ETH has been in a long-term slump, but we need to give everyone some psychological comfort.

The reason for ETH's long-term slump is that there is a view that a new round of market manipulation is underway, with large Wall Street financial institutions becoming the new market manipulators, gradually taking over the positions of the previous market manipulators.

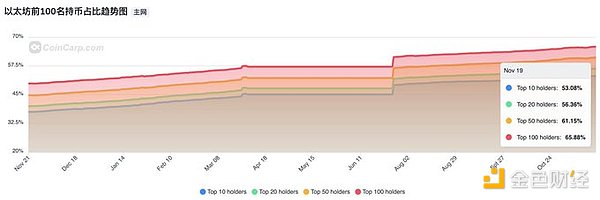

We can also verify this from the data: over the past year, the market share of the top 100 token-holding addresses has shown an upward trend, currently reaching 66%, with a significant increase in particular after the approval of the ETH ETF listing.

This indicates that the concentration of ETH is actually getting higher and higher. The top addresses have been buying, but the ETH price has not risen, what does this mean?

On the one hand, it shows that the market manipulators are still there and are continuously accumulating positions; on the other hand, it shows that there is a large amount of turnover in the market, not only are the retail investors dumping their positions, but this group of top addresses is also doing internal turnover, that is, changing market manipulators.

It should be noted that ETH and BTC are the only two tokens that have ETFs, and ETH has a very big advantage over BTC: staking rewards.

Once the ETF starts staking rewards or even re-staking, the risk-free token-denominated yield of at least 3% per year is actually very attractive, especially compared to traditional financial products.

This is the unreleased potential of ETH, and also the potential biggest positive factor.

Naturally, traditional financial institutions will not miss this cake, and have a strong willingness and motivation to become the new market manipulators of ETH.

However, ETH has already been the main narrative in the past two bull-bear cycles, and there are naturally more long-term holders, and the positions are more dispersed, so the turnover of these positions will take a relatively long time, and a full wash-out is needed.

Therefore, to suppress the price of ETH in the long run, so that the previous long-term holders will dump their positions, such as switching to popular SOL, etc., in order to concentrate the positions in the hands of the new market manipulators.

Once the new market manipulators have accumulated enough positions, they will have the motivation to drive up the price of ETH.

This is a grand scheme.

Therefore, do not dump the truly valuable positions you hold, which are BTC and ETH, and get through this long and painful wash-out, so that you can get the real long-term returns you want.