The fourth-largest cryptocurrency by market capitalization, Solana (SOL), hit a new all-time high of $263 on November 22. As of 1:48 PM on November 22, according to CoinMarketCap, Solana was trading at $261.27, up 10% from the previous day. This surpassed the previous record high of $260 set in 2021, after three years. Solana's market capitalization also increased by 9% to $123 billion (about 172.5 trillion won), exceeding the market caps of global companies like Sony and Starbucks.

Related Articles

- [Coin Report] 7 out of the top 10 coins with the highest price increase are 'meme coins'... "Emerging as a new source of liquidity"

- [Coin Report] "Bitcoin as a strategic asset, Gary Gensler's dismissal"... 'Trump Trade' fully realized

- [Coin Report] 'Uptober' finally realized... Bitcoin briefly surpassed 100 million won

- [Coin Report] Solana up 14% in a week, leading the rally alone... Caution on meme coin rug pulls still remains

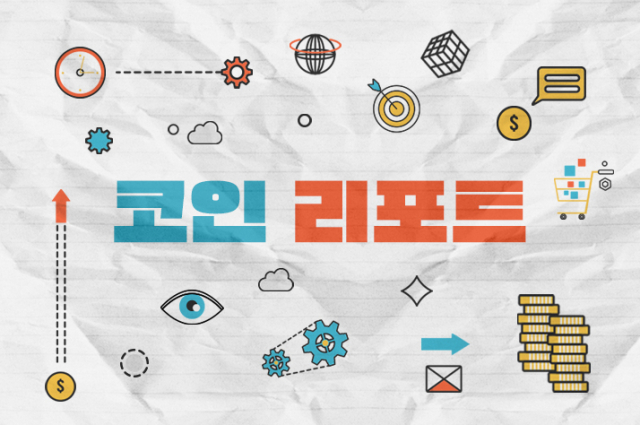

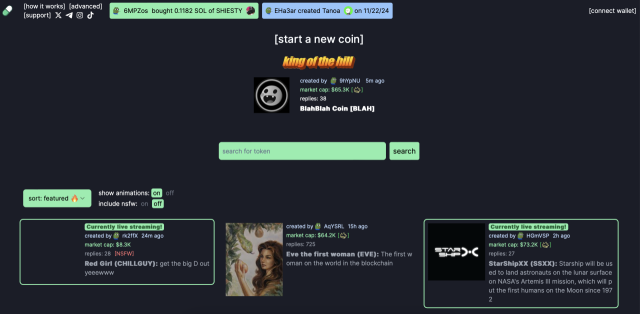

Solana is leading the ongoing cryptocurrency bull market that has continued since the election of former President Trump. The driving force behind Solana's strength is the craze for Solana-based meme coins, which has dominated the cryptocurrency market narrative this year. The Solana meme coin phenomenon began when the Solana Foundation launched the 'Saga' smartphone and airdropped the Solana-based meme coin 'BONK' to Saga purchasers, successfully boosting both Saga sales and the BONK price.

The surge in BONK price sparked a trend of meme coin issuance on the Solana blockchain. A dedicated platform called 'Pumpkin.fun' emerged, allowing easy minting and trading of Solana-based meme coins. The rise of Solana-based DeFi protocols using Pumpkin.fun has also invigorated the Solana network. The total value locked (TVL) in the Solana network has surpassed $8 billion (about 11.2 trillion won), an 8-fold increase from just $1 billion in January this year.

Experts predict that Solana will continue its long-term upward trend until next year. This is because the departure of SEC Chairman Gary Gensler, who emphasized the securities nature of altcoins like Solana, has increased the likelihood of Solana spot ETF approval. The SEC has stated that Gensler will step down as chairman on January 20, 2024, raising expectations that Solana spot ETFs pending approval at the SEC may be approved next year.

Currently, applications for Solana spot ETFs have been filed by VanEck, 21Shares, and Bitwise, awaiting SEC approval. Matthew Sigel, Head of Digital Assets Research at VanEck, said the "overwhelming likelihood" of the SEC approving crypto products has led to the forecast of a Solana spot ETF launch next year.

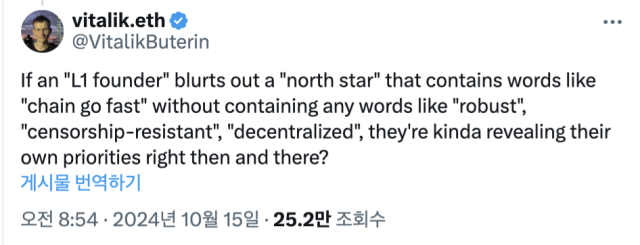

As Solana's presence grows, the industry is also re-examining the competitive landscape between Ethereum (ETH) and Solana. Solana, which was launched as an 'Ethereum killer', has challenged Ethereum's position by touting faster transaction processing speeds and lower fees. Ethereum's relatively lackluster performance amid the cryptocurrency bull market has been a boon for Solana.

Tuur Demeester, founder of cryptocurrency hedge fund Adamant Capital, analyzed that "while the price trend of Ethereum relative to Bitcoin has been sluggish, the price of Solana has risen over 925% compared to Ethereum since December 2022. Ethereum's market share hit its lowest point in April 2021," concluding that "Ethereum is gradually declining."

Solana's on-chain activity indicators have also surpassed Ethereum. On the day, Solana network's daily trading volume was $7.4 billion (about 10.4 trillion won), more than double the trading volume of the Ethereum network during the same period.