PNUT price has fallen more than 20% in the last 24 hours. After reaching $2.28 after being listed on major exchanges, it has plummeted. This sharp decline emphasizes that momentum is weakening as indicators like ADX and RSI show the uptrend is losing strength.

However, if buyers return, PNUT has the potential for a strong recovery. But if the downward pressure continues, PNUT may test key support levels and face a significant correction that could lead to further losses.

PNUT's uptrend fades

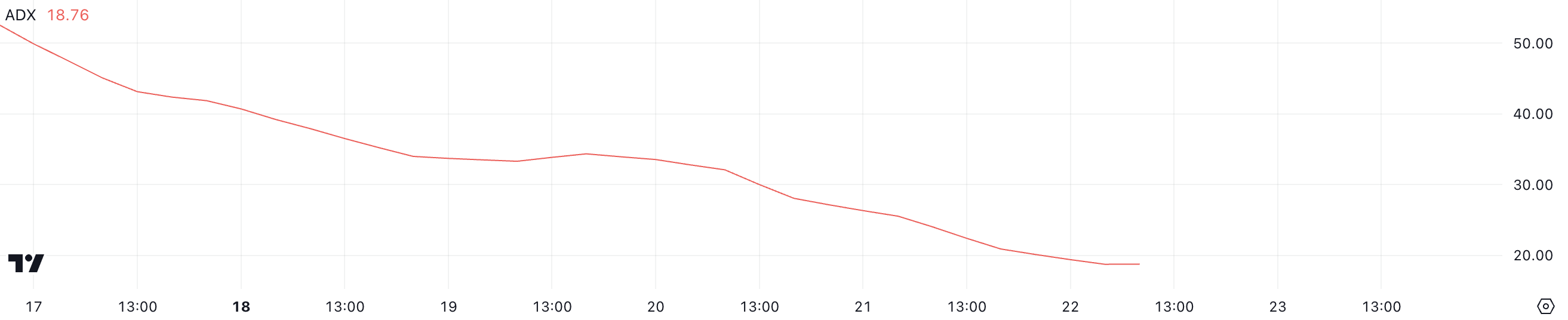

PNUT's current ADX is 18.76, down significantly from over 50 just a few days ago. The persistent decline in ADX indicates the strength of PNUT's uptrend has been steadily weakening.

While still in an uptrend, the sharp price drop in the last 24 hours highlights the increasing vulnerability in maintaining the bullish momentum. The ADX suggests a potential reversal may be approaching.

ADX measures the strength of a trend, with values above 25 indicating a strong trend and below 20 suggesting a weak or non-existent trend.

PNUT's ADX falling below 20 reflects the weakened trend. The current directional movement still shows an uptrend. However, if this trend strength continues to deteriorate, PNUT may struggle to maintain its upward trajectory. This means PNUT's price could become more vulnerable to a larger short-term reversal.

PNUT approaches oversold territory

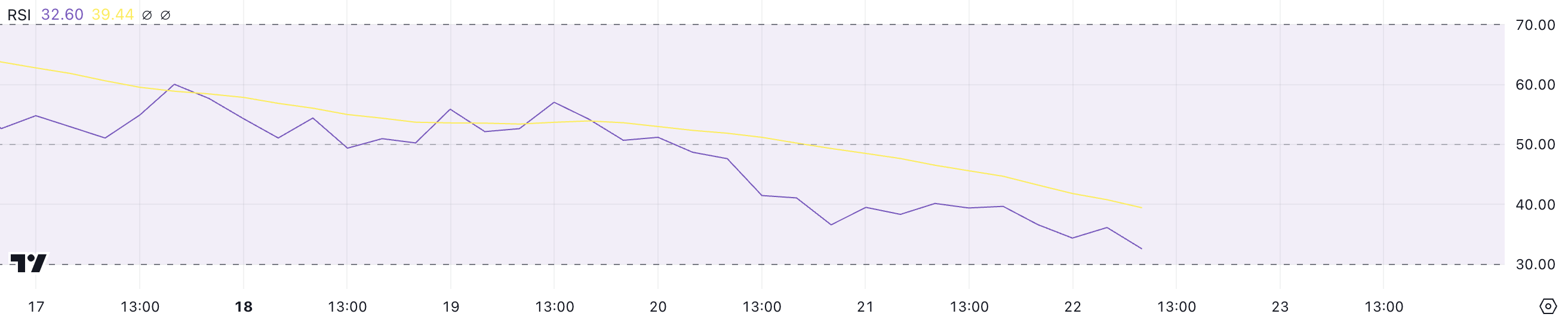

PNUT's current RSI is 32.6, the lowest level since being listed on Binance.

The Relative Strength Index (RSI) measures the momentum and magnitude of price movements. Readings above 70 indicate overbought conditions, while below 30 suggest oversold conditions.

PNUT's RSI has been declining persistently over the past few days, emphasizing the weakening momentum. The asset is now approaching oversold levels.

If the RSI falls below 30, it may indicate PNUT is significantly undervalued in the short term. However, the persistent bearish sentiment could continue to pressure the price and delay a recovery.

PNUT Price Forecast: Up to 72% Correction Possible

If PNUT's price reverses and sees a strong downtrend, it could test the $0.749 support level. If this level is not maintained, the price may further decline to $0.41 and $0.32, representing a substantial correction of up to 72%. This could mean PNUT being overtaken in market capitalization by other memecoins like MOG, GOAT, and MEW.

This scenario indicates increased downward pressure, and traders may continue to liquidate positions after the sharp rally following the major exchange listing.

Conversely, if PNUT's uptrend regains strength, the price could test resistance levels at $1.87 and $2.21.

Breaking above these levels could allow PNUT to retest its previous all-time high of $2.50, providing a potential upside of up to 111% and positioning PNUT as a top 10 memecoin in the market.