Author: Sha

I. When DeFi Becomes a Hotspot Again

Bitcoin finally reached a long-awaited new high in November, not far from the $100,000 mark, and the long-dormant Altcoin market has also seen an explosion, with leading DeFi projects like UniSwap, AAVE, Compound, and MakerDAO all seeing good gains recently. Looking back at the DeFi explosion in 2020 until now, even though there have been constant voices of pessimism, the DeFi world is still steadily developing and expanding, and gradually eroding the market share of centralized exchanges. This is still a track full of innovation and huge potential, and there are still many possibilities waiting for us to explore. Today, I want to talk about one of the projects I think is most worth watching in the recent DeFi ecosystem - the leading Base derivatives project SynFutures. Discussing how it is leading a new round of DeFi innovation by leveraging its own advantages, how it is stirring up the entire decentralized derivatives track, and the reasons behind its rapid growth and future growth potential.

II. SynFutures' Performance After Launching on Base: Occupying 50% of the Market Share, Ranking 3rd in Protocol Fee Revenue

Let's first look at SynFutures' data performance in the Base derivatives track:

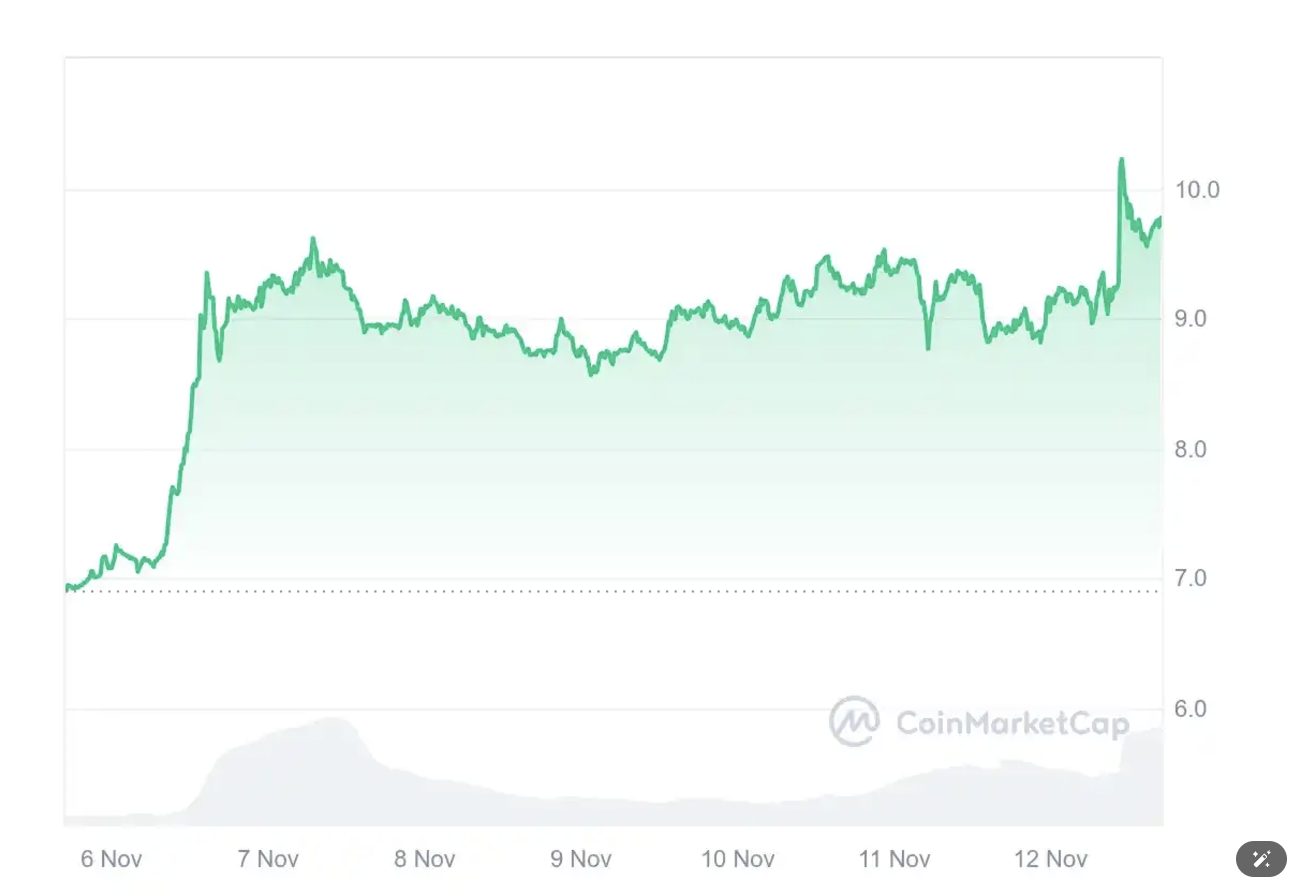

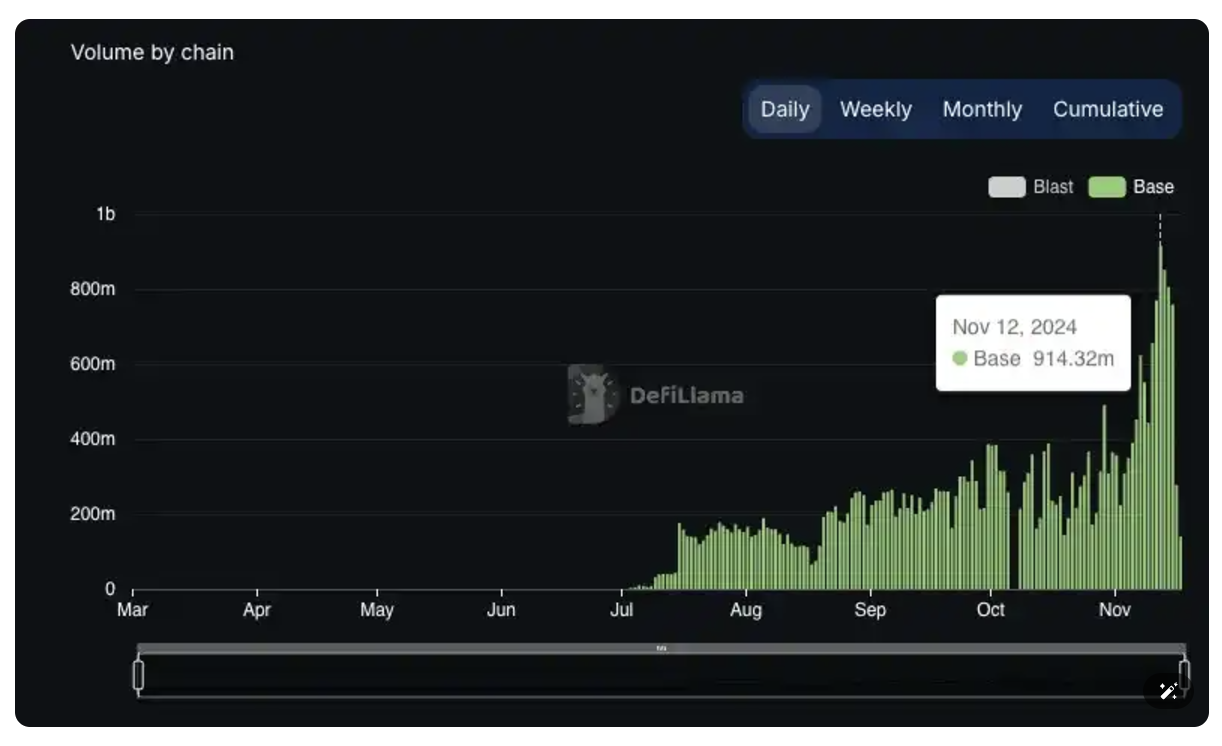

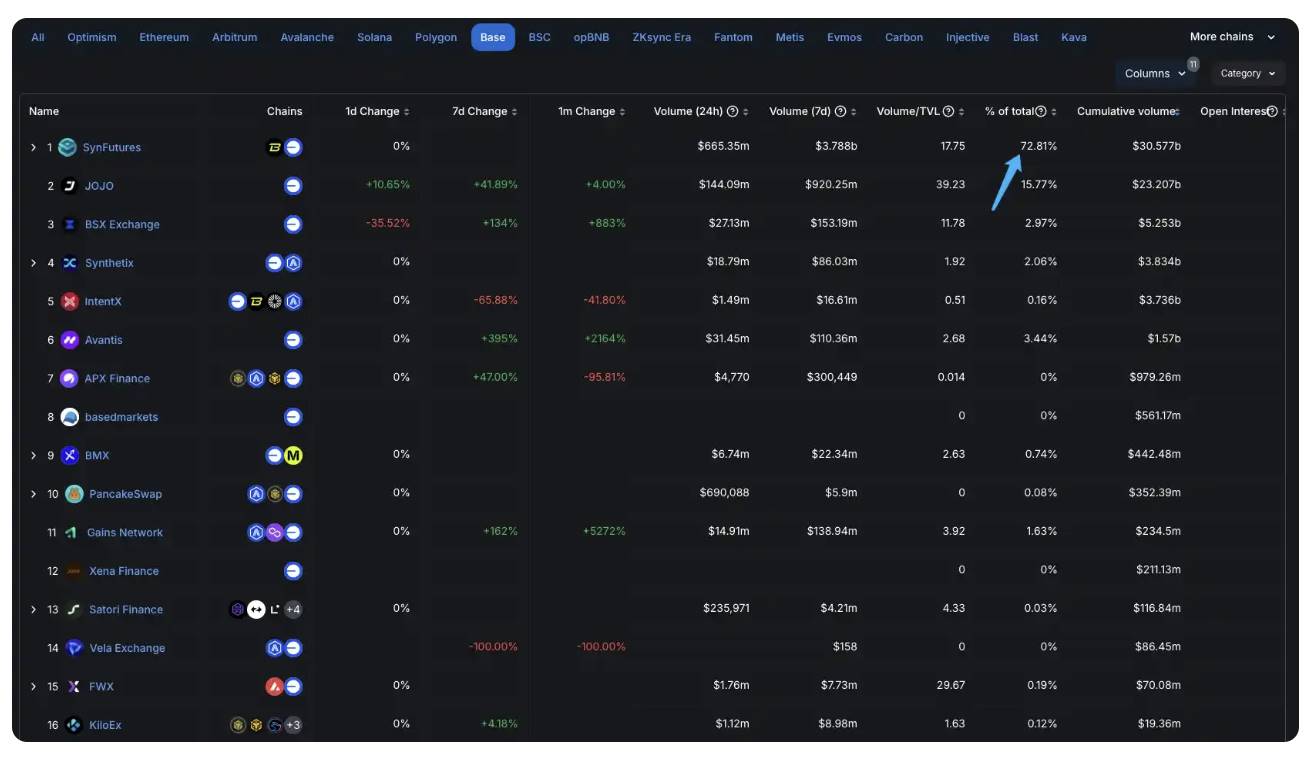

Launched on Base on July 1, with trading volume exceeding $100 million in the first 10 days

The latest trading volume on November 12 exceeded $910 million

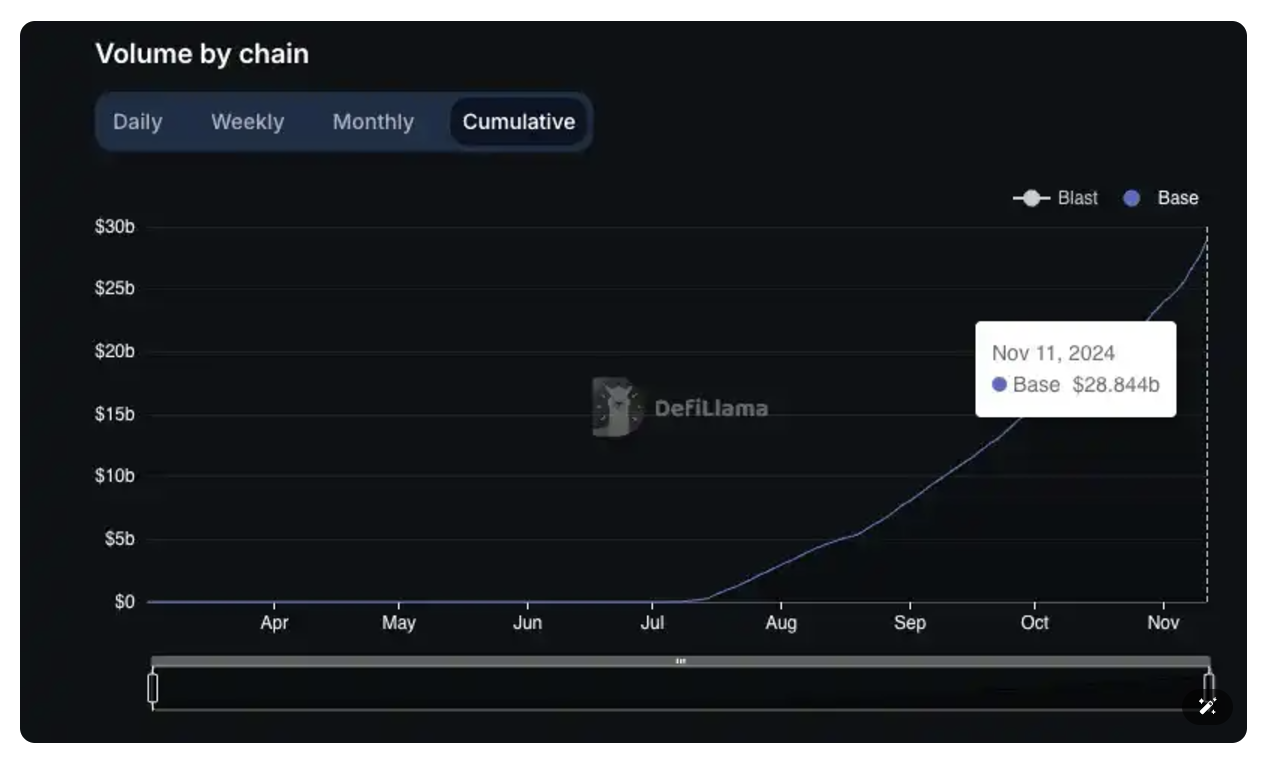

Cumulative trading volume approaching $30 billion, with a daily average trading volume of $210 million

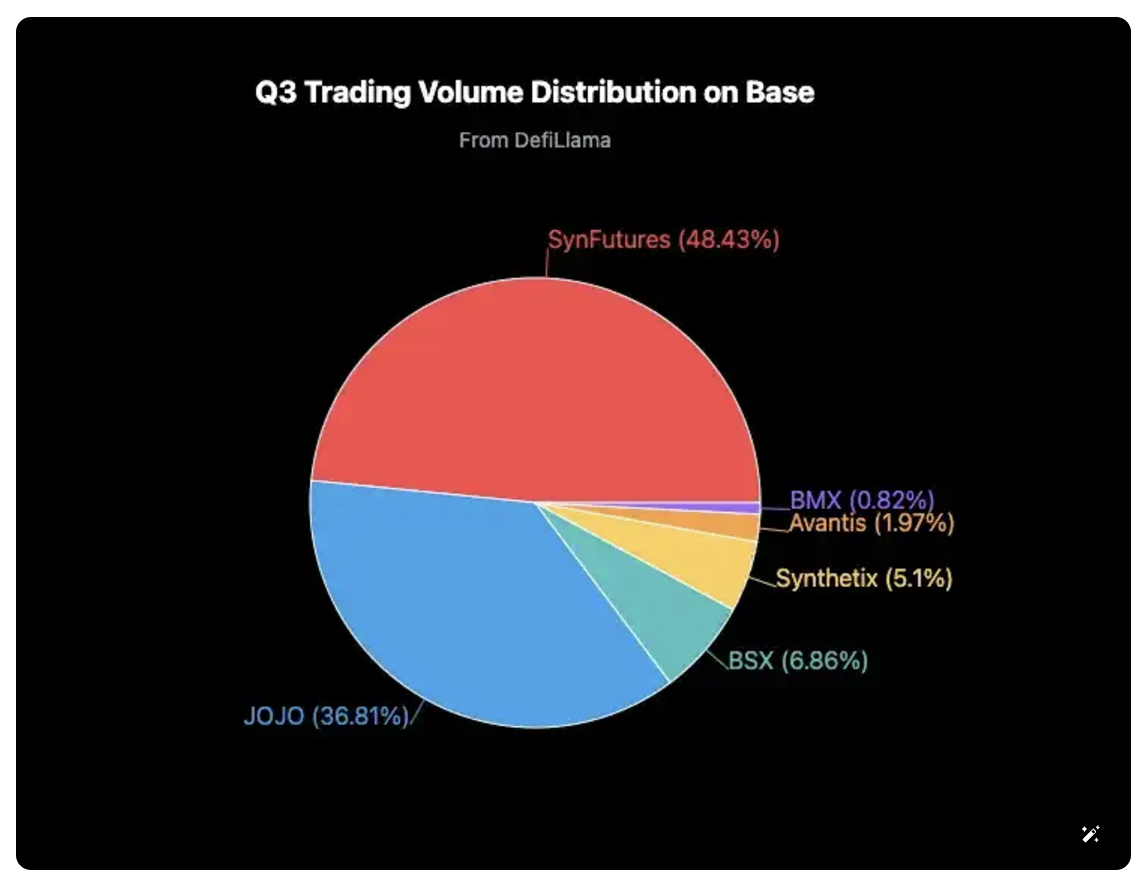

Q3 trading volume accounted for nearly 50% of the Base network

The trading volume in the past 24 hours accounted for 72% of the Base network, nearly 5 times that of the 2nd place

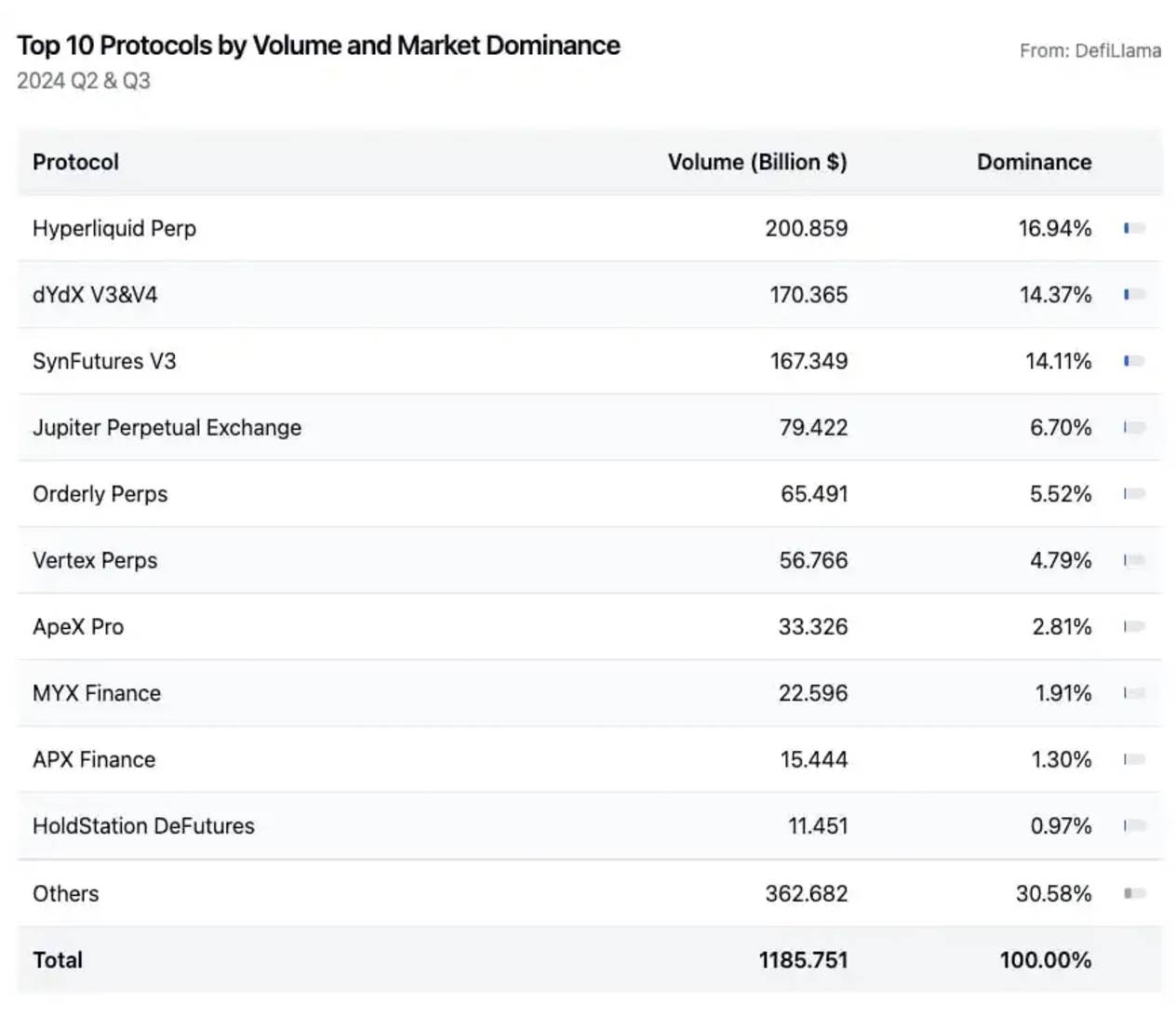

And if we look at the industry as a whole, we can see the growth of SynFutures V3 since its launch, which is no less impressive than projects like Hyperliquid, dYdX, and Jupiter. According to defillama data, the on-chain perpetual contract trading volume in Q2 and Q3 was $1.1857 trillion, with the top 3 projects accounting for over 45% of the trading volume, namely Hyperliquid (16.94%), dYdX V3 & V4 (14.37%), and SynFutures (14.11%).

These impressive achievements naturally make one curious - why is it SynFutures, and what unique advantages does it have compared to other derivatives platforms?

III. SynFutures, the Game-Changer in the Derivatives Track: Concentrated Liquidity + Pure On-Chain Order Book Model

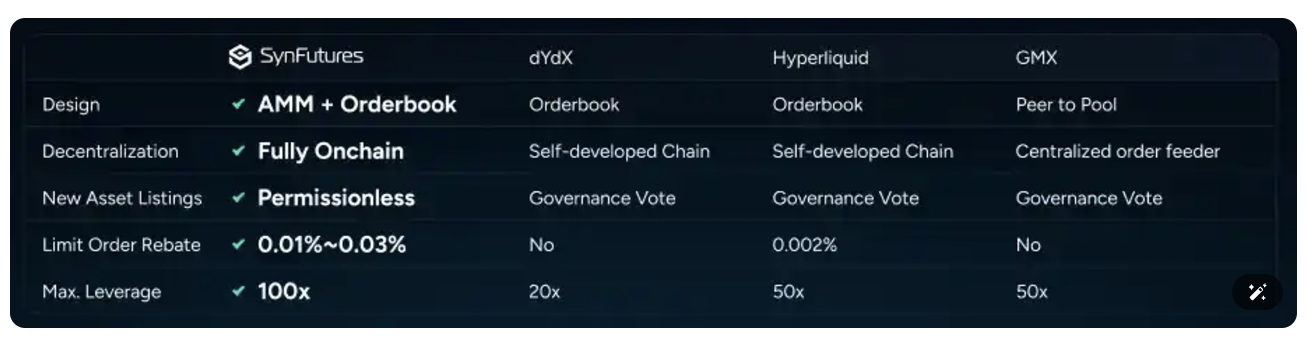

Looking back on the derivatives track in the past few years, the mainstream derivatives models can be divided into the following 3 categories:

The Vault model represented by GMX - LPs act as the counterparty to Traders, and use oracles for pricing. The representative products in this track are GMX and Jupiter. GMX supports more assets, while Jupiter benefits from the heat of SOL and has maintained high yields and high TVL, becoming one of the industry's hot projects. But the oracle risk in this type of model is still not negligible, and since they use oracles for pricing, they cannot serve as a price discovery venue and find it difficult to take on the challenge of centralized exchanges.

The derivatives application chain represented by dYdX and Hyperliquid - Relying on high performance and an experience comparable to centralized exchanges, they have gained the favor of market makers and occupy a place in the market. But the over-centralization of their off-chain order books and the fragmentation of liquidity are still a considerable challenge for traders and project parties.

Another relatively low-key but already well-performing model is the on-chain AMM model represented by SynFutures. This model references the concentrated liquidity model of UniSwap V3, and further introduces an on-chain order book to improve the overall system's capital efficiency. From the rankings and market share of Q2 and Q3 derivatives trading volume mentioned earlier, we can see that the representative of this model, SynFutures, has seen trading volume more than double that of the Vault model represented by Jupiter in the past half year. This momentum has not even stopped, and it is only a matter of time before its total trading volume surpasses the veteran decentralized derivatives exchange dYdX.

So why has the on-chain AMM model represented by SynFutures been able to achieve such a huge breakthrough in such a short time? What advantages does this model have compared to the other two mainstream models?

3.1 Concentrated Liquidity - Improving Capital Efficiency

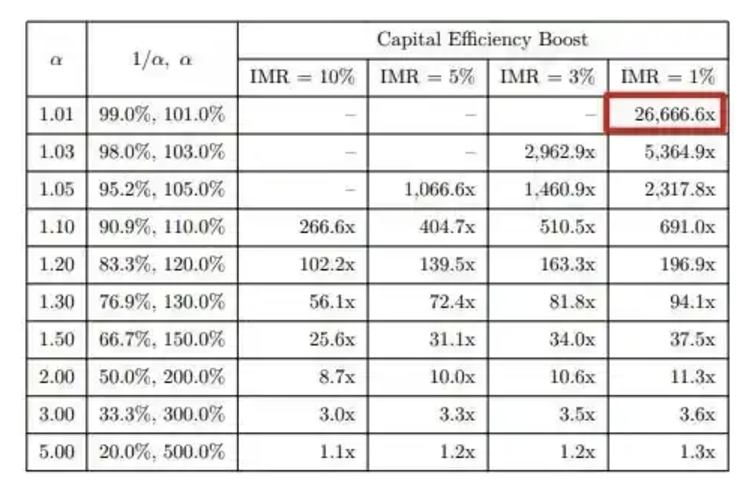

SynFutures' oAMM allows LPs to add liquidity to specified price ranges, greatly improving the liquidity depth and capital utilization efficiency of the AMM, supporting larger and more trades while creating more fee income for LPs. From its documentation, its capital efficiency can reach up to 26,666.6 times the original.

3.2 Pure On-Chain Order Book - Maintaining High Efficiency While Remaining Publicly Transparent

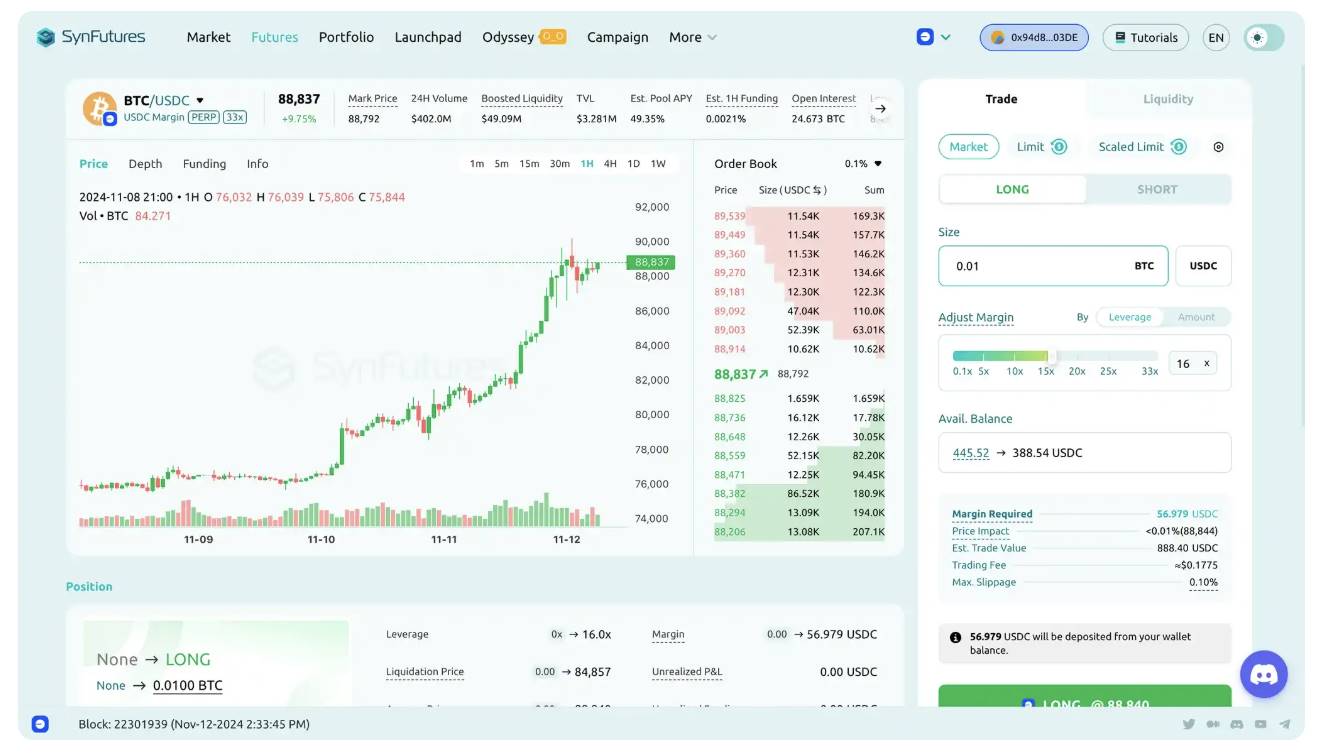

The liquidity in oAMM is distributed across specified price ranges, and each price range is composed of multiple price points. For example, LPs provide liquidity in the [80000, 90000] range for the BTC-USDC-PERP, and this price range can be divided into multiple price points, each with an equal amount of liquidity. You may have immediately realized that this is an order book, right? Yes!

oAMM allows users to provide liquidity at specified price points, to realize on-chain limit orders and simulate order book trading behavior, further improving capital efficiency. Compared to the traditional AMM market making method, market makers on centralized exchanges are more familiar with and have a higher cognitive level of limit order market making, and are also more willing to participate. So oAMM, which supports limit orders, can better attract market makers to actively market make, further improving oAMM's trading efficiency and depth, achieving trading experience comparable to centralized exchanges.

And unlike the off-chain order books of projects like dYdX, oAMM is deployed as a smart contract on the blockchain, with all data stored on-chain and verifiable by anyone, completely decentralized, so users don't have to worry about the trading platform engaging in dark pool operations or fake trades.

If we compare the different projects, we can see that SynFutures has done a good job of addressing the shortcomings of the Vault model represented by GMX and the application chain model represented by dYdX, while retaining high efficiency and high performance. At the same time, it can naturally integrate with various assets of the underlying public chain and integrate into the entire DeFi ecosystem, giving it inherent advantages. And as the underlying public chain technology is upgraded in the future, this advantage will become even more apparent.

IV. The Flywheel Effect Brought by the Perp Launchpad

In addition to the characteristics of the model itself, SynFutures has also launched the industry's first perpetual contract issuance platform, the Perp Launchpad, referencing the Pump.fun model. Over the past year, the most profitable track should be asset issuance, from Runes to Mints, from Pump.Fun to DAO.FUN, all of which have been continuously creating a wealth effect, attracting more users to enter the market, which inevitably makes some friends who believe in the value of blockchain feel nihilistic. But this is the real situation of the current stage of the industry, whoever can do asset issuance, attract market attention, and create a wealth effect, can ride the trend and become a rising star. Whether it's the success of Solana in this stage or the over $100 million in revenue of Pump.Fun, they are the best proof of this model. And SynFutures' recently launched Perp Launchpad, based on its own model innovation and new asset issuance methods, is designed to open up more new gameplay for more on-chain Degen players.