Author: OurNetwork

Compiled by: TechFlow

Real World Assets

BUIDL | PAXG | BCAP | Maple

Over $13.1 billion in real-world assets (RWA) - excluding stablecoins - have now been tokenized on-chain.

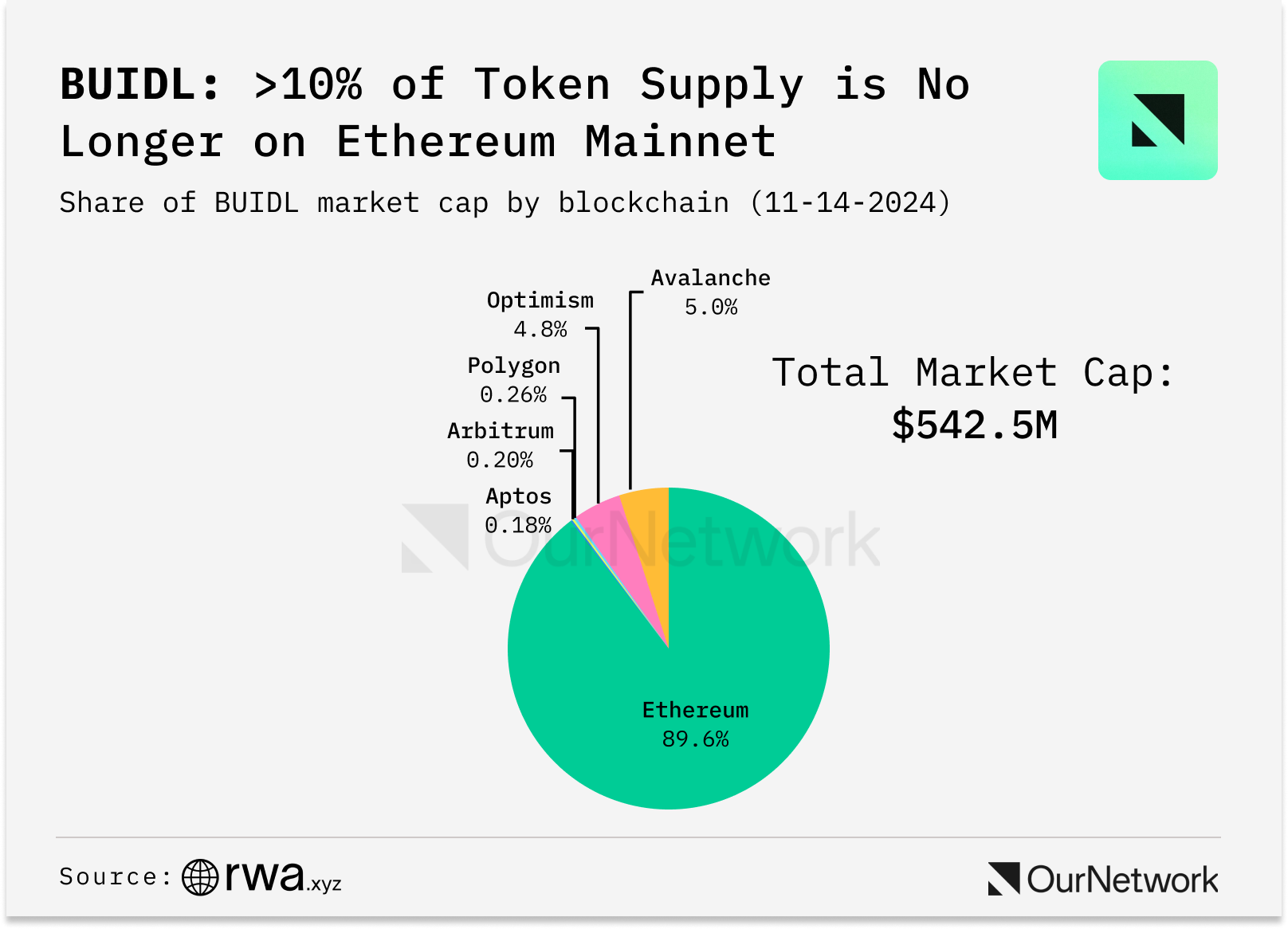

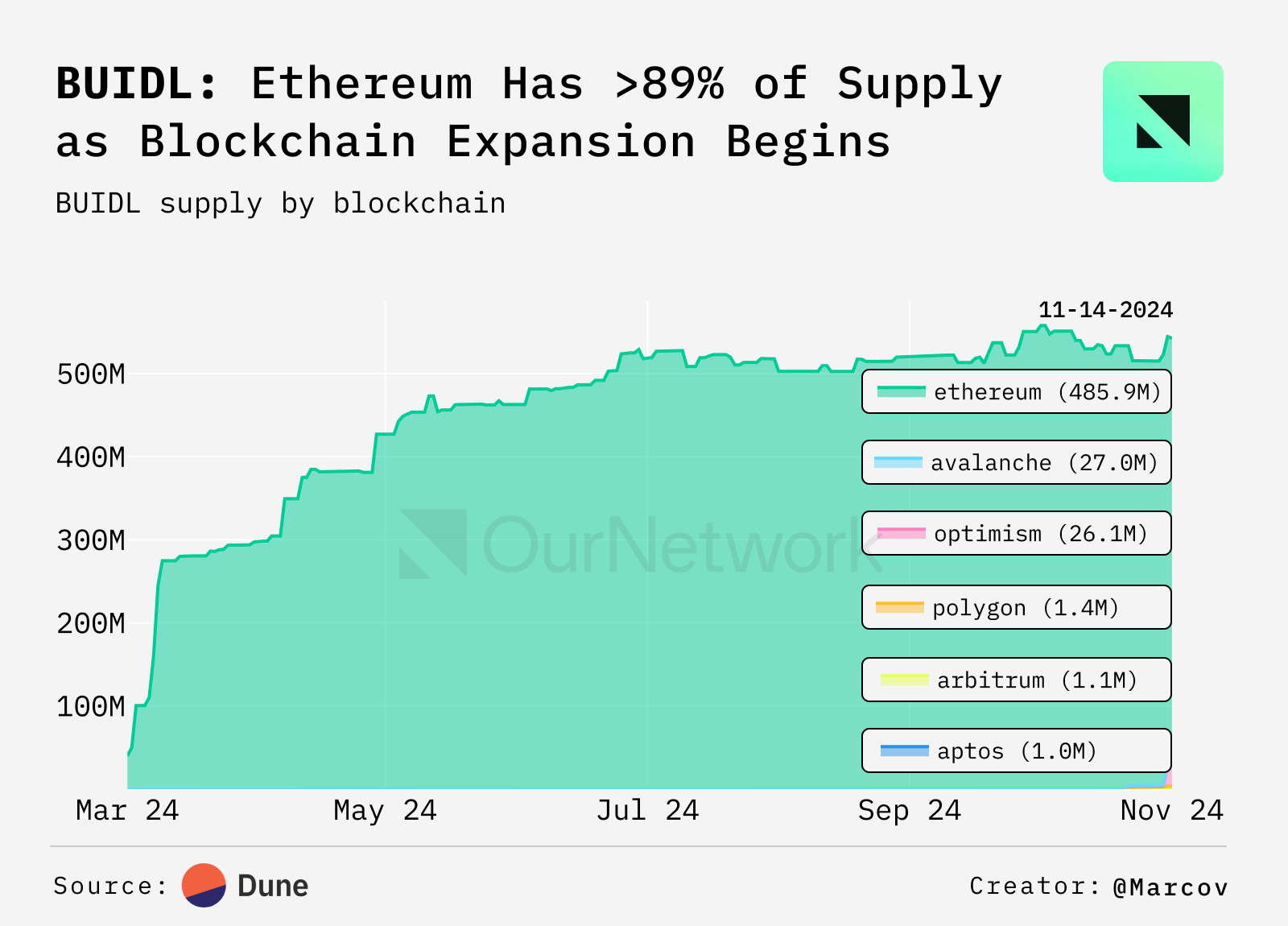

Protocols typically use economic incentives to encourage projects to build within their ecosystems. BUIDL's launches on Aptos, Polygon, Avalanche, Optimism and Arbitrum mark the first time these incentives have been brought to treasuries: Aptos, Polygon and Avalanche each agreed to pay quarterly fees to BlackRock based on the value of BUIDL stakes on their networks. It's still early to judge whether this will be successful, but as of November 14th, the total minting across all five networks has reached $56.6 million, accounting for 10.4% of the fund.

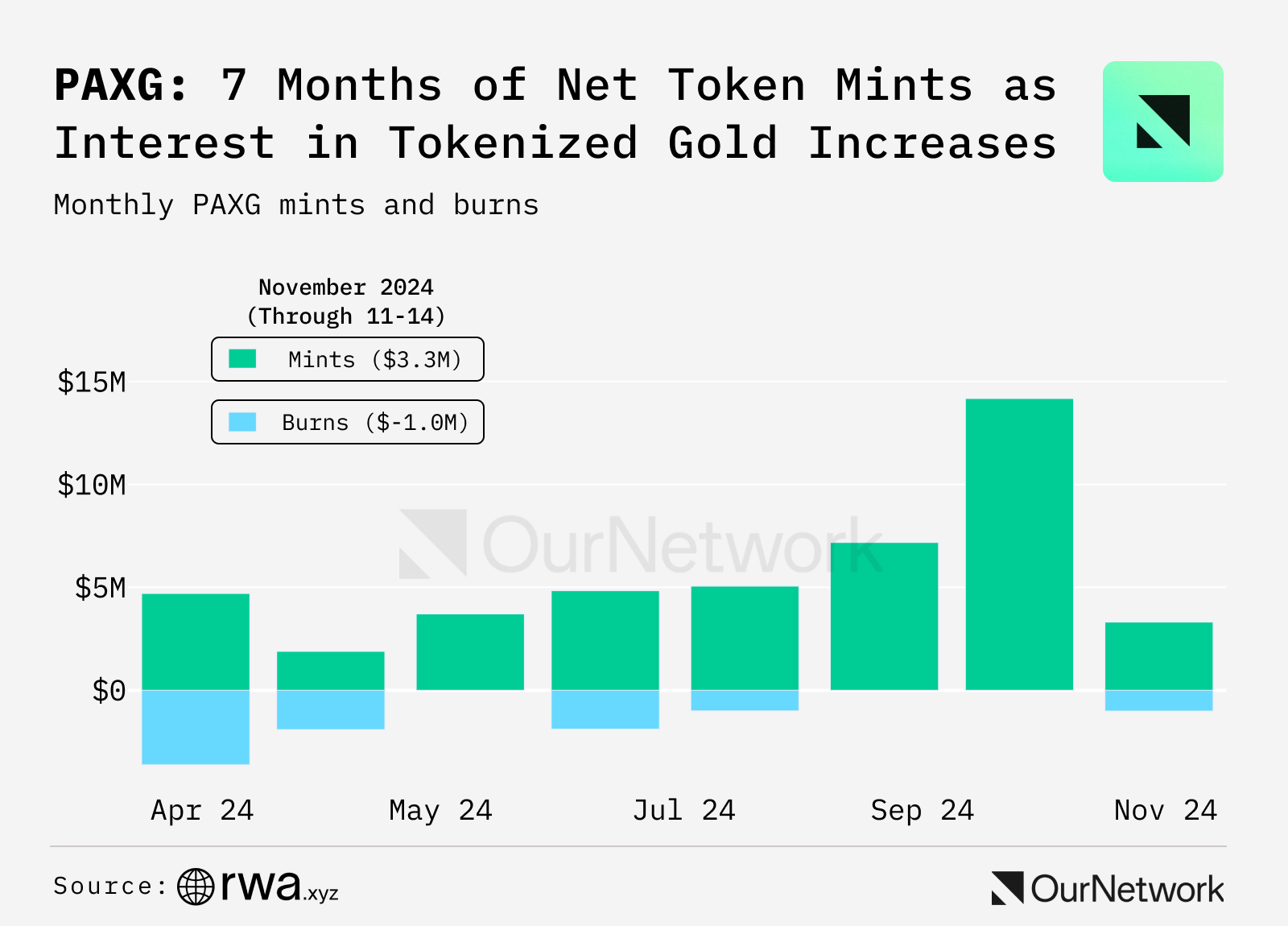

As investors seek ways to invest in gold, the demand for tokenized gold continues to rise. The asset class has grown over 20% since the start of 2024. Paxos Gold (PAXG) is the most widely held, with 52,522 wallets holding the asset. PAXG has also seen seven consecutive months of net token minting, reflecting ongoing interest in the product.

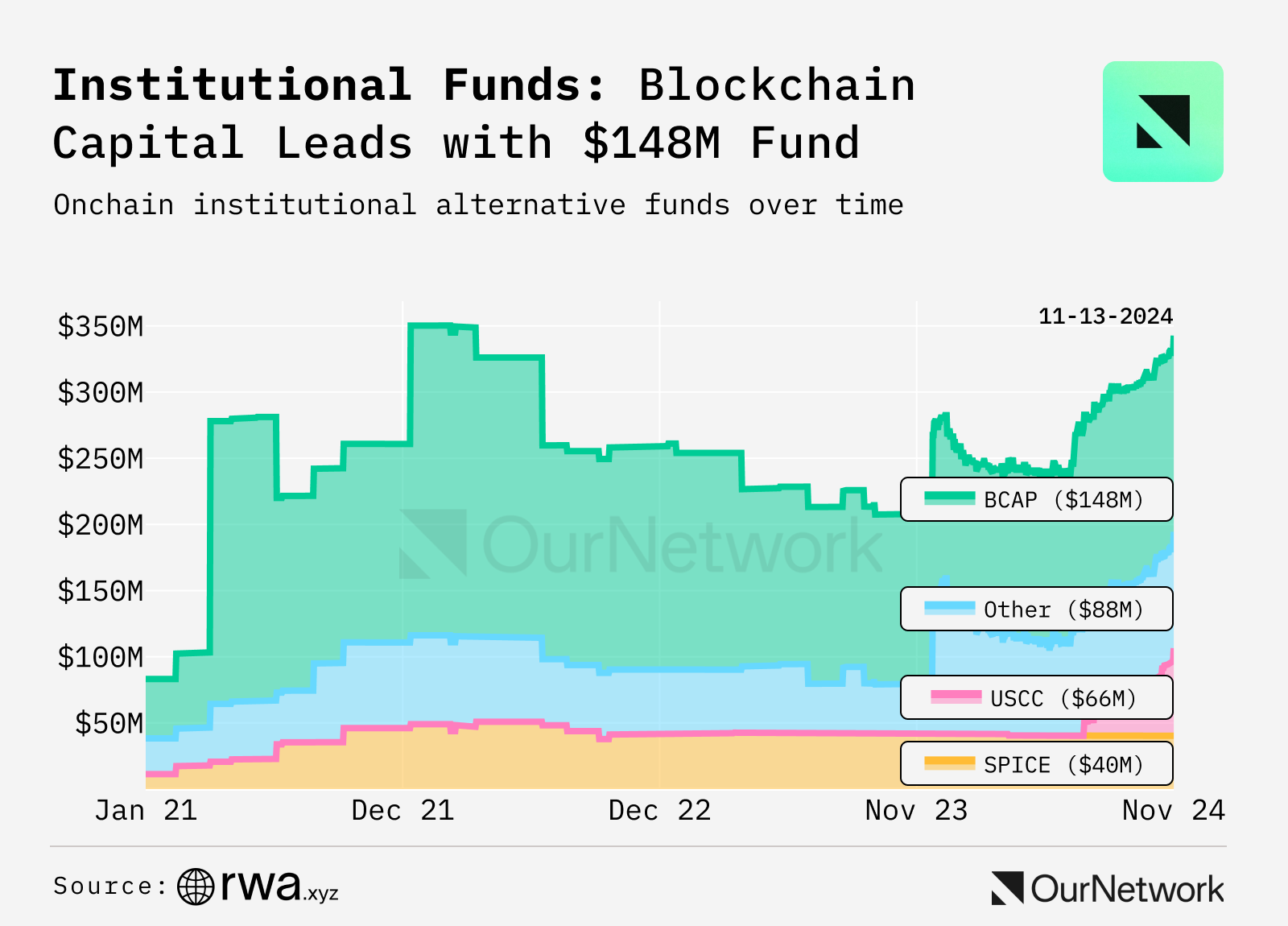

The new institutional funds dashboard on RWA.xyz is tracking $330 million in alternative fund assets under management, led by Blockchain Capital ($148 million) and Superstate's Crypto Carry Fund ($58 million). With the launch of the Securitize Fund Services platform on October 31st, we expect to see more asset managers explore tokenized funds to address issues of slow investor onboarding, delayed net asset value reporting, and other operational inefficiencies in traditional funds.

Transaction Focus: Now that the BUIDL fund has multi-chain operations, users can move capital to the three networks (Aptos, Avalanche, Polygon) that charge lower management fees. Accounts have already transferred $25.6 million from Ethereum to Avalanche. In the process, 250,000 BUIDL tokens and 25,364,613.13 BUIDL tokens were transferred and burned on the morning of November 15th, and an equivalent amount of tokens were minted on Avalanche.

Maple & Syrup

Maple & Syrup continue strong growth after surpassing $600 million in total value locked (TVL)

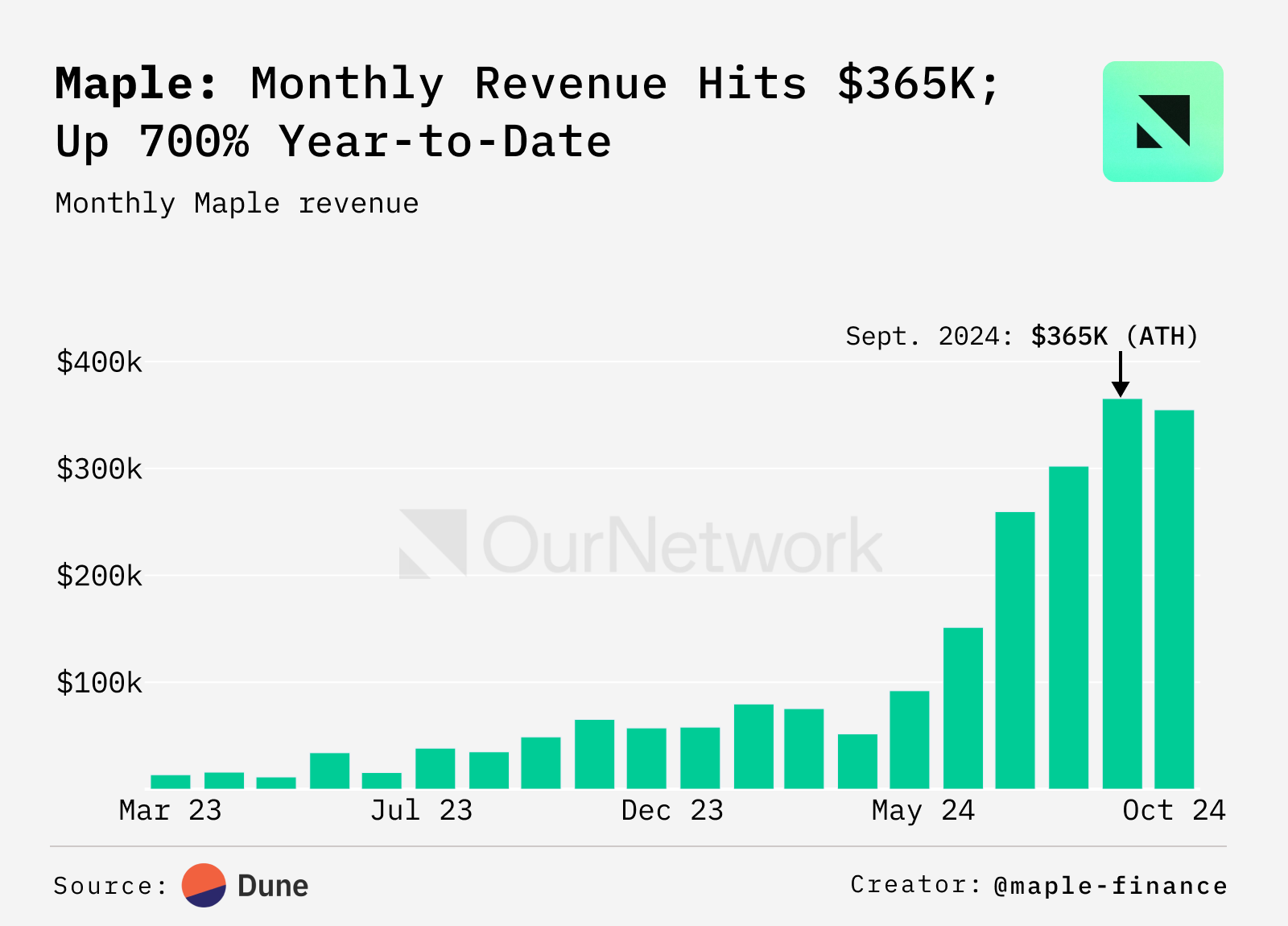

Maple Finance and Syrup provide corporate credit yields to lenders by issuing loans to institutional borrowers; these loans are always over-collateralized by liquid digital assets (like BTC, ETH and SOL). Since launching the high-yield collateral pools in March and Syrup in June, the platform's TVL has grown over 700%, recently crossing the $600 million threshold. Protocol revenue has shown a similar growth trajectory, increasing over 700% from the start of the year to October.

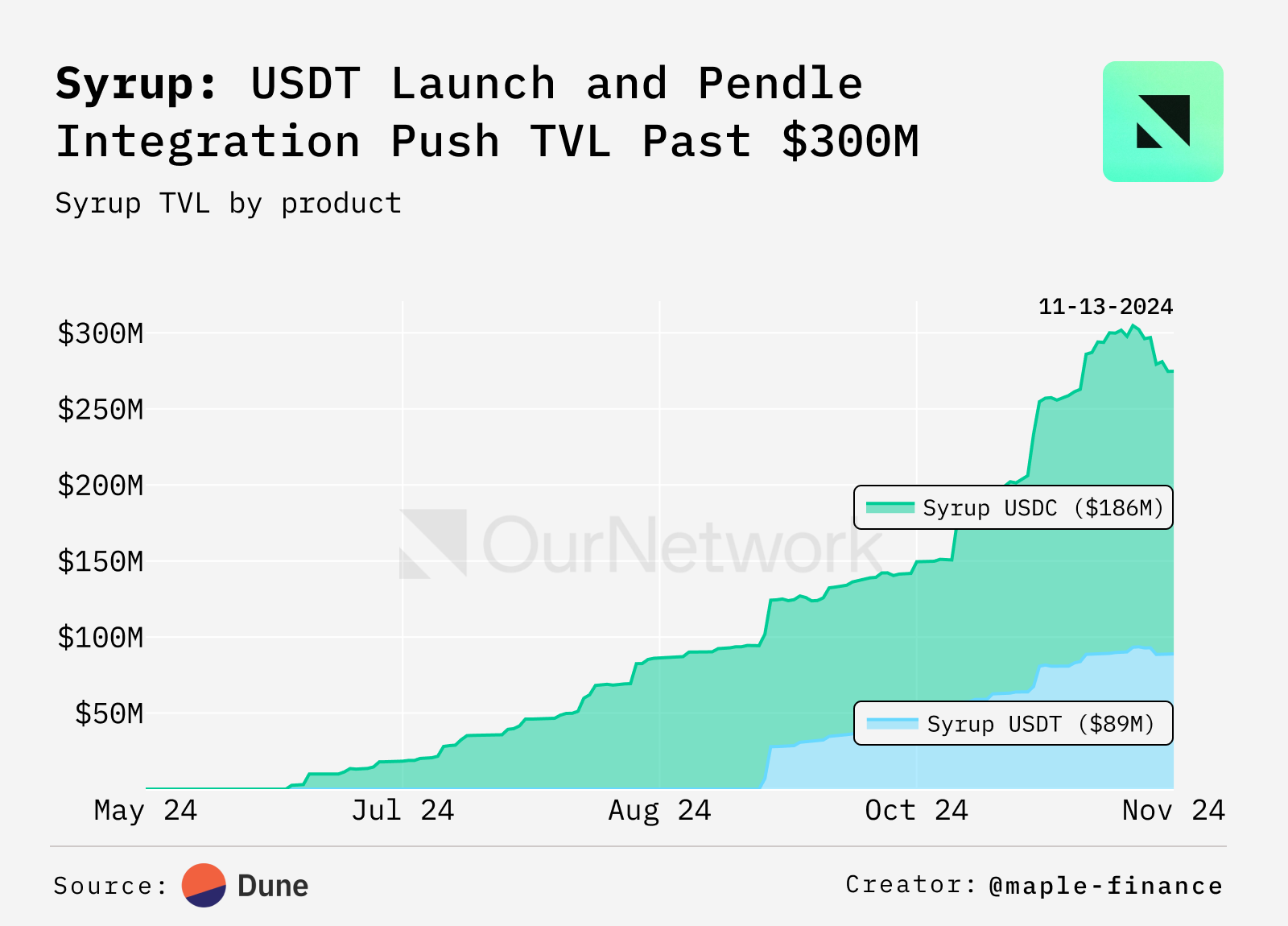

Syrup.fi has been the fastest growing product in the protocol to date. Syrup's yields also come from providing fixed-rate, over-collateralized loans to institutional borrowers. The launch of USDT and integrations with leading DeFi apps like Pendle have caused its TVL to skyrocket to over $300 million in just a few months.

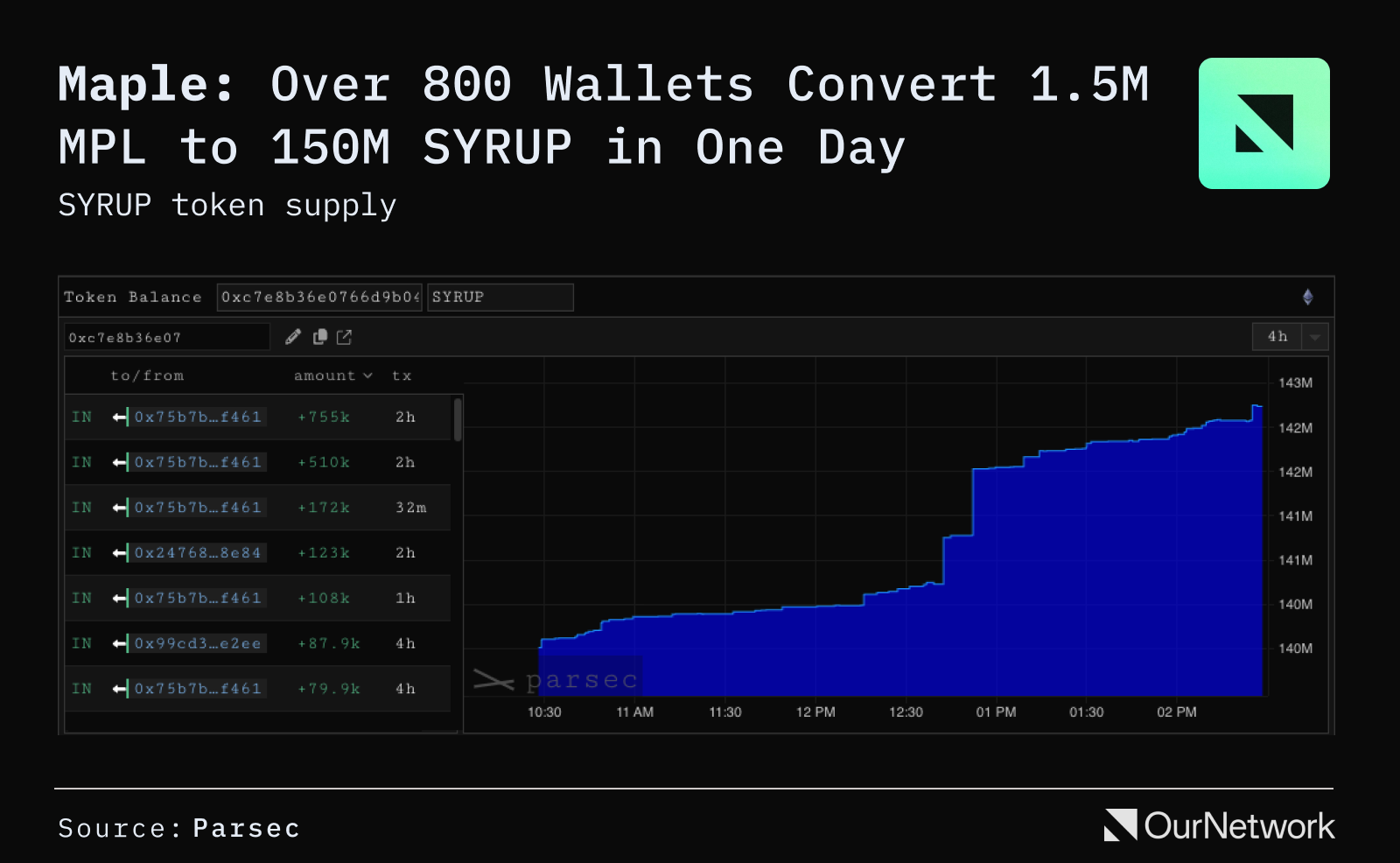

To unify Maple and Syrup under shared governance and share the growth of the ecosystem with the community, Maple DAO has introduced the SYRUP token. 1 MPL token can be converted to 100 SYRUP. In just one day, over 800 wallets have converted over 1.5 million MPL into nearly 150 million SYRUP.

BUIDL

BUIDL fund goes multi-chain, total value surpasses $543 million

This week, the BUIDL fund launched by Securitize and BlackRock expanded beyond Ethereum, landing on Aptos, Optimism, Avalanche, Polygon and Arbitrum blockchains. The BUIDL supply on Ethereum decreased from $557 million to $513 million, but with the addition of these chains, the total supply increased by $30 million to $543 million as of November 14th.

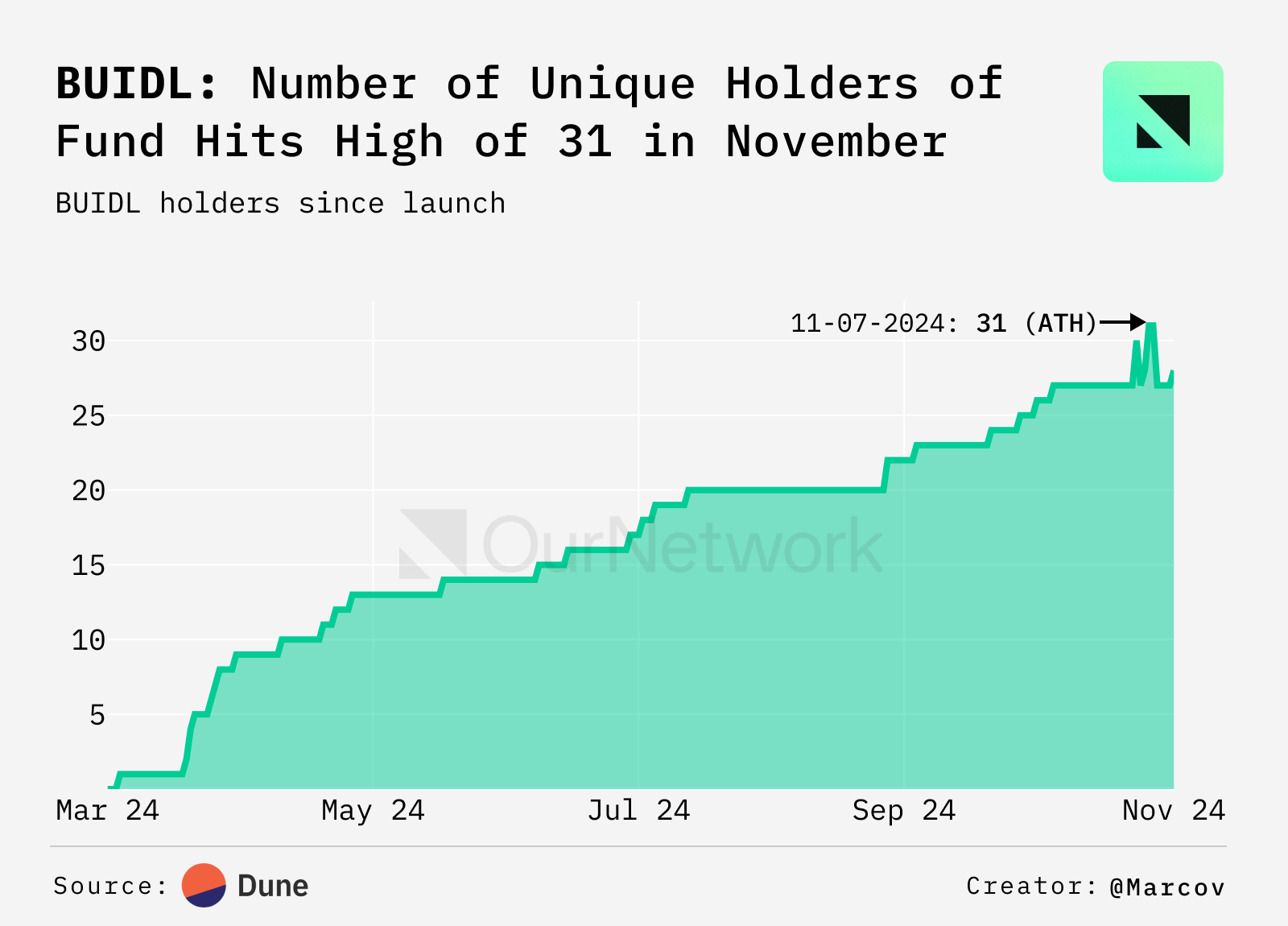

The number of unique BUIDL holders has grown slowly over time, currently at 28. The recent expansion to other chains has not increased the number of holders, as there is overlap in the wallets.

As shown, as of November 14th, 89.6% of the BUIDL supply is on Ethereum, followed by 5.0% on Avalanche, 4.8% on Optimism, 0.3% on Polygon, and 0.3% on Aptos and Arbitrum.