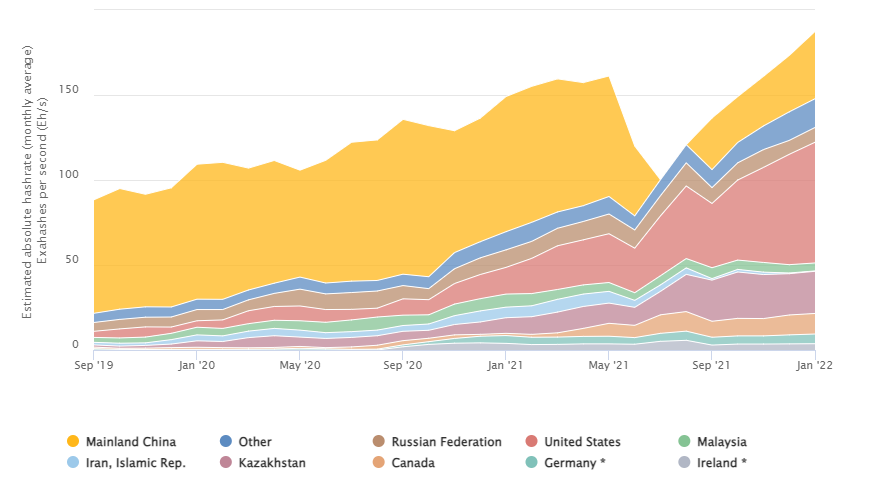

Russia’s crypto mining has become a key weapon against Western sanctions. The country is now the second-largest Bitcoin mining center after the United States. A new law from November 1 created rules for Russian cryptocurrency laws. This validates mining and lets companies make international payments with digital coins, changing how Russia handles digital money and its role in global crypto. The move signals a major shift in the country’s strategy to counter international financial restrictions.

Also Read: 2025 Commodity Trends: Oil and Copper Lead the Way – Prepare for Great Gains

Discover how Russia’s Crypto Mining Laws Impact Sanctions Evasion and Boost Digital Payments

Mining Operations and Legal Framework

Bitcoin mining in Russia has hit new records. Miners made 54,000 bitcoins worth $3 billion. The law lets registered businesses mine crypto. Russia’s cryptocurrency laws give the Bank of Russia power to watch over operations. Small miners don’t need to register if they use limited power. The central bank can stop trades that might harm the economy. This careful balance between freedom and control aims to protect the financial system while promoting growth.

Energy Resources and Sanctions Evasion

Sanctions evasion crypto plans use Russia’s vast energy supplies. Big companies Gazprom Neft, Sberbank, and Rusal now run Russia crypto mining to fight Western limits. Remote areas like Irkutsk, Sverdlovsk, and Krasnoyarsk offer cheap power and cold weather. This cuts costs and makes mining more profitable. The natural advantages of these regions have turned them into major crypto mining hubs.

Also Read: Top 3 Cryptocurrencies That You Should Watch This Weekend

International Payments Through Blockchain

The sanctions evasion cryptosystem lets picked companies send money abroad using crypto. This blockchain payment fix helps when dealing with China, India, and the UAE, which worry about U.S. penalties. Russian crypto payments hit $49 billion in one quarter of 2023-2024. This shows how blockchain payments help bypass regular banking. The system provides a crucial alternative to traditional financial channels that have become increasingly restricted.

Challenges Ahead

The mining boom faces significant problems. China bans crypto, and other partners fear U.S. punishment. The U.S. Treasury watches Russian crypto closely. They’ve targeted several companies, including Bitcoin mining Russia leader BitRiver. Success depends on whether trading partners will use crypto and how Western rules respond. The effectiveness of this strategy will be tested as international regulations continue to evolve and adapt to these new financial patterns.

Also Read: MicroStrategy (MSTR) Raises $3 Billion to Purchase More Bitcoin