Introduction

The Bitcoin market continues to heat up! According to OKX spot data, Bitcoin price hit a new all-time high on November 21, 2024, reaching a peak of $95,880, with a gain of over 4% in the past 24 hours. This trend not only ignites the enthusiasm of investors, but also allows companies closely related to Bitcoin to reap huge profits, with MicroStrategy (MicroStrategy) becoming the focus of market attention.

Latest Bitcoin price trend

Bitcoin price soars, MicroStrategy's unrealized gains exceed $15 billion

As the world's largest corporate holder of Bitcoin, MicroStrategy's holding gains have soared with the rise in Bitcoin prices. Data shows that as of now, MicroStrategy holds a total of 331,200 Bitcoins. Calculated at the current Bitcoin price of $94,800, the total value of these Bitcoins is about $31.7 billion, while MicroStrategy's cost basis is only $16.518 billion, with unrealized gains exceeding $15 billion.

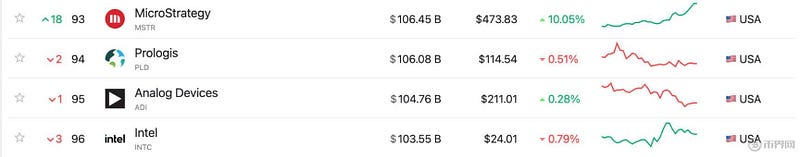

MicroStrategy joins the top 100 U.S. companies, with a market value exceeding $100 billion

Driven by the strong performance of Bitcoin, MicroStrategy's stock price has also hit new highs. On Wednesday, the stock reached a high of $498 during the session, making its market value exceed $100 billion for the first time, successfully entering the top 100 U.S. companies by market value, rising from the previous 111th place to 93rd place. Bloomberg senior ETF analyst Eric Balchunas commented that MicroStrategy's trading volume on November 19 exceeded that of Tesla and NVIDIA, making it one of the highest daily trading volume stocks in the U.S., demonstrating its remarkable market vitality.

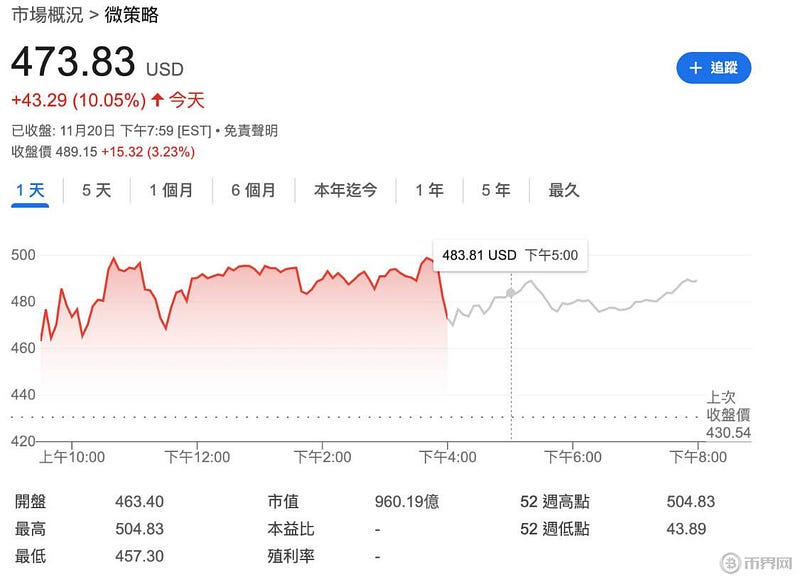

MicroStrategy's stock performance far exceeds Bitcoin and NVIDIA

MicroStrategy not only benefits from holding Bitcoin, but its stock performance has also amazed investors. As of Wednesday's close, MicroStrategy's stock price was $473.83, up more than 10% for the day, and further rose to $489.15 after hours, up more than 3%. The stock has accumulated a year-to-date gain of 591.52%, far exceeding Bitcoin's 113.18% and also surpassing the 202.86% gain of chip giant NVIDIA.

Since 2020, after MicroStrategy has included Bitcoin on its balance sheet, the stock price has cumulatively risen about 3,025% in nearly 5 years, even surpassing NVIDIA's 2,668% in the same period. This outstanding performance fully reflects the "diamond hand" strategy of its founder Michael Saylor. He insists on viewing Bitcoin as "digital gold" and a long-term value storage tool, and has increased his holdings instead of reducing them.

Bitcoin year-end target: Break through $100,000?

MicroStrategy founder Michael Saylor recently predicted on the social media platform X that Bitcoin may break through the psychological barrier of $100,000 before the end of 2024. He even plans to host a New Year's Eve party to celebrate this milestone and has launched a related poll. Data shows that more than 85% of participants believe that Bitcoin will break through $100,000 on New Year's Eve 2024.

Saylor's optimistic attitude is not without basis. With the continued influx of institutional investors, the widespread launch of Bitcoin ETFs, and the erosion of traditional currencies by inflation, Bitcoin is gradually consolidating its position in global asset allocation.

Market Outlook: Can Bitcoin Continue to Set New Records?

Whether Bitcoin can break through the $100,000 mark by the end of the year has become a focus of attention for global investors. Here are some key factors driving the rise in Bitcoin prices:

1. Inflow of institutional capital

With the launch of the first spot Bitcoin ETFs in the U.S., Bitcoin's liquidity has significantly improved, attracting more institutional investors to enter the market.

2. Inflation and demand for safe-haven assets

The ongoing global economic uncertainty and inflationary pressures have further highlighted the value of Bitcoin as "digital gold".

3. Market sentiment and confidence

The support of large companies like MicroStrategy for Bitcoin has boosted market confidence, while positive discussions about Bitcoin on social media platforms have further fueled the enthusiasm of retail investors.

4. Scarcity of supply

As the Bitcoin halving cycle approaches, its supply will be further reduced, and this scarcity may drive up prices in the future.

Outlook for Bitcoin

The strong performance of the Bitcoin market has not only boosted its own price rise, but also made MicroStrategy a star company in the capital market. As the year-end approaches, market expectations for Bitcoin to break through $100,000 are growing stronger.

Regardless of whether Bitcoin can achieve this goal, the long-term investment value behind it has gradually been validated. The successful case of MicroStrategy also provides a powerful reference for other companies to incorporate Bitcoin into their asset allocation. In the future crypto market, Bitcoin may still play a more important role, bringing more opportunities for global investors.