In the 2024 US presidential election cycle, the emergence of "the first crypto president" Trump undoubtedly serves as the best promotional ambassador for digital assets - with Trump's second term settled, Bitcoin has consecutively broken through $70,000, $80,000, and $90,000 in the past half month, just one step away from the $100,000 milestone.

Against this backdrop, the global market's recognition of digital assets has significantly increased. Imagine if the massive traditional capital starts to shift towards Web3, through which channels are these "Old Money" representing mainstream institutions and high-net-worth individuals most likely to allocate to digital assets?

The Institutionalization Wave of Digital Assets Driven by the "Trump Deal"

During the 2024 presidential election, Trump promised a series of policy measures to support Web3 and digital assets, including incorporating Bitcoin into the national reserve and relaxing industry regulations, which, although may contain political bargaining chips, undoubtedly provide an important reference framework for the future direction of the digital asset industry in the next four years.

In the next four years, we can almost foresee the relaxation at the executive, legislative, and regulatory levels under the "Trump Deal", especially in terms of market compliance and legality, and the next four years will also become a critical window to observe the institutionalization process of the digital asset market.

It is worth noting that as early as May 22, the "Financial Innovation and Technology Act of the 21st Century" (FIT21 Act) was passed in the House of Representatives with 279 votes against 136, aiming to establish a brand-new regulatory framework for digital assets. Once it is also passed by the Senate, it will provide the industry with a set of executable and clear regulatory rules, greatly reducing regulatory uncertainty, promoting the legalization process of the market, and attracting more institutional capital to flow into the digital asset field, driving the institutionalization wave of digital assets.

Source:FIT21 Act

Against this backdrop, mainstream financial institutions and high-net-worth individuals around the world have already rolled up their sleeves, with Pennsylvania State Representative Mike Cabell and Aaron Kaufer introducing a Bitcoin Strategic Reserve Act and submitting it to the Pennsylvania House of Representatives, aiming to allow the Pennsylvania State Treasurer to invest in Bitcoin, digital assets, and crypto ETFs.

According to SoSoValue data, the daily trading volume of US Bitcoin spot ETFs has repeatedly exceeded $5 billion since November 6, with a new high of over $8 billion on November 13, a record high in 8 months; in addition, the total trading volume of 3 Bitcoin spot ETFs in Hong Kong also exceeded HK$420 million in the same week, an increase of over 250% quarter-on-quarter, among which the Bitcoin ETF launched by OSL, Huaxia Fund (Hong Kong), and Jiashi International reached HK$364 million, accounting for about 86%.

Source:SoSoValue

However, unlike the small-scale traditional trading business targeting retail users, global institutional investors and high-net-worth groups have a stronger demand for compliant, secure, and efficient services. For them, the allocation of digital assets is not only a strategic shift in investment allocation, but also faces a tactical threshold of compliance and security.

Against this backdrop, new B-end ideas are also quietly brewing, and some interesting new approaches are emerging - on November 18, the licensed digital asset company OSL in Hong Kong officially announced a virtual asset ETF physical subscription service with Fosun Wealth Holdings and Huaxia, which plans to allow investors to directly subscribe to ETF products using their held virtual currencies without the need to sell and cash out first.

This means that with the blockchain infrastructure provided by OSL, Fosun can build a digital asset trading system with strict KYC/AML processes and smart risk control, allowing institutional investors or high-net-worth users to directly convert the BTC and ETH they have purchased into the corresponding ETF within the compliance framework, and enjoy the advantages of secure custody, insurance coverage, and compliance through professional custodian institutions like OSL.

In short, service providers that can offer highly compliant and secure digital asset management, trading, and payment solutions will become the core focus of market competition, which also means that the opportunities for B2B service providers are undoubtedly huge - the demand for digital asset allocation from financial institutions and high-net-worth clients will greatly drive the development of related services, especially in the fields of digital asset custody, OTC trading, asset tokenization, and payment finance.

The B2B service market is on the eve of an explosion, and all parties are rushing to layout to seize the first-mover advantage. So how will the new demands for digital assets reshape the overall industry landscape?

What Are the Key Demands Facing the Institutionalization Wave of Digital Assets?

We can break down the core pain points and demands of "Old Money" entering the digital asset market. For traditional financial institutions and high-net-worth individuals, they can be mainly divided into four modules:

Omnibus Compliance Solutions for Financial Institutions, Real-World Asset (RWA) Tokenization/On-Chain Assets, Custody/OTC Services, and PayFi Solutions.

1. Omnibus Compliance Solutions for Financial Institutions

First, for traditional financial institutions, whether it's virtual asset ETF service providers or traditional retail brokers, they have all entered the digital asset trading field since this year, and more and more investors, financial institutions, listed companies, family offices, and others have also started to actively consider allocating digital assets through compliant channels.

However, for these institutions, entering the digital asset field is not an easy task, and the biggest pain point lies in the deployment time and cost - compared to traditional financial products, the decentralized nature and technical complexity of digital assets determine that institutions need more time to complete system integration, risk management, and the establishment of a compliance framework.

Especially in building a compliance system that meets regulatory requirements (especially the KYC and AML framework), it not only requires a large amount of technical resources and financial costs, but also needs to deal with the rapidly evolving market dynamics and constantly changing compliance requirements of crypto assets, and this high cost of time and money is often the main obstacle for institutions to enter the digital asset market.

Therefore, if there is a solution that can help financial institutions quickly connect to the compliance framework and tools, and provide compliant and secure digital asset trading services to meet the diversified investment needs of clients, it will undoubtedly open the door for these institutions to the digital asset market.

Taking the currently compliant trading platform OSL in Hong Kong as an example, its comprehensive compliance solution (Omnibus) provided to external parties includes strict review of assets and transactions, a well-established KYC and AML system, and a multi-layered private key management asset security mechanism, which can greatly reduce the threshold for institutions to enter the digital asset field.

At the same time, this "professionalism + security" division of labor and cooperation model, not only fully leverages the advantages of traditional financial institutions in customer service and market promotion, but also relies on the expertise of licensed institutions in compliance, technology, and risk control, complementing each other's strengths, promoting the deep integration of traditional finance and the digital asset ecosystem, and providing a solid support for the institutionalization development of digital assets.

2. Tokenization of Real-World Assets (RWA) / On-Chain Assets

Although stocks, bonds, gold, and other traditional assets already have relatively high liquidity in the financial market, their trading is still limited by long settlement cycles, complex cross-border operations, and lack of transparency, while non-standardized assets such as art and real estate have long faced challenges in liquidity and trading efficiency.

Asset tokenization not only enhances liquidity, but also significantly improves transaction transparency and efficiency. Larry Fink, CEO of BlackRock, stated that "the tokenization of financial assets will be the next step in future development." It not only effectively prevents illegal activities, but more importantly, it can achieve real-time settlement, significantly reducing the settlement costs of stocks and bonds.

According to the latest data from the RWA research platform rwa.xyz, the current total market size of RWA exceeds $13 billion, and BlackRock's forecast is more optimistic. By 2030, the market value of tokenized assets is expected to reach $10 trillion, which means the potential growth space in the next 7 years may exceed 75 times.

However, although companies and financial institutions have seen the potential of asset tokenization, the technical threshold is relatively high. Transforming traditional assets into on-chain token assets requires comprehensive technical support and compliance assurance, and there are also challenges in terms of liquidity, legal compliance, and technical security.

Against this backdrop, as the underlying infrastructure, licensed digital asset platforms can provide innovative support for traditional financial giants to enter the RWA tokenization, and will also directly benefit from the hundreds of billions of dollars of unliquidized liquidity in the traditional financial system, by introducing it onto the chain in the form of RWA (Real World Assets) through a compliant, secure and transparent mature architecture, fully releasing its liquidity.

3. Custody/OTC Services

High-net-worth clients and institutional investors have always been most concerned about the security and liquidity of assets when considering digital asset investment - for example, asset losses caused by hacker attacks or operational mistakes, as well as the problem of insufficient market liquidity in large-scale transactions, which may lead to delayed transactions or significant price slippage, affecting asset allocation efficiency.

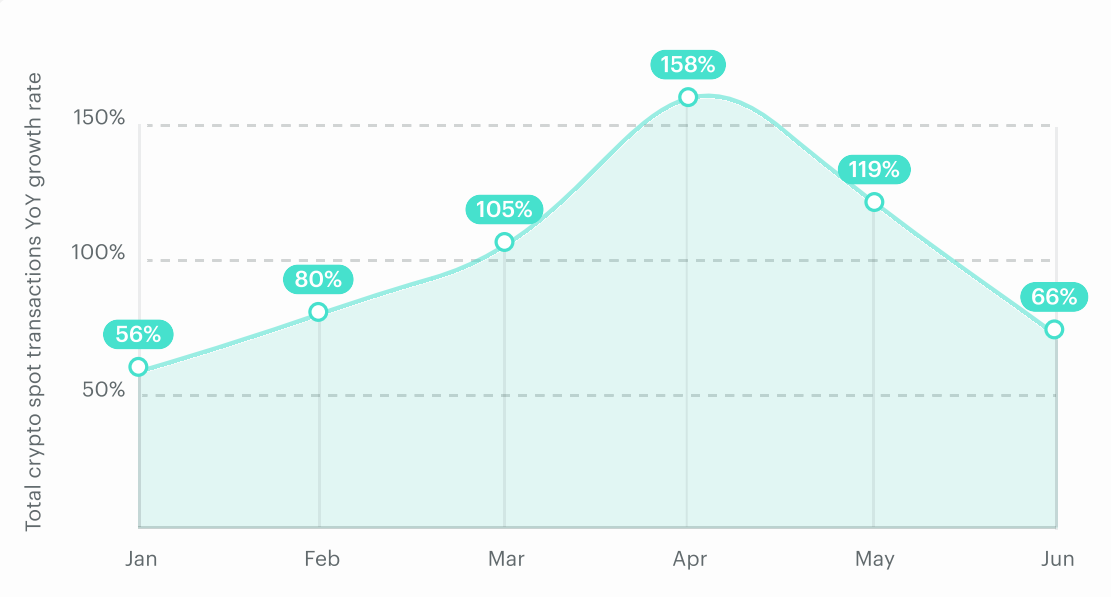

According to Finery Markets statistics, in the first half of 2024, the trading volume of institutional digital asset OTC transactions increased significantly, surging by more than 95% year-on-year, with the growth rate accelerating in the second quarter, with client trading volume growing 110% year-on-year (80% in the first quarter).

Although the trading volume of digital asset OTC is still hovering around the hundreds of billions of dollars level, compared to the tens of trillions of dollars of trading volume on centralized exchanges (CEX), the flexibility and confidentiality of OTC transactions meet the demand of investment institutions for large-scale digital asset allocation. With the gradual improvement of regulation, it is expected to attract more investors to participate, further driving the growth of its market size.

In this context, institutions need a service system with high security, high efficiency and high liquidity to meet their needs in the digital asset field: on the one hand, they need to ensure the security of large-scale assets in the storage and trading process; on the other hand, the efficient over-the-counter (OTC) network not only needs to meet the flexibility and privacy needs of large-scale transactions, but also needs to rely on blockchain technology and banking networks to achieve rapid settlement, significantly shortening the transaction cycle.

In addition, deep liquidity support is also indispensable. By integrating market resources and institutional networks, it provides stable prices and diversified trading options, helping institutions smoothly enter the digital asset market.

4. PayFi Solutions

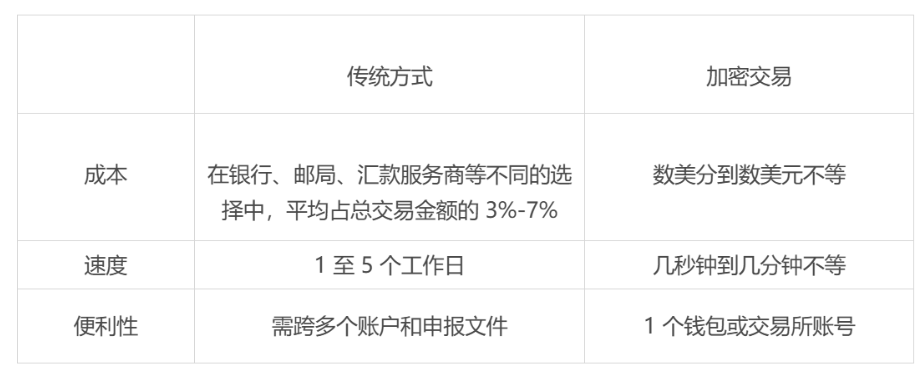

With the popularization of digital assets, the demand for digital asset payments from enterprises and merchants is gradually increasing, especially in regions with limited traditional banking infrastructure and cross-border payment scenarios, where digital assets can provide convenience and efficiency through low-cost financial services, and are considered a viable solution to these challenges.

However, the complexity and potential risks of digital asset payments have made many traditional enterprises hesitant - for enterprises that want to support digital asset payments, the biggest problem is the complexity and compliance of the payment process, and the conversion between fiat and digital assets involves exchange rate fluctuations, tax issues and regulatory restrictions in different countries, all of which increase the difficulty and cost of payments.

In short, enterprises and merchants need a backend system that can seamlessly integrate fiat and digital asset payments, not only reducing the conversion cost, but also ensuring the compliance and security of the payment process; and to meet the needs of cross-border business, the payment solution also needs to support multi-currency payment and settlement.

In fact, compliant digital asset platforms like OSL have natural advantages in expanding these businesses, and can provide enterprises with a comprehensive PayFi solution through technical and compliance support to help them address the complex challenges in the payment field:

First, these platforms support the seamless and instant conversion between fiat and digital assets, and can realize multi-currency payment and settlement globally, simplifying the cross-border payment process; secondly, platforms like OSL maintain good cooperation with banks, which can at least ensure the compliance and stability of the payment process, avoiding risks such as card freezing, and provide enterprises with a reliable operating environment.

Through the above key services, traditional institutions can enter the digital asset market efficiently and securely, while lowering the participation threshold. This service system not only solves the core pain points of asset security, liquidity, trading efficiency and investment optimization, but also provides comprehensive support for institutions' strategic layout in the digital asset ecosystem.

Variables in the Digital Asset Industry Grabbing Institutional Services

According to the latest statistics from Bank of America, the total market value of the global stock and bond markets is about $250 trillion, and the total scale of other asset categories including real estate, art, and gold is even more difficult to estimate - the global gold market is estimated to be $13 trillion, and the global commercial real estate market is valued at nearly $28 trillion.

In comparison, CoinGecko data shows that the total market value of the global digital asset market is about $3.3 trillion, only about 1.3% of the global stock and bond market, and the total scale of emerging tracks such as asset tokenization (RWA) is only $13 billion, which is almost negligible in the entire financial market.

Source:Wall Street Journal

Therefore, for the Web3 and digital asset world, 2024 is destined to have a milestone historical significance - the crypto asset layout of enterprises and institutions is gradually transitioning from the exploration stage to the deep integration stage, and the market space of To B services is expanding significantly, becoming the next growth engine driving industry development, which not only means that more enterprises and institutions are beginning to take digital asset allocation seriously, but also indicates that digital assets will further integrate with the traditional financial system.

Especially for traditional institutions and financial giants, they have a huge user base and massive capital scale, and once these resources are successfully bridged, they will inject unprecedented "incremental capital" and "incremental users" into Web3, driving the rapid rise of "New Money" in the digital asset ecosystem and accelerating the mainstream application of blockchain technology.

In this context, whoever can connect the traditional capital and massive users of Web2 giants will have the opportunity to become the key infrastructure linking Web2 (traditional finance) and Web3 (digital asset finance), and achieve a comprehensive breakthrough with the strong support of traditional capital.

In this process, the role of To B service providers is crucial, especially those with compliant, secure, efficient and diversified service capabilities, who are more likely to reap huge development dividends in this wave of institutionalization.

Taking OSL, the first digital asset platform to obtain licenses from the SFC and AMLO, listed, audited by one of the Big Four accounting firms in Hong Kong, insured and obtained SOC 2 Type 2 certification, as an example, when institutions consider adopting a certain service, it is usually because it meets the following core conditions:

● Compliance and Security: The service provider needs to strictly comply with regulatory requirements, with a sound KYC and AML system, ensuring the legality and transparency of fund flows, especially when funds flow into the digital asset market across borders, compliance is the primary condition;

● Diversified and Customized Service Capabilities: Institutional clients not only need trading services, but also comprehensive capabilities covering asset tokenization, custody, OTC trading and other fields, to achieve full-chain support for asset allocation and management.

● Efficient technical integration capabilities: Possessing a modular system architecture, able to quickly deploy digital asset trading and management functions for traditional institutions, reducing the technical access threshold, and improving service response efficiency;

● Industry experience and cooperation network: Possessing rich industry practical experience and a wide range of ecological cooperation partners, in order to quickly respond to market demands and provide customized solutions for institutional clients, accelerating their digital asset deployment;

This also means that, with the warming of the digital asset market's B2B services, the importance of licensed exchanges is becoming increasingly prominent, and it can be said that they are standing at the forefront of the new era, grasping the "lifeline" of various businesses - whether it is for enterprises to include virtual asset ETFs in their investment portfolios, or to trade and custody virtual assets such as BTC and ETH, licensed exchanges provide crucial support.

Summary

If "Web3 in 2024 is like Web2 in 2002", then now may be a good time to take action.

With the deepening of enterprises and institutions' digital asset deployment, B2B service providers are standing on the core stage of the digital asset market. Whoever can meet the diversified needs from compliance to trading, from tokenization to payment finance, will become the key player in defining the next-generation financial ecosystem.

Especially for licensed exchanges like OSL, relying on this comprehensive and multi-level service capability, their importance is expected to further increase in the wave of digital asset institutionalization, especially playing the role of a "bridge" and "infrastructure" to efficiently introduce the stock assets in the traditional financial market into the on-chain ecosystem and release their potential value.

The wind rises from the end of the green leaf, and after the dust settles in 2024, Web3 and the crypto industry may truly enter a new cycle.