Author: Chandler, Foresight News

As the price of Bitcoin continues to rise, its appeal has gradually shifted from retail investors to large institutions with substantial funds and resources. Unlike the previous bull market, where the prosperity of the ecosystem and the entry of institutions were the core drivers of the price surge, in this round of the market, the deep deployment of institutions has become an important variable in driving market development. From the successful approval of spot ETFs to the frequent increase in holdings by traditional financial giants and professional asset management institutions, institutionalization is reshaping the landscape of the Bitcoin market.

In this process, the investment logic of Bitcoin is also quietly changing - from a speculative asset that simply chases price fluctuations, it is gradually evolving into a long-term allocation tool with asset diversification and anti-inflation characteristics. At the same time, the changes in holdings and profitability of major institutions are also closely watched by the market: who is continuously increasing their Bitcoin holdings? Which institutions have already obtained considerable returns from this round of rise? Whether the changes in holding scale have had a significant impact on market prices? This article will focus on introducing the holding situations of several top-ranking institutions.

Panorama of Bitcoin Institutional Holdings: ETFs Become the Dominant Force in the Market

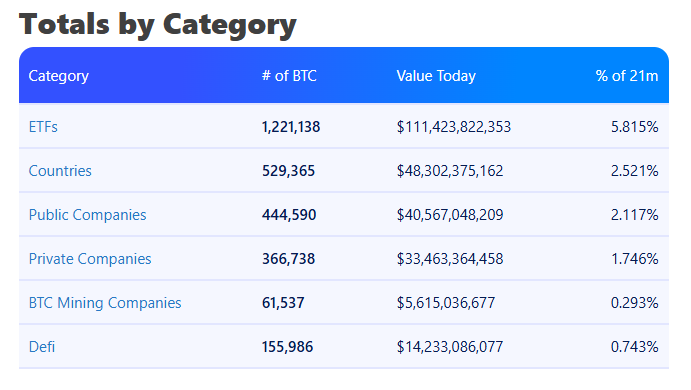

According to data from BitcoinTreasuries.com, as of November 18, 2024, 92 entities (including companies and countries) publicly hold nearly 2.718 million Bitcoins, accounting for 12.94% of the total Bitcoin supply. It can be seen that as Bitcoin is gradually seen as "digital gold", institutional investment in Bitcoin is not only a response to price fluctuations, but also a long-term plan for asset diversification and inflation hedging.

Overview of Bitcoin Institutional Holdings:

The most noteworthy is the proportion of Bitcoin ETFs, whose holdings have reached 5.82% of the total Bitcoin supply. Since the launch of the first U.S. Bitcoin spot ETF in January 2024, the process of traditional institutions encroaching on the Bitcoin market share has been accelerated.

ETF Race: BlackRock in the Lead, Grayscale Adjusts Strategy to Diversify

Bitcoin ETFs provide investors with a convenient way to invest in Bitcoin, especially the U.S. Bitcoin spot ETFs, as a new emerging tool in the market, have attracted a lot of attention. Since its launch in 2021, the ProShares Bitcoin Futures ETF has shown certain capital inflows, but its gap with the spot price of Bitcoin is relatively large, mainly affected by the volatility of the futures market. In January 2024, the first U.S. Bitcoin spot ETF was officially approved, marking a new stage for Bitcoin investment.

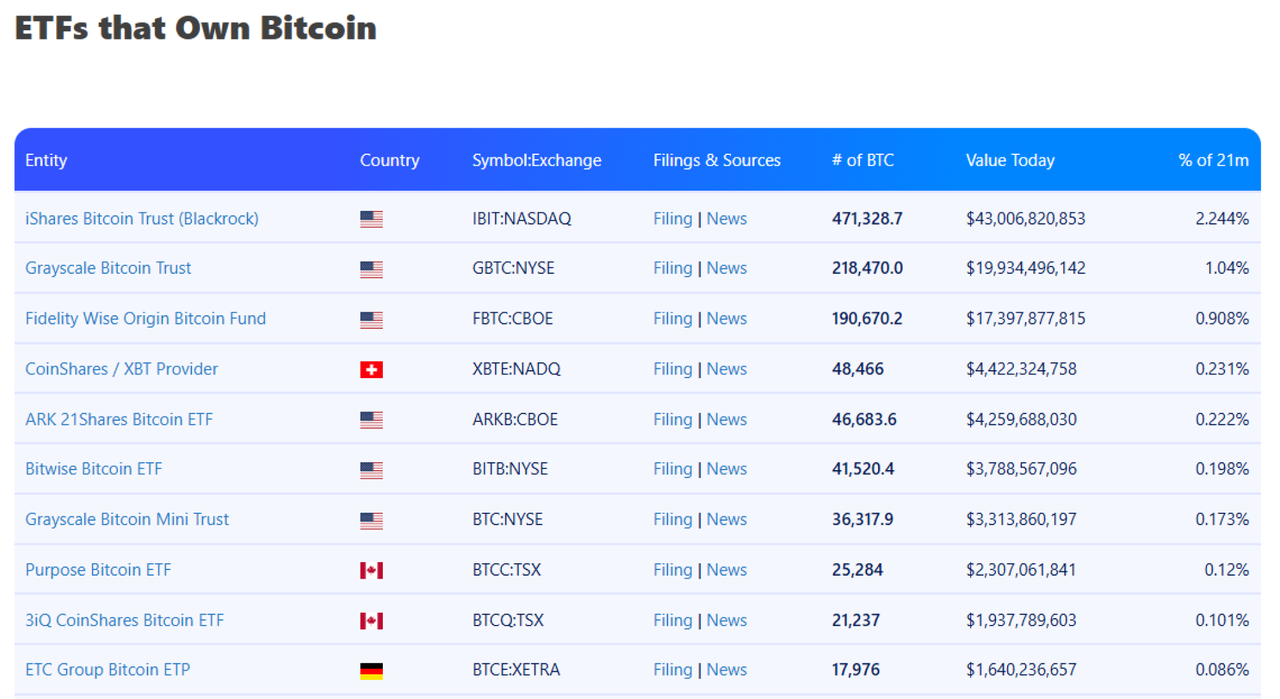

With the launch of Bitcoin spot ETFs, the participation of institutional investors has become more active, and the performance of leading institutions in the ETF holding structure is particularly noteworthy.

Top 10 Bitcoin ETF Holdings:

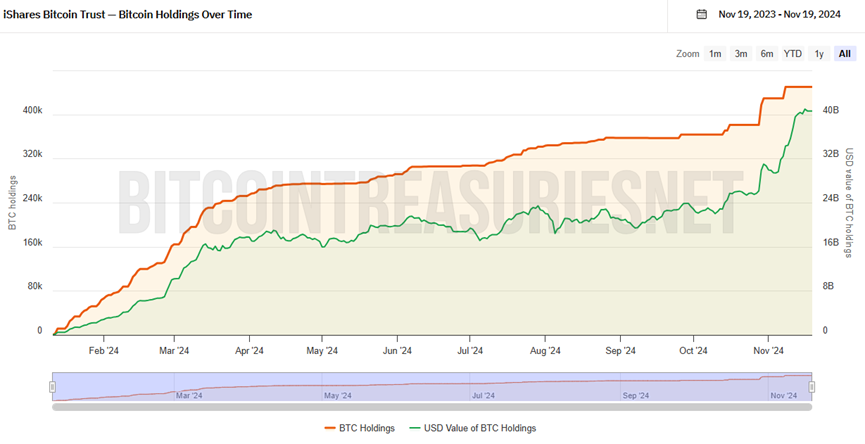

The iShares Bitcoin Trust (IBIT: NASDAQ) under BlackRock firmly occupies the top spot in the "gold-grabbing list" of Bitcoin ETFs. Since it started holding Bitcoin on January 11, 2024, the Bitcoin holdings of this trust have continued to increase. As of November 2024, the iShares Bitcoin Trust holds a total of 471,000 Bitcoins, with a market value of over $43 billion, accounting for 2.24% of the total Bitcoin supply.

According to the purchase history of iShares, BlackRock increased its holdings by more than 1,400 Bitcoins and 2,500 Bitcoins in October and November 2024 respectively, adding nearly 15,000 Bitcoins in just a few months. Based on the market price of Bitcoin at around $30,000 at the beginning of 2024, BlackRock's additional Bitcoin holdings cost about $30,000 per Bitcoin. The current price of Bitcoin is close to $91,000, and BlackRock's holdings have achieved a return of nearly double, with a cumulative profit of about $2.1 billion.

In addition to the Bitcoin market, BlackRock's layout in the digital asset field is also constantly deepening. In March 2024, BlackRock collaborated with Securitize to launch the tokenized fund BUIDL, expanding its influence in the Web3 field. Furthermore, BlackRock is also promoting the launch of an Ethereum ETF, further strengthening its strategic layout in the digital asset investment field.

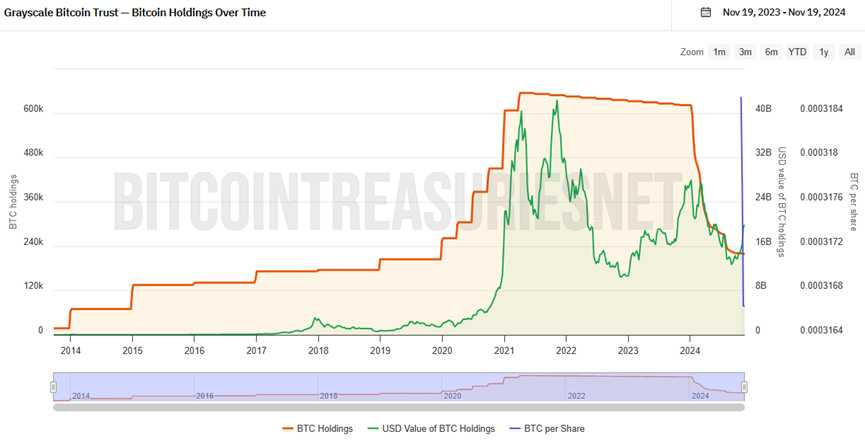

As a veteran institution in the crypto asset management field, Grayscale has been continuously reducing its Bitcoin holdings, from a peak of 654,600 Bitcoins to 218,400 Bitcoins, in contrast to the continuous increase of traditional institution BlackRock.

For Grayscale, which has deeply cultivated the crypto asset field, a more diversified crypto investment portfolio may have greater profit potential. Over the past year, Grayscale has significantly adjusted its investment strategy, accelerating the diversification of its crypto asset layout. Grayscale currently manages trust funds for 14 crypto assets, including Bitcoin, Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), and others. In addition, Grayscale has also launched three thematic funds, focusing on different types of crypto asset investments, such as DeFi, smart contract platforms, and other emerging crypto assets.

Although the main battlefield of institutional investment is still overseas, the Asian market is also worth noting. According to data from SoSoValue, as of November 2024, Hong Kong has launched 6 spot ETFs, including the Bosera Bitcoin ETF and the Hua Xia Bitcoin ETF, among which the Hong Kong Bitcoin ETF has reached an asset size of $428 million.

Focus on Listed Company Holdings: MicroStrategy Far Ahead

Although the Bitcoin holdings of these listed companies are far less than those of asset management companies, by categorizing them, we can see the diverse applications and strategic value of Bitcoin in institutions.

MicroStrategy leads with 331,200 Bitcoins, accounting for 1.58% of the global total. It is the benchmark for corporate Bitcoin reserves. U.S. companies like Marathon Digital, Riot Platforms, Hut 8, and CleanSpark represent the major Bitcoin mining companies in North America, focusing on efficient and environmentally friendly mining, with Marathon holding 25,945 Bitcoins, the most among mining companies. Crypto trading and service providers like Coinbase and Galaxy Digital hold 9,000 and 8,100 Bitcoins respectively, while Germany's Bitcoin Group holds 3,830 Bitcoins, an important participant in the European market.

Top 10 Listed Company Holdings:

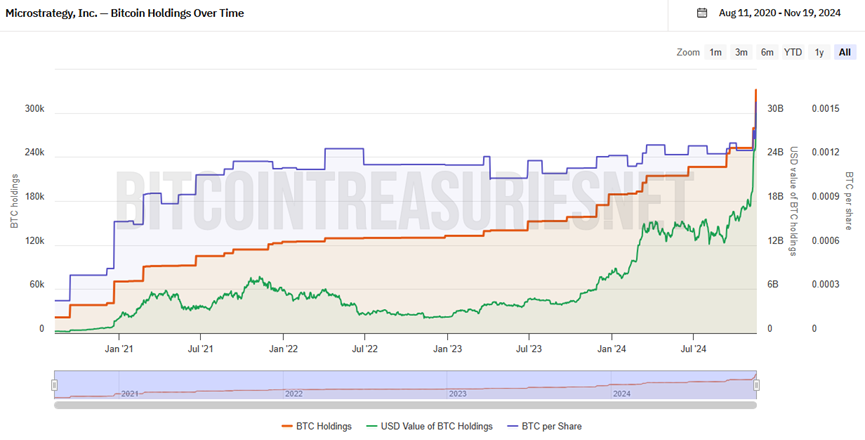

MicroStrategy (MSTR), a global business intelligence (BI) software company, seems to have become a "Bitcoin Pixiu". In August 2020, MicroStrategy announced that it had spent $250 million to purchase 21,454 BTC, becoming the first publicly traded company to implement a BTC treasury strategy.

Furthermore, on November 19, MicroStrategy announced plans to issue $1.75 billion in 0% convertible bonds, and also expects to grant the initial purchasers an option to purchase up to an additional $250 million in notes within 3 days of the initial issuance of the notes. The announcement stated that MicroStrategy intends to use the net proceeds from this issuance to purchase additional Bitcoin and for general corporate purposes.

According to its announcement, MicroStrategy used the proceeds from stock sales to purchase an additional 51,780 Bitcoins for $4.6 billion at an average price of $88,627 per Bitcoin between November 11 and 17, 2024. As of November 18, 2024, MicroStrategy's Bitcoin holdings have reached 331,200 Bitcoins, with an average purchase cost of $49,874. Based on the current market price, the company's Bitcoin investment has achieved a profit of 82.85%.

In addition to MicroStrategy, which stands out as a leader, and mining companies that continuously accumulate Bitcoin through mining, other listed companies are relatively cautious in their Bitcoin holdings, and tend to treat it as part of a diversified asset allocation.

As the founder and CEO of Tesla, Elon Musk has always been a key figure in the cryptocurrency field. In February 2021, Tesla announced that it had purchased $1.5 billion worth of Bitcoin and planned to support Bitcoin payments, which generated a huge response in the market. Although due to environmental concerns, Tesla suspended Bitcoin payments in May of the same year, the company did not completely sell off its holdings, only selling 4,320 bitcoins in March 2021 and further reducing its holdings by 29,160 bitcoins in June 2022, and has since maintained its holdings.

As of November 18, 2024, Tesla still holds 9,720 bitcoins, with a current market value of approximately $914 million.

Institutional push drives long-term recognition of Bitcoin's value

Overall, the long-term bullish sentiment of institutions towards Bitcoin as a cryptocurrency asset is becoming increasingly clear. As large institutions such as BlackRock and Grayscale continue to increase their Bitcoin holdings and strengthen their strategic deployments in areas such as Web3 and Ethereum through diversified digital asset layouts, Bitcoin is expected to occupy a more stable position in global asset allocation in the future.

Although the trend of concentration of Bitcoin holdings may pose certain challenges to the decentralized nature of Bitcoin, this is not necessarily negative. On the contrary, with the participation of large institutions and enterprises, the Bitcoin market is expected to gain greater recognition and support, and continue to play an important role in the global financial system.

On the one hand, the participation of large financial institutions and enterprises has brought more trust and stability to the Bitcoin market. The in-depth participation of these institutions reflects their confidence in the long-term value of Bitcoin, further promoting the acceptance and adoption of Bitcoin globally. This trend can provide strong support for Bitcoin prices, while also increasing market liquidity and attracting more investors to the market. On the other hand, although the concentration of holdings has increased to some extent, the decentralized network structure of Bitcoin remains solid. Numerous distributed nodes around the world ensure the independence and risk resistance of the Bitcoin network. The participation of large institutions has helped to promote the development of Bitcoin technology and the enhancement of network security, further consolidating its position as digital gold.

Furthermore, from the perspective of industry development, the in-depth participation of institutions can to some extent establish Bitcoin as a legitimate investment tool, and can also promote the maturity and stability of the market. This trend may lead to a more positive regulatory attitude, creating favorable conditions for the compliance and legalization of the digital asset market, and promoting the entire industry to develop in a more robust direction.