This morning, Justin Sun announced that he had purchased the recently popular banana $BAN for $6.2 million, and commented that "this is not just an artwork, it represents a cultural phenomenon, connecting the worlds of art, Meme and the cryptocurrency community, and I believe this work will inspire more thinking and discussion, and become a part of history.

VX: TTZS6308

As soon as this news was released, the Meme coin Ban, which has a Cattelan banana background and is listed on the Binance contract, rose by about 20% in 5 minutes, with a market capitalization briefly exceeding $230 million, but may be affected by the overall price correction of the Meme sector, and Ban has now fallen back to $160 million.

Previously, Elon Musk forwarded a photo of a large Banana sculpture alongside the SpaceX Starship on X, and responded with a "laughing" emoji, which may have contributed to a nearly 20% short-term rise in Ban.

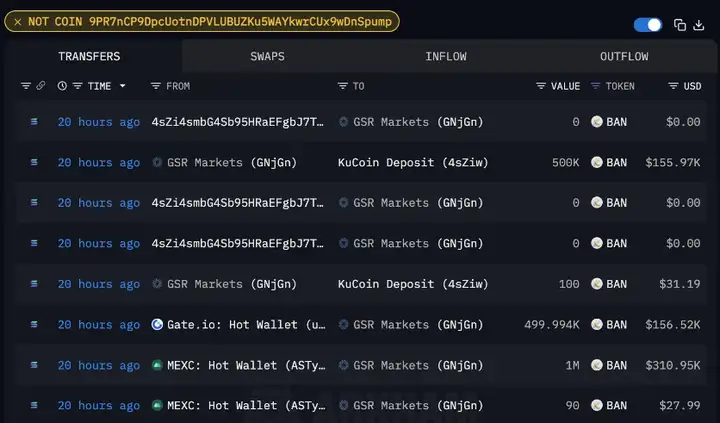

In addition, GSR Markets may be a market maker for the Meme token BAN. According to on-chain monitoring, the GSR wallet GNjGn...4iBW4 (tagged by Arkham) withdrew 1.5 million BAN from Gate and MEXC on November 18, and subsequently deposited some of it into Kucoin; the wallet G13si...zWCdu deposited $2.28 million worth of BAN into GATE, with the SOL required for the transfer provided by GSR.

Riding on the Sotheby's auction, the SpaceX Starship, listing on Binance, and GSR Markets making a market, the Meme coin Ban has frequently generated high heat and attention, accumulating multiple buffs, but the coin price has not performed as well as expected. Is it still worth chasing?

Is Ban still worth chasing?

The short-term hype heat may decline significantly, and in the past few days, most popular Memes have seen price corrections of over 30%. The current trend direction is highly uncertain.

However, as a Meme coin, Ban has managed to "ride on" both the Sotheby's auction and the SpaceX Starship, maintaining ongoing discussion heat. Therefore, in my personal opinion, Ban is worth adding to the "self-selected Meme observation list", closely monitoring large buy-in addresses for Ban, as there may be opportunities for a "second boarding".

Many people may belong to the category of those who cannot sit on the chain for a long time, are slow in playing the internal market, do not want to blindly chase, often miss the super high increase in large MC Memecoins, are afraid to chase the high price of large MC, and are afraid to put too much in small MC. Then waiting for the previously popular Meme concept to plummet and then gradually building a position is also a good choice.

That is, wait for the once popular Meme to plummet, and then gradually build a position - this is relatively more suitable for medium-sized capital, and coincidentally, in the past two days, the Meme coins as a whole have experienced a significant correction, which will provide good opportunities to get on board.

The altcoin market is not buying, how long can Meme still be hot?

I fully understand the market's emotions towards VC tokens. The projects have an extremely high FDV at launch, and after listing, there is constant unlocking and dumping to realize profits. Since it's all a casino, why not go to a relatively fairer casino and play Meme PVP, where if you lose, you can only blame your own slow hands, rather than helping dozens of billions of dollars of VC tokens to hold the bags.

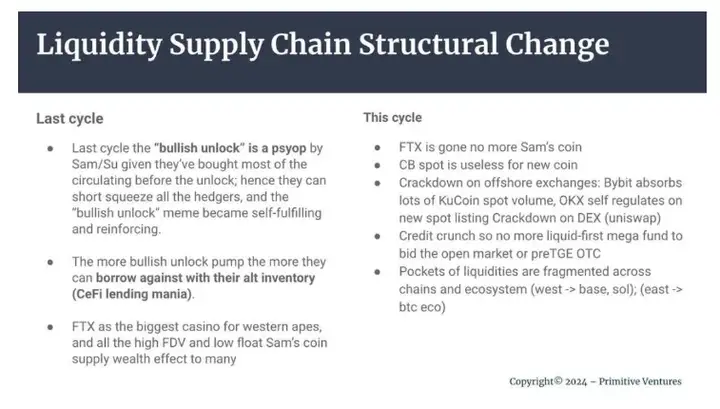

Why can Solana keep hitting new ATHs? Because they have real product implementation, and the products can keep Solana holders earning money, so the positive flywheel keeps spinning. The DeFi of the last bull market was also like this, with product launches bringing micro-innovations and fun, DEXes creating liquidity and continuous price discovery, the product and coin trading forming a consensus, CEX listings further releasing liquidity, and the project, community and CEX achieving a three-way win-win.

A healthy ecosystem is one where everyone playing on-chain is willing to buy the coin, and even more willing to evangelize it, and this liquidity supply chain can then form a positive cycle.

But now? VC tokens go mainnet and immediately have a TGE, with no real product implementation, and everyone is just here to grab the airdrops, bringing only sell pressure; at the same time, many VCs raised a lot of funds in the last bull market, and have the pressure to deploy, and in order to show good account returns for the LPs, they have to keep pushing up the valuations of the projects one round after another.

So this is the current state of VC Tokens, high valuation at launch but no buy-side, nothing to do but drop.

This naturally explains the logic behind Meme, since VC-invested projects can't be implemented, why not just speculate on something with a lower valuation and more fairness?

Meme has become the most undeniable and indispensable track-level opportunity in our industry

How long can Meme last this cycle

When everyone is passionately feeling that they can sacrifice themselves for the community, and feeling that they can make money forever, don't forget that the profit-taking side will definitely reap the harvest. Think about the NFT community back then: everyone was proud to use a monkey avatar, helping them connect with brands, holding events and collaborations all over the world, NFT Parties were held everywhere, and then what?

When all kinds of inflated self-confidence and unrealistic expectations appear, when everyone starts to hold Meme, when all kinds of hackers and rugs appear, we should start to be vigilant. Once our industry no longer has greater liquidity opportunities, and BTC starts to encounter resistance, all the enhanced Alphas will fall faster.

No need to be anxious, just find your own rhythm.

Investing is a game like this, we make bets based on our cognition, right we make money, wrong we reflect, always curious, always in awe.