Written by: Paul Veradittakit, Partner at Pantera Capital

Compiled by: Luffy, Foresight News

One week after the US election, the cryptocurrency market sentiment remains strong. Polymarket, Bitcoin, and potentially more efficient and crypto-friendly government are worth looking forward to.

Polymarket

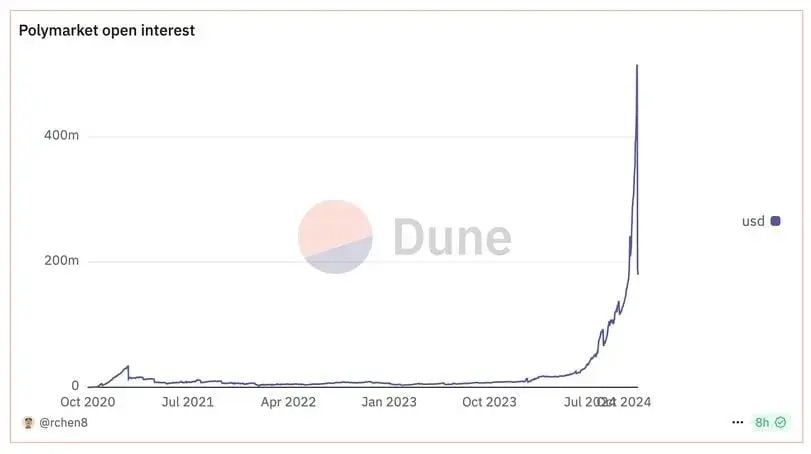

Polymarket is a prediction market built on the Polygon blockchain, and its adoption surged during the election, with the election betting volume reaching $3.2 billion, several orders of magnitude higher than before the election. Compared to other prediction markets, Polymarket charges no fees, supports seamless transactions, and is decentralized, meaning anyone can trade directly with the underlying contracts on-chain via the API (allowing anyone to create trading bots), and anyone from non-blacklisted regions can access the frontend website.

Betting volume on Polymarket

Although the betting volume has dropped significantly after the election, mainstream users have tried and grown to like using Polymarket over other centralized applications. A notable post-election phenomenon is the mainstream media's discussion of Polymarket's accuracy. The Economist, The Wall Street Journal, Forbes, and others have referred to Polymarket as the largest prediction market and used it to assess the differences between pre-election polls and voting sentiment.

Hopefully, the enthusiasm for Polymarket will permeate the broader crypto ecosystem and inspire more crypto applications to emulate Polymarket's approach, pursuing better usability, abstraction, and marketing.

Bitcoin and Altcoins

The price of Bitcoin hit a new all-time high, immediately soaring to $77,000 after the election and then continuing to rise, approaching $100,000. Altcoins indirectly related to the election have also seen significant gains, such as the Altcoins on Solana. Trump's election as president did not directly lead to an increase in Bitcoin's purchasing power, but his public support was enough to drive the token's price up.

Expectations

The positive forces that the election itself brought to the cryptocurrency industry may not last forever. However, the impact of the Republican majority in both the House and Senate may mean a more efficient government and the passage of more legislation related to cryptocurrencies.

The number of representatives supporting cryptocurrencies in both parties is significantly higher than the number opposing them (266 vs. 120 in the House, 18 vs. 12 in the Senate). Trump, who supports cryptocurrencies, may relax cryptocurrency regulations or push for more crypto-friendly regulations. World Liberty Financial is a cryptocurrency project that Trump is promoting and has stated will run as an Aave instance (one of the largest DeFi protocols).

What does this mean for the future of cryptocurrencies? First, it may mean that lobbying activities (such as those from Ripple and Coinbase) may increase to push cryptocurrency regulations in a more friendly direction.

It is believed that US regulations have been unclear, and clear regulations would fundamentally change crypto companies' thinking about operating in the US. Most of the largest crypto venture capital firms are still based in the US, so allowing crypto companies receiving funding to operate in the US could strengthen the crypto industry.

Top DeFi protocols like Compound and Uniswap have also shown new interest in protocol features that were previously "banned" (such as staking, fee conversion, etc.). Increasing regulatory transparency around these features may spur a new wave of innovation in the DeFi space.

Overall, I am very optimistic about the direction of the crypto industry after the election. A unified House and Senate may bring unexpected good news to the ever-changing crypto industry.