Over the past month, Celestia [TIA] stock price has dropped significantly, with a market capitalization shrinking by more than 12%. The daily chart reflects that the selling pressure has continued, and as the bearish momentum has persisted, the stock price has fallen another 6.60%.

TIA Active Users Surge, but Market Sentiment Remains Pessimistic

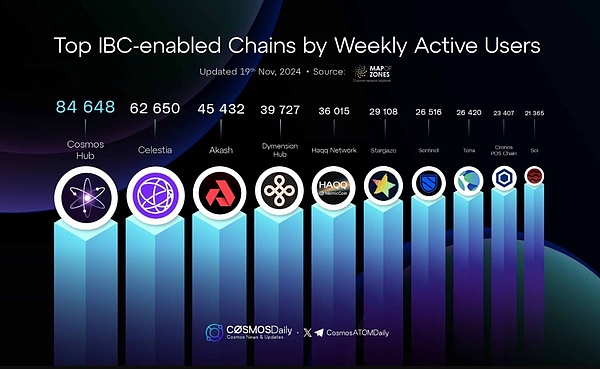

Recent data shows that over the past week, the number of active users on the Celestial blockchain network (a chain that supports IBC) of the TIA native network has increased significantly.

Join the discussion group → → VX: TZCJ1122

Chains like Celestial that enable cross-chain communication (IBC) allow for easy data transfer and interoperability between blockchains. According to the latest data, Celestial has attracted 62,650 active users, ranking second in terms of user activity among IBC chains.

However, the surge in active users has not brought positive market performance to TIA. Despite the growth, the price of TIA has continued to decline. According to CoinMarketCap data, its market capitalization has dropped 6.29% to $2.14 billion, while trading volume has plummeted 48.69%.

These indicators reflect a weakening of market confidence, and further analysis suggests that TIA may continue to maintain a bearish trend.

Bears Strengthen Control of the Market

At the time of writing, the bearish sentiment continues to dominate the market, reinforcing the existing downward signals.

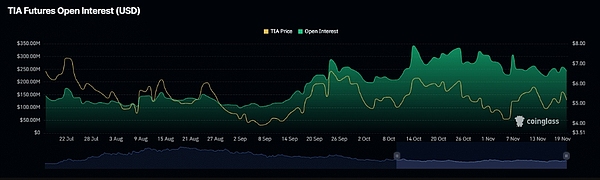

The open interest, which tracks the total value of unsettled derivative contracts (in this case, futures), has dropped significantly by 7.33% in the past 24 hours, reaching $238.65 million.

Additionally, the number of short positions exceeds the number of long positions, with a long-short ratio of 0.8328. This indicates that the bearish influence is becoming more pronounced.

The low ratio is consistent with the recent large-scale unwinding of long positions (valued at $941,100), which has increased the downward pressure on this asset. In contrast, only $71,340 worth of short positions were unwound during the same period, further emphasizing the dominance of the bearish trend.

With Increased Bearish Pressure, TIA Faces the Risk of Falling to $3.6

Since June, TIA has been trading within a consolidation channel, oscillating between key support and resistance levels. Such a pattern often signals a significant breakout, whether upward or downward.

In the current bearish market phase, TIA faces two critical downside targets. The first is $3.7, which may be tested if the selling pressure intensifies.

If the bearish momentum persists, the asset may experience a more significant decline, potentially reaching $2.2.

That's the end of the article. Follow the public account: Web3 Tangy More great articles await you~

If you want to learn more about the crypto world and get the latest news, feel free to consult me. We have the most professional community, and we publish daily market analysis and recommendations for promising potential coins. No threshold to join the group, welcome everyone to discuss together!

Join the discussion group → → VX: TZCJ1122