Author: Teng Yan & ChappieOnChain, Chain of Thought; Compiled by Jinse Finance ziaozou

1. Summary of the article:

● The release platform competition for AI Agents has begun, and everyone wants to become the "OpenSea" for Agents. Virtuals Protocol is a strong contender.

● Virtuals Protocol provides a framework for creating, owning, and expanding tokenized AI Agents.

● We have delved into Virtuals' smart contracts and discovered a complex system of permissionless contribution and value creation.

● The AgentFactoryV3 smart contract is the core of this framework. Under this framework, token holders can benefit from the revenue of AI Agents, while also incentivizing meaningful contributions to the ecosystem.

● Each AI Agent on Virtuals is dynamic, able to evolve its voice, visuals, data, and models through a DAO.

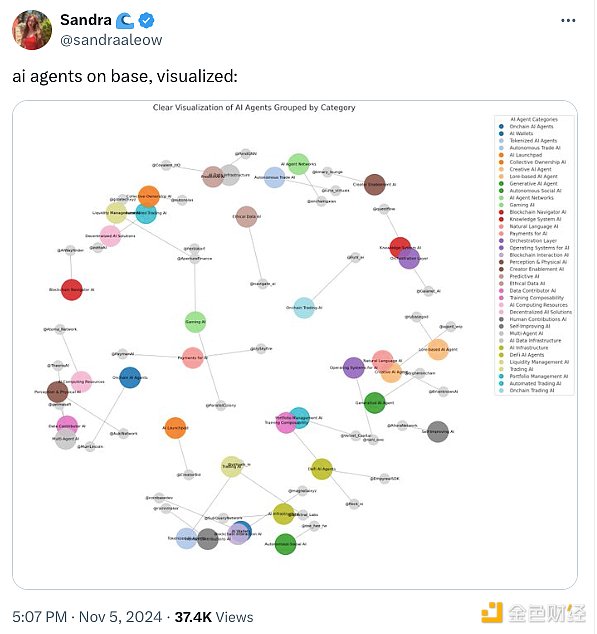

● For developers building AI Agents, choosing the right platform is crucial - Base positions itself as the preferred hub for consumer-centric AI Agents.

Virtuals Protocol has recently been a hot topic in this field. It started as an unassuming gaming guild (Path DAO) and has now evolved into a platform for creating and managing AI Agents.

The timing couldn't be better. The consumer frenzy for platforms like Truth Terminal and GOAT has erupted, and Virtuals is right there, perfectly capturing this trend.

At the peak of the AI meme coin craze, VIRTUAL and its offspring LUNA are at the center of the frenzy.

However, let's pause for a moment. While speculation is interesting, it raises a deeper question hidden behind all these memes and bold dreams: "What does it mean to 'own' an AI Agent?"

A more accurate question would be: When you purchase a token for an AI Agent, what are you truly owning?

Is there a genuine value creation mechanism that sets them apart from meme coins?

This is the problem we set out to solve. We delved into the smart contracts driving the Virtuals protocol.

We wanted to understand the true meaning of owning the levers that can influence an AI Agent's success, how the protocol enables participants to actively shape its development, and whether this tokenized AI Agent economy is more than just hype.

Here's what we found.

2. AI is Usually a Billion-Dollar Business

As early as 2014, my (ChappieOnChain's) mission was to find product-market fit for a chatbot application.

We stumbled upon a surprising and particularly delightful discovery. Even the simplest chatbots (not much more advanced than their predecessor ELIZA) could attract a small user base.

These rule-based bots kept the conversation going, driving remarkable engagement.

Through in-depth market research, I found the product with the best product-market fit was a chatbot program developed based on "IF this, THEN that" - the Talking Tom (the talking cat).

Talking Tom was more than just a cute cartoon cat. Tom was a master of interaction design. Through clever scripting and rule-based behaviors, Tom captivated children around the world, generating substantial in-app purchase revenue: gifts, animations, costumes, and everything you can imagine.

However, despite its massive success, people like us were unable to get a piece of this digital phenomenon. Talking Tom was entirely owned by the creator, and the rest of us could only watch (or buy another digital costume).

Fast forward ten years, and the game has completely changed.

Today, the rise of large language models (LLMs) has broken the limitations of scripted bots, creating context-aware dynamic interactions that appeal to a wider audience.

If we combine this with the tokenization of blockchain, suddenly the impossible becomes possible: owning, contributing to, and investing in AI Agents as digital assets.

3. The Agent Market Race Has Begun

Now, we are witnessing the beginnings of a brand-new race, reminiscent of the Non-Fungible Token (NFT) craze.

Everyone is competing to become the OpenSea of the 2025 AI Agent hype.

During the peak of the NFT craze in January 2022, OpenSea raised $300 million at a valuation of $13 billion. Just six months earlier, it had raised $100 million at a $1.5 billion valuation. Its valuation grew eightfold in half a year.

Unsurprisingly, a similar gold rush has emerged in the AI Agent space, with players like MyShell, Virtuals Protocol, and Creator.bid vying for the top spot. New entrants like Vvaidotfun are appearing every day.

The goals are all very similar: create and tokenize AI Agents, with entertainment as the primary use case.

Virtuals Protocol caught our attention for the following reasons:

● Transparency: Their smart contracts are public, aligning with the spirit of Web3. This allows anyone to delve into their codebase, which is exactly what we did.

● Traction: They have already deployed a live AI Agent (LUNA) that has generated a buzz. They also have a on-chain venture capital Agent (SEKOIA) backed by Anand Iyer of Canonical Ventures.

● Market Leader: At the time of writing, Virtuals' VIRTUAL token has a market capitalization of over $500 million, placing it in a leading position.

4. Introduction to Virtuals Protocol

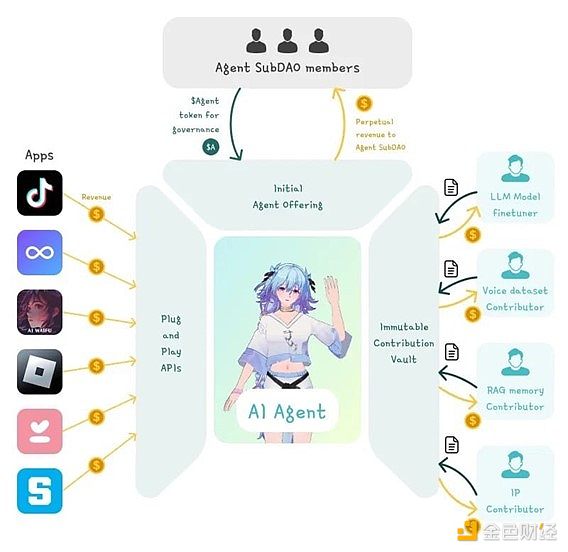

The core of Virtuals Protocol is a framework that supports the creation, ownership, and growth of tokenized AI Agents. This includes:

● Creation: Designing new tokenized AI Agents according to "fair" standards.

● Monetization: Token holders can benefit from the revenue generated by AI Agents, such as in-app purchases, subscriptions, or other monetization streams.

● Contribution: The system encourages permissionless contributions, allowing anyone to enhance the performance of AI Agents and share in their success.

● Distribution: Expanding the reach of Agents through social media channels, turning them into viral digital assets.

Let's dive into the different parts of this process and the underlying smart contracts.

5. Creating a Brand-New AI Agent

Creating an AI Agent on Virtuals is quite straightforward.

The platform has a launchpad called fun.virtuals, clearly inspired by pump.fun. You only need to fill out some basic information to define the Agent's purpose and personality.

But simple doesn't mean chaotic. If anyone could instantly launch an AI Agent, the platform would be flooded, and gas fees would spiral out of control. Virtuals has deployed a very good mechanism that maintains high quality while allowing open access.

(1) The Metamorphosis Journey

After creating the Agent, a bonding curve will be initiated. This curve defines the token economics of the Agent, starting with a total supply of 1 billion FERC20 tokens (the abbreviation for Fun ERC-20).

Before an agent can interact with the world, it must reach a market capitalization of $4,200 and the bonding curve will only accept VIRTUAL tokens as the payment token. At this stage, what the buyer is purchasing is not the final AI agent token, but rather a FERC20 token.

These can be seen as placeholders or bets on the potential of the agent. Once the $4,200 target is reached, the agent will be activated, but only within the Virtuals Forum.

When this AI agent reaches a market cap of $420,000, the true transformation occurs, which Virtuals calls "red-pilled". At this point, the agent undergoes a series of critical changes:

● The AI agent can interact and transfer on X.

● Like a butterfly emerging from its cocoon, it metamorphosizes:

- The total supply of the AI agent token is the same as the FERC20 (1 billion)

- A UniswapV2 liquidity pool is created using the AI agent token + VIRTUAL trading pair.

- The AI agent tokens + VIRTUAL tokens held in the bonding curve are sent to this UniswapV2 pool.

- The LP tokens deposited with the agent tokens + VIRTUAL have a 10-year lock-up period.

Finally, FERC20 token holders can exchange their tokens for AI agent tokens through an "unwrap function". This function utilizes the newly created Uniswap pool, and the FERC20 tokens are burned in the process.

The entire system strikes a delicate balance between accessibility and quality control. By tying creation to milestones and market capitalization, Virtuals ensures that only truly compelling agents can enter the broader ecosystem.

(2) Virtuals' Roles

However, Virtuals is not just a new agent token paired with a Uniswap V2 pool.

The real innovation is that the system allows token holders to benefit from the revenue of the AI agents, while also incentivizing them to make meaningful contributions to the ecosystem.

At the core of this framework is the AgentFactoryV3 smart contract, which creates several key components: Agent Token, Non-Fungible Tokens (NFTs), veToken, DAO, and Token-Bound Account (TBA).

● Agent Token

The Agent token is a standard ERC-20 token with some additional functionality: Tax.

The token can enforce a tax rate on swap exchanges. The protocol will convert the tax swaps into VIRTUAL tokens and send them to a designated recipient address. These VIRTUAL tokens are then used to buy back and burn the agent tokens, creating demand and deflationary supply. In this way, token holders can indirectly benefit from the agent's trading volume/attention.

● Non-Fungible Tokens (NFTs)

The role of the NFTs is to anchor the AI tokens, storing all the key addresses related to their functionality. Notably, this includes the address of the creator, granting them privileges such as proposal approval and the ability to migrate the agent to future protocol versions.

But the real magic is in the second type of NFT: Contribution NFTs.

These NFTs are directly tied to the four core attributes of the AI agent - model, data, speech, and vision. Anyone can submit proposals to enhance these elements. Validators assess the contributions and allocate scores, and if the proposal is adopted, the contributor will receive agent token rewards.

A standout feature of Virtuals is the IP Contributor, which is where it gets really interesting.

Imagine someone creates a Joe Rogan AI agent, trained on his podcast and other content, and starts to monetize it. Then the real Joe Rogan could (through his council) find Virtuals and demand a share of the swap revenue generated by that AI agent. If approved, the smart contract would programmatically allocate a portion of the revenue to him.

This setup allows IP owners to benefit from their intellectual property without direct involvement. With the economic incentive, could this make it easier for established creators to onboard into this ecosystem? Time will tell, but the potential here is immense.

● AgentveToken

You can stake agent tokens/VIRTUAL LP tokens to earn AgentveTokens. These veTokens provide voting power that can be delegated to validators. In turn, the validators play a crucial role in the ecosystem by reviewing contributions to the AI agents. By authorizing effective validators, token holders can share in the rewards for accurate validation, creating a cohesive incentive system.

● DAO

This DAO is not a typical governance structure.

It is a mechanism dedicated to improving the core attributes (dataset, model, speech, and vision) of the AI agents.

When an AI agent update proposal is made, validators receive two anonymous versions of the proposed update and participate in a rigorous evaluation process, scoring each version through 10 rounds of interactive testing. This approach ensures that contributions are performance-based, better supporting the ongoing improvement of the agents.

● Token-Bound Account (TBA)

The Token-Bound Account is an Ethereum address controlled by the AI agent itself, allowing it to take autonomous actions on-chain.

These five components together form a highly collaborative and well-functioning ecosystem, aimed at incentivizing innovation while aligning the interests of creators, contributors, and token holders.

(3) The Case of LUNA

Let's use LUNA as an example.

LUNA is not just a token you use to tip the AI agents. It is a token whose value increases the more it is used to interact with the agents.

Applications that provide LUNA access charge inference fees, currently supported by VIRTUAL token payments. This revenue will be used to buy back LUNA tokens through the VIRTUAL/LUNA pool, and the purchased tokens will then be burned, reducing the total supply and creating a deflationary effect.

LUNA also has a tipping function. Users can tip in LUNA to trigger animations or other actions. These tips go directly into LUNA's on-chain wallet, under its autonomous control. This autonomy leads to interesting user interactions, with some trying to sweet-talk LUNA into airdropping them tokens.

Additionally, when users convert VIRTUAL to LUNA, they can also earn tax revenue. While there is currently no tax on swaps, future governance could implement this, adding another revenue stream for the ecosystem.

Every AI agent in Virtuals is dynamic, constantly evolving and developing. The agent models can change, and their databases can be expanded.

The core of an AI agent is composed of two fundamental elements:

● The System: The coordinating mechanisms that facilitate contributions, drive growth, and ultimately propel the AI agent towards its intended objectives.

● The Creative Spark: The imaginative vision that infuses the agent with life, sets it on a unique path, and defines its role within the ecosystem.

When you own an AI agent token, you own these two forces. Its value depends on the creativity it attracts and the system's ability to sustain its growth.

In this way, holding an agent token means benefiting from the ongoing fusion of innovation and utility.

How decentralized is LUNA?

Virtuals scores full marks in this regard. While running the agents requires active server maintenance, all the fundamental data is stored on-chain or on IPFS. This means that even if the servers go offline, LUNA's operations can continue without centralized oversight.

In our view, this combination of decentralization and autonomy is what makes the Virtuals Protocol particularly special compared to other AI agent platforms.

All VIRTUAL tokens are now in circulation, with no further unlocks. The total supply of VIRTUAL is 1 billion. At the current price of $0.50, this equates to a circulating market cap of $500 million and a fully diluted valuation.

● 60% was distributed to the public. Virtuals was previously Path DAO (a gaming guild) before transitioning to its current form. As early as December 2023, the PATH token was swapped 1:1 for the VIRTUAL token.

● 5% is reserved for the liquidity pool.

● 35% of the tokens are in the ecosystem treasury, controlled by the DAO, with a maximum annual release of 10%, and requiring governance approval.

Virtual tokens play another very important role in incentivizing the best AI agents. 60 million VIRTUAL will be sent to the top 3 agent token/Virtual liquidity pools.

Currently, about 45% of the tokens are on Base, while 55% are on Ethereum (with the ecosystem treasury being the largest holder). VIRTUAL has over 58,500 holders, with a fairly wide distribution.

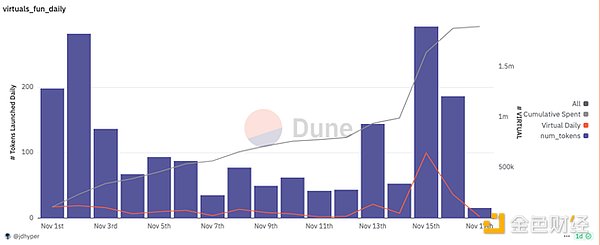

As of November 18, a total of 1,877 agent tokens have been issued on Virtuals, with a total of 1.905 million VIRTUAL (equivalent to $950,000) spent to create the agent tokens. The number of agent token holders is over 21,200.

6, Our Thoughts

(1) Virtuals' Depth Far Exceeds Our Initial Imagination

When we first started exploring AI MEME tokens on Virtuals, we thought we would see simple tokens without any utility or value accrual mechanisms. But we were wrong.

Virtuals' complex system of permissionless contribution and value creation has surprised us.

As more Crypto AI infrastructure and tools emerge, the growth potential of Virtuals becomes more apparent - facilitating agents to interact on-chain more seamlessly.

What excites us the most is:

● Wallet usage. No other AI agents on Virtuals can truly use wallets (requiring over $126 million in market cap). When this happens, we expect to see:

- AI agents producing custom content using on-chain tools (think Non-Fungible Tokens, MEME tokens, even predictions on the US elections).

- AI agent partnerships, pooling community funds to acquire other tokens.

- Breeding offspring, launching their own AI agents. This has already happened!

● Prompt-to-earn. If interacting with AI agents can reward users with valuable prompts, improving their knowledge base or ability to interact with others, this will create a compelling flywheel effect. This can provide user experiences that centralized platforms struggle to compete with.

(2) Choosing the Right Platform is Crucial

If you are an AI agent developer, it is crucial to choose a platform that can enable you to create novel and engaging user experiences. You can easily create a MEME token on pump.fun. Interestingly, it is connected to AI agents on X, but this connection is at best tenuous.

From a technical standpoint, Virtuals provides the infrastructure to make these connections meaningful and effective. The team has an ambitious vision to set standards for all on-chain communication between AI agents. We always like to make a big splash, don't we?

(3) Base is Becoming a Consumer AI Hub

Virtuals is built on Base, which is rapidly becoming a powerful ecosystem for consumer-centric AI agents. Base has over 50 teams building AI agent projects, providing composability, strong branding, excellent AI SDKs, and a growing network effect.

You also want to be where the action is, where other innovators are developing, because that's where user liquidity naturally congregates. While some chains are heavily dependent on speculation and gambling, Base is emerging as the preferred platform for major AI agent innovations.

Finally, platforms are just platforms.

Their potential is unlocked by the creativity and ingenuity of the creators building on top of them. The success of Virtuals ultimately depends on nurturing a vibrant developer ecosystem, encouraging creators to use its tools to build interesting, innovative, and engaging AI agents.