Author: Rui Shang, SevenX Ventures Compiled by: Mensh, ChainCatcher

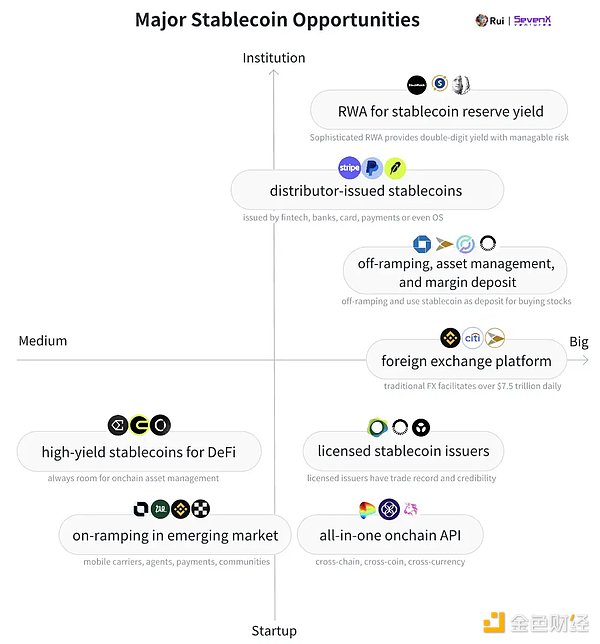

Overview: 8 key opportunities related to stablecoins -

The younger generation are digital natives, and stablecoins are their natural currency. As AI and IoT drive billions of automated micro-transactions, global finance needs flexible currency solutions. Stablecoins as "currency APIs" can transfer seamlessly like internet data, and are expected to reach $4.5 trillion in transaction volume by 2024, a figure that is likely to grow as more institutions recognize stablecoins as an unparalleled business model - Tether is projected to generate $5.2 billion in profits in the first half of 2024 through investments in its USD reserves.

In the stablecoin competition, complex crypto mechanisms are not the key, distribution and true adoption are crucial. Their adoption is mainly manifested in three key areas: crypto-native, fully banked, and unbanked worlds.

In the $29 trillion crypto-native world, stablecoins are the gateway to DeFi, critical for trading, lending, derivatives, liquidity farming, and RWA. Crypto-native stablecoins compete through liquidity incentives and DeFi integration.

In the over $400 trillion fully banked world, stablecoins improve financial efficiency, primarily used for B2B, P2P, and B2C payments. Stablecoins focus on regulation, permissioning, and leveraging banks, card networks, payments, and merchants for distribution.

In the unbanked world, stablecoins provide access to the dollar, fostering financial inclusion. Stablecoins are used for savings, payments, FX, and yield generation. Grassroots market adoption is crucial.

Natives of the Crypto World

In Q2 2024, stablecoins account for 8.2% of the total crypto market capitalization. Maintaining exchange rate stability remains challenging, and unique incentive mechanisms are key to expanding on-chain distribution, with the core issue being the limited on-chain applications.

The Battle for Pegged Rates

Fiat-backed stablecoins rely on banking relationships:

93.33% are fiat-backed stablecoins. They have greater stability and capital efficiency, with banks having the final say through control of redemptions. Regulated issuers like Paxos, successful in redeeming billions of BUSD, have become dollar issuers for PayPal.

CDP stablecoins improve collateral and liquidation to enhance rate stability:

3.89% are Collateralized Debt Position (CDP) stablecoins. They use cryptocurrencies as collateral but face challenges in scaling and volatility. By 2024, CDPs have improved their risk-bearing capacity through accepting broader liquidity and stable collateral, with Aave's GHO accepting any asset in Aave v3, and Curve's crvUSD recently adding USDM (real assets). Partial liquidations are improving, especially the soft liquidation of crvUSD, which provides a buffer for further bad debt through its custom Automated Market Maker (AMM). However, the ve-token incentive model has issues, as crvUSD's market cap shrinks when CRV's valuation drops after large-scale liquidations.

Synthetic dollars use hedging to maintain stability:

Ethena USDe alone occupied 1.67% of the stablecoin market in a year, reaching a $3 billion market cap. It is a delta-neutral synthetic dollar, taking short positions in derivatives to counteract volatility. It is expected to perform well on funding rates in the upcoming bull market, even after seasonal volatility. However, its long-term viability is heavily dependent on centralized exchanges (CEXs), which raises questions. As similar products proliferate, the impact of small capital on Ethereum may diminish. These synthetic dollars may be vulnerable to black swan events and can only maintain depressed funding rates during bear markets.

Algorithmic stablecoins have declined to 0.56%.

Liquidity Attraction Challenges

Crypto stablecoins utilize yield to attract liquidity. Fundamentally, their liquidity costs include the risk-free rate plus a risk premium. To remain competitive, stablecoin yields must at least match Treasury bill (T-bill) rates - we've seen stablecoin borrowing costs decline as T-bill rates reach 5.5%. sFrax and Dai are leading in Treasury bill exposure. By 2024, multiple RWA projects have enhanced the composability of on-chain Treasuries: crvUSD uses Mountain's USDM as collateral, while Ondo's USDY and Ethena's USDtb are backed by BlackRock's BUIDL.

Based on Treasury bill rates, stablecoins employ various strategies to add risk premiums, including fixed-budget incentives (like DEX emissions, which may lead to constraints and death spirals); user fees (tied to lending and perpetual contract volumes); volatility arbitrage (declining when volatility weakens); and reserve utilization, like staking or re-staking (lacking in appeal).

In 2024, innovative liquidity strategies are emerging:

Maximizing intra-block yields: While many yields currently come from self-consuming DeFi inflation as incentives, more innovative strategies are emerging. By using reserves as a bank, projects like CAP aim to directly channel MEV and arbitrage profits to stablecoin holders, providing sustainable and more lucrative potential yield sources.

Compounding with Treasury yields: Leveraging the new composability of RWA projects, initiatives like Usual Money (USD0) offer "theoretically" infinite yields, using Treasury yields as a benchmark - attracting $350 million in liquidity providers and entering Binance's launchpad. Agora (AUSD) is also an offshore stablecoin with Treasury yields.

Balancing high yields to withstand volatility: Newer stablecoins adopt a diversified basket approach, avoiding single-yield and volatility risks, offering balanced high yields. For example, Fortunafi's Reservoir allocates to Treasuries, Hilbert, Morpho, PSM, and dynamically adjusts the portions, incorporating other high-yield assets as needed.

Is Total Value Locked (TVL) a fleeting phenomenon? Stablecoin yields often face scalability challenges. While fixed-budget yields can drive initial growth, as Total Value Locked grows, yields get diluted, weakening the yield effect over time. If there are no sustainable yields or true utility in trading pairs and derivatives after the incentives, their Total Value Locked is unlikely to remain stable.

The DeFi Gateway Dilemma

On-chain visibility allows us to examine the true nature of stablecoins: are they the true representation of money as a medium of exchange, or merely financial products for yield?

Only the highest-yielding stablecoins are used as trading pairs on CEXs:

Nearly 80% of trading still occurs on centralized exchanges, with top CEXs supporting their "preferred" stablecoins (e.g., Binance's FDUSD, Coinbase's USDC). Other CEXs rely on the spillover liquidity of USDT and USDC. Additionally, stablecoins are vying to become margin deposits for CEXs.

Few stablecoins are used as trading pairs on DEXs:

Currently, only USDT, USDC, and a small amount of Dai are used as trading pairs. Other stablecoins, like Ethena, have 57% of their USDe staked within their own protocol, held purely as a financial product to earn yield, far from a medium of exchange.

Makerdao + Curve + Morpho + Pendle, a composite allocation:

Here is the English translation:Markets like Jupiter, GMX and DYDX tend to use USDC for deposits, as the minting-redemption process of USDT is more questionable. Lending platforms like Morpho and AAVE prefer USDC as it has better liquidity on Ethereum. On the other hand, PYUSD is mainly used for borrowing on Kamino on Solana, especially when Solana Foundation provides incentives. Ethena's USDe is primarily used for yield activities on Pendle.

RWA Undervalued:

Most RWA platforms, like Blackstone Group, use USDC as the minting asset for compliance reasons, and Blackstone is also a shareholder of Circle. DAI has seen success in its RWA products.

Expanding the Market or Exploring New Frontiers:

While stablecoins can attract major liquidity providers through incentives, they face a bottleneck - the usage of DeFi is declining. Stablecoins now face a dilemma: they must wait for the expansion of crypto-native activities, or seek new utilities beyond this domain.

Outliers in a Fully Banked World

Key Participants are in Motion

Global Regulation is Gradually Clarifying:

99% of stablecoins are backed by the US dollar, and the federal government has the ultimate influence. After the crypto-friendly Trump presidency, the US regulatory framework is expected to be clarified, as he promised to lower interest rates and ban CBDCs, which could benefit stablecoins. A US Treasury report noted the impact of stablecoins on short-term Treasury demand, with Tether holding $90 billion in US debt. Preventing crypto crimes and maintaining the dominance of the US dollar are also motivations. By 2024, multiple countries have established regulatory frameworks under common principles, including approvals for stablecoin issuance, reserve liquidity and stability requirements, restrictions on the use of foreign currency stablecoins, and generally prohibiting the generation of interest. Key examples include: MiCA (EU), PTSR (UAE), Sandbox (Hong Kong), MAS (Singapore), and PSA (Japan). Notably, Bermuda became the first country to accept stablecoin tax payments and license interest-bearing stablecoin issuance.

Licensed Issuers Gain Trust:

Stablecoin issuance requires technical capabilities, cross-regional compliance, and strong management. Key participants include Paxos (PYUSD, BUSD), Brale (USC) and Bridge (B2B API). Reserve management is handled by trusted institutions like BNY Mellon, safely generating yields by investing in their Blackstone-managed funds. BUIDL now allows a wider range of on-chain projects to earn yields.

Banks are the Gatekeepers of Withdrawals:

While on-ramping (fiat to stablecoin) has become easier, the challenge of off-ramping (stablecoin to fiat) remains, as banks struggle to verify the source of funds. Banks prefer to work with licensed exchanges like Coinbase and Kraken, which perform KYC/KYB and have similar anti-money laundering frameworks. While high-reputation banks like Standard Chartered have started accepting off-ramps, mid-sized banks like DBS in Singapore have been quick to act. B2B services like Bridge aggregate off-ramp channels and manage billions in transaction volume for high-end clients including SpaceX and the US government.

Issuers Have the Final Say:

As the compliance stablecoin leader, Circle relies on Coinbase and is seeking global licenses and partnerships. However, this strategy may be impacted as institutions issue their own stablecoins, as their business model is unparalleled - Tether, a company with 100 employees, profited $5.2 billion from investing its reserves in the first half of 2024. Banks like JPMorgan Chase have already launched JPM Coin for institutional transactions. Payment app Stripe's acquisition of Bridge shows interest in owning a stablecoin stack, not just integrating USDC. PayPal has also issued PYUSD to capture reserve yields. Card networks like Visa and Mastercard are tentatively accepting stablecoins.

Factors Behind Efficiency Improvements

Supported by trusted issuers, healthy banking relationships, and distributors, stablecoins can improve the efficiency of large-scale financial systems, particularly in the payments domain.

Traditional systems face limitations in efficiency and cost. Intra-app or intra-bank transfers provide instant settlement, but only within their ecosystems. Inter-bank payments cost around 2.6% (70% to the issuing bank, 20% to the receiving bank, 10% to the card network), and take more than a day to settle. Cross-border transactions cost even higher, around 6.25%, and can take up to five days to settle.

Stablecoin payments, by eliminating intermediaries, provide peer-to-peer instant settlement. This accelerates the flow of funds, reduces capital costs, and offers programmable features like conditional auto-payments.

B2B (annual transaction volume 120-150 trillion USD): Banks are in the best position to drive stablecoin adoption. JPMorgan Chase has developed JPM Coin on its Quorum chain, which was used for around $1 billion in daily transactions as of October 2023.

P2P (annual transaction volume 1.8-2 trillion USD): Digital wallets and mobile payment apps are best positioned, with PayPal launching PYUSD, currently with a market cap of $604 million on Ethereum and Solana. PayPal allows end-users to register and send PYUSD for free.

B2C Commerce (annual transaction volume 5.5-6 trillion USD): Stablecoins need to integrate with POS, bank APIs, and card networks, with Visa becoming the first payment network to settle transactions using USDC in 2021.

Innovators in an Underbanked World

The Shadow Dollar Economy

Emerging markets have an urgent need for stablecoins due to severe currency devaluation and economic instability. In Turkey, stablecoin purchases account for 3.7% of its GDP. People and businesses are willing to pay a premium above the legal US dollar, with stablecoin premiums reaching 30.5% in Argentina and 22.1% in Nigeria. Stablecoins provide access to the US dollar and financial inclusion.

Tether dominates this space, with a reliable 10-year track record. Even facing complex banking relationships and redemption crises - Tether admitted in April 2019 that USDT was only 70% backed by reserves - its peg has remained stable. This is because Tether has built a robust shadow dollar economy: in emerging markets, people rarely convert USDT to fiat, they view it as the US dollar, a phenomenon particularly evident in Africa and Latin America for paying employees, invoices, etc. Tether has achieved this without incentives, solely through its long-term presence and sustained utility, enhancing its credibility and acceptance. This should be the ultimate goal for every stablecoin.

Access to the US Dollar

Remittances: Remittance inequality hinders economic growth. In sub-Saharan Africa, individuals on average pay 8.5% of the total remittance amount when sending to middle- and low-income countries and developed countries. For businesses, the situation is more severe, with high fees, long processing times, bureaucracy, and exchange rate risks directly impacting the growth and competitiveness of businesses in the region.

Access to the US Dollar: From 1992 to 2022, currency volatility has cost 17 emerging market countries a staggering $1.2 trillion in GDP losses, accounting for 9.4% of their total GDP. Access to the US dollar is crucial for local financial development. Many crypto projects are focused on onboarding, with ZAR focusing on grassroots "DePIN" approaches. These methods leverage local agents to facilitate cash-to-stablecoin transactions in Africa, Latin America, and Pakistan.

Foreign Exchange: Today, the foreign exchange market has a daily trading volume exceeding $7.5 trillion. In the Global South, individuals often rely on the black market to convert local fiat to US dollars, as the black market rate is more favorable than official channels. Binance P2P is starting to be adopted, but its order book model lacks flexibility. Many projects like ViFi are building on-chain automated market maker foreign exchange solutions.

Foreign exchange:

The traditional foreign exchange system is highly inefficient, facing multiple challenges: counterparty settlement risk (CLS has improved but is cumbersome), the cost of multi-bank systems (involving six banks when buying Japanese yen in an Australian bank's London US dollar office), global settlement time zone differences (the Canadian dollar and Japanese yen banking systems overlap less than 5 hours per day), and limited access to the foreign exchange market (retail users pay 100 times the fees of large institutions). On-chain foreign exchange offers significant advantages:

- Cost, efficiency, and transparency: Oracles like Redstone and Chainlink provide real-time price quotes. Decentralized exchanges (DEXs) offer cost-efficiency and transparency, with Uniswap CLMM reducing trading costs to 0.15-0.25% - about 90% lower than traditional foreign exchange. The shift from T+2 bank settlement to instant settlement allows arbitrageurs to employ various strategies to correct mispricing.

- Flexibility and accessibility: On-chain foreign exchange enables corporate treasurers and asset managers to access a wide range of products without the need for multiple currency-specific bank accounts. Retail users can access the best foreign exchange rates using crypto wallets with embedded DEX APIs.

- Separation of currency and jurisdiction: Transactions no longer require domestic banks, decoupling them from the underlying jurisdiction. This approach leverages the efficiency of digitization while maintaining monetary sovereignty, although drawbacks still exist.

However, challenges remain, including the scarcity of non-USD-denominated digital assets, oracle security, support for long-tail currencies, regulation, and unified interfaces with upstream and downstream systems. Despite these hurdles, on-chain foreign exchange presents compelling opportunities. For example, Citi is developing a blockchain-based foreign exchange solution under the guidance of the Monetary Authority of Singapore.

Stablecoin exchanges:

Imagine a world where most companies issue their own stablecoins. Stablecoin exchanges pose a challenge: using PayPal's PYUSD to pay a merchant of JPMorgan Chase. While upstream and downstream solutions can address this issue, they lose the efficiency promised by cryptocurrencies. On-chain automated market makers (AMMs) provide the best real-time, low-cost stablecoin-to-stablecoin trading. For example, Uniswap offers multiple such pools with fees as low as 0.01%. However, once billions in assets flow on-chain, the security of smart contracts must be trusted, and sufficient depth and instant performance must be available to support real-world activities.

Cross-chain exchanges:

Major blockchains have diverse advantages and disadvantages, leading to the deployment of stablecoins across multiple chains. This multi-chain approach introduces cross-chain challenges, with bridges posing significant security risks. In my view, the best solution is for stablecoins to launch their own Layer 0, such as USDC's CCTP, PYUSD's Layer 0 integration, and the actions we've witnessed with USDT recalling bridged locked tokens, potentially launching a similar Layer 0 solution.

Meanwhile, several unresolved questions remain:

Will compliant stablecoins hinder "open finance" by potentially allowing for the monitoring, freezing, and extraction of funds?

Will compliant stablecoins still avoid providing yields that may be classified as securities, thus preventing on-chain DeFi from benefiting from its massive scaling?

Considering Ethereum's slow speed and its L2 dependence on a single sequencer, Solana's imperfect track record, and the lack of long-term performance records for other popular chains, can any open blockchain truly handle massive amounts of capital?

Will the separation of currency and jurisdiction introduce more chaos or opportunities?

The financial revolution led by stablecoins stands before us, both exciting and unpredictable - a new chapter where freedom and regulation dance in a delicate balance.

Foreign exchange:

The traditional foreign exchange system is highly inefficient, facing multiple challenges: counterparty settlement risk (CLS has improved but is cumbersome), the cost of multi-bank systems (involving six banks when buying Japanese yen in an Australian bank's London US dollar office), global settlement time zone differences (the Canadian dollar and Japanese yen banking systems overlap less than 5 hours per day), and limited access to the foreign exchange market (retail users pay 100 times the fees of large institutions). On-chain foreign exchange offers significant advantages:

- Cost, efficiency, and transparency: Oracles like Redstone and Chainlink provide real-time price quotes. Decentralized exchanges (DEXs) offer cost-efficiency and transparency, with Uniswap CLMM reducing trading costs to 0.15-0.25% - about 90% lower than traditional foreign exchange. The shift from T+2 bank settlement to instant settlement allows arbitrageurs to employ various strategies to correct mispricing.

- Flexibility and accessibility: On-chain foreign exchange enables corporate treasurers and asset managers to access a wide range of products without the need for multiple currency-specific bank accounts. Retail users can access the best foreign exchange rates using crypto wallets with embedded DEX APIs.

- Separation of currency and jurisdiction: Transactions no longer require domestic banks, decoupling them from the underlying jurisdiction. This approach leverages the efficiency of digitization while maintaining monetary sovereignty, although drawbacks still exist.

However, challenges remain, including the scarcity of non-USD-denominated digital assets, oracle security, support for long-tail currencies, regulation, and unified interfaces with upstream and downstream systems. Despite these hurdles, on-chain foreign exchange presents compelling opportunities. For example, Citi is developing a blockchain-based foreign exchange solution under the guidance of the Monetary Authority of Singapore.

Stablecoin exchanges:

Imagine a world where most companies issue their own stablecoins. Stablecoin exchanges pose a challenge: using PayPal's PYUSD to pay a merchant of JPMorgan Chase. While upstream and downstream solutions can address this issue, they lose the efficiency promised by cryptocurrencies. On-chain automated market makers (AMMs) provide the best real-time, low-cost stablecoin-to-stablecoin trading. For example, Uniswap offers multiple such pools with fees as low as 0.01%. However, once billions in assets flow on-chain, the security of smart contracts must be trusted, and sufficient depth and instant performance must be available to support real-world activities.

Cross-chain exchanges:

Major blockchains have diverse advantages and disadvantages, leading to the deployment of stablecoins across multiple chains. This multi-chain approach introduces cross-chain challenges, with bridges posing significant security risks. In my view, the best solution is for stablecoins to launch their own Layer 0, such as USDC's CCTP, PYUSD's Layer 0 integration, and the actions we've witnessed with USDT recalling bridged locked tokens, potentially launching a similar Layer 0 solution.

Meanwhile, several unresolved questions remain:

Will compliant stablecoins hinder "open finance" by potentially allowing for the monitoring, freezing, and extraction of funds?

Will compliant stablecoins still avoid providing yields that may be classified as securities, thus preventing on-chain DeFi from benefiting from its massive scaling?

Considering Ethereum's slow speed and its L2 dependence on a single sequencer, Solana's imperfect track record, and the lack of long-term performance records for other popular chains, can any open blockchain truly handle massive amounts of capital?

Will the separation of currency and jurisdiction introduce more chaos or opportunities?

The financial revolution led by stablecoins stands before us, both exciting and unpredictable - a new chapter where freedom and regulation dance in a delicate balance.