On Friday (November 22), the blue-chip public chain Solana token SOL soared more than 10%, with the price breaking through $260. Fox Business reporter Eleanor Terrett cited informed sources as saying that the U.S. Securities and Exchange Commission (SEC) has made progress in negotiations with issuers hoping to launch a Solana spot ETF on Wall Street, and they may submit a 19B-4 listing filing in the coming days, which means the Altcoin Season is likely to erupt.

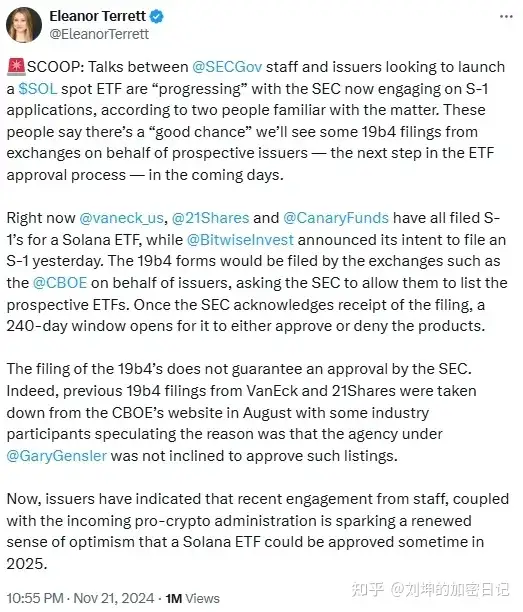

Eleanor wrote, "Two informed sources said that SEC staff and issuers hoping to launch a Solana spot ETF are making progress in negotiations, and the SEC is currently processing the S-1 application. These two people said that in the coming days, we are very likely to see some 19B-4 filings submitted by exchange representatives on behalf of potential issuers - this is the next step in the ETF approval process."

Currently, VanEck, 21Shares and Canary Capital have all filed S-1 documents for Solana ETFs, and Bitwise announced yesterday that it intends to file an S-1. The 19B-4 filings will be submitted by exchanges such as CBOE on behalf of the issuers, requesting the SEC to allow the potential ETFs to be listed. Once the SEC confirms receipt of the filings, a 240-day window will be opened. During this period, the SEC can approve or reject these products.

Submitting the 19B-4 filing does not guarantee that the SEC will approve the listing, in fact, the 19B-4 filings previously submitted by VanEck and 21Shares were withdrawn from the CBOE website in August, and some industry insiders speculate that the reason is that the SEC under the leadership of Chairman Gary Gensler is not very inclined to approve such listings. Now, the issuers say that the recent involvement of the staff, coupled with the upcoming crypto-friendly administration, is generating a new sense of optimism that a Solana ETF could be approved at some point in 2025. It is also worth noting that Gensler has confirmed that he will leave his post after the inauguration of President Trump on January 20, 2025. According to on-chain data, Solana's weekly decentralized exchange (DeX) trading volume as a percentage of Ethereum's has reached 266%. This means that Solana's DeX is now handling more than twice the trading volume of Ethereum's DeX.

This outstanding performance highlights Solana's growing power in the decentralized exchange ecosystem. In addition to surpassing Ethereum in DeX trading volume, Solana accounted for 36% of the total DeX market share in the DeFi field over the past week. These impressive data points indicate that Solana is becoming a major player in the DeX space, attracting more and more crypto users and transactions. There are several factors that can explain Solana's rapid growth, first and foremost, the speed and efficiency of its network are its main assets. Solana can process large volumes of crypto transactions at extremely low cost per second, which is particularly attractive to DeX users. In addition, Solana's increasing adoption of existing infrastructure also plays a crucial role. By integrating mature solutions and collaborating with strategic partners, Solana has consolidated its position in the crypto market and attracted more projects and investors.

As confirmed by Bitget's chief analyst Ryan Lee, its fast transaction speed and low cost make it one of the preferred platforms for developers and users. Furthermore, Solana is actively exploring innovation and practicality, making a huge contribution to the widespread adoption of cryptocurrencies. Users are increasingly inclined to use Solana and invest their assets in its ecosystem.

Solana Technical Analysis

FXStreet analyst Michael Ebiekutan said that SOL tested its historical high resistance of $259.90, making it one of the strongest trending assets among the top cryptocurrencies by market cap. This resistance level marked SOL's price peak on November 6, which has now lasted for over three years. With the recent rally, SOL's monthly and annual gains have exceeded 50% and 370% respectively.

Breaking through the resistance level will validate the cup and handle pattern, suggesting that SOL could surge over 70% to $459 in the coming weeks.