Author: Pzai, Foresight News

With Bitcoin setting a new high of $97,000, its market share in the cryptocurrency market has also reached a new high in the past 3 years. The pro-crypto group under Trump has always regarded Bitcoin as the core of its crypto strategy, and with the clarification of the crypto compliance environment, various compliant investment methods have been sought after by investors.

Crypto stocks rise, Altcoins disappoint

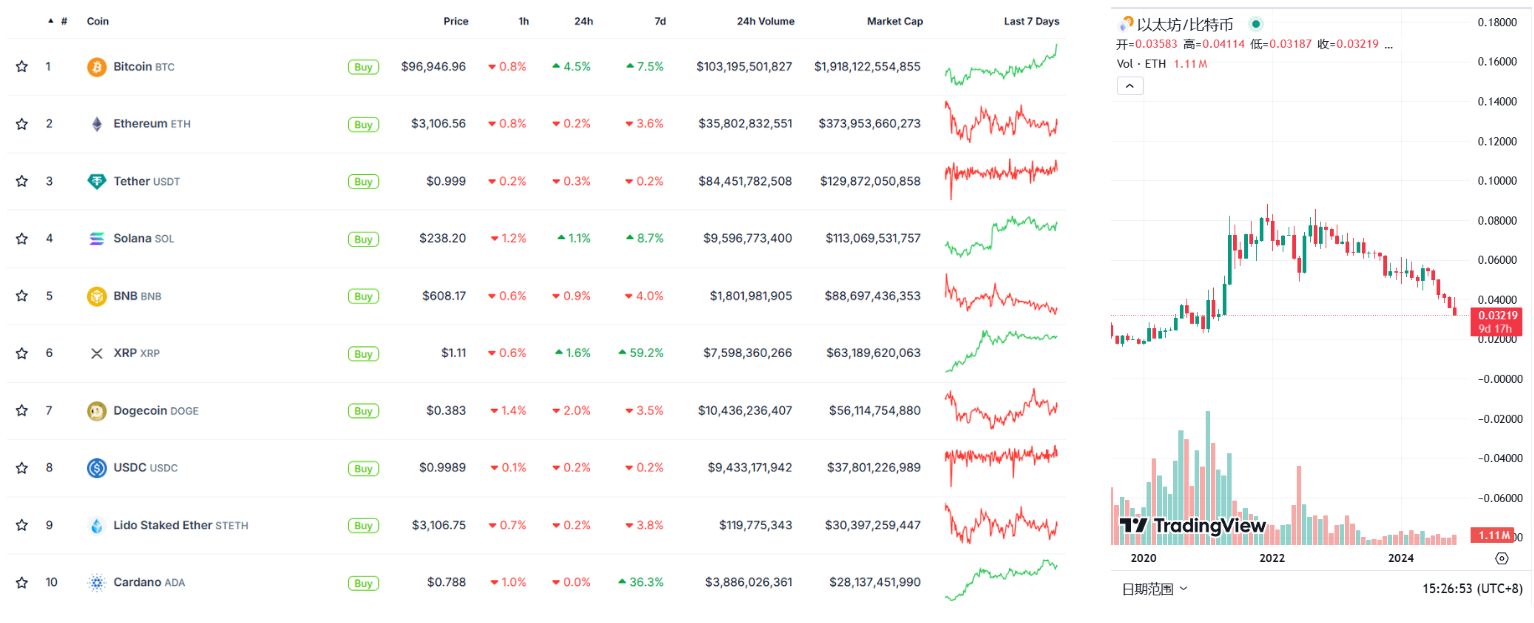

With the further aggregation of Bitcoin's on-chain and off-chain liquidity, its market share has reached a new high of 61.6% in recent years. However, the performance of Altcoins has mostly declined, with only BTC, SOL and XRP showing an increase among the top 10 crypto assets. Due to the fact that the existing compliant entry channels have their liquidity mostly concentrated on Bitcoin and its related assets, the liquidity of Altcoins has been diverted.

In addition, the exchange rate between the second largest crypto asset Ethereum and Bitcoin has fallen to 0.03217, a new low in nearly 3 years, and its poor price performance has also led to some questioning of Ethereum and its operating model in the Chinese community. As of the time of writing, Ethereum is quoted at $3,125, with long-term consolidation around the $3,000 mark.

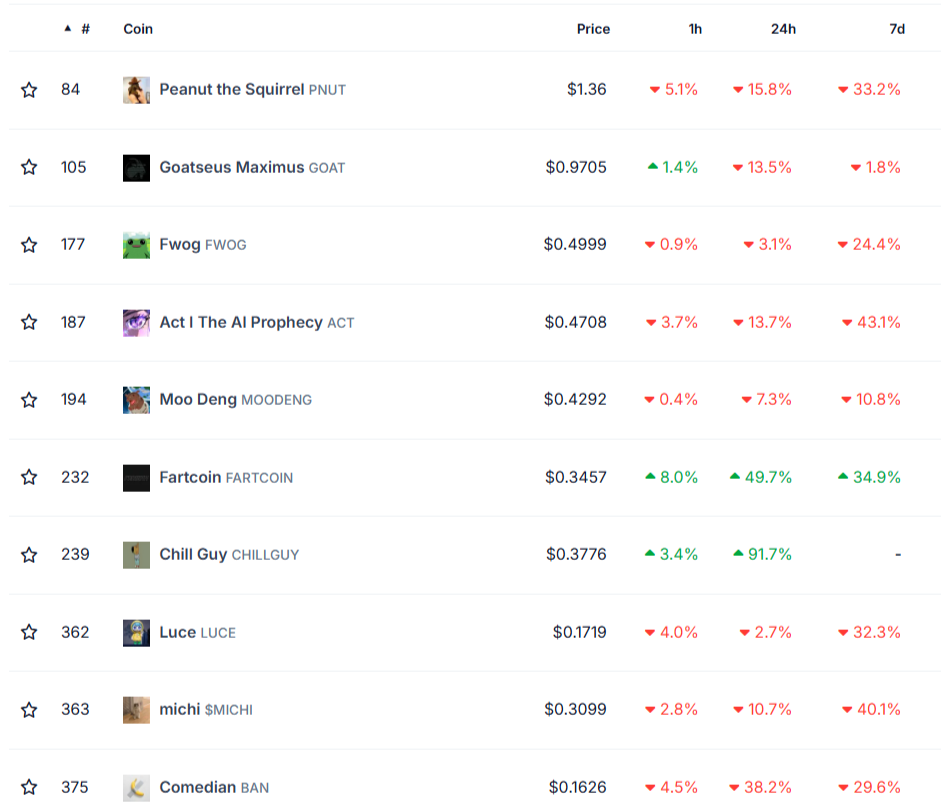

The trend of market unipolarization is also particularly evident in the MEME-related market. Among the top MEME tokens on Solana, the average daily decline is around 5%-10%, reflecting a certain degree of capital flow back to mainstream assets.

In the OTC market, the influx of a large amount of capital is driving a steady rise in the price of Bitcoin. Bloomberg senior ETF analyst Eric Balchunas said that the trading volume of Bitcoin ecosystem stocks has reached $50 billion, equivalent to the average daily trading volume of the entire UK stock market. Among them, MicroStrategy (MSTR) alone contributed $32 billion, while MSTU and MSTX (two leveraged ETFs of MSTR) totaled $6 billion, exceeding the total trading volume of all spot Bitcoin ETFs. Investors are more willing to trade with companies related to it, and MSTR's stock price has reached a historical high of $504.83, with a market value exceeding $100 billion, and a single-day trading volume exceeding Tesla, second only to Nvidia.

As a crypto-related stock in the US stock market, MSTR has also been active recently, including plans to sell $2.6 billion in notes and use the proceeds to buy Bitcoin. So far, MicroStrategy has accumulated a floating profit of over $15.5 billion.

On the ETF front, the net inflow in the past two months has exceeded $9 billion, indicating traders' confidence in Bitcoin prices, especially the further consolidation of crypto confidence after Trump's election.

Can the bull market continue?

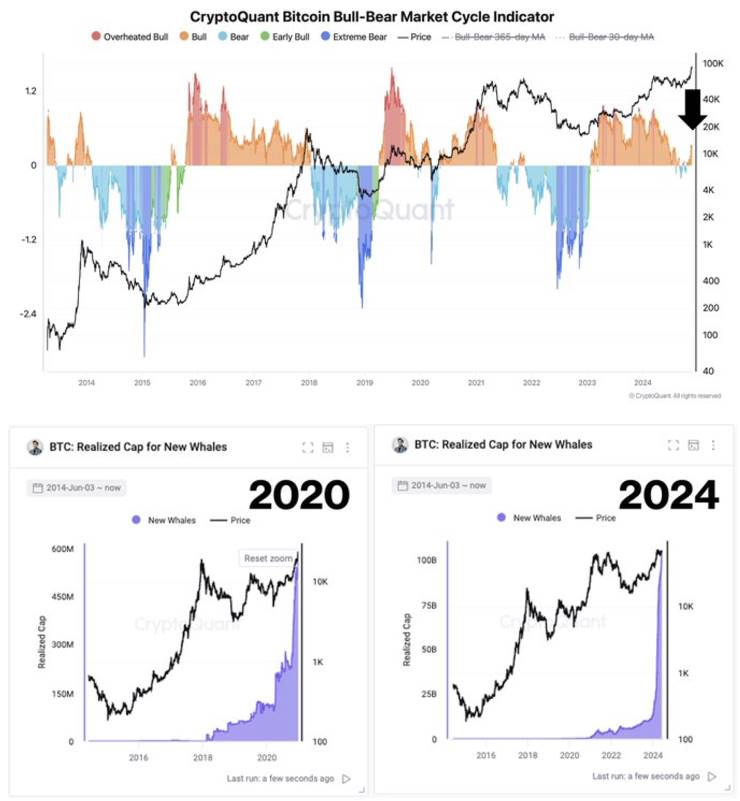

CryptoQuant founder Ki Young Ju analyzes that there is still a lot of room for the subsequent Bitcoin bull market, such as the bull-bear index turning positive recently. And the on-chain whale accumulation is also on the rise, similar to the situation in 2020. He said that the subsequent halving cycle coupled with the liquidity of institutional participation can support the future trend.

Crypto compliance sentiment still to be implemented

This week, traders are closely watching Trump's appointments of the Treasury Secretary and the Chairman of the US Securities and Exchange Commission (SEC). According to sources, the Trump team is considering establishing the first crypto-related position in the executive branch, which will also inject another dose of momentum for institutions to enter the crypto field.

The current hot candidates for the SEC Chairman include Goody Guillén, who has worked in blockchain legal business at a law firm, as the Trump team hopes to find a leader who understands the industry and takes a cautious attitude towards the application of securities laws to digital assets, until Congress passes specific legislation. In addition, Howard Lutnick, CEO of Cantor Fitzgerald, which is responsible for most of Tether's reserves, has been nominated by Trump as the new Secretary of Commerce, and the company has recently announced a Bitcoin leveraged financing business with an initial amount of up to $2 billion, reflecting the Trump team's attitude towards the crypto field is shifting towards integration.

In terms of legislative progress, although there is a constant call for digital asset regulation within the US Congress, the progress in forming a specific policy framework has been very limited. In May this year, the US House of Representatives passed the "21st Century Financial Innovation and Technology Act" (FIT21), aimed at providing federal guiding principles for the digital asset industry. However, this bill still faces many challenges, including further coordination and cooperation between the Senate and the executive branch. With the Trump administration taking office, we also look forward to the reassuring news of crypto compliance being truly implemented.