The introductory chapter mentioned how to find new MEME coins, analyze and screen them, and manually trade, providing some reference for newcomers who want to play MEME coins on the chain.

This article is an advanced chapter, mainly focusing on using indicators to screen MEME coins, using websites/Telegram Bots for automated trading and limit order placement, helping everyone further use the GMGN tool to improve trading speed and security.

GMGN website:

https://gmgn.ai/

01 Using GMGN Indicators for Advanced Screening of MEME Coins

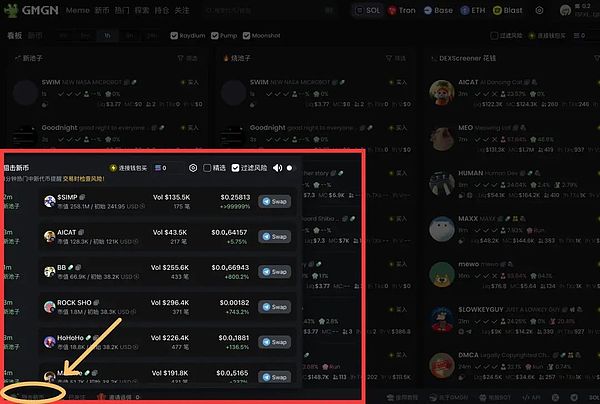

In the introductory chapter, we have analyzed the chain scanning and the thinking of judging potential MEME coins, which should be based on hot spots, narratives, market capitalization, community, and market dynamics to determine whether to buy. So how can we quickly scan the chain and screen safe tokens from the indicator perspective on the GMGN token dashboard?

Pay attention to the "Snipe New Coins" section in the bottom left corner of GMGN, and after discovering a new token, click to enter the token trading interface for detailed analysis.

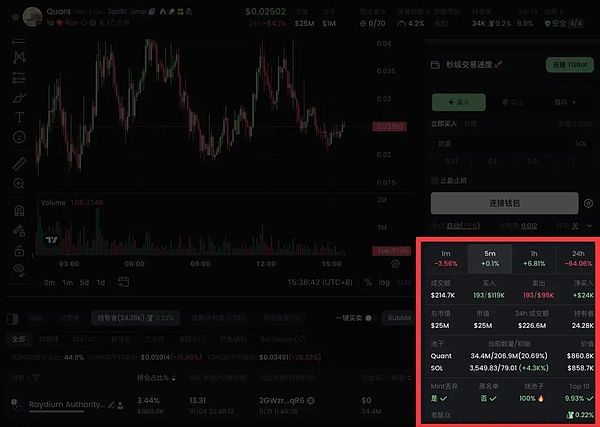

First, look at the several indicators in the bottom right corner:

Liquidity pool size: Ideally, the liquidity pool should be above 100 SOL. Although a smaller value (such as tens of SOL) can also be participated in, the risk is higher because it is easily affected by whales' dumping. However, also beware of some scammers using large pools to mislead users.

Real transaction volume: Observe the real transaction volume after the opening. If the transaction volume exceeds 60 transactions per minute or 600 transactions within 5 minutes, the token is relatively safe. Ensure that these transactions are real and not wash trading.

Mint authority abandoned: If the project party has abandoned the token minting authority, it is relatively safe. This means they cannot arbitrarily increase the token supply, thereby reducing the risk of dumping.

Blacklist: Confirm whether the project party has the right to blacklist any wallet. If "No", it is relatively safe; if "Yes", there may be risks, because this means that certain users may be restricted from selling the tokens.

Liquidity pool (LP) burned: Check if the liquidity pool (LP) has been burned. The higher the burn ratio, the more it means that the project party cannot withdraw the liquidity, and the lower the risk. 100% burning means that the project party cannot withdraw the funds, and the security is the highest. If the LP has not been burned, there is about a 60% chance of a "rug pull" (i.e., the developers suddenly withdraw the funds). This step is the key to judging the security of the project.

Top 10 holdings: Observe whether the total holdings of the top 10 holders are less than 30% of the total supply. If so, it means that the token holding is dispersed, reducing the risk of a single large holder manipulating the market.

Secondly, look at the holding indicators below the middle K-line:

Monitor the rat race: Observe whether there is a rat race phenomenon, and the lower the rat race ratio, the better. A high ratio may indicate that the project party is manipulating the market, increasing the investment risk. It is recommended that the rat race ratio does not exceed 20%. If there is no rat race at all, it is usually a more ideal situation.

Finally, check the indicators including social media and snipers at the top:

Analyze whale sniping: If there are whales quickly entering at the opening, and the liquidity pool depth is shallow, in this case, there is a 90% chance that the price will plummet, so caution is needed.

Through the above indicators, you can more effectively screen out MEME coins with security and investment potential, reduce risks, and improve success rates.

02 Using the GMGN Website for Advanced Trading

After selecting the potential tokens, how to trade? The tutorial for beginners has already carefully introduced the GMGN trading system and simple manual buy/sell operations in the previous article. This advanced tutorial mainly focuses on limit order trading and automated trading.

Enter the token address in the GMGN search box, or directly filter the tokens you think have potential on the GMGN token dashboard, and then click to enter the token trading interface.

Bind Telegram wallet: On the right side of the token trading interface, click "Buy the dips", go to the Telegram bot and bind your TG wallet.

Use the GMGN website to create limit orders

Set up the order:

Return to the GMGN website and click on the bound wallet.

Click "Buy the dips", then enter the buy amount, slippage, and anti-sandwich settings.

Create the order: Click "Create Buy Order" to successfully complete the limit buy order.

Selling with a limit order is similar, click "Auto Sell" and enter the amount, slippage, and anti-sandwich parameters, click "Create Sell Order" to successfully complete the limit sell order.

03 Using Telegram Bot for Advanced Trading

Compared to website limit orders, there is another more convenient and faster trading method: using Telegram Bot. When you send the token contract address to the Telegram bot, the bot will automatically make purchases or automatically sell the tokens according to the preset conditions, without the need for any other operations. How to achieve this?

First, add the GMGN Telegram Sniper bot as a friend.

https://t.me/GMGN_sol_bot

1. Use Telegram Bot for Limit Buy

Send the contract: In the TG Sniper bot, enter /start, select "Buy", and enter the token contract address.

Set up the order:

After entering the contract, select the "Order" tab.

Set the amount of SOL you want to buy, you can customize the amount or use the preset value.

Set the trigger price, which can be a specific price or a percentage, and select the order validity period (such as 6 hours, 24 hours, 2 days).

Complete the order: Click "Create Order" to successfully set the limit buy order.

2. Use Telegram Bot for Limit Sell

Send the contract: In the TG Sniper bot, enter /start, select "Sell", and enter the token contract address.

Set up the order:

After entering the contract, click "Order", and select the "Sell Order" area.

Set the percentage of the amount you want to sell, you can also customize the amount or use the preset value.

Set the trigger price: Set the trigger price, which can be a specific price or a percentage, and select the order validity period (such as 6 hours, 24 hours, 2 days).

Complete the order: Click "Create Order" to successfully set the limit sell order.

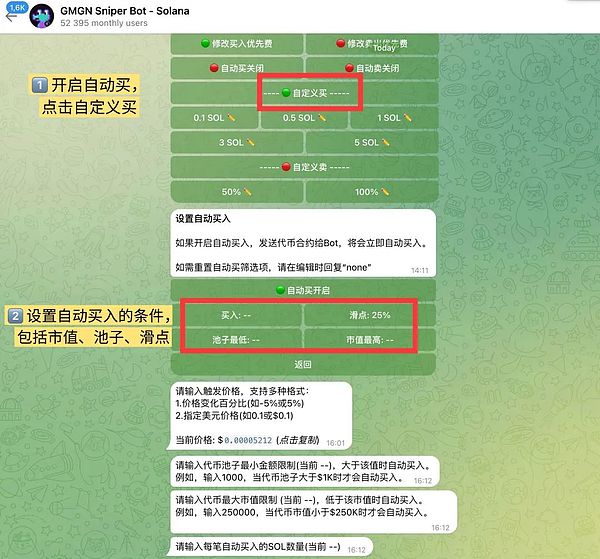

3. Use Telegram Bot for Auto Buy

Set up auto buy:

In the chat, enter /start, then select "Settings" to enter the auto buy options.

Click "Enable Auto Buy" and set the SOL amount for each transaction.

Set the minimum amount limit for the token pool, ensuring that it will only automatically buy when the pool exceeds that value. For example, enter 2000 to indicate that it will only trigger a purchase when the token pool exceeds $2,000.

Set the maximum market cap limit, ensuring that it will only buy tokens with a market cap less than that value. For example, enter 200,000 to indicate that it will only buy when the market cap is less than $200,000.

Execute the purchase: Once the setup is complete, send the token contract address to the bot, and the bot will automatically make purchases based on the preset conditions.

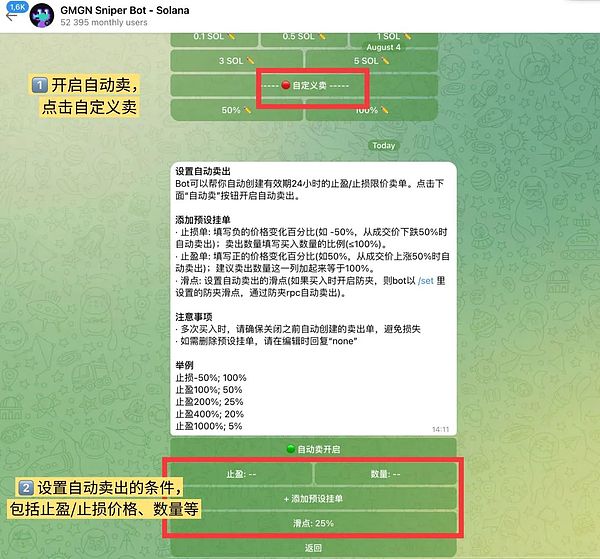

4. Use Telegram Bot for Auto Sell

Set up auto sell presets:

In the chat, enter /start, then select "Settings" to enter the auto sell settings, or directly send /autosell.

Click "Enable Auto Sell", then add preset orders.

Configure stop loss and take profit orders:

Stop loss order: Enter a negative percentage (e.g., -30% means automatically sell when the price drops 30%), and set the percentage of the sell amount (not exceeding 100%).

Take profit order: Enter a positive percentage (e.g., 30% means automatically sell when the price rises 30%), it is recommended that the total sell amount add up to 100%.

Execute the sell: Once the configuration is complete, the bot will automatically create 24-hour valid take profit and stop loss limit sell orders.

04 Summary

Through these advanced operations, you can efficiently screen, automatically trade, and place limit orders for MEME coins using the GMGN platform and Telegram Sniper bot, thereby improving trading speed and efficiency.

It should be noted that all Telegram bots face the problem of private keys being hosted on the server, and the GMGN Bot is no exception, so try not to put too many bullets in the Bot, and you can transfer the money to the exchange or your own on-chain wallet as soon as you earn it.

The on-chain activity has been very high recently, Bitcoin is on its way to $100,000, and the MEME track is also constantly staging wealth creation myths.

As a beginner, it is very easy to experience FOMO (Fear of Missing Out). However, I would like to remind everyone that thousands of MEME coins appear on the chain every day, and most of them will go to zero, with the probability of a 'large MC memecoin' (a market cap of tens of millions or hundreds of millions) being extremely low, let alone being listed on a major exchange. In short, the higher the return, the higher the risk. Please be responsible for yourself!