Author: Mu Mu | Bai Hua Blockchain

Recently, Bitcoin has been continuously setting new historical highs, and is just a step away from $100,000. The crypto industry has also shown signs of recovery, but the once-dominant "metaverse" now appears to be somewhat gloomy, and not only the crypto metaverse, but the entire tech circle's "metaverse" has been silent.

01

How is the metaverse doing now

Not long ago, Meta's financial report showed that its Q3 metaverse department is still suffering heavy losses. According to public reports, the social media giant Facebook fully transformed to an All in metaverse and changed its name to Meta in 2021. Its subsidiary department responsible for the metaverse, Reality Labs, was established in 2018. In 2021, it underwent a large-scale transformation and increased investment in the metaverse, but this also opened up a space for losses, with hundreds of billions of dollars lost in recent years.

Although Meta has reduced its spending, it still has not been able to reverse the loss situation. Despite the continued heavy losses, Meta does not seem to have abandoned the metaverse track, and it still believes that the metaverse is the "core" of defining the future of social connections, and is constantly adjusting and optimizing its business lines, continuing to invest and layout.

Domestically, it has been reported that Alibaba is also optimizing and adjusting the scale of its metaverse department "Yuanjing" to cope with the trend of declining enthusiasm in the metaverse field, laying off dozens of people. This move is said to be aimed at optimizing the business structure and improving organizational efficiency, and in the future it will continue to focus on the development of metaverse applications and tools, and provide related services to customers.

In the capital market, the financing amount of metaverse companies this year is also very low. According to Crunchbase data, this year, the financing amount of companies related to AR, VR and metaverse from seed round to growth stage is about $464 million. This is the lowest level in years. It is reported that many metaverse startups did not complete a new round of financing after raising funds in 2021.

The metaverse and the Web3 proposed by the crypto community are both called the next generation of the Internet. Although they have certain differences, the overlapping degree of the two concepts is quite high, and some people even say that Crypto and the metaverse are a perfect match, and blockchain is also the cornerstone of the metaverse.

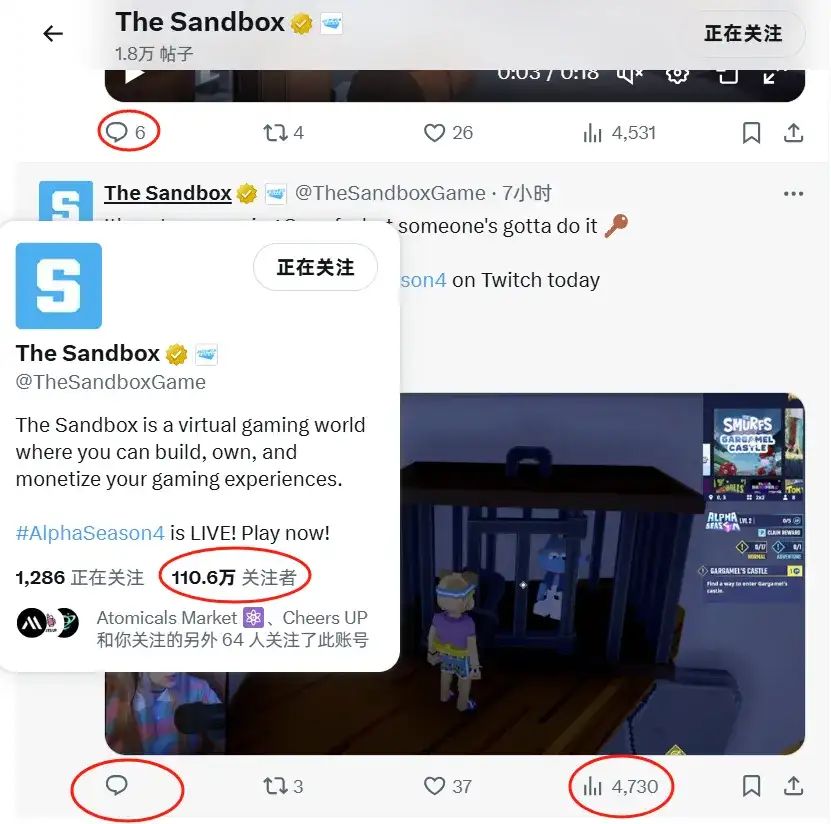

The crypto metaverse was once highly anticipated, and was also the expected large-scale landing application scenario in the crypto industry, but now from the low display rate and almost zero interaction volume of the social network accounts of the leading crypto metaverse, it also appears to be sluggish, and has not shown any obvious signs of recovery with the rise of Bitcoin, and most people seem to have lost interest in this track.

The only exception is Roblox, which was once hailed as the first stock of the metaverse. Its financial report shows that its revenue and user base are still maintaining strong growth. Even though the metaverse concept is no longer hot, the company's stock price has risen from $21.6 at the bottom in late 2022 to the current $52, with a market value of about $360 billion, which can be said to be performing well.

02

What's the problem with the metaverse?

It is clear that the metaverse is in the classic "trough period" after the bursting of the technology industry bubble. New technology concepts will all go through such a period, and the Internet, blockchain, and AI have all experienced it. Of course, each industry in the trough will encounter its own problems, and perhaps when these problems are solved, it will be the time for the metaverse to start climbing out of the trough:

1) Infrastructure and technical bottlenecks

According to the vision of the metaverse, the interconnected experience space with ultra-high image quality and high immersion can be perfectly realized in a single-machine environment. This is reflected in many AAA games. But these AAA works are mostly single-player, and to connect these large-scale virtual spaces to the Internet for simultaneous use by a large number of users is very difficult to achieve. One is that the Internet infrastructure is not enough (bandwidth and network speed are not enough), and the other is that the existing technology is not sufficient to support such scenarios.

Taking Meta's metaverse space as an example, the extremely rough and "abstract" images released by Zuckerberg at the time were heavily criticized. Simply put, the current infrastructure and technology have bottlenecks and cannot simultaneously meet the requirements of high image quality and smooth experience.

2) Funds and attention are "diverted" to AI

AI is too hot, and the limited funds and attention in the market have all been attracted to AI, so the highly invested metaverse has naturally also encountered a cold spell. Not only that, AI also occupies the GPU computing power resources that the metaverse also urgently needs, just like how the crypto asset mining industry occupied and drove up the graphics cards of game players in the past, these external factors have made the current innovation and exploration of the metaverse even more difficult.

3) Lack of profitability

Except for the early users who bought some AR and VR hardware devices to satisfy their curiosity, the current metaverse products on the market have not generated any output and profitability. Although Meta firmly believes that the metaverse is the future, the current Internet is more efficient, more convenient and has a lower cost of use, and Meta's rough metaverse applications have not been welcomed by users and are not in high demand, which is the main reason why they have not been profitable so far.

03

Will the metaverse come back?

The value and future of the metaverse are undeniable, and giants like Meta have not stopped investing. Zuckerberg believes the future will come. So how will it come back in the future?

1) The next generation of AAA games, we are approaching the future of the metaverse

The recently popular first domestic AAA game Black Myth: Wukong has brought ancient Chinese architecture into the virtual space, allowing players to experience the cultural treasures of China in an immersive way, which has been highly praised by domestic and foreign game players.

It is reported that the works brought by the Black Myth: Wukong team have adopted the latest AI technology (AI-driven DLSS3), bringing higher frame rates and better image quality. DLSS 3 can use AI to create more frames and improve image quality. This indirectly shows that the infrastructure and technical bottlenecks of the metaverse are gradually being broken through.

2) Crypto + Metaverse to continue the legend

When the metaverse was at its peak, people would say that crypto assets like Bitcoin were riding the metaverse hype, just like many tech companies had previously jumped on the blockchain concept and then withdrawn from the "knockoff crypto cat" game. Now that the Bitcoin price has broken through, the crypto metaverse sector may bring more capital and possibilities, and as capital and talent continue to flow in, the original conceptual ideas will gradually revive.

The metaverse with crypto support will be more perfect, and the complementarity between the two is shaping a new virtual economic model. The two have been called a match made in heaven, and the main points of integration include the following:

A. Ownership of virtual assets and digital identity

Non-Fungible Tokens (NFTs) are like the "bricks and mortar" of building the metaverse. In the future open metaverse space, each user will have ownership of their virtual asset data and a unique identity, protecting personal assets and privacy in the virtual world, using encryption technology to manage and verify user identity, ensuring data security, privacy protection and transaction transparency.

In the leading crypto metaverse project The Sandbox, users can freely trade virtual land and items, these virtual assets are made up of NFTs and are protected by the blockchain.

B. Decentralized economic system, incentive mechanism and creator economy

Crypto also brings a whole set of decentralized economic systems to the metaverse, from Token incentives to the creator economy, all of which have been validated by the crypto industry. For an open collaborative virtual world, these are very important. Concepts like P2E bring real benefits to creators, players, and the community in the virtual world, and a well-developed economic system is needed to build a sustainable virtual world.

In the future, with the development of the metaverse and Crypto, NFT virtual assets can also be used to connect different metaverse spaces, realizing interconnection of the virtual worlds.

In general, the metaverse is like a parallel virtual world, and the native assets in the virtual world are crypto assets, so the integration of the metaverse and Crypto is still quite high.

04

Summary

The reason why it is surpassed by AI is not that the metaverse is not good enough, but that AI is more in demand, and its value is more intuitive in the context of scarce liquidity. In fact, the current bull run in the crypto market is almost exclusively in the Bitcoin and MEME-related tracks. Once the macro environment improves and liquidity is sufficient, the metaverse and many concepts with practical application value should be able to recover, but for such a money-burning track, it is not easy to really break out, and we need to look forward to the "ChatGPT moment" of the metaverse.

Link to the article: https://www.hellobtc.com/kp/du/11/5548.html

Source: https://mp.weixin.qq.com/s/OZF0j68R34lCFoQgmJxQqw