The campaign to hold Bit in the US is continuing to gain momentum, with more and more people expressing their support every day. With support at the state and national level, the outlook for the US to hold 1 million Bit (BTC) continues to grow.

However, there are also critical views, with some arguing that holding Bit would be detrimental to the US.

VanEck supports strategic Bit holding campaign

Matthew Sigel, head of research at VanEck, announced that he fully supports strategic Bit holding, suggesting that institutional support for this concept is growing.

"Announcement: VanEck supports strategic Bit holding. No need for 'sources' — we're telling you directly," Sigel declared.

The Bit holding movement aims to position Bit as a reserve asset held by states or countries, and is gaining momentum. This follows the public support of former President Donald Trump four months ago. In his speech, Trump proposed replacing SEC Chair Gary Gensler and emphasized Bit's potential to strengthen national reserve assets. He said, "Holding Bit is the future," sparking a wave of interest among policymakers and financial institutions.

Key political figures, especially Senator Cynthia Lummis, have also expressed their support. Lummis recently proposed selling some of the US's gold holdings to acquire Bit. The long-time Bit supporter believes that diversifying the nation's reserve assets with digital currency can strengthen fiscal resilience. Her efforts have sparked discussions in Congress about the merits of such a measure.

Meanwhile, US states are also jumping into the competition. Florida's CFO has publicly endorsed a Bit holding strategy. Similarly, the Pennsylvania state legislature has recently introduced a bill supporting state-level Bit holding.

This campaign has expanded beyond the US. Sławomir Mentzen, a libertarian leader in Poland, has promised to pursue a national Bit holding strategy if elected. Mentzen's pledge reflects the international appeal of Bit as a modern monetary asset that can hedge against inflation and strengthen fiscal sovereignty.

Fox Business: "BlackRock does not support US strategic BTC holding"

As the Bit holding movement gains traction, the world's largest asset manager, BlackRock, is taking a more cautious stance. While VanEck has publicly endorsed the concept, Fox Business reporter Eleanor Terrett reported that BlackRock is skeptical.

"A source close to BlackRock told Fox Business that the giant asset manager does not support strategic BTC holding," Terrett shared.

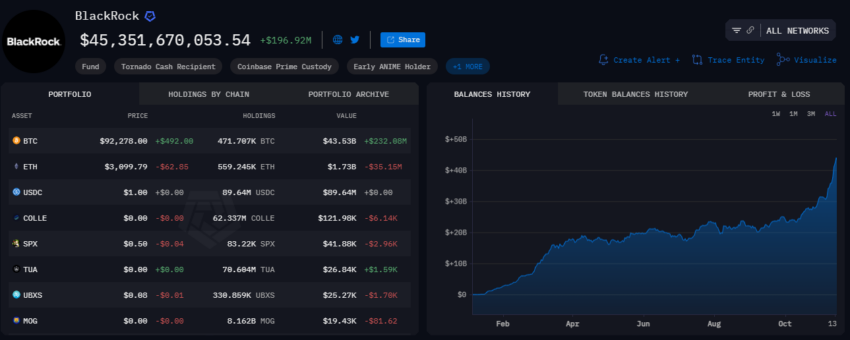

However, BlackRock's actions paint a more complex picture. The company's Bit ETF has recently surpassed $40 billion in AUM, setting an industry speed record. BlackRock has also significantly invested in MicroStrategy, a company known for its large Bit holdings, increasing its Bit exposure. The asset manager has also acquired $680 million worth of Bit through the IBIT ETF. Meanwhile, critics remain skeptical about BlackRock's intentions.

"BlackRock is playing the Franklin Templeton game — they're pushing the ETF, but they know they're really here for tokenization," one user shared on X.

This view suggests that BlackRock's ultimate goal may be the broader application of Block technology for asset tokenization, rather than Bit adoption. Meanwhile, according to data from Arkham Intelligence, BlackRock's Bit holdings currently stand at 471,707 BTC, worth approximately $4.53 billion at the time of writing.

Amid the growing skepticism, billionaire investor Mike Novogratz has recently questioned the feasibility of a US Bit reserve. Novogratz believes that Bit is too volatile and politically divisive to become a core government asset in the short term.

"The odds are low. The Republicans control the Senate, but they're not close to 60 seats. It would be wise for the US to utilize the Bit it has and add a little more... I don't think the dollar needs to be backed," Novogratz argued.

Despite the diverse opinions, the Bit reserve campaign is clearly gaining momentum. It is attracting the attention of policymakers, financial institutions, and private investors around the world. Through state-led initiatives, international adoption, or institutional investments like BlackRock's ETFs, Bit's role in the global financial system continues to grow.

"There is a new optimism not only about the macro environment, but also about the clarity of regulations on Bit and digital assets following the US elections. The elected President Donald Trump has pledged to maintain a strategic Bit reserve, and pro-crypto politicians have succeeded in congressional primaries on both sides. The combination of the macro environment and supportive policies could accelerate and expand the adoption of Bit," BlackRock shared.

Van Eck's public endorsement and the growing interest of Senator Lummis and international leaders could mark a turning point in the integration of digital assets into mainstream financial strategies.

As the debate intensifies, it remains uncertain whether Bitcoin will become the digital gold standard of the digital age, or whether the volatility and skepticism of major players like BlackRock will hinder its adoption as a reserve asset.

At the time of writing this, Bitcoin has risen 1.40% from the previous day. According to BeInCrypto data, the leading cryptocurrency is trading at $93,601.