, it can be increased to 10%.

(Note: The MEV sandwich attack refers to the MEV robot reading the incoming transaction information and executing the order first, thereby driving up the token price when you buy. Turning on the Anti-MEV mode can effectively prevent the sandwich attack.)

Select Amount, Manual Buy/Sell

The advanced section will be written later, talking about limit price automatic buy, order automatic buy, etc. Please follow.

05 Risk Warning

Hundreds or even thousands of Meme coins appear on the chain every day, most of which will go to zero, and the probability of a large MC meme coin (over 10 million/100 million market cap) is extremely low, let alone being listed on a major exchange.

In short, the higher the return, the higher the risk, please be responsible for yourself!