Author: Stacy Muur Source: Stacy in Dataland Translator: Shan Ouba, Jinse Finance

Over the past few weeks, memecoins have overshadowed all other Web3 narratives, making ordinary users feel that the meme train is the only way to get good returns.

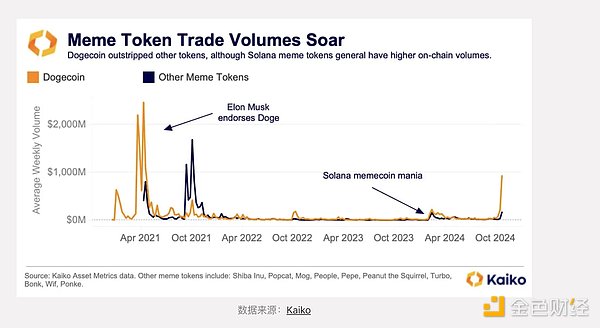

After the launch of $PNUT, $PEPE, $BONK, $BRETT and some other currencies, with the daily trading volume of memecoins reaching the highest level, the popularity of the "meme" category has also been increasing, and it is not surprising that they have attracted attention.

But are the risks and returns equal? How serious is the hype in the memecoin market?

The Current State of Memecoins

Is meme really the hot topic of the year?

If you find someone who has been involved in the Web3 market for at least five years and ask them to define 2024 as the "year", they might say this is the year of memecoins.

Many people praise memecoins as the best performing coins of the year, and the charts and rankings also support this view. But does this really reflect reality?

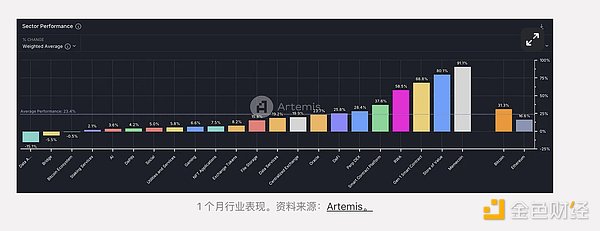

If you analyze the industry performance so far this year, the data may tell a different story. For example, on Artemis, the RWA index (Ondo, Mantra, Clearpool and Maple) leads with a growth rate of 1,900%, while the growth rate of memecoins is 258% and Bitcoin's growth rate is 104%.

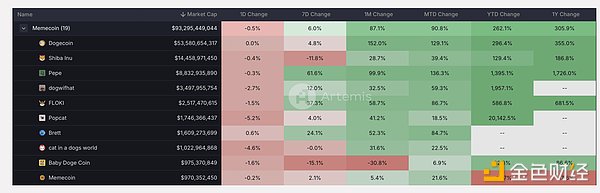

Additionally, it is important to understand which memecoins are being considered. On Artemis, the memecoin index currently only tracks the 19 largest memecoins.

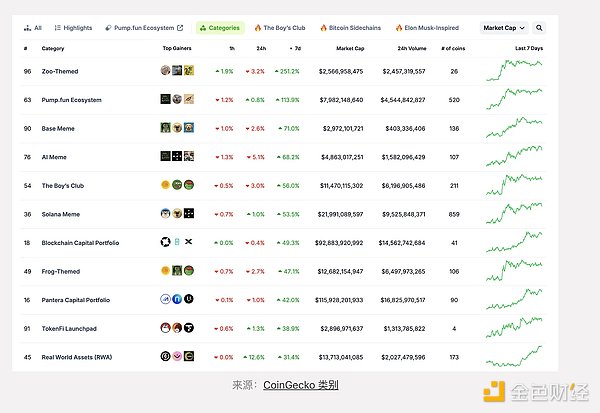

The category rankings on CoinGecko face another issue: many Memes belong to multiple categories, so a few strong winners can significantly improve the 7-day performance of multiple categories at the same time.

Taking the Pump.fun ecosystem, which tracks 520 tokens, as an example, I can understand why I think this is a problem. As the second largest gainer of the week, it looks very optimistic and has sparked strong FOMO sentiment.

However, when you look at the rankings, you'll find that less than 20 tokens have a 7-day gain of over 110% (the average for that category), which is only 3.8% in percentage terms. Additionally, less than 60 tokens (11.5%) have a positive weekly gain.

This is no longer WAGMI, is it?

From a performance tracking perspective, the main problem with Meme coins is that their industry performance is usually measured by the largest or most popular assets in that category. This creates the illusion that Meme coins outperform all other Web3 industries. However, a more accurate statement is that the leading Meme coins perform better than other categories.

This brings us to an important point: distinguishing existing memecoins from new memecoins, as they represent two completely different markets.

New Memecoins

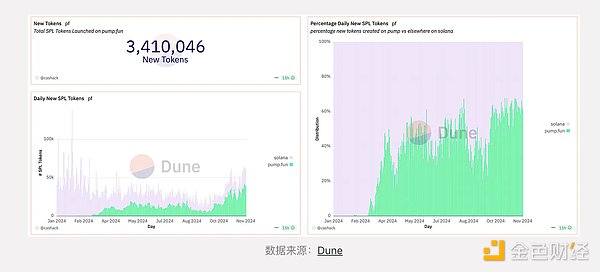

CoinGecko currently tracks 520 memecoins on its Pump.fun dashboard. Since the launch of Pump, 3 million tokens have been created.

This means that 99.982% of the tokens are unable to be tracked on CoinGecko, so we cannot understand their performance.

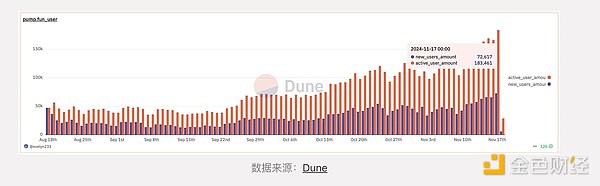

At the same time, Pump attracts 50,000 to 70,000 new users daily, and the total number of active users has now exceeded 150,000.

Here are some additional background details from my research conducted at the end of August:

Most top PNL addresses are token deployers

Only 3% of all Pumpdotfun traders have gains over $1,000

0.8% have earnings over $10,000

Over 60% of people are losing money

These are the new memecoins. Not a good choice, right?

For the average new memecoin trader, the main problem is the inability to distinguish between "new" and "mature" memecoins. Most new traders chase early protocols, hoping to replicate the 0.001% success stories of large-scale adoption - similar to $PEPE or $BONK.

I don't want to disappoint you, but the probability of dying from a lightning strike is higher: 0.011%.

Building Memecoins

For mature memecoins, the prospects are much brighter. They did not gain a certain market capitalization due to VC support or specific valuation factors. Instead, they succeed because they have a community, a bit of luck, and strategic market management.

This may sound like a conspiracy theory, but I believe that most memecoins with a solid market share are not randomly developed by developers. Behind these successes are often professional memecoin development teams with abundant market-making and marketing resources.

It needs to be clarified that I am not saying all popular memecoins are the result of perfectly executed plans, but this may apply to most memecoins.

Compared to many other Web3 areas, there are several logical factors that contribute to the superior performance of mature memecoins:

100% of the supply in circulation (no low circulation or high FDV)

No venture capital support (eliminating additional selling pressure)

Organic active holder community

No product risk (no vulnerabilities, poor execution or user acquisition issues)

Memecoin rotation pattern (gains flow from one memecoin pump to another)

Strong correlation with general market cycles

Low dependence on marketing

Memecoin trading is purely speculative, and has become more predictable this year, forming a pattern of shifting "classic" token trading volume and liquidity, especially considering the lack of a dominant or fresh narrative in Web3 currently.

By the way, measured by 1% market depth on US exchanges, memecoin liquidity hit a historic high of $110 million last week. Large Meme tokens like SHIB and DOGE continue to dominate, accounting for over 70% of the total market depth.

However, their share has been gradually declining, indicating growing interest in smaller tokens.

What Stage is the Market In?

Currently, over 50% of the trading volume on Solana comes from memecoins. On BNB, this ratio is close to 45%, and on Base, it is around 25%.

That's too much.

However, history shows that when the market is busy promoting a certain narrative after price movements, it is usually too late.

In my view, the memecoin market has already reacted to Bitcoin's rebound.

As long as the price stays around $90,000, I doubt we will see new surges in mature memecoins - we'll call them cult coins to avoid confusion with the 3 million tokens created on Pump.fun this year.

However, the retail sector, which is always behind on popular topics, is still boarding this train, hoping to ride to Valhalla.

The main problem is not just that most of the recently enrolled students are late; this is a common occurrence in all stories.

The real problem is that a large portion of retailers have jumped on the new memecoin train, and this train is usually headed to Hel, not Valhalla.

As a result, new users are turned away and unable to join further. For the Web2 norm, the difference between Meme coins and classic coins is small; they are both just stock codes. Therefore, this poor experience extends to all verticals of Web3.

To clarify, I am not against cult coins - memecoins with a fixed market share. They have many advantages. However, I believe we really need to stop using the same word on Pump.fun to describe great things and poorly designed lotteries. Let's address this issue.

Here are my final thoughts

If you are an experienced MEME coin trader, please continue your strategy, but be aware that the market may have overheated.

If you are a newbie to MEME coins and have a strong FOMO, consider allocating a small, manageable portion of your portfolio for experimentation, focusing on mature popular coins.

Don't play new games unless you know how to win. There is a very important rule: If you don't know how to win, don't play.