In recent times, the outcome of the US election and the expected improvement in the macro environment have driven a rapid surge in Bitcoin, leading to a strong overall recovery in the crypto market. The crypto industry has weathered many storms, and now "the light boat has crossed the towering mountains".

The certainty and global acceptance of crypto assets are increasing, and a friendly regulatory environment will also accelerate the world's entry into the golden age of Web3, where Chinese projects and founders will also enter a new stage of development. The market has already voted with its feet, with both the veteran public chain TRON and Binance performing well recently, and the TRX market cap reaching a new high.

01 Regulation removes the "tight collar" from crypto

When Bitcoin was first created, it did not attract much attention due to its small scale, until the "Mentougou incident" caught the attention of regulators in various countries. Starting in 2017, the rise in Bitcoin prices and the innovation of Ethereum raised concerns about the threat to the existing financial system, and some countries and regions increased their crackdown efforts. In 2018, the US SEC began to identify certain Tokens as securities and launched a multi-year legal challenge, while the EU launched the "Fifth Anti-Money Laundering Directive" (5AMLD). However, there were exceptions, such as Japan, which in 2017 passed the "Payment Services Act" to legally recognize Bitcoin as a payment method and establish clear regulations.

In 2021, the US passed the "Infrastructure Act", which was the first time it incorporated crypto tax regulation into law. Countries have begun to explore new regulatory measures and tools such as CBDC to address the challenges posed by crypto assets. That same year, countries like El Salvador were the first to embrace crypto assets. In 2022, the EU introduced the "Crypto Asset Markets Act" (MiCA) to unify its regulatory standards. Also in 2022, the collapse of FTX exchange due to financial fraud by its founder SBF heightened regulatory vigilance, and the US accelerated its legislative process, culminating in the historic approval of a crypto spot ETF.

Today, regulation seems to have found a balance between technological innovation and financial risk, and is beginning to calmly address the challenges posed by crypto assets. Trump's victory may mark the US officially removing the "tight collar" from the crypto market. During the US presidential campaign, Trump openly stated that he wants to ensure that "America becomes the crypto capital of the earth and the world's Bitcoin superpower".

As a new technology, crypto assets have gone through a transformation from skepticism to vigilance to gradual acceptance globally. A clear legal framework and a friendly regulatory environment mean an ideal environment for Web3 entrepreneurs, and the risks faced by crypto platform founders have become truly manageable.

02 Payments are the primary demand in the crypto industry

From the vision of Bitcoin's peer-to-peer payments to the explosion of various concepts, then the bursting of the bubble, the crypto market has finally returned to pragmatism, with the real adoption value becoming the focus of attention.

With the "legal tender" setting in El Salvador and the large-scale adoption of stablecoins, there is a strong demand for remittances and cross-border payments, as well as hedging tools, in regions with weak financial infrastructure. Crypto assets, as a unique asset class, have entered the mainstream. Users in markets like Thailand and South Korea are increasingly using USDT-TRC20 for remittances and payments, with the advantages of shorter settlement times and lower fees partially replacing traditional banking channels.

In other words, crypto assets have entered the mainstream while carrying the vision of reshaping the financial system, building an open and free payment network. The recent hot "RWA" concept has brought the traditional and crypto worlds together, promoting consensus building among different groups.

The current stablecoin market with a supply of around $160 billion has become the most important track and moat in the crypto ecosystem infrastructure. The state of the stablecoin track can provide a glimpse of the prosperity and adoption value of various public chain ecosystems.

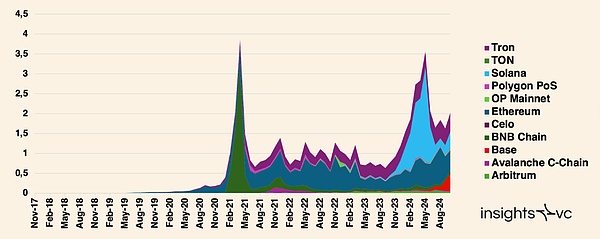

Stablecoin transfer volume by network (unit: trillion USD)

A stablecoin report released by Insights4vc in early November shows that as of October 2024, TRON, Polygon, Solana and Ethereum are leading in stablecoin activity. While Ethereum is still leading in overall settlement value, the number of monthly active addresses is gradually decreasing compared to lower-cost networks like TRON.

According to public data, the USDT-TRC20 issued on the TRON chain has a scale of over $61.8 billion, accounting for nearly half of the total USDT circulation. This year, USDT-TRC20 has successively landed in key markets like Thailand and South Korea, with a surge in trading volume.

The rapid development of USDT-TRC20 in recent years is mainly due to the low transaction costs and high efficiency of the TRON network, the widespread support of trading platforms, and the large-scale popularization in cross-border payment and fast settlement regions. As more countries accept cryptocurrencies and regulatory attitudes become clearer, the market share of USDT-TRC20 is expected to further strengthen, making TRON one of the most prosperous public chains.

In the third quarter of 2024, TRON protocol revenue reached a record high of $577 million. As a veteran public chain, through its keen adaptability to market changes, it has firmly grasped the industry's urgent needs and consolidated its market position in the midst of drastic changes.

In fact, the current state of the crypto industry is that although the crypto market has seen a strong recovery, with Bitcoin constantly setting new highs, many track assets have not been able to return to their historical highs, reflecting that there are still unresolved issues in the crypto industry, and the crypto ecosystem landscape is not yet settled. Beyond Ethereum, there are still ample opportunities for innovative public chains like TRON and Solana that can seize the "urgent need" for stablecoins.

03 The real reason behind the MEME craze

In addition to the urgent need for the stablecoin market, the crypto industry has also seen a continuous stream of MEME crazes. The earliest Memecoin, Doge, was born from an internet "joke", and with the growth of the community and the support of public figures like Musk, it has gradually become a symbol of social currency and identity.

MEME, as a decentralized way of building crypto culture and communities, has shaped a unique "community culture" that has attracted a large number of participants. After years of development, the combination of MEME culture and the Crypto ecosystem has generated tremendous energy, making MEME an important track.

Currently, Memecoins are active in ecosystems such as Ethereum, Solana and TRON. The Ethereum ecosystem and community are mature, being the birthplace of veteran Meme projects like PEPE and SHIB, but high gas fees and low efficiency have limited its progress. Solana has brought high efficiency and low fees, becoming the choice for many new Memecoins, but its network stability and developer ecosystem are relatively weak. TRON is also known for its low fees and high efficiency, and its ecosystem project SunPump has become one of the most popular Memecoin launch platforms, with the SUNDOG project on the platform having a market cap of over $1 billion.

The TRON ecosystem driven by Justin Sun is precisely through the cultural shaping similar to veteran Meme projects like Doge, building a large and passionate community. The Memecoin projects and culture in the TRON ecosystem have gradually spread to global users, forming their own community. The Meme projects in the ecosystem have driven the formation and development of the crypto punk culture. The good performance of the TRON ecosystem in the second half of this year is inseparable from this community spirit.

Musk's support has had a huge impact on crypto assets and Meme culture at one point. Justin Sun's previous statements were in line with Musk's, as they both advocate the ideals of freedom, innovation and decentralization, and hope to change the world through technology and culture.

The tightening monetary policy in the US has led to a lack of liquidity in the crypto market, and while the infrastructure of the crypto ecosystem has made some progress, the adoption of Web3 applications has been relatively slow, resulting in a lack of solid use cases beyond payments. However, the success of Meme tokens also represents the persistent FOMO sentiment in the market.

The regulatory certainty brought about by the US election and the potential for future rate cuts may reverse this situation. When the FOMO sentiment flows to tracks beyond Meme, the adoption of Web3 applications may experience a surge.

04 Next Stop: The Golden Age of Global Web3

The latest report from Matrixport shows that 7.51% of the global population is using digital currencies, and this is expected to exceed 8% by 2025. Cryptocurrencies may transition from a niche market to the mainstream financial system.

Standard Chartered Bank recently released a report predicting that the global cryptocurrency market capitalization will nearly quadruple in the next two years, reaching $10 trillion by the end of 2026. Currently, the total market capitalization of cryptocurrencies exceeds $3 trillion, and this forecast suggests that the market still has significant growth potential. With the further development of technology and market infrastructure, as well as the increased participation of more users and institutions, the applications of cryptocurrencies and Web3 will become a new mainstream.

After the regulatory "tightening collar" is officially removed, we are likely to welcome the arrival of the golden age of Web3. The public chain ecosystems that can effectively support the real-world application value are limited, and they will focus on capturing the demand for stablecoins and the thriving Meme sector, such as the Ethereum, Solana, and TRON ecosystems.

Among the leading public chains, TRON is the only Chinese public chain.

Although some Chinese projects have been controversial, the Chinese community actually plays a crucial role in the crypto industry globally. Chinese users and developers have played an important role in crypto technology R&D and crypto market trading. TRON has become one of the largest blockchain platforms globally, being a top player in both stablecoin payment settlement and the Meme sector, providing the best experience for Chinese users and developers, demonstrating the strength of Chinese people and Chinese projects in the blockchain industry.

Unfortunately, due to the "original sin of crypto" in many people's eyes, the companies and individuals in this industry are often viewed with prejudice.

Since the founding of TRON, it has been accompanied by some doubts and controversies, mostly surrounding Justin Sun's high-profile marketing approach and technical roadmap. However, over time, people have found that the high-profile marketing approach is being increasingly adopted in the crypto industry, such as by the Solana Foundation and other project teams promoting Meme tokens. Additionally, the open-source nature and technological innovation of crypto have also dispelled the suspicion of plagiarism against TRON, and with the decline of EOS, TRON is telling the world that its path is the right one.

"Don't just look at what he says, but also look at what he does," and by observing Justin Sun's on-chain operations in recent years, it can be seen that compared to the overly aggressive risk preference of figures like SBF, with a similar scale, Justin Sun is more involved in stable, established DeFi protocols with low-risk stable coin yields, which has allowed him to navigate the bull and bear markets with almost no risk, demonstrating his steady and pragmatic personality despite his flamboyant marketing approach. The projects he has participated in creating also reflect this.

Similarly, OK founder Star Xu also faced some controversies in the early days, but in recent years, OK has focused on user experience and built a well-regarded Web3 wallet portal, and although the trading platform has encountered some incidents, it has also won user recognition through full compensation.

It's time to take off the colored glasses when looking at figures like Justin Sun. In the golden age of Web3, the Chinese community needs to provide more support for Chinese industry players to establish a greater voice and better protect the interests of Chinese crypto users.

05 Summary

The friendly regulation in the US and the changing macro environment have brought certainty to the future of the Web3 golden age, and the leading public chain ecosystems that have captured the demand for payments and the Meme culture craze will clearly benefit. The influx of more incremental capital, developers, and users will drive the further growth of the Web3 industry.

In the golden age, the Chinese force in the crypto industry will continue to play an important role, and with a deep moat of performance and continuous innovation, the Chinese projects represented by TRON will clearly bring greater surprises to users and investors.