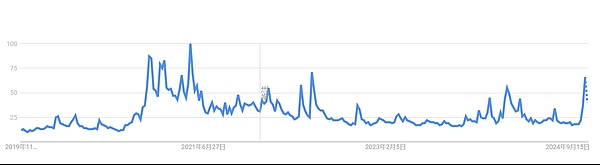

Recently, the price of Bitcoin has broken through $93,000, setting a new historical high, and is just a stone's throw away from $100,000. Google Trends shows that the popularity of Bitcoin has reached a new high since 2021.

In addition, CryptoQuant CEO Ki Young Ju released data showing that the trading volume of Bitcoin retail investors (below $100,000) has reached a new high in 3 years, also indicating that retail investors have entered the market.

After the Bitcoin price rally stagnated and began to fluctuate and consolidate, some funds flowed into meme coins, and some altcoins still performed poorly.

Welcome to the discussion group→→VX: TZCJ1122

In the future, what other catalysts will drive the bullish price rise?

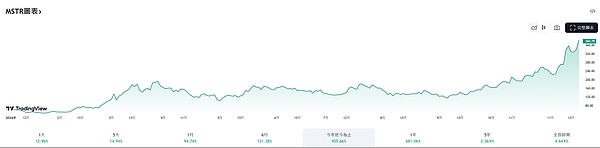

1. MicroStrategy may be included in the S&P 500 index

According to CCN reports, its new accounting standards may allow MSTR to be included in the S&P 500 index.

Data shows that MSTR's US stock performance has been outstanding, with a return of over 450% so far this year.

If MicroStrategy can enter the S&P 500, more qualified companies may be included in the index in the future, thereby gaining more attention and influence from traditional capital. This is undoubtedly a major positive for the crypto market.

2. Microsoft is reviewing a Bitcoin investment proposal

In the Form A filed with the US Securities and Exchange Commission (SEC) on October 24, Microsoft listed the issues to be discussed at the next shareholders' meeting. One of the proposals suggests that the tech company should research Bitcoin to hedge against inflation and other macroeconomic impacts. On October 30, Microsoft shareholders have already begun preliminary voting on whether the company should invest in Bitcoin.

The document also shows that Microsoft will vote on the "assessment of investment in Bitcoin" at its shareholders' meeting on December 10. Although the board of directors has proposed to oppose this proposal, shareholders have different thoughts. Vanguard and BlackRock are Microsoft's current largest institutional shareholders, holding 8.95% and 7.30% respectively.

If the vote is successful, as a listed company with huge influence, it may affect and drive more listed companies to purchase Bitcoin.

3. The Fed may cut interest rates by 25 basis points in December

Crypto assets represented by Bitcoin are increasingly affected by macroeconomic factors, and the Fed's interest rate cut policy still has a significant impact on the inflow of funds into crypto assets.

According to the CME "Fed Watch": the probability of the Fed cutting 25 basis points in December is 61.9%, and the probability of keeping the current interest rate unchanged is 38.1%.

BlackRock's Chief Investment Officer (CIO) Rick Rieder said he still expects the FOMC to cut interest rates by 25 basis points in December. Rieder said the current federal funds rate target range of 4.5% to 4.75% is restrictive. After the rate cut in December, the Fed is expected to pause the rate cuts, and the FOMC will evaluate the number and pace of rate cuts. By 2025, the Fed is expected to cut rates at least twice.

In addition, Goldman Sachs' chief economist Hazus still expects "the Fed to cut interest rates consecutively in December, January and March, and then cut interest rates once a quarter in June and September, but he believes the FOMC may slow the pace of rate cuts faster, possibly as early as the December or January meeting." However, unless the employment or inflation report in November is surprisingly strong, the FOMC is unlikely to skip the rate cut in December.

The Fed's next meeting will be held from December 17 to 18.

In addition to the above three catalysts, Gary, the chairman of the US SEC, who has been criticized by the crypto industry as too harsh, may announce his resignation after Thanksgiving, and Trump will take office as the new US president in January next year, and the future crypto regulatory policy may be more relaxed and friendly.

Current popular Meme tokens: Ambush them

1. BAKKT

Trump's social media company is in deep negotiations to acquire the cryptocurrency trading platform Bakkt;

Currently, Bakkt's contract address has already been released. Bakkt's biggest narrative is the Trump acquisition concept, Trump's acquisition of the digital asset market, and the market value is waiting to break through one billion dollars. Bakkt has become the leader of the Trump acquisition concept, and one hundred million dollars is not an exaggeration? This is Trump after all.

2. LUCE

$LUCE is the only religious meme coin, the Catholic Church has announced "LUCE" (which means "light" in Italian), which is the mascot for the Holy Year 2025.

LUCE is dressed as a pilgrim, wearing a yellow raincoat, wearing worn-out boots, wearing a missionary's cross and a pilgrim's staff, with eyes full of scallop shells - a symbol of hope.

The stimulation of market sentiment, the boost of Binance's expectations, and the unique meme theme have jointly driven their rapid rise.

3. ACT

First, the research on AI+meme, which leads to the judgment on this target, the ceiling of the new track, the high-potential token, and the low market value.

The second point is the judgment on the community. Because this community is truly decentralized, it is a community project that has no boss at all. From the perspective of the token distribution: if you choose a target with 80% of the tokens controlled, then it's just a few people making money, right? Then the exchange users will all become the bag holders, do you think it can rise? This kind of thing is a strong boss coin, and the exchange will not be inclined to choose it to protect its secondary users.

Thirdly, I think it is the relatively rich story connotation of ACT itself, the whole story is a story of a farmer and a snake, which is a process of the entire crypto community uniting to fuck the evil Dev.

The article ends here, follow the public account: Web3团子 for more good articles~

If you want to learn more about the crypto world and get the latest frontier information, feel free to consult me. We have the most professional exchange community, and we publish daily market analysis and high-potential coin recommendations every day. There is no threshold to join the group, welcome everyone to exchange together!

Welcome to the discussion group→→VX: TZCJ1122